0001444380FALSE00014443802025-03-042025-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 4, 2025

NEVRO CORP.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36715 | | 56-2568057 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | |

| 1800 Bridge Parkway | | | | |

Redwood City, California | | | | 94065 |

| (Address of Principal Executive Offices) | | | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (650) 251-0005

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | NVRO | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On March 4, 2025, Nevro Corp. (“Nevro” or the “Company”) issued a press release relating to its financial results for the three months and full year ended December 31, 2024. The full text of the press release is furnished herewith as Exhibit 99.1.

The information furnished pursuant to this Item 2.02 of this Current Report on Form 8-K and the Exhibit 99.1 attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the press release attached as Exhibit 99.1 to this Current Report on Form 8-K shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | NEVRO CORP. |

| | | | |

| Date: | March 4, 2025 | By: | /s/ Roderick H. MacLeod |

| | | | Roderick H. MacLeod

Chief Financial Officer |

Nevro Reports Fourth-Quarter and Full-Year 2024 Financial Results

REDWOOD CITY, California – March 4, 2025 – Nevro Corp. (NYSE: NVRO), a global medical device company that is delivering comprehensive, life-changing solutions for the treatment of chronic pain, today reported its fourth-quarter and full-year 2024 financial results.

“We are pleased that adjusted EBITDA for the full-year 2024 came in ahead of our revised expectations and that our balance sheet remains strong, reflecting our ongoing focus on working capital management and the benefits from our 2024 restructurings,” said Kevin Thornal, Nevro’s president and CEO. “Importantly, we look forward to joining forces with Globus Medical to achieve our full potential and working together to free patients from the burden of chronic pain.”

Fourth-Quarter 2024 Business Highlights and Recent Developments

•On February 6, 2025, Nevro and Globus Medical (NYSE: GMED) announced that they had entered into a definitive agreement for Globus Medical to acquire all shares of Nevro in an all-cash transaction valued at approximately $250 million, or $5.85 per share. The transaction is expected to close in the second quarter of 2025 and remains subject to the approval of Nevro’s shareholders, regulatory approval and other customary closing conditions.

•Launched the full market release of HFX iQ™ with HFX AdaptivAI™, a responsive, personalized pain management platform powering the HFX iQ spinal cord stimulation (SCS) system in November 2024.

•Launched the HFX iQ SCS system in select European countries in January 2025 following receipt of CE Mark Certification in November 2024.

•As previously announced on October 29, 2024, new data was published in the Journal of Pain Research demonstrating significant, durable pain relief and long-term and clinically meaningful reductions in hemoglobin A1c (HbA1c) and weight in study participants with painful diabetic neuropathy and Type 2 diabetes who received 10 kHz high-frequency SCS therapy.

•As previously announced on November 18, 2024, new data was published in Medical Devices: Evidence and Research which demonstrate the superiority of the Nevro1™ SI Joint Fusion System, a posterior-integrated transfixation cage system offering enhanced stability, minimized bone removal and increased fusion potential compared to a posterolateral cylindrical-threaded single implant system.

Fourth-Quarter 2024 Financial Results

Worldwide revenue for the fourth quarter of 2024 was $105.5 million, a decrease of 9.1% as reported and 9.2% on a constant currency basis, compared with $116.2 million in the fourth quarter of 2023.

U.S. revenue in the fourth quarter of 2024 was $91.4 million, a decrease of 9.9% compared with $101.5 million in the prior year period. U.S. permanent implant procedures decreased by 7.0% compared with the fourth quarter of 2023, and U.S. trial procedures decreased approximately 14.2% compared with the fourth quarter of 2023.

International revenue in the fourth quarter of 2024 was $14.1 million compared with $14.7 million in the fourth quarter of 2023, a decrease of 3.8% as reported and 4.2% on a constant currency basis.

Gross profit for the fourth quarter of 2024 was $65.9 million, compared with $81.5 million in the fourth quarter of 2023. Gross margin was 62.5% in the fourth quarter of 2024 compared with 70.1% in the fourth quarter of 2023.

Operating expenses for the fourth quarter of 2024 were $117.3 million compared with $93.3 million for the year-ago period and include a $38.2 million goodwill impairment charge and $0.7 million in intangible amortization, offset by $9.8 million in contingent consideration revaluations related to Nevro’s 2023 acquisition of Vyrsa™ Technologies and $1.9 million reduction in litigation-related expenses. Excluding these items, operating expenses in the fourth quarter of 2024 improved by $3.2 million, or 3.4% compared with the prior-year quarter.

