Second Quarter 2024 Revenue of $82 Million,

Operating Income of $25 Million

Net Loss Margin of 27% and Adjusted EBITDA

Margin of 45%

Raising FY 2024 Guidance to 27% or Greater

Revenue Growth and 42%+ Adjusted EBITDA Margin

Grindr Inc. (NYSE: GRND), the Global Gayborhood in Your

PocketTM, today posted its financial results for the second fiscal

quarter ended June 30, 2024, in a Letter to Shareholders. The

Letter to Shareholders can be accessed on Grindr’s Investor

Relations website.

“Our outstanding second quarter results reflect continued global

user growth as we enhance the value and merchandising of our

product offerings,” said George Arison, CEO of Grindr. “Our strong

execution increases our confidence in our 2024 outlook, which we

have raised today. We are looking forward to delivering more for

our users and driving continued performance momentum while

progressing toward our long-term vision of building the Global

Gayborhood in Your PocketTM.”

Earnings Webcast Information

Grindr will host a live webcast today at 2:00 p.m. Pacific Time

to discuss the Company’s second quarter 2024 financial results. The

webcast of the conference call can be accessed as follows:

Event: Grindr Second Quarter 2024 Earnings Conference Call

Date: Thursday, August 8, 2024

Time: 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time)

Live Webcast Site: https://investors.grindr.com/

An archived webcast of the conference call will also be

accessible on Grindr’s Investor Relations page,

https://investors.grindr.com

Forward Looking

Statements

This press release contains statements that may constitute

forward-looking statements within the meaning of the federal

securities laws. Forward-looking statements relate to expectations,

beliefs, projections, future plans and strategies, anticipated

events or trends and similar expressions concerning matters that

are not historical facts. These forward-looking statements include

statements regarding our intentions, beliefs, current expectations

or projections concerning, among other things, results of

operations, financial condition, liquidity, prospects, growth,

strategies and the markets in which we operate. In some cases, you

can identify these forward-looking statements by the use of

terminology such as “anticipates,” “approximately,” “believes,”

“continues,” “could,” “estimates,” “expects,” “goal,” “intends,”

“may,” “outlook,” “plans,” “potential,” “predicts,” “seeks,”

“should,” “upcoming,” “will” or the negative version of these words

or other comparable words or phrases.

The forward-looking statements, including statements regarding

our strategic priorities; product roadmap; new plans, products, and

features; AI-first features; our long term vision and our annual

revenue and adjusted EBITDA guidance for 2024, reflect our current

views about our business and future events and are subject to

numerous known and unknown risks, uncertainties, assumptions and

changes in circumstances that may cause actual results to differ

materially from those expressed in any forward-looking statement.

There are no guarantees that any transactions or events described

will happen as described (or that they will happen at all). The

following factors, among others, could cause actual results and

future events to differ materially from those set forth in or

contemplated by the forward-looking statements:

- our ability to retain existing users and add new users;

- the impact of the regulatory environment and complexities with

compliance related to such environment, including maintaining

compliance with privacy, data protection, and user safety laws and

regulations;

- our ability to address privacy concerns and protect systems and

infrastructure from cyber-attacks and prevent unauthorized data

access;

- our success in retaining or recruiting our directors, officers,

key employees, or other key personnel, and our success in managing

any changes in such roles;

- our ability to respond to general economic conditions;

- competition in the dating and social networking products and

services industry;

- our ability to adapt to changes in technology and user

preferences in a timely and cost-effective manner;

- our ability to successfully adopt generative artificial

intelligence processes and algorithms into our daily operations,

including by deploying generative artificial intelligence and

machine learning into our products and services;

- our dependence on the integrity of third-party systems and

infrastructure;

- our ability to protect our intellectual property rights from

unauthorized use by third parties;

- whether the concentration of our stock ownership and voting

power limits our stockholders’ ability to influence corporate

matters; and

- the effects of macroeconomic and geopolitical events on our

business, such as health epidemics, pandemics, natural disasters,

and wars or other regional conflicts.

