UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of February 2025

Commission File Number: 001-40416

Nouveau

Monde Graphite Inc.

(Translation of registrant’s name into English)

481 rue Brassard

Saint-Michel-des-Saints, Quebec

Canada J0K 3B0

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

¨ Form 40-F

x

DOCUMENTS TO BE FILED AS PART OF THIS

FORM 6-K

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, there unto duly authorized.

| |

Nouveau Monde Graphite Inc. |

| |

(Registrant) |

| |

|

| Date: February 25,

2025 |

/s/ Josée Gagnon |

| |

Josée Gagnon |

| |

Vice President, Legal Affairs & Corporate Secretary |

Exhibit 99.1

STATEMENT OF EXECUTIVE COMPENSATION

February 24, 2025

This statement of

executive compensation aims to correct the section C on the compensation of the named executive officers, included in the 2023 annual

information form of Nouveau Monde Graphite Inc. (the “Corporation”) dated May 28, 2024. The information

provided in this statement of executive compensation is given as of May 28, 2024.

NAMED

EXECUTIVE OFFICERS

Compensation Discussion and Analysis

General

The named executive

officers are the President and Chief Executive Officer, the Chief Financial Officer, the Chief Operating Officer, the Vice-President,

Sales and Marketing, and the Vice-President Legal Affairs and Corporate Secretary (collectively, the “Named Executive

Officers”).

The members of the Human Resources Committee (formally

the Human Resources, DEI and Compensation Committee) are required to consult with and make recommendations to the board of directors of

the Corporation (the “Board of Directors”) on compensation structure of the President and Chief Executive Officer

of the Corporation, the Chief Financial Officer of the Corporation and the Chief Operating Officer of the Corporation (collectively, the “Executive

Officers”) and compensation plan matters. The make-up of the Human Resources Committee, the determination as to whether the

members are independent and a description of the responsibilities, powers and operations of the Human Resources Committee are set out

under the section “Compensation Governance” in this Circular.

The Board of Directors, on recommendation of the

Human Resources Committee, analyzes, reviews and determines the compensation structure of the Executive Officers. Regarding the analyze

and determination of the other Named Executive Officers, it is delegated by the Board of Directors to the President and Chief Executive

Officer, which follows the remuneration practices detailed below.

The Named Executive Officers’ compensation

has been established with a view to attracting and retaining executives critical to the Corporation’s short and long-term success

and to continue to provide executives with compensation that is in accordance with existing market standards generally.

The Named Executive Officers’ compensation

structure is comprised of a base compensation, performance bonus and stock options granted under the Corporation’s stock option

plan (the “Plan”), following its ratification and confirmation by the Corporation’s shareholders, or any

combination of these elements.

Through its compensation practices, the Corporation

seeks to provide value to its Shareholders through a strong executive leadership. Specifically, the Named Executive Officers’ compensation

structure seeks to (i) attract and retain talented and experienced executives necessary to achieve the Corporation’s strategic

objectives, (ii) motivate and reward executives whose knowledge, skills and performance are critical to the Corporation’s success,

(iii) align the interests of the Corporation’s executives and Shareholders by motivating executives to increase Shareholder

value, and (iv) provide a competitive compensation structure in which a significant portion of total compensation is determined by

corporate and individual results and the creation of Shareholder value and foster a shared commitment among executives by coordinating

their corporate and individual goals.

Within the context of the overall objectives of

the Corporation’s compensation practices, the Corporation determined the specific amounts of compensation paid to each Named Executive

Officer for the fiscal years ended December 31, 2021, December 31, 2022 and December 31, 2023, as applicable, based on

a number of factors, including (i) the Corporation’s understanding of the amount of compensation generally paid by similarly

situated businesses to their executives with similar roles and responsibilities, (ii) the Corporation’s executives’ performance

during the fiscal year in general and as measured against predetermined corporate and individual performance goals, (iii) the roles

and responsibilities of the Corporation’s executives, (iv) the individual experience and skills of, and expected contributions

from the Corporation’s executives, (v) the amounts of compensation being paid to the Corporation’s other executives,

and (vi) any other contractual commitments that the Corporation has made to its executives regarding compensation.

Base Compensation

The Corporation’s

approach is to pay its Named Executive Officers a base compensation that is competitive with those of other executives in similar businesses.

The Corporation believes that a competitive base compensation is a necessary element of any compensation program that is designed to attract

and retain talented and experienced executives. The Corporation also believes that attractive base compensations can motivate and reward

executives for their overall performance. The base compensation of each Named Executive Officer is reviewed annually and may be adjusted

in accordance with the terms of such Named Executive Officers’ employment. In establishing the base compensation of the Named Executive

Officers, the Corporation ensures that the base salary of such executive officers is reasonably positioned within a comparator

group in the mining industry for equivalent positions and similar experience.

