Morgan Stanley Identifies 6 Key Focus Areas for the Future-Ready Family Office

22 November 2024 - 1:30AM

Business Wire

- Morgan Stanley reports on the rising need for flexible

structures in family offices

- Offices adapting to address need to uphold values, safeguard

legacies, educate heirs, and maximize tech amid complex

markets

Morgan Stanley Wealth Management today released a comprehensive

report identifying essential focus areas and recommended steps for

family offices to target growth more effectively.

With the number of family offices projected to expand 75% by

2030,1 trends indicate growing urgency and demand for adaptable

structures that help families express values, protect legacies,

educate the next generation and leverage technology to navigate

cybersecurity challenges and change amid complex markets.

Additionally, offices are now facing a faster pace of

intergenerational wealth transfers, underscoring the need to remain

relevant for future generations.

To that end, the report identifies six essential pillars family

offices will need to embrace to keep pace. Key takeaways

include:2

- Allow governance to evolve: The governance structure of

a family office is crucial for its long-term sustainability. It

should balance flexibility with clear priorities, allowing for

changes both within and outside the family—for example, including

mechanisms for a graceful exit to allow family members to pursue

separate interests. Regular reviews of governance rules should be

conducted, involving younger generations to consider shifting

objectives and priorities.

- Staff like an institution: Family offices should

establish a healthy pipeline to invite, train, and promote fresh

talent that can support current and evolving needs. It's essential

to plan for succession and delegate responsibilities to younger

staff members to ensure continuity, mitigate key-person risk, and

help smooth generational divides. One of the most important

decisions will be to identify which roles to keep in-house and then

build supplemental external partnerships.

- Data matters: To stay at the forefront of market trends

and maximize investment capabilities, Family offices require

robust, reliable data sources and the capability to build or access

a consolidated reporting platform. A rigorous approach to deal

sourcing and due diligence is also necessary, defining investment

parameters and adhering to a strict process for sourcing and

vetting new deals.

- Fill the financial education gap: Family offices are

prioritizing effective financial education programs for younger

generations, which means meeting students where they are and

recognizing generational differences. It’s essential for trainers

to find the right balance of technical knowledge, interpersonal

skills and experience. Additionally, as academic organizations

de-emphasize financial literacy, family offices have an opportunity

to fill this gap and help prepare younger generations to carry the

torch. This may be an important area where external resources can

help supplement or build new financial education programs for

families.

- Anticipate the cyber threat: Family offices are

increasingly targeted by cyberattacks that threaten long-term

stability. However, there are simple yet effective steps that can

help mitigate common threats such as identity theft, online scams,

malware and fraud. These recommended measures include automatic

updates, unique strong passwords, multi-factor authentication and

careful handling of links and attachments.

- AI is a balancing act: Family offices are also under

pressure to stay current with advancements in technology,

particularly artificial intelligence (AI). AI can help family

offices operate more efficiently, particularly in client

communications and reporting. However, it’s key to fully understand

potential security implications and ensure a secure perimeter for

family information.

“Family Offices are pivotal in managing wealth and preserving

legacies, and as families and environments evolve, so must the

industry,” said Liz Dennis, Head of Private Wealth Management.

“This guidance is designed to support family offices of all shapes

and sizes as they work to ensure continuity across generations.

Even with technology's potential, human expertise remains

irreplaceable—and forward-thinking family offices must define clear

strategies and infrastructure to continue adding value as

indispensable partners for generations to come.”

Morgan Stanley Wealth Management is committed to helping family

offices understand the shifting dynamics they face and the

practices that will allow them to navigate changes and fulfill the

family’s mission across generations. For more information, please

visit Morgan Stanley Family Office.

Full report available here.

- Deloitte Private’s latest report in its Family Office Insights

Series - Global Edition explores the rapid expansion of family

offices and offers a vision of the future landscape | Deloitte

Global

- Morgan Stanley Family Office: The Future-Ready Family Office:

Evolving with Purpose

About Morgan Stanley Wealth Management Morgan Stanley

Wealth Management, a global leader, provides access to a wide range

of products and services to individuals, businesses and

institutions, including brokerage and investment advisory services,

financial and wealth planning, cash management and lending products

and services, annuities and insurance, retirement and trust

services.

About Morgan Stanley Morgan Stanley (NYSE: MS) is a

leading global financial services firm providing a wide range of

investment banking, securities, wealth management and investment

management services. With offices in 42 countries, the Firm’s

employees serve clients worldwide including corporations,

governments, institutions and individuals. For further information

about Morgan Stanley, please visit www.morganstanley.com.

This has been prepared for informational purposes only and is

not a solicitation of any offer to buy or sell any security or

other financial instrument, or to participate in any trading

strategy. This material does not provide individually tailored

investment advice. It has been prepared without regard to the

individual financial circumstances and objectives of persons who

receive it. Morgan Stanley recommends that investors independently

evaluate particular investments and strategies and encourages

investors to seek the advice of a Financial Advisor.

Past performance is not a guarantee or indicative of future

performance. Historical data shown represents past performance and

does not guarantee comparable future results.

This material contains forward-looking statements and there can

be no guarantee that they will come to pass. Diversification and

asset allocation do not guarantee a profit or protect against loss

in a declining financial market.

This material should not be viewed as investment advice or

recommendations with respect to asset allocation or any particular

investment.

Artificial intelligence (AI) is subject to limitations, and you

should be aware that any output from an AI-supported tool or

service made available by the Firm for your use is subject to such

limitations, including but not limited to inaccuracy,

incompleteness, or embedded bias. You should always verify the

results of any AI-generated output.

This article is provided for educational and informational

purposes only and no representation of any kind is intended with

respect to the practices described. Nothing in this article should

be construed as a cybersecurity evaluation. Morgan Stanley is not

responsible for determining what cybersecurity best practices are

most appropriate for your needs. While efforts have been made to

assure the completeness and accuracy of the information as of the

date of the presentation, no representation is made that such

information is accurate or complete, and Morgan Stanley undertakes

no obligation to update the information as its practices change.

Reproduction, transmission, dissemination, or other use without

authorization or attribution is prohibited.

Morgan Stanley Wealth Management is the trade name of Morgan

Stanley Smith Barney LLC, a registered broker-dealer in the United

States.

© 2024 Morgan Stanley Smith Barney LLC. Member SIPC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120595991/en/

Media Relations: Sue Siering Susan.Siering@morganstanley.com,

Jeanne Joe Perrone Jeanne.Perrone@morganstanley.com

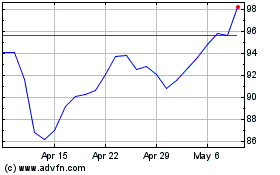

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Oct 2024 to Nov 2024

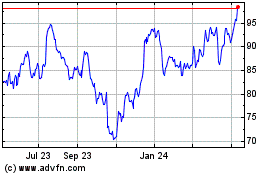

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Nov 2023 to Nov 2024