In addition, statements that “Grindr believes” or “we believe”

and similar statements reflect our beliefs and opinions on the

relevant subjects as of the date of any such statement. These

statements are based upon information available to us as of the

date they are made, and while we believe such information forms a

reasonable basis for such statements, such information may be

limited or incomplete, and such statements should not be read to

indicate that we have conducted an exhaustive inquiry into, or

review of, all potentially available relevant information. These

statements are inherently uncertain and investors are cautioned not

to unduly rely upon these statements.

While forward-looking statements reflect our good faith beliefs,

they are not guarantees of future performance. Except to the extent

required by applicable law, we are under no obligation (and

expressly disclaim any such obligation) to update or revise our

forward-looking statements whether as a result of new information,

future events, or otherwise. For a further discussion of these and

other factors that could cause our future results, performance, or

transactions to differ significantly from those expressed in any

forward-looking statement, please see the section titled “Risk

Factors.” in annual reports on Form 10-K and quarterly reports on

Form 10-Q that we file with the Securities and Exchange Commission

from time to time. Any forward-looking statement speaks only as of

the date on which it is made, and you should not place undue

reliance on any forward-looking statements, which are based only on

information currently available to us (or to third parties making

the forward-looking statements).

Non-GAAP Financial

Measures

We use Adjusted EBITDA and Adjusted EBITDA margin, free cash

flow, and free cash flow conversion, which are non-GAAP measures,

to understand and evaluate our core operating performance. These

non-GAAP financial measures, which may differ from similarly titled

measures used by other companies, are presented to enhance

investors’ overall understanding of our financial performance and

should not be considered a substitute for, or superior to, the

financial information prepared and presented in accordance with

GAAP.

Adjusted EBITDA and Adjusted EBITDA Margin

Adjusted EBITDA adjusts for the impact of items that we do not

consider indicative of the operational performance of our business.

We define Adjusted EBITDA as net income (loss) excluding income tax

provision; interest expense, net; depreciation and amortization;

stock-based compensation expense; transaction-related costs; gain

(loss) in fair value of warrant liability; and severance expense,

litigation-related costs, and other items, in each case that are

unrelated to our core ongoing business operations. Adjusted EBITDA

Margin is calculated by dividing Adjusted EBITDA for a period by

revenue for the same period.

Our management uses this measure internally to evaluate the

performance of our business and this measure is one of the primary

metrics by which management and other employees are compensated. We

exclude the above items as some are non-cash in nature and others

may not be representative of normal operating results. While we

believe that Adjusted EBITDA and Adjusted EBITDA Margin are useful

in evaluating our business, this information should be considered

as supplemental in nature and is not meant as a substitute for the

related financial information prepared and presented in accordance

with GAAP.

A reconciliation of net (loss) income and net (loss) income

margin to Adjusted EBITDA and Adjusted EBITDA margin for the three

and six months ended June 30, 2024 and 2023, are presented below.

We are not able to estimate net income (loss) or net income (loss)

margin on a forward-looking basis or reconcile the guidance

provided for Adjusted EBITDA margin to net income (loss) margin on

a forward-looking basis without unreasonable efforts due to the

variability and complexity with respect to the charges excluded

from Adjusted EBITDA margin. In particular, the measures and

effects of our stock-based compensation related to equity grants

and the gain (loss) on changes in fair value of our warrant

liability that, in each case, are directly impacted by

unpredictable fluctuations in our share price. The variability of

the above charges could have a significant and potentially

unpredictable impact on our future GAAP financial results.

Free Cash Flow and Free Cash Flow Conversion

We define free cash flow as net cash provided by (used in)

operating activities less capitalized software, and purchases of

property and equipment. Free cash flow is an indicator of liquidity

that provides information to our management and investors about the

amount of cash generated from operations, after capitalized

software development costs and purchases of property and equipment,

that can be used to repay debt obligations and/or for strategic

initiatives. Free cash flow conversion is calculated by dividing

free cash flow for a period by Adjusted EBITDA for the same period.

