AM Best Affirms Credit Ratings of Kemper Corporation, Its Affiliates and Subsidiaries

14 September 2024 - 6:09AM

Business Wire

AM Best has affirmed the Financial Strength Rating (FSR)

of A- (Excellent) and the Long-Term Issuer Credit Ratings

(Long-Term ICRs) of “a-” (Excellent) of the property/casualty

subsidiaries and affiliated insurance companies of Kemper

Corporation (Kemper Corp.) [NYSE: KMPR], collectively referred to

as Kemper Property & Casualty Group (Kemper P&C). AM Best

also has affirmed the FSR of A- (Excellent) and the Long-Term ICRs

of “a-” (Excellent) of Kemper Corp.’s life subsidiaries,

collectively referred to as Kemper Life Group (Kemper Life)

(Chicago, IL). Concurrently, AM Best has affirmed the Long-Term ICR

of “bbb-” (Good) and the Long-Term Issue Credit Ratings (Long-Term

IRs) and indicative Long-Term IRs of Kemper Corp., the ultimate

parent, headquartered in Chicago, IL. The outlook of these Credit

Ratings (ratings) is stable. (See below for further discussion and

a detailed listing of all companies and ratings.)

The ratings of Kemper P&C reflect its balance sheet

strength, which AM Best assesses as very strong, as well as its

marginal operating performance, neutral business profile and

appropriate enterprise risk management (ERM).

Kemper P&C’s earnings and balance sheet strength have been

significantly impacted in recent years by substantial operating

losses, largely driven by inflation-related severity increases.

This led to sharp fluctuations in surplus levels, mixed reserve

development trends and elevated underwriting leverage. The group’s

concentration in California further pressured results, as the

state’s regulatory environment made it difficult for Kemper P&C

to secure necessary rate adjustments for a prolonged period.

Nonetheless, Kemper P&C’s strategic rate adjustments and

non-rate actions have proven effective, with operating results

stabilizing and showing significant improvement through late 2023

and in the first half of 2024. Consequently, the group has resumed

generating underlying surplus gains, strengthening its

risk-adjusted capitalization and overall balance sheet. The group’s

balance sheet strength is further supported by both implicit and

explicit support from its parent company, Kemper Corp., as well as

key initiatives such as the preferred home and auto exit and the

Kemper Bermuda initiative. However, AM Best notes Kemper Corp.’s

financial leverage remains elevated but is expected to improve

going forward.

While Kemper P&C and Kemper Corp. have reported improved

results through the first half of 2024, AM Best notes the group has

begun to shift its focus back toward business growth, which is

expected to bring operating performance more in-line with

historical norms. Additionally, after implementing large rate

increases over the past few years, management anticipates returning

to regular maintenance rate adjustments and a steadier course of

business going forward.

The ratings of Kemper Life reflect its balance sheet strength,

which AM Best assesses as very strong, as well as its adequate

operating performance, neutral business profile, appropriate ERM,

and consideration of the group’s affiliation with lead rating unit,

Kemper P&C.

In 2022, Kemper Life announced that it was entering into an

agreement with Kemper Bermuda to cede 80% of its life business to

its offshore affiliate. This initiative, along with a reserve

review reduction completed in late 2023, has resulted in the

release of over $600 million in dividends to the parent company,

Kemper Corp. Given that the Kemper Bermuda initiative has been

completed, AM Best expects Kemper Life’s overall balance sheet to

be more stable going forward. Additionally, AM Best notes it

considers the consolidated risk-adjusted capitalizations of both

the statutory group and Bermuda entity to ensure Kemper Life’s

economic overall balance sheet strength remains appropriately

assessed.

The stable outlooks for Kemper Corp., its affiliates and

subsidiaries reflect AM Best’s view that the consolidated results

are expected to remain profitable as management begins to unwind

certain non-rate actions and return to growth. However, given

Kemper Corp.’s overall enterprise-wide focus on increasing capital

efficiency–in part to satisfy shareholder return

expectations–through the dividends of subsidiary capital to the

parent company, and through intra-group reinsurance–AM Best

acknowledges the potential volatility in the group’s overall

consolidated risk-adjusted capitalization, and that of its

principal operating units, which may impact the group’s go-forward

credit profile.

The FSR of A- (Excellent) and the Long-Term ICRs of “a-”

(Excellent) have been affirmed with stable outlooks for the members

of Kemper Property & Casualty Group:

- Trinity Universal Insurance Company

- Alpha Property & Casualty Insurance Company

- Capitol County Mutual Fire Insurance Company

- Charter Indemnity Company

- Financial Indemnity Company

- Infinity Insurance Company

- Infinity Assurance Insurance Company

- Infinity Auto Insurance Company

- Infinity Casualty Insurance Company

- Infinity Indemnity Insurance Company

- Infinity Preferred Insurance Company

- Infinity Safeguard Insurance Company

- Infinity Select Insurance Company

- Infinity Standard Insurance Company

- Infinity County Mutual Insurance Company

- Kemper Independence Insurance Company

- Merastar Insurance Company

- Mutual Savings Fire Insurance Company

- Kemper Financial Indemnity Company

- Old Reliable Casualty Company

- Response Insurance Company

- Response Worldwide Direct Auto Insurance Company

- Response Worldwide Insurance Company

- Union National Fire Insurance Company

- United Casualty Insurance Company of America

- Unitrin Advantage Insurance Company

- Unitrin Auto and Home Insurance Company

- Unitrin County Mutual Insurance Company

- Unitrin Direct Insurance Company

- Unitrin Direct Property & Casualty Company

- Unitrin Preferred Insurance Company

- Unitrin Safeguard Insurance Company

- Valley Property & Casualty Insurance Company

- Warner Insurance Company

The FSR of A- (Excellent) and the Long-Term ICRs of “a-”

(Excellent) have been affirmed with stable outlooks for the members

of Kemper Life Group:

- United Insurance Company of America

- Mutual Savings Life Insurance Company

- The Reliable Life Insurance Company

- Union National Life Insurance Company

The following Long-Term IRs have been affirmed with stable

outlooks:

Kemper Corporation— -- “bbb-” (Good) on $450 million 4.35%

senior unsecured notes, due 2025 -- “bbb-” (Good) on $400 million

2.4% senior unsecured notes, due 2030 -- “bbb-” (Good) on $400

million 3.8% senior unsecured notes, due 2032 -- “bb” (Fair) on

$150 million junior subordinated debentures, due 2062

The following indicative Long-Term IRs under the shelf

registration have been affirmed with stable outlooks for the shelf

registration:

Kemper Corporation— -- “bbb-” (Good) on senior unsecured debt --

“bb+” (Fair) on subordinated debt -- “bb” (Fair) on preferred

stock

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s

Performance Assessments, Best’s Preliminary Credit Assessments and

AM Best press releases, please view Guide to Proper Use of

Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2024 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240913690884/en/

Cristian Sieira Financial Analyst +1 908 882

2315 cristian.sieira@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 882 2310

christopher.sharkey@ambest.com

Alan Murray Director +1 908 882 2195

alan.murray@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 882 2318 al.slavin@ambest.com

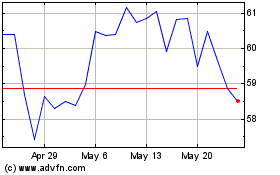

Kemper (NYSE:KMPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

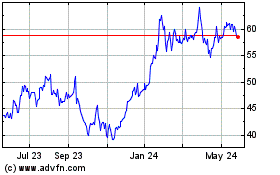

Kemper (NYSE:KMPR)

Historical Stock Chart

From Jan 2024 to Jan 2025