Net loss from operations for the fourth quarter of 2024 was $51.4 million, or approximately $24.1 million excluding the goodwill impairment charge, intangible amortization, contingent consideration revaluations, and year-over-year decrease in litigation-related expenses. Net loss from operations in the fourth quarter of 2023 was $11.8 million.

Adjusted EBITDA for the fourth quarter of 2024 was negative $5.2 million compared with positive $8.4 million in the fourth quarter of 2023. Adjusted EBITDA excludes interest, taxes, restructuring charges, litigation-related credits and expenses, gain on extinguishment of debt, supplier renegotiation charge, and non-cash items such as amortization of intangibles, changes in fair value of contingent consideration, changes in fair market value of warrants, stock-based compensation, impairment of goodwill and depreciation and amortization. Refer to the financial table at the end of this release for GAAP to non-GAAP reconciliations, definitions and further information regarding the use of non-GAAP metrics.

Cash, cash equivalents and short-term investments totaled $292.5 million as of December 31, 2024, an increase of $15.5 million from September 30, 2024.

Full-Year 2024 Financial Results

Nevro’s full-year 2024 worldwide revenue was $408.5 million, a decrease of 3.9% as reported and 4.0% on a constant currency basis, compared with $425.2 million for full-year 2023. U.S. revenue was approximately $353.1 million, a decrease of 3.7% as reported and on a constant currency basis, compared with $366.6 million for full-year 2023.

International revenue was $55.4 million, a decrease of 5.4% as reported, and 6.2% on a constant currency basis, compared with $58.6 million in the prior year period. Refer to the financial statements for additional full-year 2024 results and GAAP to non-GAAP reconciliations, definitions and further information regarding the use of non-GAAP metrics.

Gross profit for full-year 2024 was $269.5 million compared with $290.1 million for full-year 2023. Gross margin was 66.0% for full-year 2024 compared with 68.2% for full-year 2023.

Net loss from operations for full-year 2024 was $126.2 million compared with $99.3 million for full-year 2023. Full-year 2024 adjusted EBITDA was negative $13.6 million compared with negative $17.7 million in 2023.

For more information regarding the non-GAAP financial measures discussed in this press release, please see the financial table at the end of this release for GAAP to non-GAAP reconciliations, definitions and further information regarding the use of non-GAAP metrics.

2025 Financial Guidance and Fourth-Quarter 2024 Earnings Conference Call and Webcast

As previously announced on February 6, 2025, given the pending acquisition of Nevro by Globus Medical, Nevro is not issuing full-year 2025 guidance, nor is the company holding an earnings conference call and webcast in connection with reporting its fourth-quarter and full-year 2024 financial results.

Internet Posting of Information

Nevro routinely posts information that may be important to investors in the "Investor Relations" section of its website at www.nevro.com. The Company encourages investors and potential investors to consult the Nevro website regularly for important information about Nevro.

About Nevro Corp.

Headquartered in Redwood City, California, Nevro is a global medical device company focused on delivering comprehensive, life-changing solutions that continue to set the standard for enduring patient outcomes in chronic pain treatment. Nevro's comprehensive HFX™ spinal cord stimulation (SCS) platform includes the Senza® SCS system and support services for the treatment of chronic pain of the trunk and limb and painful diabetic neuropathy. Nevro also offers minimally invasive treatment options for patients suffering from chronic sacroiliac (SI) joint pain.

Senza®, Senza II®, Senza Omnia®, and HFX iQ™ are the only SCS systems that deliver Nevro's proprietary 10 kHz Therapy™. Nevro's unique support services provide every patient with HFX Coach™ support throughout their pain relief journey and every physician with HFX Cloud™ insights for enhanced patient and practice management.

SENZA, SENZA II, SENZA OMNIA, OMNIA, HF10, the HF10 logo, 10 kHz Therapy, HFX, the HFX logo, HFX iQ, the HFX iQ logo, HFX Algorithm, HFX CONNECT, the HFX Connect logo, HFX ACCESS, the HFX Access logo, HFX COACH, the HFX Coach logo, HFX CLOUD, the HFX Cloud logo, RELIEF MULTIPLIED, the X logo, NEVRO, and the NEVRO logo are trademarks or registered trademarks of Nevro Corp. Patents covering Senza HFX iQ and other Nevro products are listed at Nevro.com/patents.

