Executed New Lease Agreements with Four

Quality Replacement Operators

Completed Safe and Orderly Transitions of

Operations at 15 Hospitals

Medical Properties Trust, Inc. (the “Company” or “MPT”) (NYSE:

MPW) today announced that it reached a global settlement agreement

with Steward Health Care System (“Steward”), its secured lenders

(“the Lenders”) and the Unsecured Creditors Committee (“UCC”) that

restores MPT’s control over its real estate, severs its

relationship with Steward and facilitates the immediate transition

of operations to quality replacement operators at 15 hospitals

around the country.

Regarding the settlement, the Company issued the following

statement:

“From our initial underwriting of these

properties, MPT has strongly believed in the mission critical

nature of these hospitals as well as their cash flow potential

under the right management.

Throughout Steward’s lengthy restructuring

process, our focus has been on supporting efforts to bring quality

replacement operators into each of these facilities. That is why we

consented to Steward marketing our real estate alongside operations

as part of the bankruptcy sales process. And it is why we have

worked around the clock for the past several weeks to facilitate a

consensual resolution following Steward’s motion to reject our

lease.

We have been working tirelessly to identify

replacement operators and negotiate new lease terms, and we have

been encouraged by the enthusiasm and eagerness of multiple

operators to manage these important facilities despite declines in

Steward’s operations during its restructuring process. As a result,

we were able to rapidly come to terms with several new tenants. We

have also collaborated closely with state regulators to put orderly

transition plans in place that would avoid hospital closures,

protect jobs, and ensure continuity of care for patients.

We believe this global settlement is a

positive outcome for all stakeholders. By replacing Steward, we are

better positioned to protect the critical function of these

facilities for the benefit of their communities and the value of

our real estate for the benefit of our shareholders.”

The settlement agreement involves 23 hospitals previously

operated by Steward which will remain following the anticipated

“Space Coast” transaction described later in this press release.

MPT has already reached definitive agreements with four tenants to

immediately lease and operate 15 hospitals in Arizona, Florida,

Louisiana, Ohio and Texas, as summarized in the following

table:

OPERATOR

REGION(S)

OPERATOR DESCRIPTION

HEALTHCARE SYSTEMS OF

AMERICA

Southeast Florida (5), East Texas

(2), Louisiana (1)

A community-based hospital system

based in Los Angeles, CA affiliated with American Hospital Systems,

which currently operates four acute care hospitals

HONOR HEALTH

Arizona (3)

A non-profit, local community

healthcare system serving the greater Phoenix area with a network

encompassing acute-care hospitals, an extensive medical group,

outpatient surgery centers, a cancer care network, clinical

research, and more

QUORUM HEALTH

West Texas (2)

A leading operator of general

acute care hospitals and outpatient services with a diversified

portfolio in rural and mid-sized markets across the United

States

INSIGHT HEALTH

Ohio (2)

A physician-led provider of

community-based, patient-centric care

Effective September 11, 2024, these replacement operators will

be the beneficiaries of operating revenue and have responsibility

for the expenses of the hospitals each will manage for Steward on

an interim basis until purchase agreements can be finalized with

Steward with respect to the operations.

Based on the new lease agreements already in place, MPT expects

to receive aggregate annualized cash rental payments of

approximately $160 million on this portfolio’s approximate $2.0

billion lease base upon stabilization in the fourth quarter of

2026, including the impact of each lease’s contractual minimum

annual escalator. This represents approximately 95% of the cash

rent Steward would have contractually owed for the same assets in

the fourth quarter of 2026, based on minimum rent escalators. The

weighted average initial term of the leases is approximately 18

years.

To expedite the re-tenanting process and minimize any disruption

to patient care as new operators are ramping up, cash rent payments

will not be due for the remainder of 2024 for all 15 properties.

Cash rent payments are generally expected to commence in the first

quarter of 2025, reach approximately 50% of aggregate fully

stabilized rent by the end of 2025 and achieve full stabilization

in the fourth quarter of 2026.

In addition, MPT is in active discussions regarding solutions

related to its ongoing Norwood, Massachusetts and Texarkana, Texas

construction projects, as well as, separately, four hospitals

closed well before Steward’s bankruptcy and two that recently

closed or otherwise became subject to uncertainty during the

restructuring process. These six facilities have an aggregate lease

base of approximately $300 million.

Under the terms of the agreement, MPT has consented to the sale

of three “Space Coast” Florida hospitals to Orlando Health, with a

substantial portion of the proceeds being transferred to Steward.

