(All amounts in US$ unless otherwise

indicated)

Lithium Americas Corp. (TSX: LAC) (NYSE: LAC)

(“Lithium Americas” or the “Company”) today announced

the closing of its previously announced joint venture (the

“JV”) with General Motors Holdings LLC (“GM”) to

fund, develop, construct and operate Thacker Pass in Humboldt

County, Nevada to supply battery-quality lithium carbonate for the

North American critical minerals supply chain (“Thacker

Pass” or the “Project”).

Lithium Americas now holds a 62% interest in Thacker Pass and

will manage the Project. GM has acquired a 38% interest in Thacker

Pass for $625 million in total cash and letters of credit (“GM’s

JV Investment”), comprised of $430 million of direct cash

funding to the JV to support the construction of Phase 11 and a

$195 million letter of credit facility (“LC Facility”).

As part of closing, GM has funded $330 million of cash into the

JV alongside $138 million2 of funding from Lithium Americas. The

remaining $100 million cash contribution from GM, and Lithium

Americas’ $181 million contribution, is to be contributed at the

final investment decision (“FID”) for Phase 1.

GM will post the LC Facility prior to first draw on the

Company’s previously announced $2.26 billion loan from the U.S.

Department of Energy (“DOE Loan”), which is expected to

occur in the middle of 2025.

“Together, Lithium Americas and GM are focused on bringing

Thacker Pass to production to significantly improve domestic output

of critical lithium supply to reduce dependence on foreign

suppliers and to start creating new jobs and bringing economic

activity to northern Nevada,” said Jonathan Evans, President and

CEO of Lithium Americas. “We are targeting to announce the final

investment decision in early 2025. Our engineering, procurement and

construction management contractor, Bechtel, and other major

contractors have been ramping up work at site to de-risk the

construction schedule, as we continue to target completion in late

2027.”

As part of the JV close, Lithium Americas and the DOE have

concluded an amendment of the DOE Loan documents to accommodate the

formation of the JV. The principal terms of the DOE Loan remain

unchanged.

ADVISORS

In connection with the JV with GM, Goldman Sachs & Co. LLC

and Evercore Group L.L.C. are acting as financial advisors to

Lithium Americas and Vinson & Elkins LLP and Cassels Brock

& Blackwell LLP are acting as legal counsel to Lithium

Americas. BMO Capital Markets acted as financial advisor to Lithium

Americas in connection with GM’s original investment announced in

January 2023.

In connection with the DOE Loan, Goldman Sachs & Co. LLC is

acting as financial advisor, and Vinson & Elkins LLP is acting

as legal counsel to Lithium Americas.

ABOUT LITHIUM AMERICAS

Lithium Americas is committed to responsibly developing the

Thacker Pass project located in Humboldt County in northern Nevada,

which hosts the largest known Measured and Indicated lithium

resource in North America. The Company is focused on advancing

Thacker Pass Phase 1 toward production, targeting nameplate

capacity of 40,000 tpa of battery-quality lithium carbonate. The

Company and its engineering, procurement and construction

management contractor, Bechtel, entered into a National

Construction Agreement (Project Labor Agreement) with North

America’s Building Trades Unions for construction of Thacker Pass.

The three-year construction build is expected to create

approximately 1,800 direct jobs. Lithium Americas’ shares are

listed on the Toronto Stock Exchange and New York Stock Exchange

under the symbol LAC. To learn more, visit www.lithiumamericas.com

or follow @LithiumAmericas on social media.

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking information” within

the meaning of applicable Canadian securities legislation, and

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995

(collectively referred to as “forward-looking information”

(“FLI”)). All statements, other than statements of

historical fact, are FLI and can be identified by the use of

statements that include, but are not limited to, words, such as

“anticipate,” “plan,” “continues,” “estimate,” “expect,” “may,”

“will,” “projects,” “predict,” “proposes,” “potential,” “target,”

“implement,” “scheduled,” “forecast,” “intend,” “would,” “could,”

“might,” “should,” “believe” and similar terminology, or statements

that certain actions, events or results “may,” “could,” “would,”

“might” or “will” be taken, occur or be achieved. FLI in this news

release includes, but is not limited to, expectations regarding

satisfaction of draw-down conditions for the DOE Loan; the timing

of GM’s posting of the LC Facility and the first draw on the DOE

Loan; ; anticipated timing for FID; expectation about the extent

that the JV, DOE Loan, and cash on hand would fund the development

and construction of Thacker Pass; expectations and timing on the

commencement of major construction and first production; project

de-risking initiatives; expectations related to the construction

build, job creation and nameplate capacity of the Project as well

as other statements with respect to the Company’s future objectives

and strategies to achieve these objectives, and management’s

beliefs, plans, estimates and intentions, and similar statements

concerning anticipated future events, results, circumstances,

performance or expectations that are not historical facts.