The Corporation entered into the President and

CEO Agreement (as defined below) with its President and Chief Executive Officer on February 21, 2018, the CFO Agreement (as defined

below) with its Chief Financial Officer on March 30, 2018, and the COO Agreement (as defined below) with its Chief Operating Officer

on January 9, 2022, the Vice-President, Sales and Marketing Agreement (as defined below) with its Vice-President, Sales and Marketing

on September 12, 2019, and the Vice-President, Legal Affairs and Corporate Secretary Agreement (as defined below) with its Vice-President,

Legal Affairs and Corporate Secretary on September 6, 2022. The base compensation of such individuals reflects the base compensation

that the Corporation negotiated with them. Such base compensation was also based on the experience and skills of, and expected contribution

from, each Named Executive Officer, their roles and responsibilities and other factors. Certain terms of the President and CEO Agreement,

the CFO Agreement, the COO Agreement, the Vice-President, Sales and Marketing Agreement, and the Vice-President, Legal Affairs and Corporate

Secretary Agreement are summarized under the section “Termination, Change of Control and Other Benefits” in this statement.

Performance Bonus

The Named Executive Officers have an opportunity

to earn an annual bonus based on corporate and individual performance in the context of the overall performance of the Corporation. Individual

target bonuses, which are established by the Human Resources Committee, are between 25% and 50% of the base compensation of the Named

Executive Officer. Bonuses granted to Executive Officers are recommended by the Human Resources Committee to the Board of Directors which

ultimately approves the award of such bonuses and the ones to the other Named Executive Officers by the President and Chief Executive

Officer.

Bonuses are primarily based upon performance,

as measured against predetermined corporate and individual goals covering business development, ESG management and performance, as well

as corporate and financial achievements. The objectives of the Executive Officers are presented to the Human Resources Committee and discussed

with each of them, while the objectives of the other Named Executive Officers are reviewed and discussed with the President and Chief

Executive Officer. The primary objective of the Corporation’s bonus payments is to motivate and reward the Named Executive Officer

for meeting the Corporation’s short-term objectives using a performance-based compensation program with objectively determinable

goals that are specifically tailored for each of the Named Executive Officer. Bonuses are granted based on the achievement of criteria,

which are established annually. Bonuses are established, among others, on the following criteria: financing, human resources, budget and

cost control and permitting and development of projects. In addition, certain Named Executive Officers are eligible for bonuses payable

upon the achievement of significant milestones in the progress of the major projects under their responsibility. These bonuses are paid

in a lump sum based on the milestones and amounts established in employment contracts. For additional information regarding the grant

of performance bonuses, please see the table included under the section “Named Executive Officer Summary Compensation Table”

in this statement. Please also refer to the section “Termination, Change of Control and Other Benefits” in this statement.

Stock Options

The Corporation’s grant of stock options

to its Named Executive Officers under the Plan is a method of compensation which is used to attract and retain personnel and to provide

an incentive to participate in the long-term development of the Corporation and to increase Shareholder value. The relative emphasis of

stock options for compensating Named Executive Officers will generally vary depending on the number of stock options that are outstanding

from time to time. For the fiscal year ended December 31, 2023, the Corporation granted 212,500 stock options to directors of the

Corporation, 600,000 stock options to the Named Executive Officers, 800,000 stock options to employees of the Corporation and 476,048

stock options to consultants of the Corporation.

The Corporation generally expects that future

grants to Named Executive Officers should be based on the following factors: (i) the terms of the executive’s employment; (ii) the

executive’s past performance; (iii) the executive’s anticipated future contribution; (iv) the prior stock options

grants to such executive; (v) the percentage of outstanding equity owned by the executive; (vi) the level of vested and unvested

stock options and (vii) the market practices and the executive’s responsibilities and performance.

The Corporation has not set specific target levels

for the grant of stock options to Named Executive Officers but seeks to be competitive with similar businesses. Generally, initial option-based

awards are set in the Named Executive Officers’ employment agreements in accordance with the items set out in the previous paragraph,

as applicable. The terms of such employment agreements are recommended by the Human Resources Committee and approved by the Board of Directors.

Additional stock option grants will be recommended by the Human Resources Committee to the Board of Directors which ultimately has the

responsibility to grant stock options. For a summary of the main terms of the Plan, see the section “Stock Option Plan”

in this statement.

Management of Risks

The Human Resources Committee and the Board of

Directors periodically assess the implications of the risks associated with the Corporation’s compensation policies and practices.

The Human Resources Committee maintains sufficient discretion and flexibility in implementing compensation decisions such that unintended

consequences in remuneration can be minimized, while still being responsive to market influences in a competitive environment. The Human

Resources Committee believes that the following elements, among others, mitigate the risks associated with the Corporation’s compensation

program for its executives: (i) all material contracts and agreements have to be approved by the Board of Directors, (ii) the

Board of Directors approves annual and capital budget, and (iii) a significant portion of the compensation is based on the overall

performance of the Corporation. The Human Resources Committee is satisfied that the Corporation’s policies and practices do not

encourage any executive or individual to take inappropriate or excessive risks. In this respect, the Human Resources Committee has not

identified risks arising from the executive compensation policies and practices that are reasonably likely to have a material adverse

effect on the Corporation.

Performance Graph

The following chart

compares the cumulative total return on a $100 investment in the Common Shares to the cumulative total return on the S&P/TSX Capped

Materials and the S&P/TSX Composite Total Return Index from January 1st, 2019, to December 31, 2023. Effective

as of March 24, 2021, the Corporation implemented the Consolidation on the basis of the Consolidation Ratio.

