Second Quarter Results of $11.4 Million in

Revenue, Exceeding High End of Guidance Range, Representing 106%

Year-Over-Year Growth

Secures $9 Million in Bookings, Including

System Design Win with ARLIS

Demonstrates Company Record Two-Qubit Native

Gate Fidelity of 99.9%, Paving the Way for Highly Accurate Quantum

Systems

Announces Discovery of Partial Error Correction

Technique, Bringing Quantum Era Within Reach

Raises Full Year Revenue Guidance Range to

Between $38 Million and $42 Million

IonQ (NYSE: IONQ), a leader in the quantum computing industry,

today announced financial results for the quarter ended June 30,

2024.

“This was a tremendous quarter for IonQ, with the company

posting revenue well above the high-end of our guidance range and

leading the industry in technical innovations that have brought the

quantum era within reach,” said Peter Chapman, President and CEO of

IonQ. “Specifically, the second quarter saw the launch of our

accelerated technical roadmap, our demonstration of 99.9% fidelity

using our next-generation barium qubits, and our invention of an

industry-first partial error correction scheme, a new technique

that could allow much larger applications to run on near-term

quantum systems.”

“This was also a major quarter for IonQ’s commercialization,

including our win of a system design project with ARLIS (the

Applied Research Laboratory for Intelligence and Security) via a

competitive bidding process and an extension of our system access

contract with AWS.”

Financial Highlights

- IonQ recognized revenue of $11.4 million for the second

quarter, which is above the high end of the previously provided

range of $7.6 to $9.2 million, and represents 106% growth compared

to $5.5 million in the prior year.

- IonQ achieved $9.0 million in new bookings for the second

quarter.

- Cash, cash equivalents and investments were $402.0 million as

of June 30, 2024.

- Net loss was $37.6 million and Adjusted EBITDA loss was $23.7

million for the second quarter.* Exclusions from Adjusted EBITDA

include a non-cash gain of $6.6 million related to the change in

the fair value of IonQ’s warrant liabilities.

*Adjusted EBITDA is a non-GAAP financial measure defined under

“Non-GAAP Financial Measures,” and is reconciled to net loss, its

closest comparable GAAP measure, at the end of this release.

Technical Highlights

- IonQ demonstrated a company record, two-qubit native gate

fidelity of 99.9% using its next-generation barium qubits, paving

the way for highly accurate quantum systems to tackle increasingly

complex problems for customers. This milestone was achieved on an

engineering development system running two qubits and IonQ believes

it is a harbinger for superior qubit fidelities on forthcoming

barium-based production systems.

- IonQ announced the invention of a new, industry-first partial

error correction technique for an important class of quantum gates.

The technique, which reduces the errors for Clifford gates within

circuits, offers the potential to supercharge the accuracy of

near-term quantum computers, bringing IonQ much closer to

commercial advantage. This Clifford error reduction technique,

which IonQ plans to offer in upcoming Tempo systems, allows for

more accurate quantum algorithms and requires a ratio of only about

three physical qubits per one error-reduced qubit.

- IonQ announced new, more aggressive technical roadmap targets

on its webinar in June, including a goal of 99.999% logical

two-qubit gate fidelity and 100 physical qubits in new systems by

the end of 2025.

- IonQ announced an exciting new research project with the United

States Naval Research Lab (NRL) using IonQ Aria to sample quantum

states in molecular structures affecting corrosion. Corrosion is a

more than $20 billion problem annually for the Navy, and through

this project, IonQ quantum computers delivered results ahead of

what is possible with classical computers.

Commercial Highlights

- IonQ announced its selection by the Applied Research Laboratory

for Intelligence and Security (ARLIS) through a competitive bidding

process to design a first-of-its-kind, networked system for blind

quantum computing. Blind quantum computing is a process where

quantum computers remain ‘blind’ to what information is being

processed through them, and is a key achievement target for the US

national security apparatus. In fiscal 2023 and 2024, Congress

funded this research for a total of $40 million. The initial phase

of the contract is a $5.7 million award for the design of the

quantum computers based on IonQ trapped ion processors. IonQ

expects to complete this work by the end of this year. In the next

phase of the project, ARLIS plans to have two systems built based

on the initial IonQ design.

