UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2025

Commission File Number: 001-39147

ONECONNECT FINANCIAL TECHNOLOGY CO., LTD.

(Registrant’s Name)

21/24F, Ping An Finance Center

No. 5033 Yitian Road, Futian District

Shenzhen, Guangdong, 518000

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

OneConnect Financial Technology Co., Ltd. |

| |

|

| |

By: |

/s/ Dangyang Chen |

| |

Name: |

Dangyang Chen |

| |

Title: |

Chairman of the Board and Chief Executive Officer |

| Date: March 3, 2025 |

|

|

Exhibit 99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this joint

announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever

arising from or in reliance upon the whole or any part of the contents of this joint announcement.

THE

TRANSACTIONS CONTEMPLATED BY THIS JOINT ANNOUNCEMENT HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE US SECURITIES AND EXCHANGE COMMISSION

OR BY ANY US STATE SECURITIES COMMISSION, NOR HAS THE SEC OR ANY US STATE SECURITIES COMMISSION PASSED UPON THE MERITS OR FAIRNESS OF

THE TRANSACTIONS OR UPON THE ADEQUACY OR ACCURACY OF THE INFORMATION CONTAINED IN THIS JOINT ANNOUNCEMENT. ANY REPRESENTATION TO THE CONTRARY

IS A CRIMINAL OFFENSE.

This

joint announcement is for information purposes only and is not intended to and does not constitute, or form part of, an invitation or

offer to acquire, purchase or subscribe for any securities of the Company nor is it a solicitation of any vote or approval in any jurisdiction,

nor shall there be any sale, issuance or transfer of securities of the Company in any jurisdiction in contravention of applicable laws.

This

joint announcement is not for release, publication or distribution, in whole or in part, in, into or from any jurisdiction where to do

so would constitute a violation of the applicable laws or regulations of such jurisdiction.

| |

|

| Bo Yu Limited |

OneConnect Financial

Technology Co., Ltd. |

| |

壹賬通金融科技有限公司 |

| (Incorporated in the British

Virgin Islands with limited liability) |

(Incorporated in the Cayman Islands with limited liability) |

| |

(Stock code: 6638) |

| |

(NYSE Stock Ticker: OCFT) |

JOINT

ANNOUNCEMENT

(1)

INSIDE INFORMATION

(2)

ANNOUNCEMENT PURSUANT TO RULE 3.7 OF THE TAKEOVERS CODE AND

(3) RESUMPTION OF TRADING

This announcement is jointly made

by OneConnect Financial Technology Co., Ltd. (the “Company”) and Bo Yu Limited (“Bo Yu”) pursuant

to Rule 3.7 of the Code on Takeovers and Mergers issued by the Securities and Futures Commission of Hong Kong (the “Takeovers

Code”), and by the Company pursuant to Rule 13.09 of the Rules Governing the Listing of Securities (the “Listing

Rules”) on The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) and the Inside Information Provisions

(as defined under the Listing Rules) under Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong)

(the “SFO”).

The Company is dual listed on

the New York Stock Exchange (Ticker: OCFT) and on the Stock Exchange. Pursuant to the disclosure rules under the U.S. Securities

and Exchange Act of 1934 and New York Stock Exchange requirements, including NYSE Listed Company Manual 202.05 (Timely Disclosure of Material

News Development), details of the Indicative Proposal (as defined below), including the proposed cancellation price, are required to be

included in the Form 6-K to be furnished with the U.S. Securities and Exchange Commission.

As required by the U.S. securities laws and regulations, including the SEC Rule Section 240.13d-1 (Filing of Schedules 13D and 13G) and

Schedule 13D Item 7 (Material to be Filed as Exhibits), Bo Yu shall also, within 5 business days from the date of Indicative

Proposal dated March 1, 2025, report on applicable schedule detailing its plans or proposals (including the Indicative Proposal which

contains the proposed cancellation price) that relate to further acquisition of Company's securities or any extraordinary corporate transaction

involving the Company. Accordingly, the disclosure of the cancellation price and Annex A in this joint announcement is necessary to prevent selective

disclosure of material information between jurisdictions.

