SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

HELIOGEN, INC.

(Name of Issuer)

Common Stock, $0.0001 par value per share

(Title of Class of Securities)

42329E105

(CUSIP Number)

Galloway Capital Partners, LLC

323 Sunny Isles Blvd., 7th Floor

Sunny Isles Beach, FL 33160

(212) 247-1339

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

With Copies To:

May 24, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§

240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom

copies are to be sent.

* The remainder

of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of

securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

CUSIP No. 758932206

| 1 |

NAME OF REPORTING PERSONS

Galloway Capital Partners, LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a) ☐

(b) ☒ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS (see instructions)

OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) or 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware, United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

378,800(1) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

378,800(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

378,800(1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW 11 EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

6.41%*(2) |

| 14 |

TYPE OF REPORTING PERSON (see instructions)

OO |

| |

|

|

|

| (1) | The securities are held and managed by Galloway Capital Partners, LLC (“GCP”). Bruce Galloway is the managing member of

GCP. Mr. Galloway has sole voting and dispositive control of GCP. Mr. Galloway may be deemed to have beneficial ownership of the common

stock held directly by GCP. |

| (2) | This percentage is calculated based upon 5,970,373 shares of Common Stock outstanding

as of May 2, 2024, as reported in the Issuer’s Form 10Q filed with the Securities and Exchange Commission on May 8, 2024. |

| 1 |

NAME OF REPORTING PERSONS

Bruce Galloway |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS (see instructions)

OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d) or 2(e)

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Florida, United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

378,800(1) |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

378,800(1) |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

378,800(1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW 11 EXCLUDES CERTAIN SHARES (see instructions)

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

6.41%*(2) |

| 14 |

TYPE OF REPORTING PERSON (see instructions)

IN |

| |

|

|

|

| (1) | The securities are held and managed by Galloway Capital Partners, LLC (“GCP”). Bruce Galloway is the managing member of

GCP. Mr. Galloway has sole voting and dispositive control of GCP. Mr. Galloway may be deemed to have beneficial ownership of the common

stock held directly by GCP. |

| (2) | This percentage is calculated based upon 5,970,373 shares of Common Stock outstanding

as of May 2, 2024, as reported in the Issuer’s Form 10Q filed with the Securities and Exchange Commission on May 8, 2024. |

Item 1. Security and Issuer

This Schedule 13D relates to the

common stock, par value $0.0001 per share (“Common Stock”), of Heliogen, Inc., a Delaware corporation (the “Issuer”).

The principal executive office of the Issuer is located at 130 West Union Street, Pasadena, CA 91103. Information given in response to

each item below shall be deemed incorporated by reference in all other items below.

As

of May 23, 2024, the Reporting Persons (defined below) beneficially owned an aggregate of 378,800 shares

of Common Stock, representing approximately 6.41% of the outstanding shares of Common Stock.

Item 2. Identity and Background

This Schedule 13D is being filed on behalf of each of

the following persons (collectively, the “Reporting Persons”):

| |

(i) |

Galloway Capital Partners, LLC |

Galloway Capital Partners, LLC

is a Delaware limited liability company, and Bruce Galloway is a citizen of Florida. Bruce Galloway is the managing member of Galloway

Capital Partners, LLC.

The address of the principal business

office of each Reporting Person is 323 Sunny Isles Blvd, 7th Floor, Sunny Isles Beach, FL 33160.

During the last five years, neither

Reporting Person nor any executive officer or director of Galloway Capital Partners, LLC has (i) been convicted in any criminal proceeding

or (ii) been a party to any civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which he was

subject to any judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal

or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or other Consideration.

Galloway

Capital Partners, LLC acquired 111,800 shares of Common Stock in open market purchases from August 2023 through May 2024. The aggregate

purchase price for the shares of Common Stock was approximately $2.47 per share. Such shares of Common Stock were purchased with investment

capital of Galloway Capital Partners, LLC and Mr. Galloway.

