false

0000056873

0000056873

2024-12-11

2024-12-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

December 11, 2024

The Kroger Co.

(Exact Name of Registrant as Specified in Its Charter)

| Ohio |

|

No. 1-303 |

|

31-0345740 |

(State

or Other Jurisdiction of

Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer Identification

No.) |

1014 Vine Street

Cincinnati, OH | | 45202 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(513) 762-4000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name Of Each Exchange On Which

Registered |

| Common Stock, $1.00 par value per share |

|

KR |

|

New

York Stock Exchange |

Indicate by

check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.02 | Termination of a Material Definitive Agreement. |

On December 11, 2024, The Kroger Co. (“Kroger” or

the “Company”) delivered a notice (the ‘Termination Notice”) to Albertsons Companies, Inc. (“Albertsons”)

terminating the previously announced Agreement and Plan of Merger, dated as of October 13, 2022, by and among the Company, Albertsons

and Kettle Merger Sub, Inc. (“Merger Sub”), which provided for the merger of Merger Sub with and into Albertsons, with

Albertsons as the surviving corporation and a direct, wholly owned subsidiary of Kroger (the “Merger” and such agreement,

the “Merger Agreement”). Capitalized terms used and not defined herein have the meanings assigned to them in the Merger Agreement.

The Termination Notice further notified Albertsons that a prior termination letter sent by Albertsons to Kroger, dated December 10,

2024, is not an effective termination. In connection with the Termination Notice, Kroger notified Albertsons that Kroger has no obligation

to pay the Parent Termination Fee because Albertsons has failed to perform and comply in all material respects with its covenants under

the Merger Agreement.

The Company's termination of the Merger Agreement followed the December 10,

2024 decision of United States District Court for the District of Oregon in the case Federal Trade Commission et al. v. The Kroger Company

and Albertsons Companies, Inc. (Case No.: 3:24-cv-00347-AN), whereby the court issued a preliminary injunction enjoining the consummation

of the Merger.

| Item 7.01. | Regulation FD Disclosure. |

On December 11, 2024, the Company issued a press release regarding

the matters described in Item 1.02 of this Current Report on Form 8-K, a copy of which is filed as Exhibit 99.1.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

THE KROGER CO. |

| |

|

| |

By: |

/s/ Christine

S. Wheatley |

| |

Name: |

Christine S. Wheatley |

| |

Title: |

Senior Vice President, General Counsel and Secretary |

Date: December 11, 2024

Exhibit 99.1

Kroger

Reiterates Its Commitment to Lower Prices and Initiates New $7.5B Share Buyback Program

Reiterates

Commitment to Investing in America to Lower Grocery Prices, Raise Associate Wages, and Support Local Communities

Highlights

Resilience of Value Creation Model and Strong Momentum to Drive Long-term, Sustainable Growth

Board

of Directors Authorizes $7.5B Share Repurchase Program including $5B

Accelerated Share Repurchase

CINCINNATI,

December 11, 2024 – The Kroger Co. (NYSE: KR) today terminated its merger agreement with Albertsons after the U.S. District

Court for the District of Oregon granted the Federal Trade Commission’s request for a preliminary injunction to block the proposed

merger. After reviewing options, the company determined it is no longer in its best interests to pursue the merger.

“Kroger

is moving forward from a position of strength. Our go-to-market strategy provides exceptional value and unique omnichannel experiences

to our customers which powers our value creation model. We look forward to accelerating our flywheel to grow our alternative profit businesses

and generate increased cash flows. The strength of our balance sheet and sustainability of our model allows us to pursue a variety of

growth opportunities, including further investment in our store network through new stores and remodels, which will be an important part

of our 8 – 11% TSR model over time,” said Rodney McMullen, Kroger’s Chairman and CEO.

America’s

Grocer is Committed to Lowering Grocery Prices & Investing in Associates

“Kroger

has an extraordinary track record of investing in America,” said McMullen. “We are at our best when we serve others –

our customers, associates, and communities – and we take seriously our responsibility to provide great value by consistently lowering prices and

offering more choices. When we do this, more customers shop with us and buy more groceries, which allows us to reinvest in even lower prices,

a better shopping experience and higher wages. We know this model works because we've been doing it successfully for many years, and

this is exactly what we will continue to do."