The board (the “Board”)

of directors of the Company has noted irregular trading volumes and price movements in the shares of the Company (the “Shares”)

on February 28, 2025 and wishes to inform its shareholders that on March 1, 2025, the Company received a preliminary non-binding

proposal from Bo Yu (together with its affiliated entities, the “Proposing Buyer”) in relation to a possible privatization

of the Company by way of a scheme of arrangement, which if proceeded with, could result in a delisting of the Company from the Stock Exchange

and the New York Stock Exchange (the “Indicative Proposal”). A copy of the Indicative Proposal is attached hereto as

Annex A, which will also be furnished as an exhibit to the Form 6-K of the Company with the U.S. Securities and Exchange Commission.

As of the date of this joint announcement,

Bo Yu (which directly holds 353,077,356 Shares, representing approximately 30.18% of the total issued share capital of the Company based

on information available to the Company) is a controlling shareholder of the Company and a subsidiary of Ping An Insurance (Group) Company

of China, Ltd. (“Ping An Group”). As of the date of this joint announcement and based on information available

to the Company, Ping An Group (through its subsidiaries including Bo Yu) holds 375,764,724 Shares, representing approximately 32.12% of

the issued share capital of the Company.

As provided in the Indicative

Proposal, Bo Yu proposes to acquire each Share for HK$2.068 in cash (the “Cancellation Price”), equivalent to approximately

US$7.98 per American Depositary Share of the Company (“ADS”, with each ADS representing thirty (30) Shares), which

represents a premium of 72.33% over the closing price of the Shares of HK$1.200 quoted on the Stock Exchange as of February 27, 2025

(being the last trading day prior to February 28, 2025 when there were irregular trading volumes and price movements in the Shares),

a premium of 100.00% over the average closing price of the Shares of HK$1.034 quoted on the Stock Exchange during the last 15 trading

days prior to February 27, 2025 and including such date, and a premium of 131.66% over the average closing price of the Shares of

HK$0.893 quoted on the Stock Exchange during the last 30 trading days prior to February 27, 2025 and including such date.

As provided in the Indicative

Proposal, Bo Yu does not anticipate revising the Cancellation Price, and should the Indicative Proposal progress to a firm offer under

the Takeovers Code, Bo Yu will then confirm its intention not to increase the Cancellation Price. For the purposes of the Takeovers Code,

the Cancellation Price shall be regarded as a floor price in any eventual offer. However, your attention is drawn to the Indicative Proposal,

where Bo Yu states that it has no intention of revising the Cancellation Price, and will confirm the same in any eventual offer unless

as required under the Takeovers Code.

The consideration of the Indicative

Proposal is at a preliminary stage and there is therefore no certainty that the Indicative Proposal will ultimately lead to an Offer (as

defined in the Takeovers Code) being made in relation to the Shares and ADSs. Save as disclosed above, the Board is not aware of any information

that would need be disclosed under Rule 13.09 of Listing Rules and the Inside Information Provisions (as defined under the Listing

Rules) under Part XIVA of the SFO.

WARNING: Shareholders, holders

of ADSs and potential investors of the Company should be aware that the Indicative Proposal is non-binding in nature, and may or may not

proceed, and if it does proceed, the terms of any such Indicative Proposal are at this stage uncertain. Shareholders, holders of ADSs

and potential investors are advised to exercise caution when dealing in the Shares, ADSs and/or other securities of the Company. Persons

who are in doubt as to the action they should take should consult their stockbroker, bank manager, solicitor or other professional advisors.

MONTHLY UPDATE

In compliance with Rule 3.7

of the Takeovers Code, monthly announcement(s) setting out the progress of the Indicative Proposal will be made until an announcement

of a firm intention to make an offer under Rule 3.5 of the Takeovers Code or of a decision not to proceed with an offer is made.

Further announcement(s) will be made by the Company as and when appropriate or required in accordance with the Listing Rules and/or

the Takeovers Code (as the case may be).

RELEVANT SECURITIES OF THE COMPANY

As of the date of this joint announcement,

the authorized share capital of the Company is US$50,000 divided into 5,000,000,000 Shares, and the Company has 1,169,980,653 Shares in

issue. Additionally, the Company has adopted a stock incentive plan on November 7, 2017 (the “Stock Incentive Plan”,

which was amended from time to time) which permits the award of, among others, options (the “Options”) and performance

share units (“PSUs”). As of the date of this joint announcement, the number of underlying Shares in respect of the

outstanding Options and PSUs are 6,803,200 Shares and 21,821,258 Shares, respectively.

Save for the above, the Company

has no other relevant securities (as defined in Note 4 to Rule 22 of the Takeovers Code) in issue.

DISCLOSURE OF DEALINGS

For the purpose of the Takeovers

Code, the offer period commences on the date of this joint announcement, being March 3, 2025.

