0001760965false00017609652023-12-112023-12-11

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 11, 2023

KONTOOR BRANDS, INC.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| North Carolina | | 001-38854 | | 83-2680248 |

(State or other jurisdiction

of incorporation) | | (Commission file number) | | (I.R.S. employer

identification number) |

400 N. Elm Street

Greensboro, North Carolina 27401

(Address of principal executive offices)

(336) 332-3400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on which Registered |

| Common Stock, no par value | | KTB | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 8.01. Other Events.

On December 11, 2023, Kontoor Brands, Inc. issued a press release announcing that its Board of Directors has authorized a share repurchase program of up to $300 million of the Company’s common stock. The new repurchase authorization replaces the existing share repurchase program announced on August 5, 2021. The timing and amount of repurchases will be determined by the Company based on its evaluation of market conditions, continued compliance with its debt covenants and other factors. The program does not have an expiration date but may be suspended, modified or terminated at any time without prior notice. The press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | Description | | | |

| Press release issued by Kontoor Brands, Inc., dated December 11, 2023, announcing the share repurchase program. | | | |

| 104 | Cover Page Interactive Data File - The cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. | | | |

| | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| KONTOOR BRANDS, INC. | |

| Date: December 11, 2023 | By: | /s/ Thomas L. Doerr, Jr. | |

| Name: | Thomas L. Doerr, Jr. | |

| Title: | Executive Vice President, General Counsel & Secretary | |

|

KONTOOR BRANDS ANNOUNCES $300 MILLION SHARE REPURCHASE PROGRAM

GREENSBORO, N.C. - December 11, 2023 - Kontoor Brands, Inc. (NYSE: KTB), a global lifestyle apparel company, with a portfolio led by two of the world’s most iconic consumer brands, Wrangler® and Lee®, today reported that the Company’s Board of Directors has authorized a share repurchase program of up to $300 million of the Company’s common stock. The new repurchase authorization replaces the existing share repurchase program announced on August 5, 2021.

“Today’s announcement of a $300 million share repurchase program illustrates our enhanced capital allocation optionality and reflects the strong cash flow generation of our business, while underscoring Kontoor’s unrelenting focus on delivering superior Total Shareholder Return over time,” said Scott Baxter, President, Chief Executive Officer and Chair of Kontoor Brands.

The share repurchase program approved by the Company’s Board of Directors authorizes the repurchase of up to $300 million of the Company’s outstanding common stock. The timing and amount of repurchases will be determined by the Company based on its evaluation of market conditions, continued compliance with its debt covenants and other factors. The program does not have an expiration date but may be suspended, modified or terminated at any time without prior notice. The Company expects to fund repurchases through cash flow generated from operations.

About Kontoor Brands

Kontoor Brands, Inc. (NYSE: KTB) is a global lifestyle apparel company, with a portfolio led by two of the world’s most iconic consumer brands: Wrangler® and Lee®. Kontoor designs, manufactures and distributes superior high-quality products that look good and fit right, giving people around the world the freedom and confidence to express themselves. Kontoor Brands is a purpose-led organization focused on leveraging its global platform, strategic sourcing model and best-in-class supply chain to drive brand growth and deliver long-term value for its stakeholders. For more information about Kontoor Brands, please visit www.KontoorBrands.com.

Forward-Looking Statements

Certain statements included in this release and attachments are "forward-looking statements" within the meaning of the federal securities laws. Forward-looking statements are made based on our expectations and beliefs concerning future events impacting the Company and therefore involve several risks and uncertainties. You can