Kroger’s

ongoing investments in America include:

| · | $5

billion in lower prices since 2003 |

| · | $2.4

billion in incremental wage increases on top of industry-leading benefits since 2018, a 38%

increase in average hourly rate, while growing opportunities for a largely unionized grocery

workforce |

| · | $3.6

- $3.8 billion in annual capital investments to build new and remodel stores, food processing

and other facilities, improve the customer experience and create additional job opportunities |

| · | $2.3

billion to support local communities through charitable giving since 2017, including $1.5

billion to feed hungry families |

“I

appreciate our associates who remained focused on taking care of our customers, communities and each other throughout the merger process,”

added McMullen.

Share

Repurchase Program Including Accelerated Share Repurchases

Now

that Kroger has terminated the merger agreement, the company is ready to deploy its capacity. With its strengthened balance

sheet, Kroger will resume share repurchases after a more than two-year pause. Since announcing the merger, Kroger used its strong free

cash flow and debt financing to build meaningful balance sheet capacity while maintaining its investment-grade rating.

Kroger’s

Board of Directors approved a new share repurchase program authorizing the repurchase of up to $7.5

billion of common stock. The new repurchase authorization replaces Kroger’s existing $1 billion authorization which was

approved in September 2022. Kroger intends to enter an accelerated share repurchase (“ASR”) agreement for the repurchase

of approximately $5 billion of common stock.

“Our

strong balance sheet and free cash flows position us to deliver on our commitment to grow the business and return capital to shareholders,

maintaining capacity to invest in lower prices and higher associate wages,” McMullen said.

Kroger

expects to continue to generate strong free cash flow and remains committed to its capital allocation priorities including maintaining

its current investment grade debt rating, investing in the business to drive long-term sustainable net earnings growth, and returning

excess free cash flow to shareholders via share repurchases and a growing dividend over time, subject to board approval.

Looking

forward, Kroger plans to host an Investor Day event in late spring of 2025 to share an update on its strategic priorities, future growth

prospects and long-term financial outlook.

Merger

Debt Redemption

In

connection with the termination of the merger agreement, Kroger will begin the process of redeeming the $4.7 billion of its senior notes

issued on August 27, 2024, that include a special mandatory redemption provision in accordance with their terms. The notes will

be redeemed at a redemption price equal to 101% of their principal amount, plus accrued and unpaid interest to, but excluding, the special

mandatory redemption date.

Termination

of Exchange Offers

In

connection with the termination of the merger agreement, Kroger has also elected to terminate its previously announced offers to exchange

(collectively, the “Exchange Offers”) any and all outstanding notes (the “ACI Notes”) issued by Albertsons Companies, Inc.,

New Albertsons, L.P., Safeway Inc., Albertson’s LLC, Albertsons Safeway LLC and American Stores Company, LLC (collectively, the

“ACI Issuing Entities”), for up to $7,441,608,000 aggregate principal amount of new notes to be issued by Kroger and cash.

Kroger has also elected to terminate the related solicitation of consents (the “Consent Solicitation” and, together with

the Exchange Offer, the “Exchange Offer and Consent Solicitation”) on behalf of the ACI Issuing Entities to adopt certain

proposed amendments to the indentures governing the ACI Notes (the “ACI Indentures”).

As

a result of the Exchange Offer being terminated, the total consideration, including any consent fee, will not be paid or become payable

to holders of the ACI Notes who have validly tendered and not validly withdrawn their ACI Notes for exchange in the Exchange Offer, and

the ACI Notes validly tendered and not validly withdrawn for exchange pursuant to the Exchange Offer will be promptly returned to the

tendering holders. As a result of the Consent Solicitation being terminated, the proposed amendments to the ACI Indentures and the supplemental

indentures previously entered into reflecting such proposed amendments will not become operative.

About

the Exchange Offers

Global

Bondholder Services Corporation served as exchange agent and information agent for the now terminated Exchange Offer and Consent Solicitation.

You should direct questions and requests for assistance to Global Bondholder Services Corporation at (855) 654-2015 (toll-free) or (212)

430-3774 (banks and brokers), or by email at contact@gbsc-usa.com.