In accordance with Rule 3.8

of the Takeovers Code, the respective associates (as defined under the Takeovers Code which includes, among others, any person who owns

or controls 5% or more of any class of relevant securities (as defined in Note 4 to Rule 22 of the Takeovers Code) of the Proposing

Buyer and the Company) of the Proposing Buyer and the Company are hereby reminded to disclose their dealings in any relevant securities

of the Company pursuant to Rule 22 of the Takeovers Code.

In accordance with Rule 3.8

of the Takeovers Code, reproduced below is the full text of Note 11 to Rule 22 of the Takeovers Code:

“Responsibilities

of stockbrokers, banks and other intermediaries

Stockbrokers,

banks and others who deal in relevant securities on behalf of clients have a general duty to ensure, so far as they are able, that those

clients are aware of the disclosure obligations attaching to associates of an offeror or the offeree company and other persons under Rule 22

and that those clients are willing to comply with them. Principal traders and dealers who deal directly with investors should, in appropriate

cases, likewise draw attention to the relevant Rules. However, this does not apply when the total value of dealings (excluding stamp duty

and commission) in any relevant security undertaken for a client during any 7 day period is less than $1 million.

This

dispensation does not alter the obligation of principals, associates and other persons themselves to initiate disclosure of their own

dealings, whatever total value is involved.

Intermediaries

are expected to co-operate with the Executive in its dealings enquiries. Therefore, those who deal in relevant securities should appreciate

that stockbrokers and other intermediaries will supply the Executive with relevant information as to those dealings, including identities

of clients, as part of that co-operation.”

“Executive”

referred to above has the meaning ascribed to it under the Takeovers Code.

TRADING HALT AND RESUMPTION

OF TRADING IN THE SHARES

At the request of the Company,

trading in the Shares on the Stock Exchange was halted with effect from 9:00 a.m. on Monday, March 3, 2025 pending the release

of this joint announcement. Application has been made by the Company for resumption of trading in the Shares on the Stock Exchange with

effect from 9:00 a.m. on Tuesday, March 4, 2025.

| By order of the board of directors

of |

By order of the Board |

| Bo Yu Limited |

OneConnect Financial Technology Co., Ltd. |

| Ms. Yanmei Dong |

Mr. Chen Dangyang |

| Director |

Chairman of the Board and Chief Executive Officer |

Hong Kong, March 3, 2025

As

at the date of this joint announcement, the directors of the Offeror are Ms. Song Gao and Ms. Yanmei Dong.

The

directors of the Offeror accept full responsibility for the accuracy of the information contained in this joint announcement (other than

that relating to the Company) and confirm, having made all reasonable enquiries, that to the best of their knowledge, opinions expressed

in this joint announcement (other than those expressed by the Directors) have been arrived at after due and careful consideration and

there are no other facts not contained in this joint announcement, the omission of which would make any statement in this joint announcement

misleading.

As

at the date of this joint announcement, the executive directors of Ping An Group are Ma Mingzhe, Xie Yonglin, Michael Guo, Cai Fangfang

and Fu Xin; the non-executive directors of Ping An Group are Soopakij Chearavanont, Yang Xiaoping, He Jianfeng and Cai Xun; the independent

non-executive directors of Ping An Group are Ng Sing Yip, Chu Yiyun, Liu Hong, Ng Kong Ping Albert, Jin Li and Wang Guangqian.

The

directors of Ping An Group jointly and severally accept full responsibility for the accuracy of the information contained in this joint

announcement (other than the information relating to the Company) and confirm, having made all reasonable inquiries, that to the best

of their knowledge, opinions expressed in this joint announcement (other than those expressed by the Directors in their capacity as such)

have been arrived at after due and careful consideration and there are no other facts not contained in this joint announcement the omission

of which would make any statement in this joint announcement misleading.

As

at the date of this joint announcement, the board of directors of the Company comprises Mr. Chen Dangyang as the executive director,

Mr. Michael Guo, Ms. Xin Fu, Mr. Wenwei Dou and Ms. Wenjun Wang as the non-executive directors and Dr. Yaolin

Zhang, Mr. Tianruo Pu, Mr. Wing Kin Anthony Chow and Mr. Koon Wing Ernest Ip as the independent non-executive directors.