The Reporting Persons have effectuated

transactions to acquire shares of Common Stock within the past 60 days, as reflected in Schedule 1 to this Report. Other than as set forth

in this Report, none of the Reporting Persons has effected any transactions in the shares of Common Stock within the past 60 days.

Item 4. Purpose of Transaction.

Each Reporting Person acquired

the securities described in this Schedule 13D for investment purposes and intend to review its investment in the Issuer on a continuing

basis. Each Reporting Person may from time to time acquire additional securities of the Issuer or retain or sell all or a portion of the

shares then held by such Reporting Person, in the open market, block trades, underwritten public offerings or privately negotiated transactions.

Any actions any Reporting Person might undertake with respect to its investment in the Issuer may be made at any time and from time to

time and will be dependent upon such Reporting Person’s review of numerous factors, including, but not limited to: ongoing evaluation

of the Issuer’s business, financial condition, operations, prospects and strategic alternatives; price levels of the Issuer’s

securities; general market, industry and economic conditions; the relative attractiveness of alternative business and investment opportunities;

tax considerations; liquidity of the Issuer’s securities; and other factors and future developments.

Each

Reporting Person may consider, explore and/or develop plans and/or make proposals (whether preliminary or final) with respect to, among

other things, the Issuer’s performance, operations, management, governance (including potential changes to the Board), conflicted

party transactions, capital allocation policies, and strategy and plans of the Issuer. Each Reporting Person intends to engage the

Board and management with respect to the matters referred to in the preceding sentence. In addition, each Reporting Person may, at any

time and from time to time, (i) review or reconsider its position and/or change its purpose and/or formulate plans or proposals with respect

thereto and (ii) propose or consider one or more of the actions described in subparagraphs (a) - (j) of Item 4 of Schedule 13D.

On May

23, 2024, the Reporting Persons delivered a letter to the Issuer’s Chairman and Chief Executive Officer. In the letter, the Reporting

Persons highlighted disappointment in the share price and the need to enhance shareholder value. A copy of the letter is attached hereto

as Exhibit 99.1 and is incorporated herein by reference.

Item 5. Interest in Securities of the

Issuer.

(a) See

Items 11 and 13 on the cover pages to this Schedule 13D for the aggregate number and percentage of the class of securities identified

pursuant to Item 1 owned by the Reporting Person.

(b) Number

of shares as to which the Reporting Persons have:

i. Sole

power to vote or to direct the vote: See Item 7 on cover pages to this Statement.

ii. Shared

power to vote or to direct the vote: See Item 8 on cover pages to this Statement.

iii. Sole

power to dispose or direct the disposition: See Item 9 on cover pages to this Statement.

iv. Shared

power to dispose or direct the disposition: See Item 10 on cover pages to this Statement.

(c) Other

than as set forth in response to Item 3 above, no other transactions in the Issuer’s Common Stock by the Reporting Persons were

effected in the past 60 days.

(d) No

other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale

of, the Common Stock beneficially owned by the Reporting Persons.

(e) Not

applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with

Respect to Securities of the Issuer.

Except for the relationships described

above and in the responses to Items 4 and 5 herein, none of the Reporting Persons, nor, to the best of their knowledge, any persons identified

in Item 2 hereof has any contracts, arrangements, understandings or relationships (legal or otherwise) with any person, with respect to

any securities of the Issuer.

Item 7. Material to be Filed as Exhibits.

[The remainder of this page intentionally left blank]

SIGNATURE

After reasonable inquiry and to the best of the knowledge

and belief of each of the undersigned, each of the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: May 23, 2024

| |

By: |

/s/ Bruce Galloway |

| |

Name: |

Bruce Galloway |

| |

|

| |

GALLOWAY CAPITAL PARTNERS, LLC |

| |

|

| |

By: |

/s/ Bruce Galloway |

| |

Name: |

Bruce Galloway |

| |

Title: |

Managing Member |

Exhibit 99.1

JOINT FILING AGREEMENT

The undersigned

hereby agree that the statement on Schedule 13D with respect to the Common Stock of Heliogen, Inc. dated as of May 23, 2024 is, and

any amendments thereto (including amendments on Schedule 13G) signed by each of the undersigned shall be, filed on behalf of each of us

pursuant to and in accordance with the provisions of Rule 13d-1(k) under the Securities Exchange Act of 1934.