To learn more about Nevro, visit www.nevro.com and connect with us on LinkedIn, X, Facebook, and Instagram.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements in this press release include, but are not limited to, statements regarding the consummation of the transaction described above. These forward-looking statements involve a number of risks and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements, including but not limited to the ability of the parties to consummate the proposed transaction and the possibility that various closing conditions for the transaction may not be satisfied or waived, and the ability to realize the benefits expected from the transaction. The forward-looking statements in this communication are based on information available to Nevro as of the date hereof, and Nevro disclaims any obligation to update any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based, except as required by law. For additional information regarding forward-looking statements, please refer to discussions under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in our most recent Annual Report on Form 10-K, and in our other reports filed with the Securities and Exchange Commission (“SEC”). Nevro’s SEC filings are available on the Investor Relations section of its website at https://nevro.com/English/us/investors/overview/default.aspx and on the SEC’s website at www.sec.gov.

The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: (i) the proposed transaction may not be completed in a timely manner or at all, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect Nevro or the expected benefits of the proposed transaction or that the approval of Nevro’s stockholders is not obtained; (ii) the failure to realize the anticipated benefits of the proposed transaction; (iii) the possibility that competing offers or acquisition proposals for Nevro will be made; (iv) the possibility that any or all of the various conditions to the consummation of the merger may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals); (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, including in circumstances which would require Nevro to pay a termination fee or other expenses; and (vi) the effect of the announcement or pendency of the merger on Nevro’s ability to retain and hire key personnel, or its operating results and business generally.

No Offer or Solicitation

This press release is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Additional Information and Where to Find It

This press release may be deemed solicitation material in respect of the proposed transaction. A Nevro special stockholder meeting will be announced to obtain Nevro stockholder approval in connection with the proposed transaction. Nevro expects to file with the SEC a proxy statement and has filed or may file with the SEC other relevant documents in connection with the proposed transaction. Nevro stockholders are urged to read the definitive proxy statement and other relevant materials carefully and in their entirety when they become available because they will contain important information about Nevro and the proposed transaction. Investors may obtain a free copy of these materials (when they are available) and other documents filed by Nevro with the SEC at the SEC’s website at www.sec.gov, and at Nevro’s website at https://www.nevro.com.

Participants in the Solicitation

Nevro and its directors, executive officers and certain employees and other persons may be deemed to be participants in soliciting proxies from its stockholders in connection with the proposed transaction. Information regarding Nevro’s directors and executive officers is set forth in Nevro’s proxy statement on Schedule 14A for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 12, 2024, and in Nevro’s Current Reports on Form 8-K filed with the SEC. Additional information regarding the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Nevro’s stockholders in connection with the proposed transaction and any direct or indirect interests they may have in the proposed transaction will be set forth in Nevro’s definitive proxy statement for its special stockholder meeting to be filed with the SEC in connection with the proposed transaction.

Investor and Media Contact:

Angie McCabe

Vice President, Investor Relations & Corporate Communications

angeline.mccabe@nevro.com

Nevro Corp.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (unaudited) | | | | |

| Revenue | $ | 105,548 | | | $ | 116,176 | | | $ | 408,518 | | | $ | 425,174 | |

| Cost of revenue | 39,629 | | | 34,699 | | | 138,990 | | | 135,114 | |

| Gross profit | 65,919 | | | 81,477 | | | 269,528 | | | 290,060 | |

| Operating expenses | | | | | | | |

| Research and development | 11,987 | | | 12,420 | | | 51,511 | | | 54,418 | |

| Sales, general and administrative | 76,198 | | | 80,598 | | | 309,769 | | | 334,704 | |

| Amortization of intangibles | 737 | | | 246 | | | 2,948 | | | 246 | |

| Change in fair value of contingent consideration | (9,803) | | | — | | | (6,679) | | | — | |

| Impairment of goodwill | 38,208 | | | — | | | 38,208 | | | — | |

| Total operating expenses | 117,327 | | | 93,264 | | | 395,757 | | | 389,368 | |