About

Kroger

At

The Kroger Co. (NYSE: KR), we are dedicated to our Purpose: to Feed the Human Spirit™. We are, across our family

of companies nearly 414,000 associates who serve over eleven million customers daily through a seamless digital shopping experience and

retail food stores under a variety of banner names, serving America through food inspiration and uplift, and creating #ZeroHungerZeroWaste

communities. To learn more about us, visit our newsroom and investor relations site.

Forward

Looking Statements

This

press release contains certain statements that constitute “forward-looking statements” about Kroger’s financial position

and the future performance of the company. These statements are based on management’s assumptions and beliefs in light of the information

currently available to it. Such statements are indicated by words or phrases such as “achieve,” “committed,”

“confidence,” “continue,” “deliver,” “expect,” “future,” “guidance,”

“model,” “outlook,” “strategy,” “target,” “trends,” “well-positioned,”

and variations of such words and similar phrases. Various uncertainties and other factors could cause actual results to differ materially

from those contained in the forward-looking statements. These include the specific risk factors identified in “Risk Factors”

in our annual report on Form 10-K for our last fiscal year and any subsequent filings, as well as the following:

Kroger's

ability to achieve sales, earnings, incremental FIFO operating profit, and adjusted free cash flow goals may be affected by: the termination

of the merger agreement and our proposed transaction with Albertsons and related divestiture plan; labor negotiations; potential work

stoppages; changes in the unemployment rate; pressures in the labor market; changes in government-funded benefit programs; changes in

the types and numbers of businesses that compete with Kroger; pricing and promotional activities of existing and new competitors, and

the aggressiveness of that competition; Kroger's response to these actions; the state of the economy, including interest rates, the inflationary,

disinflationary and/or deflationary trends and such trends in certain commodities, products and/or operating costs; the geopolitical

environment including wars and conflicts; unstable political situations and social unrest; changes in tariffs; the effect that fuel costs

have on consumer spending; volatility of fuel margins; manufacturing commodity costs; supply constraints; diesel fuel costs related to

Kroger’s logistics operations; trends in consumer spending; the extent to which Kroger’s customers exercise caution in their

purchasing in response to economic conditions; the uncertainty of economic growth or recession; stock repurchases; changes in the regulatory

environment in which Kroger operates, along with changes in federal policy and at regulatory agencies; Kroger’s ability to retain

pharmacy sales from third party payors; consolidation in the healthcare industry, including pharmacy benefit managers; Kroger’s

ability to negotiate modifications to multi-employer pension plans; natural disasters or adverse weather conditions; the effect of public

health crises or other significant catastrophic events; the potential costs and risks associated with potential cyber-attacks or data

security breaches; the success of Kroger's future growth plans; the ability to execute our growth strategy and value creation model,

including continued cost savings, growth of our alternative profit businesses, and our ability to better serve our customers and to generate

customer loyalty and sustainable growth through our strategic pillars of fresh, our brands, personalization, and seamless; the successful

integration of merged companies and new strategic collaborations; and the risks relating to or arising from our proposed nationwide opioid

litigation settlement, including our ability to finalize and effectuate the settlement, the scope and coverage of the ultimate settlement

and the expected financial or other impacts that could result from the settlement. Our ability to achieve these goals may also be affected

by our ability to manage the factors identified above. Our ability to execute our financial strategy may be affected by our ability to

generate cash flow.

Kroger

assumes no obligation to update the information contained herein unless required by applicable law. Please refer to Kroger's reports

and filings with the Securities and Exchange Commission for a further discussion of these risks and uncertainties.

Contacts:

Media: Erin Rolfes (513) 762-1080; Investors: Rob Quast (513) 762-4969

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

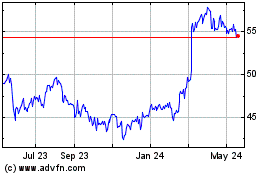

Kroger (NYSE:KR)

Historical Stock Chart

From Feb 2025 to Mar 2025

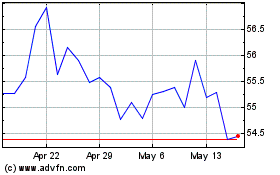

Kroger (NYSE:KR)

Historical Stock Chart

From Mar 2024 to Mar 2025