The

amounts indicated in the graph above and in the chart below are as of December 31 in each of the year 2019, 2020, 2021, 2022 and

2023.

| | |

January 1,

2019 | | |

December 31,

2019 | | |

December 31,

2020 | | |

December 31,

2021 | | |

December 31,

2022 | | |

December 31,

2023 | |

| Nouveau Monde Graphite Common share | |

| 100 | | |

| 69.64 | | |

| 367.86 | | |

| 313.93 | | |

| 184.29 | | |

| 123.21 | |

| S&P/TSX Capped Materials | |

| 100 | | |

| 125.16 | | |

| 151.75 | | |

| 157.91 | | |

| 160.65 | | |

| 158.48 | |

| S&P/TSX Composite | |

| 100 | | |

| 118.93 | | |

| 121.51 | | |

| 147.92 | | |

| 135.11 | | |

| 146.08 | |

As shown in the

above performance graph, during the fiscal year ended December 31, 2023, the Corporation’s Common Share price performed slightly

worse than the S&P/TSX Capped Materials Index and the S&P/TSX Composite Index for the 2023 calendar year. The Corporation believes

that this underperformance was largely due to weaker graphite prices, despite the advancement of the Matawinie Mine and Bécancour

Battery Material Plant projects and improved long-term outlook for graphite demand from battery manufacturer and the electric vehicle

industry. Total Shareholder return increased by approximately 23% between January 1, 2019, and December 31, 2023. The Common

Shares performance is also affected by a number of factors, including the Corporation’s performance and general market and economic

conditions, many of which are beyond the control of the Corporation and the Named Executive Officers. Some of these risks are discussed

under the section “Risk Factors” of the Corporation’s Annual Information Form dated March 27, 2024,

which is available under the Corporation’s profile on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov.

Market price performance is not the only predictor

or outcome of the success of the Corporation’s team, especially in the short term. The trend in overall compensation paid to the

Named Executive Officers over the past three years has not directly tracked the performance of the market price of the Common Shares or

the S&P/TSX Composite Index. Given the Corporation’s stage of development, the Corporation’s Common Share price is volatile

and is currently not a significant factor in cash compensation consideration. It is one of many considerations that influence the Named

Executive Officers’ compensation decisions. As a result, the factors considered by the Human Resources Committee and by the Board

of Directors and the President and Chief Executive Officer in determining compensation matters, such as the amount of compensation generally

paid by similarly situated companies to their executive officers with similar roles and responsibilities, the Named Executive Officers’

performance, the roles and responsibilities of the Named Executive Officers, and the individual experience and skills of, and expected

contributions from the Named Executive Officers, may not be significantly affected by the market price of the Common Shares. The value

of long-term incentive compensation in the form of Options is influenced by the Corporation’s Common Share price performance.

Human Resources Committee

As of May 28, 2024, the Human Resources Committee

(previously the human resources committee, of DEI, and remuneration) was consisted of the three (3) following directors: Messrs. Arne

H Frandsen, Daniel Buron, and James Scarlett. Mr. Buron and Mr. Scarlett are considered independent under the Regulation

52-110 respecting Audit Committees (the “Regulation 52-110”).

All the members

of the Human Resources Committee have relevant experience to fulfill their responsibilities related to Named Executive Officers’

compensation, including making decisions and determinations as to the suitability of compensation policies and practices. Each member

has held a number of executive management positions. All the members of the Human Resources Committee have experience in matters

of executive compensation that is relevant to their responsibilities as members of such Committee by virtue of their respective professions

and long-standing involvement with public companies. In connection with each member’s various responsibilities in such positions,

each member of the Human Resources Committee strives to keep abreast of trends and developments affecting executive compensation.

For a description of the policies and practices

adopted by the Board of Directors to determine the compensation of the Corporation’s directors and officers, see the section “Corporate

Governance – Compensation” in this statement.

The Human Resources

Committee is responsible for assisting the Board of Directors in discharging its oversight responsibilities relating to the compensation

and retention of Executive Officers having the skills and expertise needed to enable the Corporation to achieve its goals and strategies

at a fair and competitive compensation, including appropriate performance incentives. The members of the Human Resources Committee are

more specifically responsible for (i) reviewing the goals and objectives of the Corporation’s executive officers’

compensation plans and amending, or recommending that the Board amend, these goals and objectives if the Committee deems appropriate;

(ii) having regard to the Corporation’s goals and objectives with respect to executive officers’ compensation plans,

reviewing such plans and amending existing plans or adopting new plans, or recommending that the Board do so, if the Committee deems appropriate;

(iii) having regard to the goals and objectives established by the Board, evaluating the CEO’s performance and, based on such

evaluation, determining and recommending the CEO’s annual compensation, including, as appropriate, salary, bonus, incentive and

equity compensation and, if it deems appropriate, discussing the CEO’s compensation with the Board; (iv) reviewing the evaluation

process and compensation structure for the Corporation’s executive officers and making recommendations to the Board with respect

to the compensation of the executive officers, including, as appropriate, salary, bonus, incentive and equity compensation; (v) assessing

annually the competitiveness and appropriateness of the Corporation’s policies relating to the compensation of executive officers;

(vi) reviewing and, if appropriate, recommending to the Board the approval of, any adoption, amendment and termination of the Corporation’s

incentive and equity- based compensation plans and overseeing their administration, including discharging any duties imposed on the Board

by any of those plans to the extent such duties may be delegated to the Committee; (vii) reviewing and recommending to the Board

the employment contracts and other hiring or termination packages to be entered into with the CEO and other executive officers; and (viii) to

the extent the Committee deems appropriate, overseeing the selection of any peer group used in determining compensation or any element

of compensation.