| Loss from operations | (51,408) | | | (11,787) | | | (126,229) | | | (99,308) | |

| Other income (expense) | | | | | | | |

| Interest income (expense), net | (3,645) | | | 781 | | | (13,583) | | | 6,152 | |

| Change in fair market value of warrants | 1,385 | | | (8,051) | | | 27,887 | | | (8,051) | |

| Gain on extinguishment of debt | — | | | 3,934 | | | — | | | 3,934 | |

| Other income (expense), net | 727 | | | (436) | | | (421) | | | (586) | |

| Loss before income taxes | (52,941) | | | (15,559) | | | (112,346) | | | (97,859) | |

| Provision for income taxes | 169 | | | (6,578) | | | 1,093 | | | (5,646) | |

| Net loss | $ | (53,110) | | | $ | (8,981) | | | $ | (113,439) | | | $ | (92,213) | |

| Changes in foreign currency translation adjustment | (2,032) | | | 1,087 | | | (907) | | | 1,164 | |

Changes in unrealized gains (losses)

on short-term investments, net | (625) | | | 821 | | | (62) | | | 1,687 | |

| Net change in other comprehensive income (loss) | (2,657) | | | 1,908 | | | (969) | | | 2,851 | |

| Comprehensive loss | $ | (55,767) | | | $ | (7,073) | | | $ | (114,408) | | | $ | (89,362) | |

| Net loss per share, basic and diluted | $ | (1.41) | | | $ | (0.25) | | | $ | (3.06) | | | $ | (2.56) | |

| Weighted average shares used to compute basic and diluted net loss per share | 37,616,374 | | | 36,277,243 | | | 37,088,476 | | | 35,981,431 | |

Nevro Corp.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share data)

| | | | | | | | | | | |

| December 31,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 94,539 | | | $ | 104,217 | |

| Short-term investments | 197,995 | | | 218,506 | |

| Accounts receivable, net | 71,884 | | | 79,377 | |

| Inventories | 103,268 | | | 118,676 | |

| Prepaid expenses and other current assets | 8,316 | | | 10,145 | |

| Total current assets | 476,002 | | | 530,921 | |

| Property and equipment, net | 26,562 | | | 24,568 | |

| Operating lease assets | 21,186 | | | 8,944 | |

| Goodwill | — | | | 38,164 | |

| Intangible assets, net | 24,408 | | | 27,354 | |

| Other assets | 5,171 | | | 5,156 | |

| Restricted cash | 512 | | | 606 | |

| Total assets | $ | 553,841 | | | $ | 635,713 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 24,457 | | | $ | 22,520 | |

| Accrued liabilities | 38,415 | | | 45,297 | |

| Short-term debt | 37,972 | | | — | |

| Contingent liabilities, current portion | 1,781 | | | 9,836 | |

| Other current liabilities | 318 | | | 5,722 | |

| Total current liabilities | 102,943 | | | 83,375 | |

| Long-term debt | 187,666 | | | 211,471 | |

| Long-term lease liabilities | 25,525 | | | 4,634 | |

| Contingent liabilities, long-term | 3,633 | | | 12,257 | |

| Warrant liability | 853 | | | 28,739 | |

| Other long-term liabilities | 2,213 | | | 2,092 | |

| Total liabilities | 322,833 | | | 342,568 | |

| Stockholders' equity | | | |

| Common stock, $0.001 par value, 290,000,000 shares authorized at December 31, 2024 and 2023; 38,490,769 and 37,044,390 shares issued at December 31, 2024 and 2023; 37,824,467 and 36,361,474 shares outstanding at December 31, 2024 and 2023, respectively | 38 | | | 36 | |

| Additional paid-in capital | 1,045,031 | | | 992,762 | |

| Accumulated other comprehensive income (loss) | (1,212) | | | (243) | |

| Accumulated deficit | (812,849) | | | (699,410) | |

| Total stockholders' equity | 231,008 | | | 293,145 | |

| Total liabilities and stockholders' equity | $ | 553,841 | | | $ | 635,713 | |

Nevro Corp.

GAAP to Non-GAAP Adjusted EBITDA Reconciliation

(unaudited)

(in thousands)

The following table presents a reconciliation of GAAP net loss, as prepared in accordance with U.S. Generally Accepted Accounting Principles ("GAAP"), to adjusted EBITDA, a non-GAAP financial measure.