identify these statements by the fact that they use words such as “will,” “anticipate,” “estimate,” “expect,” “should,” “may” and other words and terms of similar meaning or use of future dates. We caution that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in the forward-looking statements. We do not intend to update any of these forward-looking statements or publicly announce the results of any revisions to these forward-looking statements, other than as required under the U.S. federal securities laws. Potential risks and uncertainties that could cause the actual results of operations or financial condition of the Company to differ materially from those expressed or implied by forward-looking statements in this release include, but are not limited to: macroeconomic conditions, including inflation, rising interest rates, recessionary concerns, fluctuating foreign currency exchange rates and distress in global credit and banking markets, as well as ongoing global supply chain disruptions, labor challenges, the COVID-19 pandemic and geopolitical events, continue to adversely impact global economic conditions and have had, and may continue to have, a negative impact on the Company’s business, results of operations, financial condition and cash flows (including future uncertain impacts); the level of consumer demand for apparel; supply chain and shipping disruptions, which could continue to result in shipping delays, an increase in transportation costs and increased product costs or lost sales; reliance on a small number of large customers; the COVID-19 pandemic continues to negatively affect the Company’s business and could continue to result in supply chain disruptions, reduced consumer traffic and purchasing, closed factories and stores, and reduced workforces (including future uncertain effects); intense industry competition; the ability to accurately forecast demand for products; the Company’s ability to gauge consumer preferences and product trends, and to respond to constantly changing markets; the Company’s ability to maintain the images of its brands; increasing pressure on margins; e-commerce operations through the Company’s direct-to-consumer business; the financial difficulty experienced by the retail industry; possible goodwill and other asset impairment; the ability to implement the Company’s business strategy; the stability of manufacturing facilities and foreign suppliers; fluctuations in wage rates and the price, availability and quality of raw materials and contracted products; the reliance on a limited number of suppliers for raw material sourcing and the ability to obtain raw materials on a timely basis or in sufficient quantity or quality; disruption to distribution systems; seasonality; unseasonal or severe weather conditions; the Company's and its vendors’ ability to maintain the strength and security of information technology systems; the risk that facilities and systems and those of third-party service providers may be vulnerable to and unable to anticipate or detect data security breaches and data or financial loss; ability to properly collect, use, manage and secure consumer and employee data; foreign currency fluctuations; disruption and volatility in the global capital and credit markets and its impact on the Company's ability to obtain short-term or long-term financing on favorable terms; the impact of climate change and related legislative and regulatory responses; legal, regulatory, political and economic risks; changes to trade policy, including tariff and import/export regulations; compliance with anti-bribery, anti-corruption and anti-money laundering laws by the Company and third-party suppliers and manufacturers; changes in tax laws and liabilities; the costs of compliance with or

the violation of national, state and local laws and regulations for environmental, consumer protection, employment, privacy, safety and other matters; continuity of members of management; labor relations; the ability to protect trademarks and other intellectual property rights; the ability of the Company’s licensees to generate expected sales and maintain the value of the Company’s brands; the Company maintaining satisfactory credit ratings; restrictions on the Company’s business relating to its debt obligations; volatility in the price and trading volume of the Company’s common stock; anti-takeover provisions in the Company’s organizational documents; and fluctuations in the amount and frequency of our share repurchases.

Many of the foregoing risks and uncertainties will be exacerbated by any worsening of the global business and economic environment. More information on potential factors that could affect the Company's financial results are described in detail in the Company’s most recent Annual Report on Form 10-K and in other reports and statements that the Company files with the SEC.

Contacts

Investors:

Joseph Alkire, (336) 332-3267

EVP, Chief Financial Officer

Joseph.Alkire@kontoorbrands.com

or

Media:

Julia Burge, (336) 332-5122

Director, External Communications

Julia.Burge@kontoorbrands.com

###

v3.23.3

Document and Entity Information Document

|

Dec. 11, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 11, 2023

|

| Entity Registrant Name |

KONTOOR BRANDS, INC.

|

| Entity Central Index Key |

0001760965

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

NC

|

| Entity File Number |

001-38854

|

| Entity Tax Identification Number |

83-2680248

|

| Entity Address, Address Line One |

400 N. Elm Street

|

| Entity Address, City or Town |

Greensboro

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27401

|

| City Area Code |

(336)

|

| Local Phone Number |

332-3400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

KTB

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Document Information [Line Items] |

|

| Document Period End Date |

Dec. 11, 2023

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

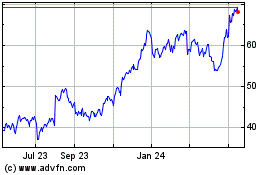

Kontoor Brands (NYSE:KTB)

Historical Stock Chart

From Nov 2024 to Dec 2024

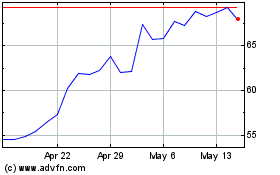

Kontoor Brands (NYSE:KTB)

Historical Stock Chart

From Dec 2023 to Dec 2024