The Human Resources Committee has the authority

to retain the services of any compensation consultants to provide independent advice on executive compensation and related governance

issues. The Human Resources Committee also has the authority to determine and pay the fees of such consultants. All compensation and non-compensation

services provided by such independent advisors to the Corporation must be pre-approved by the Human Resources Committee or its chair.

NAMED EXECUTIVE OFFICERS SUMMARY COMPENSATION

TABLE

The following table details all compensation paid

to the Named Executive Officers of the Corporation for the fiscal years ended December 31, 2021, December 31, 2022, and December 31,

2023. Effective as of March 24, 2021, the Corporation implemented the Consolidation on the basis of the Consolidation Ratio. The

numbers and prices of Common Shares and other information on securities convertible into Common Shares provided in this section are stated

after giving effect to the Consolidation.

TABLE OF COMPENSATION

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Equity Incentive |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plan Compensation ($) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Share-Based |

|

|

Option-Based |

|

|

|

Annual |

|

|

Long-Term |

|

Pension |

|

All Other |

|

|

Total |

|

| Name and |

|

|

|

|

Salary |

|

|

Awards |

|

|

Awards (4) |

|

|

|

Incentive |

|

|

Incentive |

|

Value |

|

Compensation |

|

|

Compensation |

|

| Position |

|

Year |

|

|

($) |

|

|

($) |

|

|

($) |

|

|

|

Plans (5) |

|

|

Plans |

|

($) |

|

($) |

|

|

($) |

|

| Eric

| |

2021 | |

| 425,000 | | |

N/A | |

| 1,428,476 | | |

| 276,250 | | |

N/A | |

N/A | |

N/A | |

| 2,129,726 | |

| Desaulniers, | |

2022 | |

| 460,000 | | |

N/A | |

| 755,918 | | |

| 299,000 | | |

N/A | |

N/A | |

N/A | |

| 1,514,918 | |

| President, | |

2023 | |

| 460,000 | | |

N/A | |

| 647,137 | | |

| 299,000 | | |

N/A | |

N/A | |

N/A | |

| 1,406,137 | |

| Chief Executive Officer and Director(1) | |

| |

| | | |

| |

| | | |

| | | |

| |

| |

| |

| | |

| Charles-Olivier | |

2021 | |

| 325,000 | | |

N/A | |

| 714,238 | | |

| 178,750 | | |

N/A | |

N/A | |

N/A | |

| 1,217,988 | |

| Tarte, Chief | |

2022 | |

| 335,000 | | |

N/A | |

| 377,959 | | |

| 230,750 | | |

N/A | |

N/A | |

N/A | |

| 943,709 | |

| Financial | |

2023 | |

| 335,000 | | |

N/A | |

| 520,523 | | |

| 184,250 | | |

N/A | |

N/A | |

N/A | |

| 1,039,773 | |

| Officer | |

| |

| | | |

| |

| | | |

| | | |

| |

| |

| |

| | |

| Bernard | |

2021 | |

| – | | |

– | |

| – | | |

| – | | |

– | |

– | |

– | |

| – | |

| Perron,

| |

2022 | |

| 369,231 | | |

N/A | |

| 1,211,050 | | |

| 275,000 | | |

N/A | |

N/A | |

N/A | |

| 1,855,281 | |

| Chief | |

2023 | |

| 400,000 | | |

N/A | |

| 520,523 | | |

| 220,000 | | |

N/A | |

N/A | |

N/A | |

| 1,140,523 | |

| Operating Officer(2) | |

| |

| | | |

| |

| | | |

| | | |

| |

| |

| |

| | |

| Josée Gagnon, | |

2021 | |

| – | | |

– | |

| – | | |

| – | | |

– | |

– | |

– | |

| – | |

| Vice-President, | |

2022 | |

| 55,769 | | |

N/A | |

| 202,422 | | |

| 18,100 | | |

N/A | |

N/A | |

N/A | |

| 276,292 | |

| Legal Affairs | |

2023 | |

| 290,000 | | |

N/A | |

| 112,546 | | |

| 74,313 | | |

N/A | |

N/A | |

N/A | |

| 476,858 | |

| and Corporate Secretary | |

| |

| | | |

| |

| | | |

| | | |

| |

| |

| |

| | |

| Patrice | |

2021 | |

| 241,500 | | |

N/A | |

| 72,375 | | |

| 65,658 | | |

N/A | |

N/A | |

N/A | |

| 379,533 | |

| Boulanger, | |

2022 | |

| 255,990 | | |

N/A | |

| 377,959 | | |

| 76,797 | | |

N/A | |

N/A | |

N/A | |

| 710,746 | |

| Vice-President, | |

2023 | |

| 285,000 | | |

N/A | |

| 225,091 | | |

| 71,606 | | |

N/A | |

N/A | |

N/A | |

| 581,6973 | |

| Sales and

Marketing | |

| |

| | | |

| |

| | | |

| | | |

| |

| |

| |

| | |

Notes:

| (1) | Mr. Desaulniers, who is also a director of the Corporation, is not being compensated for the services

delivered as such. |

| (2) | Mr. Perron was appointed as Chief Operating Officer of the Corporation on January 17, 2022.