| |

GALLOWAY CAPITAL PARTNERS, LLC |

| |

|

| |

By: |

/s/ Bruce Galloway |

| |

|

Name: Bruce Galloway |

| |

|

Title: Managing Member |

| |

|

| |

|

/s/ Bruce Galloway |

| |

|

Bruce Galloway |

Schedule 1

Purchases by the Reporting Persons

| Date | |

Shares | |

Share Price |

| | |

| |

|

| April 19, 2024 | | |

| 9,215 | | |

$ | 1.42 | |

| April 22, 2024 | | |

| 17,150 | | |

$ | 1.41 | |

| April 23, 2024 | | |

| 7,200 | | |

$ | 1.33 | |

| | | |

| | | |

| | |

| May 9, 2024 | | |

| 31,510 | | |

$ | 1.60 | |

| May 10, 2024 | | |

| 2,000 | | |

$ | 1.69 | |

| May 13, 2024 | | |

| 10,970 | | |

$ | 1.78 | |

| May 14, 2024 | | |

| 12,800 | | |

$ | 1.85 | |

| May 15, 2024 | | |

| 2,873 | | |

$ | 1.89 | |

| May 17, 2024 | | |

| 10,501 | | |

$ | 2.28 | |

EXHIBIT 99.2

Galloway Capital Partners, LLC

May 23, 2024

Julie Kane, Chairperson of the Board

Christiana Obiaya, Chief Executive Officer

Heliogen, Inc.

130 West Union Street

Pasadena, CA 91103

Dear Mssrs. Kane and Obiaya:

We have been shareholders of Heliogen, Inc. (the “Company”

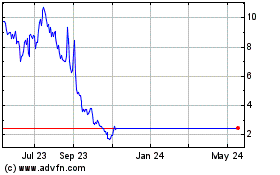

or “Heliogen”) for almost a year. We are quite disappointed with the performance of the Company’s common stock, which

is -99.9% since going public.

We believe the Company is significantly undervalued

and requires our support and expertise in creating shareholder value. Since the Company went public via a SPAC, the stock has been heavily

shorted by investors who target these types of transactions. We believe the Company has made major strides in the development of its AI

assisted concentrated solar in order to produce steam as well as the development of clean hydrogen.

We are stunned that the Company’s market cap

is a tiny fraction of its invested capital of approximately $500 million. The share price is certainly not reflective of this as well

the value of the Company’s development and strategic joint ventures. We support management’s retention of an advisor to assist

in securing joint ventures with deep-pocketed energy companies, utilities and/or government agencies. We believe Heliogen should be successful

and can achieve its potential through these endeavors as well as programs under the Inflation Reduction Act. In addition, the Company

should also explore utilizing its valuable $500 million net operating lost carry forward.

Galloway Capital Partners and its founder, Bruce Galloway,

have significant experience investing in undervalued publicly traded companies. We would like to assist in the process of growing the

Company, improving the financial structure and enhancing shareholder value, which we believe should be multiples of the current valuation.

Our interests are clearly aligned, and we believe that we can bring strong insight and constructive actions which will benefit all of

the Company’s shareholders.

Please let me know when you would be available to

discuss these important matters. I can be reached at: bgalloway@gallowaycap.com or 917-405-4591.

Very truly yours,

Bruce Galloway

President and Chief Investment Officer

Heliogen (NYSE:HLGN)

Historical Stock Chart

From Dec 2024 to Jan 2025

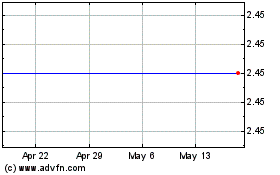

Heliogen (NYSE:HLGN)

Historical Stock Chart

From Jan 2024 to Jan 2025