- IonQ announced the extension of its access contract with AWS to

continue to offer its world-class quantum computers via Amazon

Braket, the quantum computing service of AWS, to developers

everywhere who want to leverage the power of quantum computing. AWS

users can access IonQ’s generally available quantum computers

including IonQ Aria through Amazon Braket, and request early access

to IonQ Forte through Braket Direct.

- In July, IonQ started final assembly of its first Forte

Enterprise system at QuantumBasel in Basel, Switzerland, where

installation and setup has begun.

- IonQ announced the start of construction on two more Forte

Enterprise systems being manufactured in the Company’s Seattle

facility.

Corporate Highlights

- IonQ announced the promotion of Dr. Dean Kassmann to Senior

Vice President of the newly formed Engineering and Technology

division. Dr. Kassmann has over 30 years of leadership experience

in software, hardware, and technology development, and has been

instrumental in delivering IonQ’s technical milestone

achievements.

2024 Financial Outlook

- For the full year 2024, IonQ is increasing its revenue

expectations to between $38 million and $42 million, with between

$9 million and $12 million for the third quarter.

- For the full year 2024, IonQ is reiterating its previously

stated bookings range of $75 million and $95 million.

Second Quarter 2024 Conference Call

IonQ will host a conference call today at 4:30 p.m. Eastern time

to review the Company’s financial results for the second quarter

June 30, 2024 and to provide a business update. The call will be

accessible by telephone at 844-512-2921 (domestic) or

+1-412-317-6671 (international). The call will also be available

live via webcast on the Company’s website here, or directly here. A

telephone replay of the conference call will be available

approximately three hours after its conclusion at 844-512-2921

(domestic) or 412-317-6671 (international) with access code

13746744 and will be available until 11:59 p.m. Eastern time,

August 21, 2024. An archive of the webcast will also be available

here shortly after the call and will remain available for one

year.

Non-GAAP Financial Measures

To supplement IonQ’s condensed consolidated financial statements

presented in accordance with GAAP, IonQ uses non-GAAP measures of

certain components of financial performance. Adjusted EBITDA is a

financial measure that is not required by or presented in

accordance with GAAP. Management believes that this measure

provides investors an additional meaningful method to evaluate

certain aspects of the Company’s results period over period.

Adjusted EBITDA is defined as net loss before interest income,

interest expense, income tax expense, depreciation and amortization

expense, stock-based compensation, change in fair value of assumed

warrant liabilities, and other non-recurring non-operating income

and expenses. IonQ uses Adjusted EBITDA to measure the operating

performance of its business, excluding specifically identified

items that it does not believe directly reflect its core operations

and may not be indicative of recurring operations. The presentation

of non-GAAP financial measures is not meant to be considered in

isolation or as a substitute for the financial results prepared in

accordance with GAAP, and IonQ’s non-GAAP measures may be different

from non-GAAP measures used by other companies. IonQ shows a

reconciliation of GAAP to non-GAAP financial measures at the end of

this release.

About IonQ

IonQ, Inc. is a leader in quantum computing that delivers

high-performance systems capable of solving the world’s largest and

most complex commercial and research use cases. IonQ’s current

generation quantum computer, IonQ Forte, is the latest in a line of

cutting-edge systems, boasting 36 algorithmic qubits. The Company’s

innovative technology and rapid growth were recognized in Fast

Company’s 2023 Next Big Things in Tech List and Deloitte’s 2023

Technology Fast 500™ List, respectively. Available through all

major cloud providers, IonQ is making quantum computing more

accessible and impactful than ever before. Learn more at

IonQ.com.