For the fiscal year 2022, this therefore represents the salary that was paid to him for the period from January 17, 2022, to December 31,

2022, based on an annual base salary of $400,000. |

| (3) | Mrs. Gagnon was appointed as Vice-President, Legal Affairs and Corporate Secretary of the Corporation

on October 11, 2022. For the fiscal year 2022, this therefore represents the salary that was paid to him for the period from October 11,

2022, to December 31, 2022, based on an annual base salary of $290,000. |

| (4) | The amounts provided in this column represent the dollar amount based on the fair value of the stock options

granted to the Named Executive Officers under the Plan on the grant date for the covered fiscal year. During fiscal year ended December 31,

2023, Messrs. Desaulniers, Tarte, Perron, Boulanger, and Mrs. Gagnon were granted on May 12, 2023, 230,000 stock options,

185,000 stock options, 185,000 stock options, 80,000 stock options, and 40,000 stock options, respectively. Mr. Perron and Mrs. Gagnon

were granted 225,000 stock options and 50,000 stock options, respectively upon their hiring on 2022. The grant date fair value of the

awards was $2.81 for Messrs. Desaulniers, Tarte, Perron, Boulanger and Mrs. Gagnon stock options granted on May 12, 2023.

Mr. Perron’s grant date fair value was $5.38 on January 24, 2022, and $4.05 on November 14, 2022 for Mrs. Gagnon.

The fair value of the awards is the same as the fair value determined for accounting purposes. The values indicated in the table reflect

the estimated fair value of the stock options on the date of grant. They do not represent cash received by the optionees, and the actual

value realized upon the future vesting and exercise of such stock options may be less, equal to zero or greater than the grant date faire

value indicated in the table above. The Black-Scholes method has been used in calculating the grant date fair value of the option-based

awards. The Black-Scholes method is used to estimate the grant date fair value of option-based awards because it is the most used share-based

award pricing model and is considered to produce a reasonable estimate of fair value. The grant date fair value of the stock options was

estimated using the Black-Scholes option pricing model with the following assumptions: |

| Assumptions | |

May 25,

2021 | | |

November 17,

2021 | | |

January 24,

2022 | | |

March 28,

2022 | | |

November 14,

2022 | | |

May 12,

2023 | |

| Risk-Free Interest Rate | |

| 0.87 | % | |

| 1.47 | % | |

| 1.62 | % | |

| 2.44 | % | |

| 3.25 | % | |

| 2.91 | % |

| Expected Life (In Years) | |

| 5 | | |

| 5 | | |

| 5 | | |

| 5 | | |

| 5 | | |

| 5 | |

| Expected Volatility | |

| 68 | % | |

| 72 | % | |

| 74 | % | |

| 74 | % | |

| 74 | % | |

| 69 | % |

| Grant Date Fair Value ($) | |

| 9.52 | | |

| 4.83 | | |

| 5.38 | | |

| 5.04 | | |

| 4.05 | | |

| 2.81 | |

| (5) | The amounts provided in this column represent the payment of annual cash incentive bonuses by the Corporation

in reward of objectives achieved by the Named Executive Officers in respect of the applicable fiscal year. In addition, during the fiscal

year 2022, Mr. Perron received a bonus upon the achievement of a significant milestone, as predetermined in the COO Agreement. The

annual cash incentive bonuses are generally paid following the end of the applicable fiscal year. Please also refer to the section “Termination,

Change of Control and Other Benefits” in this statement. |

INCENTIVE PLAN AWARDS

Outstanding Share-Based Awards and Option-Based Awards

The following table

lays out, for each Named Executive Officer, all awards outstanding as of the end of the fiscal year ended December 31, 2023. This

table also includes awards granted before the most recent fiscal year of the Corporation. Effective as of March 24, 2021, the Corporation

implemented the Consolidation on the basis of the Consolidation Ratio. The numbers and prices of Common Shares and other information on

securities convertible into Common Shares provided in this section are stated after giving effect to the Consolidation.

| |

|

Options-Based

Awards |

|

|

Share-Based

Awards |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market or |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payout |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market or |