Free cash flow and free cash flow conversion do not represent our

residual cash flow available for discretionary purposes and does

not reflect our future contractual commitments. A reconciliation of

net cash provided by (used in) operating activities and operating

cash flow conversion to free cash flow and free cash flow

conversion, respectively, for the three and six months ended June

30, 2024 and 2023, are presented below.

The following table reconciles our non-GAAP financial measures

to the most comparable GAAP financial measures for the three and

six months ended June 30, 2024 and 2023.

Three Months Ended June

30,

Six Months Ended June

30,

($ in thousands)

2024

2023

2024

2023

Reconciliation of net (loss) income to

Adjusted EBITDA

Net (loss) income

$

(22,424

)

$

22,331

$

(31,830

)

$

(10,568

)

Interest expense, net

6,669

12,917

13,854

23,710

Income tax provision (benefit)

4,965

(14,051

)

7,645

1,452

Depreciation and amortization

4,235

8,140

8,354

16,092

Litigation-related costs (1)

661

288

1,083

1,499

Stock-based compensation expense

7,721

3,605

15,590

6,946

Severance expense (2)

—

—

58

—

Change in fair value of warrant liability

(3)

35,118

(7,098

)

53,798

8,219

Other (4)

—

752

—

1,533

Adjusted EBITDA

$

36,945

$

26,884

$

68,552

$

48,883

Revenue

$

82,345

$

61,538

$

157,690

$

117,347

Net (loss) income margin

(27.2

)%

36.3

%

(20.2

)%

(9.0

)%

Adjusted EBITDA Margin

44.9

%

43.7

%

43.5

%

41.7

%

Net cash provided by operating

activities

$

15,850

$

6,303

$

36,299

$

14,783

Less:

Capitalized development software costs and

purchases of property and equipment

$

(1,696

)

$

(1,083

)

$

(2,844

)

$

(2,575

)

Free cash flow

$

14,154

$

5,220

$

33,455

$

12,208

Operating cash flow conversion (5)

(70.7

)%

28.2

%

(114.0

)%

(139.9

)%

Free cash flow conversion

38.3

%

19.4

%

48.8

%

25.0

%

(1)

Litigation-related costs

primarily represent external legal fees associated with outstanding

litigation or regulatory matters, including fees incurred in

connection with the potential Norwegian Data Protection Authority

fine and CWA unionization.

(2)

Severance expense relates to

severance incurred for employees who elected not to relocate or

participate in our RTO Plan and other severance arrangements.

(3)

Change in fair value of warrant

liability relates to the warrants that were remeasured as of June

30, 2024 and 2023.

(4)

Other represents other costs that

are unrelated to our core ongoing business operations.

(5)

Operating cash flow conversion

represents net cash provided by (used in) operating activities as a

percentage of net income (loss).

Trademarks

This press release may contain trademarks of Grindr. Solely for

convenience, trademarks referred to in this press release may

appear without the ® or TM symbols, but such references are not

intended to indicate, in any way, that Grindr will not assert, to

the fullest extent under applicable law, its rights to these

trademarks.

About Grindr Inc.

With more than 14 million monthly active users, Grindr has grown

to become the Global Gayborhood in Your PocketTM, on a mission to

make a world where the lives of our global community are free,

equal, and just. Available in 190 countries and territories, Grindr

is often the primary way for its users to connect, express

themselves, and discover the world around them. Since 2015 Grindr

for Equality has advanced human rights, health, and safety for

millions of LGBTQ+ people in partnership with organizations in

every region of the world. Grindr has offices in West Hollywood,

the Bay Area, Chicago, and New York. The Grindr app is available on

the App Store and Google Play.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808990840/en/

Investors: IR@grindr.com

Media: Press@grindr.com

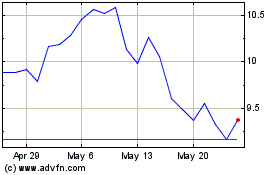

Grindr (NYSE:GRND)

Historical Stock Chart

From Dec 2024 to Jan 2025

Grindr (NYSE:GRND)

Historical Stock Chart

From Jan 2024 to Jan 2025