The

directors of the Company jointly and severally accept full responsibility for the accuracy of the information contained in this

joint announcement (other than information relating to the Offeror and Ping An Group) and confirm, having made all reasonable

inquiries, that to the best of their knowledge, opinions expressed in this joint announcement (other than those expressed by the

directors of the Offeror and of the Ping An Group in their respective capacity as such) have been arrived at after due and careful

consideration and there are no other facts not contained in this joint announcement, the omission of which would make any statement

in this joint announcement misleading.

Where the English and the Chinese

texts conflict, the English text prevails.

Annex A

Preliminary Non-Binding Proposal

to Acquire OneConnect Financial Technology Co., Ltd.

March 1, 2025

The Board of Directors (the “Board”)

OneConnect Financial Technology Co., Ltd.

21/24F,

Ping An Finance Center

No. 5033 Yitian Road

Futian District

Shenzhen, Guangdong Province 518000

People’s

Republic of China

Dear Members of the Board of Directors,

After carefully evaluating the

recent challenges in the business and financial performance of OneConnect Financial Technology Co., Ltd. (the “Company”),

its trading price, the prospects of enabling digital transformation of its services, and the potential benefits of transitioning to a

private, non-traded company, Bo Yu Limited (together with its affiliated entities, “Bo Yu” or the “Proposing

Buyer”) is pleased to submit this non-binding proposal (the “Proposal”) to acquire all outstanding shares

of the Company not already owned by the Proposing Buyer in a going-private transaction (the “Transaction”).

We propose to acquire each share

of the Company for HK$2.068 in cash, equivalent to approximately US$7.98 per American Depositary Share of the Company (“ADS,”

with each ADS representing thirty (30) ordinary shares). This offer represents a premium of 72.33% over the closing price of the Company’s

shares quoted on The Stock Exchange of Hong Kong Limited (“HKSE”) as of February 27, 2025, a premium of 100.00%

over the average closing price of the Company’s shares quoted on the HKSE during the last 15 trading days prior to and including

such date, and a premium of 131.66% over the average closing price of the Company’s shares quoted on the HKSE during the last 30

trading days prior to and including such date.

We have noted irregular trading

volumes and price movements in the Company’s shares on February 28, 2025. Accordingly, we have calculated our premium based

on the closing price as of February 27, 2025, the last trading day prior to such price disturbance. To ensure equal dissemination

of information regarding our intentions, we urge the Board to issue an announcement pursuant to the Code on Takeovers and Mergers of Hong

Kong (the “Takeovers Code”) upon receipt of this Proposal.

Our Proposal represents a well-considered

and substantial premium over the Company’s recent trading price. We encourage the Board to engage with us and give shareholders

the opportunity to evaluate and decide whether to accept this Proposal. We do not anticipate revising the price stated in this Proposal,

and should the Transaction progress to a firm offer under the Takeovers Code, we will confirm our intention not to increase the offer

price.

Given the Company’s dual

listing on the New York Stock Exchange and the HKSE, we intend to implement the Transaction through a court-sanctioned scheme of arrangement.

Such scheme of arrangement will, inter alia, require the approval by at least 75% of disinterested shareholders at a general meeting of

the Company, with no more than 10% of all disinterested shareholders voting against it. We are confident in the attractiveness of this

Proposal to disinterested shareholders.

We look forward to working collaboratively

with the Company and the Board to implement this Proposal in an efficient and timely manner. We do not expect the need to conduct due

diligence on the Company, nor do we anticipate substantial regulatory obstacles to impede the successful completion of the Transaction.

We have sufficient financial resources readily available to fund the Transaction.

Please note that this letter does

not constitute a binding commitment regarding the Transaction. A binding commitment will only arise from a firm offer made in compliance

with the Takeovers Code, the rules and regulations of the U.S. Securities and Exchange Commission, and other applicable laws and

regulations, and will be subject to the terms and conditions set forth in the relevant documentation.

We appreciate your consideration and look forward to

your response.

Yours faithfully,

For and on behalf of

BO YU LIMITED

Name:

Title: Director

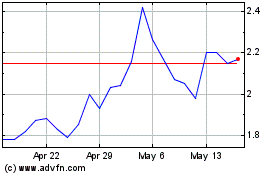

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

From Feb 2025 to Mar 2025

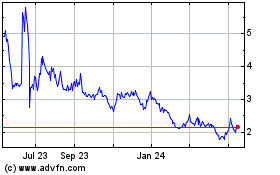

OneConnect Financial Tec... (NYSE:OCFT)

Historical Stock Chart

From Mar 2024 to Mar 2025