Reconciliation of actual results:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (unaudited) | | (unaudited) |

| GAAP Net Loss | $ | (53,110) | | | $ | (8,981) | | | $ | (113,439) | | | $ | (92,213) | |

| Non-GAAP Adjustments: | | | | | | | |

| Interest (income) expense, net | 3,645 | | | (781) | | | 13,583 | | | (6,152) | |

| Provision for income taxes | 169 | | | (6,578) | | | 1,093 | | | (5,646) | |

| Depreciation and amortization | 2,019 | | | 1,869 | | | 7,994 | | | 6,885 | |

| Stock-based compensation expense and other equity related charges | 12,506 | | | 15,533 | | | 48,936 | | | 58,782 | |

| Amortization of intangibles | 737 | | | 246 | | | 2,948 | | | 246 | |

| Change in fair value of contingent consideration | (9,803) | | | — | | | (6,679) | | | — | |

| Impairment of goodwill | 38,208 | | | — | | | 38,208 | | | — | |

| Change in fair market value of warrants | (1,385) | | | 8,051 | | | (27,887) | | | 8,051 | |

| Gain on extinguishment of debt | — | | | (3,934) | | | — | | | (3,934) | |

| Litigation-related expenses | 1,062 | | | 2,941 | | | 4,114 | | | 15,913 | |

| Restructuring charges | 730 | | | — | | | 11,538 | | | 373 | |

| Supplier renegotiation charge | — | | | — | | | 6,000 | | | — | |

| Adjusted EBITDA | $ | (5,222) | | | $ | 8,366 | | | $ | (13,591) | | | $ | (17,695) | |

Management uses certain non-GAAP financial measures, most specifically adjusted EBITDA, as a supplement to GAAP financial measures to further evaluate the Company's operating performance period over period, analyze the underlying business trends, assess performance relative to competitors and establish operational objectives.

Management believes it is important to provide investors with the same non-GAAP metrics it uses to evaluate the performance and underlying trends of the Company's business operations to facilitate comparisons to its historical operating results and evaluate the effectiveness of its operating strategies. Disclosure of these non-GAAP financial measures also facilitates comparisons of the Company's underlying operating performance with other companies in the industry that also supplement their GAAP results with non-GAAP financial measures.

EBITDA is a non-GAAP financial measure, which is calculated by adding interest income and expense, net; provision for income taxes; and depreciation and amortization to net loss. In calculating non-GAAP adjusted EBITDA, the Company further adjusts for the following items:

•Stock-based compensation expense and other equity-related charges – Nevro excludes non-cash costs related to the company's stock-based plans, which include stock options, restricted stock units and performance-based restricted stock units as these expenses do not require cash settlement from the company. In the period ended December 31, 2023, Nevro also excluded one-time equity-related charges of $1.9 million associated with the company’s acquisition of Vyrsa Technologies.

•Amortization of intangibles – The company excludes amortization of intangibles from the acquisition of businesses.

•Change in fair value of contingent consideration – The company excludes the changes in the fair value of its contingent consideration liability.

•Goodwill impairment – The company excludes any goodwill impairment.

•Change in fair market value of warrants – The company excludes the changes in the fair value of its warrant liability.

•Gain on extinguishment of debt – The company excludes gains and losses from extinguishment of early debt repayment.

•Litigation-related expenses – The company excludes legal and professional fees as well as charges and credits associated with certain legal matters, which management considers not related to the underlying operating performance of the business.

•Restructuring charges – The company excludes charges incurred as a direct result of restructuring programs, such as salaries and other compensation-related expenses.

•Supplier contract renegotiation charge - Nevro excludes one-time costs associated with the renegotiation of a supplier contract in 2024.

The non-GAAP financial measure should not be considered in isolation from, or as a replacement for, the most directly comparable GAAP financial measures, as it is not prepared in accordance with U.S. GAAP.

Amounts may not add due to rounding.

# # #

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

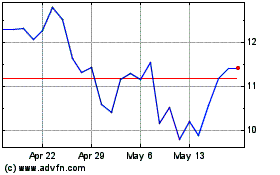

Nevro (NYSE:NVRO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Nevro (NYSE:NVRO)

Historical Stock Chart

From Mar 2024 to Mar 2025