In turn, Steward and its other stakeholders have relinquished all

rights to any further allocation of value from transactions related

to any other hospital remaining in the portfolio as of September

11, 2024. Further, upon completion of the transition process for

the hospitals, the parties have agreed to mutually dismiss claims

against each other and exchange broad general releases including

for MPT’s loans and deferred rent.

The Bankruptcy Court has scheduled a hearing for Tuesday,

September 17, for consideration and approval of a final order

confirming the settlement. The agreement also remains subject to

the completion of Steward’s sales to the replacement operators and

approval by relevant state and local regulators.

About Medical Properties Trust, Inc.

Medical Properties Trust, Inc. is a self-advised real estate

investment trust formed in 2003 to acquire and develop net-leased

hospital facilities. From its inception in Birmingham, Alabama, the

Company has grown to become one of the world’s largest owners of

hospital real estate with 435 facilities and approximately 42,000

licensed beds in nine countries and across three continents as of

June 30, 2024. MPT’s financing model facilitates acquisitions and

recapitalizations and allows operators of hospitals to unlock the

value of their real estate assets to fund facility improvements,

technology upgrades and other investments in operations. For more

information, please visit the Company’s website at

www.medicalpropertiestrust.com.

Forward-Looking Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements can generally be identified by

the use of forward-looking words such as “may”, “will”, “would”,

“could”, “expect”, “intend”, “plan”, “estimate”, “target”,

“anticipate”, “believe”, “objectives”, “outlook”, “guidance” or

other similar words, and include statements regarding our

strategies, objectives, asset sales and other liquidity

transactions (including the use of proceeds thereof), expected

re-tenanting of vacant facilities and any related regulatory

approvals, and expected outcomes from Steward’s Chapter 11

restructuring process, including the terms of the agreement

described in this press release. Forward-looking statements involve

known and unknown risks and uncertainties that may cause our actual

results or future events to differ materially from those expressed

in or underlying such forward-looking statements, including, but

not limited to: (i) the risk that the outcome and terms of the

bankruptcy restructuring of Steward will not be consistent with

those anticipated by the Company; (ii) the risk that the Company is

unable to successfully re-tenant the Steward portfolio hospitals,

on the terms described herein or at all; (iii) the risk that

previously announced or contemplated property sales, loan

repayments, and other capital recycling transactions do not occur

as anticipated or at all; (iv) the risk that MPT is not able to

attain its leverage, liquidity and cost of capital objectives

within a reasonable time period or at all; (v) MPT’s ability to

obtain debt financing on attractive terms or at all, as a result of

changes in interest rates and other factors, which may adversely

impact its ability to pay down, refinance, restructure or extend

its indebtedness as it becomes due, or pursue acquisition and

development opportunities; (vi) the ability of our tenants,

operators and borrowers to satisfy their obligations under their

respective contractual arrangements with us; (vii) the ability of

our tenants and operators to operate profitably and generate

positive cash flow, remain solvent, comply with applicable laws,

rules and regulations in the operation of our properties, to

deliver high-quality services, to attract and retain qualified

personnel and to attract patients; (viii) the risk that we are

unable to monetize our investments in certain tenants at full value

within a reasonable time period or at all, (ix) our success in

implementing our business strategy and our ability to identify,

underwrite, finance, consummate and integrate acquisitions and

investments; and (x) the risks and uncertainties of litigation or

other regulatory proceedings.

The risks described above are not exhaustive and additional

factors could adversely affect our business and financial

performance, including the risk factors discussed under the section

captioned “Risk Factors” in our most recent Annual Report on Form

10-K and our Form 10-Q, and as may be updated in our other filings

with the SEC. Forward-looking statements are inherently uncertain

and actual performance or outcomes may vary materially from any

forward-looking statements and the assumptions on which those

statements are based. Readers are cautioned to not place undue

reliance on forward-looking statements as predictions of future

events. We disclaim any responsibility to update such

forward-looking statements, which speak only as of the date on

which they were made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240911823985/en/

Drew Babin, CFA, CMA Head of Financial Strategy and Investor

Relations Medical Properties Trust, Inc. (646) 884-9809

dbabin@medicalpropertiestrust.com

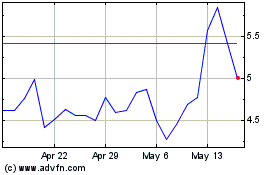

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Nov 2024 to Dec 2024

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Dec 2023 to Dec 2024