Morgan Stanley Private Equity Secondaries Completes Equity Financing Alongside RunTide Capital in ATSG and Evolve IP

01 November 2024 - 1:00AM

Business Wire

Investment funds managed by Morgan Stanley Private Equity

Secondaries, through a vehicle managed by RunTide Capital,

announced today the completion of an equity financing to consummate

the combination between ATSG and Evolve IP.

ATSG is a global technology provider for cloud, IT managed

services, and cybersecurity, and Evolve IP is a global leader in

desktop-as-a-service, unified communications, contact center, and

other cloud services. The combined organization will create a

leading global IT managed services provider serving over 1,700

global customers across 950,000 end-users. The transaction is

expected to accelerate ATSG’s services and solutions capabilities

and further enhance the combined entity’s ability to solve

customers’ increasingly interconnected and complex technology

challenges.

Commenting on the transaction, Dan Wieder, Managing Director at

Morgan Stanley Private Equity Secondaries, said: “We are thrilled

to partner with RunTide Capital to support a transformational

combination of two attractively positioned IT services companies.

The combination creates a scaled platform with a best-in-class

suite of solutions led by an experienced management team. ATSG has

successfully executed on its multi-pronged approach to value

creation since our initial investment in 2021. We are excited to

use the continuation fund technology in novel ways to provide

further support to an existing investment in a leading middle

market platform backed by a highly specialized and aligned General

Partner.”

Morgan Stanley Private Equity Secondaries investment funds

invested in ATSG through a continuation fund transaction, alongside

RunTide Capital, in January 2021.

Rob Manning, Partner of RunTide Capital, noted: “We are

delighted to further our partnership with Morgan Stanley Private

Equity Secondaries through our investment in the ATSG platform. The

opportunity to bring together ATSG and Evolve IP marks an exciting

new chapter in our IT outsourcing investment thesis. The

complimentary portfolios, go-to-market strategies, and

technological capabilities will accelerate growth, bringing

enhanced services to an even wider global customer base.”

About RunTide Capital:

RunTide Capital is a private equity firm focused on building

tech-enabled growth companies. The Founding Partners are seasoned

investors with deep operating experience, having started their

careers as founders and C-level executives of high growth

technology companies. For more information, please visit

www.runtidecapital.com.

About ATSG:

ATSG is a leading global managed services provider, delivering

award-winning digital transformation services to today’s dynamic

enterprises. Its robust portfolio of premium managed services

includes Cloud, desktop-as-a-service, Network, Operations, and

Cybersecurity services. Headquartered in Manhattan, New York, ATSG

is a portfolio company of RunTide Capital, a private equity firm

focused on building tech-enabled growth companies.

About Morgan Stanley Private Equity Secondaries

Morgan Stanley Private Equity Secondaries, an investment team

within Morgan Stanley Investment Management, seeks to deliver

innovative private market solutions to a global client base. As

part of a broader team of 250 dedicated private markets focused

professionals, the secondaries business draws on decades of

investment experience across private markets. With a focus on

single asset GP-led transactions in developed buyout and growth

markets, the team structures compelling opportunities within less

efficient markets and has deployed $5.4 billion to 54 GP-led

secondaries transactions as of June 30, 2024. For further

information about Morgan Stanley Private Equity Secondaries, visit

www.morganstanley.com/im/ashbridge.

Morgan Stanley Investment Management

Morgan Stanley Investment Management, together with its

investment advisory affiliates, has more than 1,400 investment

professionals around the world and $1.6 trillion in assets under

management or supervision as of September 30, 2024. Morgan Stanley

Investment Management strives to provide outstanding long-term

investment performance, service, and a comprehensive suite of

investment management solutions to a diverse client base, which

includes governments, institutions, corporations and individuals

worldwide. For further information about Morgan Stanley Investment

Management, please visit www.morganstanley.com/im.

About Morgan Stanley

Morgan Stanley (NYSE: MS) is a leading global financial services

firm providing a wide range of investment banking, securities,

wealth management and investment management services. With offices

in 42 countries, the Firm’s employees serve clients worldwide

including corporations, governments, institutions and individuals.

For further information about Morgan Stanley, please visit

www.morganstanley.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241031794387/en/

Media Relations:

Morgan Stanley: Alyson Barnes

alyson.barnes@morganstanley.com

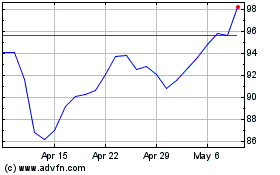

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Oct 2024 to Nov 2024

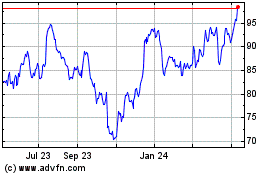

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Nov 2023 to Nov 2024