|

Value of |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payout |

|

Vested |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of |

|

Value of |

|

Share-Based |

| |

|

|

|

|

Number of |

|

|

|

|

|

|

|

|

|

|

|

Value of |

|

|

Shares or |

|

Share-Based |

|

Awards |

| |

|

Date of |

|

|

Securities |

|

|

|

Option |

|

|

|

Option |

|

|

|

Unexercised |

|

|

Units of |

|

Awards |

|

not Paid |

| |

|

Issue or |

|

|

Underlying |

|

|

|

Exercise |

|

|

|

Expiration |

|

|

|

in-the-Money |

|

|

Shares that |

|

that Have |

|

out or |

| Name and |

|

Grant |

|

|

Unexercised |

|

|

|

Price |

|

|

|

Date |

|

|

|

Options |

|

|

Have Not |

|

Not Vested |

|

Distributed |

| Position |

|

(m/d/y) |

|

|

Options (#) |

|

|

|

($) |

|

|

|

(m/d/y) |

|

|

|

($)(1) |

|

|

Vested (#) |

|

($) |

|

($) |

| Eric Desaulniers, | |

05/27/2019 | |

| 75,000 | | |

| 2.35 | | |

| 05/27/2024 | | |

| 82,500 | | |

N/A | |

N/A | |

N/A |

| President, Chief | |

09/02/2020 | |

| 300,000 | | |

| 1.85 | | |

| 09/02/2025 | | |

| 480,000 | | |

| |

| |

|

| Executive Officer | |

05/25/2021 | |

| 150,000 | | |

| 16.84 | | |

| 05/24/2026 | | |

| Nil | | |

| |

| |

|

| and Director | |

03/28/2022 | |

| 150,000 | | |

| 8.20 | | |

| 03/28/2027 | | |

| Nil | | |

| |

| |

|

| | |

05/12/2023 | |

| 230,000 | | |

| 4.77 | | |

| 05/12/2028 | | |

| Nil | | |

| |

| |

|

| Charles-Olivier | |

05/27/2019 | |

| 37,500 | | |

| 2.35 | | |

| 05/27/2024 | | |

| 41,250 | | |

N/A | |

N/A | |

N/A |

| Tarte, Chief | |

09/02/2020 | |

| 150,000 | | |

| 1.85 | | |

| 09/02/2025 | | |

| 240,000 | | |

| |

| |

|

| Financial Officer | |

05/25/2021 | |

| 75,000 | | |

| 16.84 | | |

| 05/24/2026 | | |

| Nil | | |

| |

| |

|

| | |

03/28/2022 | |

| 75,000 | | |

| 8.20 | | |

| 03/28/2027 | | |

| Nil | | |

| |

| |

|

| | |

05/12/2023 | |

| 185,000 | | |

| 4.77 | | |

| 05/12/2028 | | |

| | | |

| |

| |

|

| Bernard Perron, | |

01/24/2022 | |

| 225,000 | | |

| 8.87 | | |

| 01/23/2027 | | |

| Nil | | |

N/A | |

N/A | |

N/A |

| Chief Operating | |

05/12/2023 | |

| 185,000 | | |

| 4.77 | | |

| 05/12/2028 | | |

| Nil | | |

| |

| |

|

| Officer | |

| |

| | | |

| | | |

| | | |

| | | |

| |

| |

|

| Josée Gagnon, | |

11/14/2022 | |

| 50,000 | | |

| 6.48 | | |

| 11/14/2027 | | |

| Nil | | |

N/A | |

N/A | |

N/A |

| Vice-President, | |

05/12/2023 | |

| 40,000 | | |

| 4.77 | | |

| 05/12/2028 | | |

| Nil | | |

| |

| |

|

| Legal Affairs and Corporate Secretary | |

| |

| | | |

| | | |

| | | |

| | | |

| |

| |

|

| Patrice | |

09/12/2019 | |

| 35,000 | | |

| 2.35 | | |

| 09/12/2024 | | |

| 38,500 | | |

N/A | |

N/A | |

N/A |

| Boulanger, | |

10/01/2020 | |

| 15,000 | | |

| 2.40 | | |

| 10/01/2025 | | |

| 15,750 | | |

| |

| |

|

| Vice-President, | |

11/17/2021 | |

| 15,000 | | |

| 8.08 | | |

| 11/17/2026 | | |

| Nil | | |

| |

| |

|

| Sales and | |

03/28/2022 | |

| 75,000 | | |

| 8.20 | | |

| 03/28/2027 | | |

| Nil | | |

| |

| |

|

| Marketing | |

05/12/2023 | |

| 80,000 | | |

| 4.77 | | |

| 05/12/2028 | | |

| Nil | | |

| |

| |

|

Note:

| (1) | The value of the unexercised vested in-the-money options at fiscal year-end represents the difference

between the closing price of the Common Shares on the Exchange as of December 31, 2023 ($3.45) and the respective exercise price

of the stock options. This value has not been, and may never be, realized. The actual gain, if any, will depend on the stock price on

the dates, if any, on which the stock options are exercised. |

Value Vested or Earned During the Year

The following table

lays out, for each Named Executive Officer, the value vested of all awards as well as the value earned during the fiscal year ended

December 31, 2023. Effective as of March 24, 2021, the Corporation implemented the Consolidation on the basis of the Consolidation

Ratio. The numbers and prices of Common Shares and other information on securities convertible into Common Shares provided in this section

are stated after giving effect to the Consolidation.

