Holley Performance Brands' Enhanced Operational Performance and Recent Credit Upgrades Have Enabled an Amendment to the Revolving Credit Facility, Creating a Covenant-Lite Capital Structure

06 December 2024 - 12:00AM

Business Wire

Proactively Enters into an Amendment which

Provides Improved Financial Flexibility

Holley Performance Brands (NYSE: HLLY) a leader in automotive

aftermarket performance solutions, today announced the successful

amendment of its senior secured revolving credit facility,

effective December 4, 2024. This amendment was driven by

operational improvements and recent credit upgrades.

The amendment includes a springing covenant of 5.0x total net

leverage that is only tested when the revolver is drawn and extends

the maturity date to November 18, 2029. Additionally, available

borrowing under the revolver is updated to $100 million.

“We are pleased to announce an amendment to our revolver,

enhancing Holley's financial flexibility to support our capital

needs, thanks to our operational success and improved earnings and

cash flow,” said Jesse Weaver, Chief Financial Officer of Holley.

“Our improved operational performance combined with upgrades from

S&P and Moody’s on our credit and debt ratings this year,

allowed us to proactively amend our revolving credit facility. We

are proud of the efforts taken to further reduce risk by replacing

the current maintenance covenant with a springing covenant while

also reducing refinancing risk by extending the maturity on the

revolver through 2029. The amended terms provide us with further

confidence as we deliver on our transformational initiatives and

drive long-term value at Holley.”

For more Holley Performance Brands company news, click here.

Certain statements in this press release may be considered

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are

subject to risks, uncertainties, and other important factors which

could cause actual results to differ materially from those

expressed or implied by such forward-looking statements, including

but not limited to Holley’s ability to (1) successfully design,

develop, and market new products, (2) maintain and strengthen

demand for our products and brands, (3) attract new customers in a

cost-effective manner, (4) expand into additional consumer markets,

and (5) and the other risks and uncertainties set forth in the

Annual Report on Form 10-K for the year ended December 31, 2023

filed with the U.S. Securities and Exchange Commission (“SEC”) on

March 14, 2024, and in any subsequent filings with the SEC.

About Holley Performance

Brands Holley Performance Brands (NYSE: HLLY) leads in

the design, manufacturing and marketing of high-performance

products for automotive enthusiasts. The company owns and manages a

portfolio of iconic brands, catering to a diverse community of

enthusiasts passionate about the customization and performance of

their vehicles. Holley Performance Brands distinguishes itself

through a strategic focus on four consumer vertical groupings,

including Domestic Muscle, Modern Truck & Off-Road, Euro &

Import, and Safety & Racing, ensuring a wide-ranging impact

across the automotive aftermarket industry. Renowned for its

innovative approach and strategic acquisitions, Holley Performance

Brands is committed to enhancing the enthusiast experience and

driving growth through innovation. For more information on Holley

Performance Brands and its dedication to automotive excellence,

visit https://www.holley.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241204624686/en/

Media Relations Contact(s): Jordan Moore,

jmoore@tinymightyco.com / Sydney Goggans,

sgoggans@tinymightyco.com

Investor Relations Contacts: Anthony Rozmus / Neel Sikka

Solebury Strategic Communications 203-428-3224

Holley@soleburystrat.com

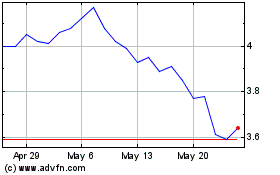

Holley (NYSE:HLLY)

Historical Stock Chart

From Feb 2025 to Mar 2025

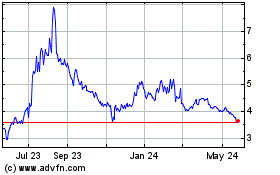

Holley (NYSE:HLLY)

Historical Stock Chart

From Mar 2024 to Mar 2025