0001032220FALSE00010322202024-12-102024-12-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 10, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Maximus, Inc. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | |

| Virginia | | 1-12997 | | 54-1000588 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | |

| 1600 Tysons Boulevard | | McLean | , | | VA | | 22102 |

(Address of principal executive offices) | | (Zip Code) |

| | | | | | | | | |

| Registrant's telephone number, including the area code | | ( | 703 | ) | 251-8500 | | |

| | | | | | | | | |

| No Change |

| (Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, no par value | | MMS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On December 10, 2024, the Board of Directors (the “Board”) of Maximus, Inc. (the “Company”) approved an increase to the Company's existing stock purchase program. The increased stock purchase program authorizes the Company to purchase up to an aggregate amount of $200 million of the Company’s common stock, no par value (“Common Stock”).

The Company intends to purchase shares opportunistically at prevailing market prices in the open market, via 10b5-1 plans, or in privately negotiated transactions, with the amount and timing of purchases depending on market conditions, corporate needs, and other factors.

This program does not obligate the Company to acquire any particular amount of Common Stock, has no specified expiration date, and may be extended, modified, suspended or discontinued at any time at the Company’s discretion.

The Company issued a press release announcing the increase to the existing stock purchase program. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Forward-Looking Statements

Except for historical information, all of the statements, expectations, and assumptions contained in this Current Report on Form 8-K are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995, including statements regarding the Company’s stock purchase program and capital allocation priorities. Actual results may differ materially from those explicit or implicit in the forward-looking statements. Important factors that could cause actual results to differ materially include, but are not limited to: the fact that common stock purchases may not be conducted in the timeframe or in the manner the Company expects, or at all, the Company’s capital allocation priorities may shift and the other risk factors disclosed in the Company’s Annual Report on Form 10-K for the year ended September 30, 2024, as updated by the Company’s other filings with the Securities and Exchange Commission, copies of which are available free of charge on the Company’s website at investor.maximus.com. The Company assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| | |

| Press release issued by Maximus, Inc. dated December 11, 2024 |

| 104 | Cover Page Interactive Data File, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Maximus, Inc. |

| | (Registrant) |

| | |

| Date: December 11, 2024 | | /s/ John T. Martinez |

| | John T. Martinez |

| | Chief Legal Officer and Secretary |

FOR IMMEDIATE RELEASE

Maximus Board Authorizes $200 Million Increase to Purchase Program of Maximus Common Stock

Previous $200 million authorization has been completed

(Tysons, Va. – December 11, 2024) – Maximus (NYSE: MMS), a leading employer and provider of government services, announced today that its Board of Directors has authorized a $200 million increase to the purchase program for Maximus common stock, enabling ongoing, opportunistic purchase activity.

The previous $200 million authorization announced in June 2024 had $171.4 million available capacity at September 30, 2024. Recent share purchase activity in the current quarter consumed the remaining capacity.

The Company intends to purchase shares opportunistically at prevailing market prices in the open market, via 10b5-1 plans, or in privately negotiated transactions, with the amount and timing of purchases depending on market conditions, corporate needs, and other factors.

This program does not obligate the Company to acquire any particular amount of Common Stock, has no specified expiration date, and may be extended, modified, suspended or discontinued at any time at the Company’s discretion.

“We are confident in our future and ability to be an effective and efficient partner to government. Increasing the amount authorized under this program is consistent with our opportunistic approach to purchasing our common stock,” commented Bruce Caswell, President and Chief Executive Officer of Maximus. “Our capital allocation priorities are unchanged and continue to be based on a disciplined approach to maximize value for our shareholders.”

About Maximus

As a leading strategic partner to government, Maximus helps improve the delivery of public services amid complex technology, health, economic, environmental, and social challenges. With a deep understanding of program service delivery, acute insights that achieve operational excellence, and an extensive awareness of the needs of the people being served, our employees advance the critical missions of our partners. Maximus delivers innovative business process management, impactful consulting services, and technology solutions that provide improved outcomes for the public and higher levels of productivity and efficiency of government-sponsored programs. For more information, visit maximus.com.

Forward-Looking Statements

Except for historical information, all of the statements, expectations, and assumptions contained in this Current Report on Form 8-K are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995, including statements regarding the Company’s stock purchase program and capital allocation priorities. Actual results may differ materially from those explicit or implicit in the forward-looking statements. Important factors that could cause actual results to differ materially include, but are not limited to: the fact that common stock purchases may not be conducted in the timeframe or in the manner the Company expects, or at all, the Company’s capital allocation priorities may shift and the other risk factors disclosed in the Company’s Annual Report on Form 10-K for the year ended September 30, 2024, as updated by the Company’s other filings with the Securities and Exchange Commission, copies of which are available free of charge on the Company’s website at investor.maximus.com. The Company assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

| | | | | | | | |

| Contacts: | Investor Relations | Media & Public Relations |

| | James Francis | Eileen Cassidy Rivera |

| | Jessica Batt | media@maximus.com |

| | IR@maximus.com | |

-XXX-

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

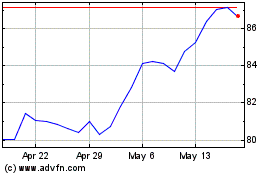

MAXIMUS (NYSE:MMS)

Historical Stock Chart

From Nov 2024 to Dec 2024

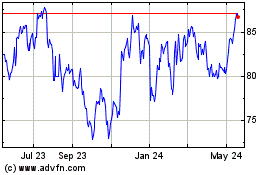

MAXIMUS (NYSE:MMS)

Historical Stock Chart

From Dec 2023 to Dec 2024