| Name and Position | |

Option-Based

Awards – Value

Vested During the Year ($)(1) | | |

Share-Based Awards – Value

Vested During the Year

($) | |

Non-Equity

Incentive Plan

Compensation – Value Earned

During the Year ($)(2) | |

| Eric Desaulniers, President, Chief Executive Officer and Director | |

| N/A | | |

N/A | |

| 299,000 | |

| Charles-Olivier Tarte, Chief Financial Officer | |

| N/A | | |

N/A | |

| 184,250 | |

| Bernard Perron, Chief Operating Officer | |

| N/A | | |

N/A | |

| 220,000 | |

| Josée Gagnon, Vice-President, Legal Affairs and Corporate Secretary | |

| 15,250 | | |

N/A | |

| 74,313 | |

| Patrice Boulanger, Vice-President, Sales and Marketing | |

| N/A | | |

N/A | |

| 71,606 | |

Notes:

| (1) | The value of the vested options at fiscal year-end represents the aggregate dollar value that would have

been realized if the stock options had been exercised on their respective vesting dates, based on the difference between the market (closing)

price of the Common Shares on the date of vesting and the exercise price payable in order to exercise the stock options. |

| (2) | The value of the non-equity incentive plan compensation at fiscal year-end represents the amounts paid

as an annual incentive plan bonus in respect of the fiscal year ended December 31, 2023, and corresponds to the amounts disclosed

in the “Table of Compensation” above. |

TERMINATION, CHANGE OF CONTROL AND OTHER BENEFITS

Eric

Desaulniers

The Corporation entered into an employment agreement

with Mr. Eric Desaulniers on February 21, 2018, pursuant to which the terms of his employment as President and Chief Executive

Officer of the Corporation were confirmed (the “President and CEO Agreement”). The President and CEO Agreement

provides for an indeterminate term. Pursuant to the President and CEO Agreement, Mr. Desaulniers is entitled to receive an annual

base salary as well as an annual bonus of up to 25% of his annual base salary, subject to the attainment of certain objectives set by

the Board of Directors. At the discretion of the Board of Directors, in the event Mr. Desaulniers exceptionally surpasses the objectives

set by the Board of Directors, Mr. Desaulniers could be awarded an annual bonus of up to 50% of his annual base salary. However,

consistent with fiscal year ended December 31, 2022 and to reward the achievement of certain corporate, strategic and business objectives

for the fiscal year ended December 31, 2023, including (i) the successful negotiation of strategic commercial agreements, including

the offtake agreement with Panasonic Energy Co., Ltd. and the supply agreement with General Motors Holding LLC, (ii) the successful

negotiation of financing agreements with Panasonic, GM, Mitsui and Pallinghurst, (iii) the completion of the preliminary economic

assessment for the Uatnan Mining Project and the successful negotiation of the asset purchase agreement regarding the Lac Guéret

property, and (iv) the advancement of commitments and targets related to key ESG matters, the Board of Directors granted Mr. Desaulniers

a bonus representing 65% of his annual base salary for fiscal year ended December 31, 2023. Mr. Desaulniers is also entitled

to stock options that may be granted, from time to time, by the Board of Directors under the Plan.

The Corporation may terminate without a serious

reason the President and CEO Agreement by giving Mr. Desaulniers a twelve-month (12) written notice. Similarly, any substantial alteration

in working conditions warrants the same notice period. In the event the President and CEO Agreement is terminated following a reverse

take-over, Mr. Desaulniers shall be entitled to receive a lump sum representing twenty-four (24) months of his annual base salary

and an indemnity corresponding to the vacation accrued.

Charles-Olivier

Tarte

The Corporation entered into an employment agreement

with Mr. Charles-Olivier Tarte on March 30, 2018, pursuant to which the terms of his employment as Chief Financial Officer of

the Corporation were confirmed (the “CFO Agreement”). The CFO Agreement provides for an indeterminate term. Pursuant

to the CFO Agreement, Mr. Tarte is entitled to receive an annual base salary as well as an annual bonus of up to 25% of his annual

base salary, subject to the attainment of certain objectives set by the Board of Directors. At the discretion of the Board of Directors,

in the event Mr. Tarte exceptionally surpasses the objectives set by the Board of Directors, Mr. Tarte could be awarded an annual

bonus of up to 50% of his annual base salary. However, consistent with fiscal year ended December 31, 2022 and to reward the achievement

of certain corporate, strategic and business objectives for the fiscal year ended December 31, 2023, including (i) the successful

negotiation of strategic commercial agreements, including the offtake agreement with Panasonic Energy Co., Ltd. and the supply agreement

with General Motors Holdings LLC, (ii) the successful negotiation of financing agreements with Panasonic, GM, Mitsui and Pallinghurst,

and (iii) the completion of the preliminary economic assessment for the Uatnan Mining Project and the successful negotiation of the

asset purchase agreement regarding the Lac Guéret property, the Board of Directors granted Mr. Tarte a bonus representing

55% of his annual base salary for fiscal year ended December 31, 2023. Mr. Tarte is also entitled to stock options that may

be granted, from time to time, by the Board of Directors under the Plan.

The Corporation may terminate without a serious

reason the CFO Agreement by giving Mr. Tarte a twelve-month (12) written notice. Similarly, any substantial alteration in working

conditions warrants the same notice period. In the event the CFO Agreement is terminated following a reverse take-over, Mr. Tarte

shall be entitled to receive a lump sum representing twenty-four (24) months of his annual base salary and an indemnity corresponding

to the vacation accrued.

