DWS Closed-End Funds Announce Extension of Share Repurchase Programs

23 September 2023 - 6:35AM

Business Wire

DWS Municipal Income Trust (NYSE: KTF) and DWS Strategic

Municipal Income Trust (NYSE: KSM) (each, a “Fund,” and

collectively, the “Funds”) each announced today that its respective

Board of Trustees has extended the Fund’s existing open market

share repurchase program for an additional twelve-month period.

Each Fund may continue to purchase outstanding shares of beneficial

interest in open-market transactions over the twelve-month period

from December 1, 2023 until November 30, 2024 when the Fund’s

shares trade at a discount to net asset value (“NAV”). The amount

and timing of the repurchases will be at the discretion of DWS

Investment Management Americas, Inc. (“DIMA”), the Funds’

investment adviser, and subject to market conditions and investment

considerations. DIMA will seek to purchase shares at prices that

will be accretive to each Fund’s NAV.

The authorization of the extension of the Funds’ repurchase

programs follows the previous repurchase programs, which commenced

on December 1, 2022 and run until November 30, 2023. Results of

repurchases under each Fund’s program appear in the Fund’s

shareholder reports.

For more information on each Fund visit dws.com or call (800)

349-4281.

Important Information

DWS Municipal Income Trust. Bond investments are subject to

interest-rate, credit, liquidity and market risks to varying

degrees. When interest rates rise, bond prices generally fall.

Credit risk refers to the ability of an issuer to make timely

payments of principal and interest. Municipal securities are

subject to the risk that litigation, legislation or other political

events, local business or economic conditions or the bankruptcy of

the issuer could have a significant effect on an issuer’s ability

to make payments of principal and/or interest. The market for

municipal bonds may be less liquid than for taxable bonds and there

may be less information available on the financial condition of

issuers of municipal securities than for public corporations.

Investing in derivatives entails special risks relating to

liquidity, leverage and credit that may reduce returns and/or

increase volatility. Leverage results in additional risks and can

magnify the effect of any gains or losses. Although the fund seeks

income that is exempt from federal income taxes, a portion of the

fund’s distributions may be subject to federal, state and local

taxes, including the alternative minimum tax.

DWS Strategic Municipal Income Trust. Bond investments are

subject to interest-rate, credit, liquidity and market risks to

varying degrees. When interest rates rise, bond prices generally

fall. Credit risk refers to the ability of an issuer to make timely

payments of principal and interest. Municipal securities are

subject to the risk that litigation, legislation or other political

events, local business or economic conditions or the bankruptcy of

the issuer could have a significant effect on an issuer’s ability

to make payments of principal and/or interest. The market for

municipal bonds may be less liquid than for taxable bonds and there

may be less information available on the financial condition of

issuers of municipal securities than for public corporations.

Investing in derivatives entails special risks relating to

liquidity, leverage and credit that may reduce returns and/or

increase volatility. Leverage results in additional risks and can

magnify the effect of any gains or losses. Although the fund seeks

income that is exempt from federal income taxes, a portion of the

fund’s distributions may be subject to federal, state and local

taxes, including the alternative minimum tax.

Closed-end funds, unlike open-end funds, are not continuously

offered. There is a one-time public offering and once issued,

shares of closed-end funds are bought and sold in the open market

through a stock exchange. Shares of closed-end funds frequently

trade at a discount to the net asset value. The price of a fund’s

shares is determined by a number of factors, several of which are

beyond the control of the fund. Therefore, the fund cannot predict

whether its shares will trade at, below or above net asset

value.

Past performance is no guarantee of future results.

This press release shall not constitute an offer to sell or a

solicitation to buy, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer or

solicitation or sale would be unlawful prior to registration or

qualification under the laws of such state or jurisdiction.

War, terrorism, sanctions, economic uncertainty, trade

disputes, public health crises and related geopolitical events have

led, and, in the future, may lead to significant disruptions in US

and world economies and markets, which may lead to increased market

volatility and may have significant adverse effects on the fund and

its investments.

NOT FDIC/ NCUA INSURED • MAY LOSE VALUE • NO

BANK GUARANTEE NOT A DEPOSIT • NOT INSURED BY ANY FEDERAL

GOVERNMENT AGENCY

DWS Distributors, Inc. 222 South Riverside Plaza Chicago,

IL 60606-5808 www.dws.com Tel (800) 621-1148 © 2023 DWS Group GmbH

& Co. KGaA. All rights reserved

The brand DWS represents DWS Group GmbH & Co. KGaA and any

of its subsidiaries such as DWS Distributors, Inc. which offers

investment products or DWS Investment Management Americas, Inc. and

RREEF America L.L.C. which offer advisory services. (R-097552-1)

(09/23)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230922603793/en/

For additional information:

DWS Press Office (212) 454-4500 Shareholder Account Information

(800) 294-4366 DWS Closed-End Funds (800) 349-4281

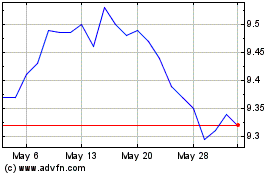

DWS Municipal Income (NYSE:KTF)

Historical Stock Chart

From Dec 2024 to Jan 2025

DWS Municipal Income (NYSE:KTF)

Historical Stock Chart

From Jan 2024 to Jan 2025