IonQ Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Some of the forward-looking statements can be identified

by the use of forward-looking words. Statements that are not

historical in nature, including the words “anticipate,” “expect,”

“suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,”

“projects,” “should,” “could,” “would,” “may,” “will,” “forecast”,

“offers” and other similar expressions are intended to identify

forward-looking statements. These statements include those related

to the Company’s technology driving commercial advantage in the

future; the Company’s future financial and operating performance,

including our preliminary outlook and guidance; the appearance of

new applications of IonQ’s products and services; the ability for

third parties to implement IonQ’s offerings to solve their problems

and increase their quantum computing capabilities; expansion of

IonQ’s sales pipeline; IonQ’s quantum computing capabilities and

plans; future deliveries of and access to IonQ’s quantum computers

and services; future purchases of IonQ’s offerings by customers

using congressionally-appropriated funds from the U.S. government;

IonQ’s performance of existing contracts in the future, including

anticipated timing of completion of research, development and

manufacturing by IonQ; IonQ receiving additional revenues under

planned subsequent phases of customer contracts; and the

scalability and reliability of IonQ’s quantum computing offerings.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this press

release, including but not limited to: changes in the competitive

industries in which IonQ operates, including development of

competing technologies; our ability to sell effectively to

government entities and large enterprises; changes in laws and

regulations affecting IonQ’s business; IonQ’s ability to implement

its business plans, forecasts and other expectations, to identify

and realize partnerships and opportunities, and to engage new and

existing customers; IonQ’s ability to deliver services and products

within currently anticipated timelines; IonQ’s customers deciding

or declining to extend contracts into new phases; changes in U.S.

government spending or policy that may affect IonQ’s customers;

changes to U.S. government goals and metrics of success with regard

to implementation of quantum computing; and risks associated with

U.S. government sales, including availability of funding and

provisions that allow the government to unilaterally terminate or

modify contracts for convenience. You should carefully consider the

foregoing factors and the other risks and uncertainties disclosed

in the Company’s filings, including but not limited to those

described in the “Risk Factors'' section of IonQ’s most recent

Quarterly Report on Form 10-Q and other documents filed by IonQ

from time to time with the Securities and Exchange Commission.

These filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements, and IonQ assumes no obligation and does not intend to

update or revise these forward-looking statements, whether as a

result of new information, future events, or otherwise. IonQ does

not give any assurance that it will achieve its expectations.

IonQ, Inc. Condensed

Consolidated Statements of Operations (unaudited) (in

thousands, except share and per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue

$

11,381

$

5,515

$

18,963

$

9,800

Costs and expenses:

Cost of revenue (excluding depreciation

and amortization)

5,623

1,901

9,037

2,937

Research and development

31,204

19,869

63,572

36,102

Sales and marketing

6,137

3,575

12,838

6,242

General and administrative

13,053

10,930

27,073

21,511

Depreciation and amortization

4,305

2,329

8,260

4,120

Total operating costs and expenses

60,322

38,604

120,780

70,912

Loss from operations

(48,941

)

(33,089

)

(101,817

)

(61,112

)

Gain (loss) on change in fair value of

warrant liabilities

6,639

(15,537

)

15,266

(19,147

)

Interest income, net

4,801

4,877

9,600

9,108

Other income (expense), net

(45

)

31

(179

)

95

Loss before income tax expense

(37,546

)

(43,718

)

(77,130

)

(71,056

)

Income tax benefit (expense)

(15

)

—

(23

)

—

Net loss

$

(37,561

)

$

(43,718

)

$

(77,153

)

$

(71,056

)

Net loss per share attributable to

common stockholders—basic and diluted

$

(0.18

)

$

(0.22

)

$

(0.37

)

$

(0.35

)

Weighted average shares used in computing

net loss per share attributable to common stockholders—basic and

diluted

211,637,479

201,431,494

209,898,459

200,775,817

IonQ, Inc. Condensed

Consolidated Balance Sheets (unaudited) (in thousands)

June 30,

December 31,

2024

2023

Assets

Current assets:

Cash and cash equivalents

$

41,752

$

35,665

Short-term investments

328,045

319,776

Accounts receivable

7,893

11,467

Prepaid expenses and other current

assets

27,165

23,081

Total current assets

404,855

389,989

Long-term investments

32,171

100,489

Property and equipment, net

47,883

37,515

Operating lease right-of-use assets

9,938

4,613

Intangible assets, net

16,969

15,077

Goodwill

719

742

Other noncurrent assets

4,900

5,155

Total Assets

$

517,435

$

553,580

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

6,324

$

5,599

Accrued expenses

8,925

18,376

Current portion of operating lease

liabilities

1,479

710

Unearned revenue

13,668

12,087

Current portion of stock option early

exercise liabilities

392

392

Total current liabilities

30,788

37,164

Operating lease liabilities, net of

current portion

15,152

7,395

Unearned revenue, net of current

portion

121

447

Stock option early exercise liabilities,

net of current portion

252

448

Warrant liabilities

7,738

23,004

Other noncurrent liabilities

110

128

Total liabilities

$

54,161

$

68,586

Stockholders’ Equity:

Common stock

$

21

$

20

Additional paid-in capital

893,797

839,014

Accumulated deficit

(429,226

)

(352,073

)

Accumulated other comprehensive loss

(1,318

)

(1,967

)

Total stockholders’ equity

463,274

484,994

Total Liabilities and Stockholders’

Equity

$

517,435

$

553,580

IonQ, Inc. Condensed

Consolidated Statements of Cash Flows (unaudited) (in

thousands)

Six Months Ended June

30,

2024

2023

Cash flows from operating

activities:

Net loss

$

(77,153

)

$

(71,056

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

8,260

4,120

Non-cash research and development

arrangements

260

260

Stock-based compensation

43,040

21,572

(Gain) loss on change in fair value of

warrant liabilities

(15,266

)

19,147

Amortization of premiums and accretion of

discounts on available-for-sale securities

(4,787

)

(4,593

)

Other, net

1,896

736

Changes in operating assets and

liabilities:

Accounts receivable

3,558

2,074

Prepaid expenses and other current

assets

(8,341

)

(2,928

)

Accounts payable

(165

)

479

Accrued expenses

(2,116

)

2,267

Unearned revenue

1,262

(2,005

)

Other assets and liabilities

2,508

26

Net cash provided by (used in) operating

activities

$

(47,044

)

$

(29,901

)

Cash flows from investing

activities:

Purchases of property and equipment

(10,629

)

(2,411

)

Capitalized software development costs

(2,129

)

(1,950

)

Intangible asset acquisition costs

(892

)

(628

)

Purchases of available-for-sale

securities

(146,098

)

(185,377

)

Maturities of available-for-sale

securities

211,572

189,446

Net cash provided by (used in) investing

activities

$

51,824

$

(920

)

Cash flows from financing

activities:

Proceeds from stock options exercised

1,185

541

Other financing, net

141

(1

)

Net cash provided by (used in) financing

activities

$

1,326

$

540

Effect of foreign exchange rate changes on

cash, cash equivalents and restricted cash

4

—

Net change in cash, cash equivalents and

restricted cash

6,110

(30,281

)

Cash, cash equivalents and restricted cash

at the beginning of the period

38,081

46,367

Cash, cash equivalents and restricted

cash at the end of the period

$

44,191

$

16,086

IonQ, Inc.

Reconciliation of Net Loss to Adjusted EBITDA (unaudited)

(in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net loss

$

(37,561

)

$

(43,718

)

$

(77,153

)

$

(71,056

)

Interest income, net

(4,801

)

(4,877

)

(9,600

)

(9,108

)

Interest expense

—

—

—

—

Income tax (benefit) expense

15

—

23

—

Depreciation and amortization

4,305

2,329

8,260

4,120

Stock-based compensation

20,979

11,304

43,040

21,572

(Gain) loss on change in fair value of

warrant liabilities

(6,639

)

15,537

(15,266

)

19,147

Adjusted EBITDA

$

(23,702

)

$

(19,425

)

$

(50,696

)

$

(35,325

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807802557/en/

IonQ Media Contact: Tyler Ogoshi press@ionq.com

IonQ Investor Contact: investors@ionq.com

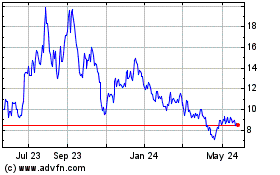

IonQ (NYSE:IONQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

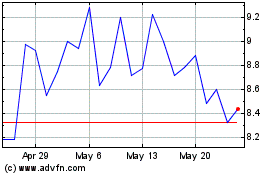

IonQ (NYSE:IONQ)

Historical Stock Chart

From Nov 2023 to Nov 2024