Amended Statement of Ownership (sc 13g/a)

14 February 2023 - 8:14AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13G

Under

the Securities Exchange Act of 1934

(Amendment

No. 8)*

Morgan Stanley India Investment Fund, Inc.

(Name

of Issuer)

Common

Stock

(Title

of Class of Securities)

61745C105

(CUSIP

Number)

December

31, 2022

(Date

of Event Which Requires Filing of This Statement)

Check the appropriate box to designate the rule pursuant to which

this Schedule is filed:

☒ Rule 13d-1(b)

☐ Rule 13d-1(c)

☐ Rule 13d-1(d)

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP

No. 61745C105

|

13G |

Page

2 of 6 Pages |

| 1 |

|

NAME

OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS

City of London Investment Management Company Limited, a company

incorporated under the laws of England and Wales

|

|

|

| 2 |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

|

(a)

☐

(b)

☐ |

| 3 |

|

SEC

USE ONLY

|

|

|

| 4 |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

England

and Wales

|

|

|

|

|

|

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH |

|

5 |

|

SOLE

VOTING POWER

3,093,489

|

| |

6 |

|

SHARED

VOTING POWER

0

|

| |

7 |

|

SOLE

DISPOSITIVE POWER

3,093,489

|

| |

8 |

|

SHARED

DISPOSITIVE POWER

0

|

|

|

|

|

|

| 9 |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,093,489

|

|

|

| 10 |

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

|

|

☐ |

| 11 |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

29.4%

|

|

|

12 |

|

TYPE

OF REPORTING PERSON

IA

|

|

|

CUSIP

No. 61745C105

|

13G |

Page

3 of 6 Pages |

| Item 1(a). |

Name of Issuer: |

Morgan

Stanley India Investment Fund, Inc.

| Item 1(b). |

Address of

Issuer's Principal Executive Offices: |

The

principal executive offices of the Fund are located at:

522

Fifth Avenue

New

York, NY 10036

| Item 2(a). |

Name of Person

Filing: |

This statement is being filed by City of London Investment

Management Company Limited (“CLIM” or the “Reporting Person”). CLIM is a fund manager, which specializes in investing

in closed-end investment companies and is a registered investment adviser under Section 203 of the Investment Advisers Act of 1940. CLIM

is controlled by City of London Investment Group plc (“CLIG”), which is listed on the London Stock Exchange. However, in accordance

with SEC Release No. 34-39538 (January 12, 1998), effective informational barriers have been established between CLIM and CLIG such that

voting and investment power over the subject securities is exercised by CLIM independently of CLIG, and, accordingly, attribution of beneficial

ownership is not required between CLIM and CLIG.

CLIM is principally engaged in the business of providing

investment advisory services to various public and private investment funds, including Emerging (BMI) Markets Country Fund (“BMI”),

a private investment fund organized as a Delaware business trust, Emerging Markets Free Fund (“CF”), a private investment

fund organized as a Delaware business trust, Emerging Markets Global Fund (“CG”), a private investment fund organized as a

Delaware business trust, Emerging Markets Investable Fund (“CI”), a private investment fund organized as a Delaware business

trust, Global Emerging Markets Fund (“EUREKA”), a private investment fund organized as a Delaware business trust, The Emerging

World Fund (“EWF”), a Dublin, Ireland-listed open-ended investment company, Emerging (Free) Markets Country Fund (“FREE”),

a private investment fund organized as a Delaware business trust, Emerging Markets Country Fund (“GBL”), a private investment

fund organized as a Delaware business trust, Investable Emerging Markets Country Fund (“INV”), a private investment fund organized

as a Delaware business trust, The EM Plus CEF Fund (“PLUS”), a private investment fund organized as a Delaware business trust,

The EM Special Situations CEF Focused Fund (“UNIQUE”), a private investment fund organized as a Delaware business trust, and

unaffiliated third-party segregated accounts over which CLIM exercises discretionary voting and investment authority (the “Segregated

Accounts”).

BMI, CF, CG, CI, EUREKA, EWF, FREE, GBL, INV, PLUS, and UNIQUE

are collectively referred to herein as the “City of London Funds.”