Bernard

Perron

The Corporation entered into an employment agreement

with Mr. Bernard Perron on January 9, 2022, pursuant to which the terms of his employment as Chief Operating Officer were confirmed

(the “COO Agreement”). The COO Agreement provides for an indeterminate term. Pursuant to the COO Agreement, Mr. Perron

is entitled to receive an annual base salary as well as an annual bonus of up to 25% of his annual base salary, subject to the attainment

of certain objectives set by the President and Chief Executive Officer. The Board of Directors may increase at its discretion this target

bonus. However, consistent with fiscal year ended December 31, 2022, and to reward the achievement of certain corporate, strategic

and business objectives for the fiscal year ended December 31, 2023, including the completion of the preliminary economic study for

the Uatnan Mining Project, the Board of Directors granted Mr. Perron a bonus representing 55% of his annual base salary for fiscal

year ended December 31, 2023. In addition, Mr. Perron is eligible for bonuses payable upon the achievement of significant milestones

in the progress of major projects under his responsibility. These bonuses are paid as a lump sum based on amounts pre-determined in the

COO Agreement. Mr. Perron is also entitled to stock options that may be granted, from time to time, by the Board of Directors under

the Plan.

The Corporation may terminate without a serious

reason the COO Agreement by giving Mr. Perron a twelve-month (12) written notice. Similarly, any substantial alteration in working

conditions warrants the same notice period. In the event the COO Agreement is terminated following a reverse take-over, Mr. Perron

shall be entitled to receive a lump sum representing twenty-four (24) months of his annual base salary and an indemnity corresponding

to the vacation accrued.

PATRICE BOULANGER

The Corporation entered into an employment agreement

with Mr. Patrice Boulanger on September 12, 2019, under which the terms of his employment as Vice-President, Sales and Marketing

of the Corporation were confirmed (the “Vice-President, Sales and Marketing Agreement”). The Vice-President, Sales

and Marketing Agreement provides for an indeterminate term. Under the Vice-President, Sales and Marketing Agreement, Mr. Boulanger

is entitled to receive an annual base salary, as well as an annual bonus of up to 25% of his base salary, subject to the achievement of

certain objectives set by his immediate supervisor, and up to 50% of his base salary if the objectives are achieved exceptionally. Mr. Boulanger

is also entitled to stock options which may be granted, from time to time, by the Board of Directors under the Plan.

The Corporation may terminate without a serious

reason the Vice-President, Sales and Marketing Agreement by giving Mr. Boulanger a six-month (6) written notice. If the Vice-President,

Sales and Marketing Agreement is terminated as a result of a reverse takeover, Mr. Boulanger shall be entitled to receive a lump

sum payment representing twice his full annual compensation, including benefits and perquisites.

JOSÉE GAGNON

The Corporation entered into an employment agreement

with Mrs. Josée Gagnon on September 6, 2022, under which the terms of her employment as Vice-President, Legal Affairs

and Corporate Secretary of the Corporation were confirmed (the “Vice-President, Legal Affairs and Corporate Secretary Agreement”).

The Vice-President, Legal Affairs and Corporation Secretary Agreement provides for an indeterminate term. Under the Vice-President, Legal

Affairs and Corporation Secretary Agreement, Mrs. Gagnon is entitled to receive an annual base salary, as well as an annual bonus

of up to 25% of her base salary, subject to the achievement of certain objectives set by the Board of Directors. Mrs. Gagnon is also

entitled to stock options which may be granted, from time to time, by the Board of Directors under the Plan.

The Corporation may terminate without a serious

reason the Vice-President, Legal Affairs and Corporation Secretary Agreement by giving Mrs. Gagnon a twelve-month (12) written notice.

Similarly, any substantial alteration in working conditions warrants the same notice period. If the ice-President, Legal Affairs and Corporation

Secretary Agreement is terminated as a result of a reverse takeover, Mrs. Gagnon shall be entitled to receive a lump sum representing

twenty-four (24) months of his annual base salary and an indemnity corresponding to the vacation accrued.

ADDITIONAL INFORMATION

Additional information

relating to the Corporation is available under the Corporation’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR

at www.sec.gov. Financial information is provided in the Corporation’s consolidated audited financial statements for the

fiscal years ended December 31, 2023, and 2022 and the management’s discussion and analysis for the fiscal year ended December 31,

2023. Copies of the Corporation’s financial statements and management’s discussion and analysis may be obtained under the

Corporation’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov, or upon written request to the Vice-President,

Legal Affairs and Corporate Secretary at:

| |

By e-mail: |

legal@nmg.com |

| |

|

|

| |

By mail: |

Nouveau Monde Graphite Inc.

481 Brassard Street

Saint-Michel-des-Saints, Québec J0K 3B0

Attention: Mrs. Josée Gagnon, Vice-President, Legal Affairs and Corporate Secretary |

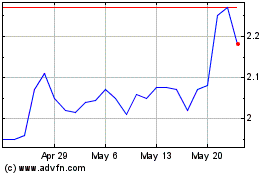

Nouveau Monde Graphite (NYSE:NMG)

Historical Stock Chart

From Jan 2025 to Feb 2025

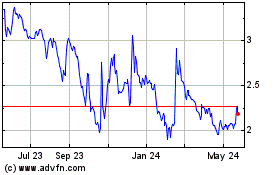

Nouveau Monde Graphite (NYSE:NMG)

Historical Stock Chart

From Feb 2024 to Feb 2025