FLI involves known and unknown risks, assumptions and other

factors that may cause actual results or performance to differ

materially. FLI reflects the Company’s current views about future

events, and while considered reasonable by the Company as of the

date of this news release, are inherently subject to significant

uncertainties and contingencies. Accordingly, there can be no

certainty that they will accurately reflect actual results.

Assumptions upon which such FLI is based include, without

limitation, the absence of material adverse events affecting the

Company during the construction of the Project; the ability of the

Company to satisfy all draw-down conditions under the DOE Loan;

expectations regarding the Company's financial resources and future

prospects; the ability to meet future objectives and priorities; a

cordial business relationship between the Company and third party

strategic and contractual partners; general business and economic

uncertainties and adverse market conditions; the availability of

equipment and facilities necessary to complete development and

construction at the Project; unforeseen technological and

engineering problems; political factors, including the impact of

the results of the 2024 U.S. presidential election on, among other

things, the extractive resource industry, the green energy

transition and the electric vehicle market; uncertainties inherent

to feasibility studies and mineral resource and mineral reserve

estimates; uncertainties relating to receiving and maintaining

mining, exploration, environmental and other permits or approvals

in Nevada; demand for lithium, including that such demand is

supported by growth in the electric vehicle market; current

technological trends; the impact of increasing competition in the

lithium business, and the Company’s competitive position in the

industry; compliance by joint venture partners with terms of

agreements; the regulation of the mining industry by various

governmental agencies; as well as assumptions concerning general

economic and industry growth rates, commodity prices, resource

estimates, currency exchange and interest rates and competitive

conditions. Although the Company believes that the assumptions and

expectations reflected in such FLI are reasonable, the Company can

give no assurance that these assumptions and expectations will

prove to be correct.

Readers are cautioned that the foregoing lists of factors are

not exhaustive. There can be no assurance that FLI will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information. As such,

readers are cautioned not to place undue reliance on this

information, and that this information may not be appropriate for

any other purpose, including investment purposes. The Company’s

actual results could differ materially from those anticipated in

any FLI as a result of the risk factors set out herein and in the

Company’s filings with securities regulators.

The FLI contained in this news release is expressly qualified by

these cautionary statements. All FLI in this news release speaks as

of the date of this news release. The Company does not undertake

any obligation to update or revise any FLI, whether as a result of

new information, future events or otherwise, except as required by

law. Additional information about these assumptions and risks and

uncertainties is contained in the Company’s filings with securities

regulators, including the Company’s most recent Annual Report on

Form 20-F and most recent management’s discussion and analysis for

our most recently completed financial year and, if applicable,

interim financial period, which are available on SEDAR+ at

www.sedarplus.ca and on EDGAR at www.sec.gov. All FLI contained in

this news release is expressly qualified by the risk factors set

out in the aforementioned documents.

__________________________ 1 Phase 1 is the initial phase of

production at Thacker Pass, targeting 40,000 tonnes per annum

(“tpa”) of battery-grade lithium carbonate. 2 Represents

$211 million initial Lithium Americas estimated contribution

referenced in the October 16, 2024 announcement of the JV with GM,

adjusted for credits on agreed expenditures that occurred after

August 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241223531237/en/

INVESTOR CONTACT Virginia Morgan, VP, IR and ESG

+1-778-726-4070 ir@lithiumamericas.com

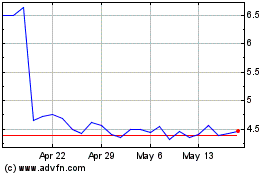

Lithium Americas (NYSE:LAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Lithium Americas (NYSE:LAC)

Historical Stock Chart

From Jan 2024 to Jan 2025