The Shares to which this Schedule 13G relates are owned directly by the

City of London Funds and the Segregated Accounts.

CUSIP

No. 61745C105

|

13G |

Page

4 of 6 Pages |

| Item

2(b). |

Address

of Principal Business Office or, if none, Residence: |

77

Gracechurch Street

London EC3V 0AS

England

England and Wales

| Item

2(d). |

Title

of Class of Securities: |

Common Stock, par value $.001 per share

61745C105

| Item

3. |

If This Statement is Filed Pursuant to Rule 13d-1(b), or 13d-2(b)

or (c), Check Whether the Person Filing is a: |

| (a) |

☐ | Broker

or dealer registered under Section 15 of the Act (15 U.S.C. 78o); |

| (b) |

☐ | Bank

as defined in Section 3(a)(6) of the Act (15 U.S.C. 78c); |

| (c) |

☐ | Insurance

company as defined in Section 3(a)(19) of the Act (15 U.S.C. 78c); |

| (d) |

☐ | Investment

company registered under Section 8 of the Investment Company Act of 1940 (15 U.S.C. 80a-8); |

| (e) |

☒ | An

investment adviser in accordance with Rule 13d-1(b)(1)(ii)(E); |

| (f) |

☐ | An

employee benefit plan or endowment fund in accordance with Rule 13d-1(b)(1)(ii)(F); |

| (g) |

☐ | A

parent holding company or control person in accordance with Rule 13d-1(b)(1)(ii)(G); |

| (h) |

☐ | A

savings association as defined in Section 3(b) of the Federal Deposit Insurance Act (12 U.S.C. 1813); |

| (i) |

☐ | A

church plan that is excluded from the definition of an investment company under Section 3(c)(14) of the Investment Company Act

(15 U.S.C. 80a-3); |

| (j) |

☐ | Group,

in accordance with Rule 13d-1(b)(1)(ii)(J). |

CUSIP

No. 61745C105

|

13G |

Page

5 of 6 Pages |

(a)

Amount beneficially owned:

3,093,489

(b)

Percent of Class:

29.4%

(c)

Number of shares as to which such person has:

(i) Sole power to vote or direct the

vote: 3,093,489

(ii) Shared power to vote or direct the vote:

0

(iii) Sole power to dispose or to direct the disposition

of: 3,093,489

(iv) Shared power to dispose or

to direct the disposition of: 0

| Item

5. |

Ownership

of Five Percent or Less of a Class. |

Not applicable.

| Item

6. |

Ownership

of More than Five Percent on Behalf of Another Person. |

Not applicable.

| Item

7. |

Identification

and Classification of the Subsidiary Which Acquired the Security being Reported on by the Parent Holding Company. |

Not

applicable.

| Item

8. |

Identification

and Classification of Members of the Group. |

Not

applicable.

| Item

9. |

Notice

of Dissolution of Group. |

Not

applicable.

By signing below I certify that, to the best of my knowledge and

belief, the securities referred to above were acquired and are held in the ordinary course of business and were not acquired and

are not held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities and were

not acquired and are not held in connection with or as a participant in any transaction having that purpose or effect.

CUSIP

No. 61745C105

|

13G |

Page

6 of 6 Pages |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement is true, complete and correct.

Dated: February 13, 2023

| |

CITY

OF LONDON INVESTMENT MANAGEMENT COMPANY LIMITED

|

|

| |

|

|

|

|

By:

|

/s/ Catrina Reagan |

|

| |

|

Name: Catrina Reagan |

|

| |

|

Title: US Chief Compliance Officer |

|

| |

|

|

|

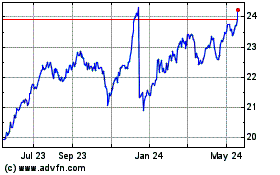

Morgan Stanley India Inv... (NYSE:IIF)

Historical Stock Chart

From Oct 2024 to Nov 2024

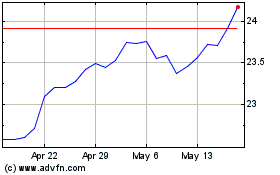

Morgan Stanley India Inv... (NYSE:IIF)

Historical Stock Chart

From Nov 2023 to Nov 2024