PIMCO California Municipal Income Fund, PIMCO California Municipal Income Fund II, PIMCO California Municipal Income Fund III, PIMCO Municipal Income Fund, PIMCO Municipal Income Fund II, PIMCO Municipal Income Fund III, PIMCO New York Municipal Income Fun

18 April 2024 - 8:23AM

PIMCO California Municipal Income Fund (NYSE: PCQ), PIMCO

California Municipal Income Fund II (NYSE: PCK), PIMCO California

Municipal Income Fund III (NYSE: PZC), PIMCO Municipal Income Fund

(NYSE: PMF), PIMCO Municipal Income Fund II (NYSE: PML), PIMCO

Municipal Income Fund III (NYSE: PMX), PIMCO New York Municipal

Income Fund (NYSE: PNF), PIMCO New York Municipal Income Fund II

(NYSE: PNI) and PIMCO New York Municipal Income Fund III (NYSE:

PYN) (each, a “Fund” and, together, the “Funds”) today announced

the expiration and final results of each Fund’s

previously-announced voluntary tender offer (each, a “Tender Offer”

and, together, the “Tender Offers”) for up to 100% of the Fund’s

outstanding auction rate preferred shares (“ARPS”) at a price equal

to 98% of the ARPS’ per share liquidation preference of $25,000 per

share (or $24,500 per share) and any unpaid dividends accrued

through the expiration date of the Tender Offer. The Tender Offers

expired on April 12, 2024, at 5:00 p.m. New York City time. All

ARPS that were validly tendered and not withdrawn during the

offering period of the Tender Offers have been accepted for payment

as set forth below.

|

NYSE Ticker |

Number of Shares Accepted for Payment |

Shares Accepted as Percentage of the Fund’s Outstanding

ARPS |

Number of ARPS Remaining Outstanding |

|

PCQ |

4,372 |

99.45% |

24 |

|

PCK |

3,856 |

98.49% |

59 |

|

PZC |

3,426 |

98.70% |

45 |

|

PMF |

5,705 |

98.28% |

100 |

|

PML |

9,329 |

97.32% |

257 |

|

PMX |

5,130 |

99.09% |

47 |

|

PNF |

1,317 |

98.58% |

19 |

|

PNI |

2,022 |

98.92% |

22 |

|

PYN |

1,038 |

99.71% |

3 |

All ARPS that were not tendered will remain

outstanding, and the terms of the outstanding ARPS will remain the

same as prior to the Tender Offers.

Any questions regarding the Tender Offers can be

directed to the Funds’ Information Agent, EQ Fund Solutions, LLC,

at (877) 478-5044. Each Fund’s daily New York Stock Exchange

closing market price for its common shares, net asset value per

common share, as well as other information, including updated

portfolio statistics and performance, are available

at www.pimco.com/closedendfunds.

As previously announced, each Fund may determine

to replace all or a portion of the leverage previously obtained

through tendered ARPS with other forms of leverage in accordance

with the Fund’s investment policies and related public disclosures.

There is no guarantee that a Fund will be able to replace all or a

portion of the leverage previously obtained through tendered ARPS

with leverage at comparable costs and other terms, or will elect to

do so, and any replacement leverage may be at a higher interest

rate and/or may result in higher costs to the Fund’s common

shareholders.

Following the expiration of the Tender Offers,

each Fund issued Remarketable Variable Rate MuniFund Term Preferred

Shares on April 17, 2024, each with a liquidation preference of

$100,000 per share (and at a price of $100,000 per share) (the

“RVMTP Shares”) in the amount and total proceeds shown in the table

below. The RVMTP Shares will have a Term Redemption Date of April

17, 2054 and an Early Term Redemption Date every 5th anniversary of

the issuance date, as those terms are used in the section

“Description of Capital Structure – Preferred Shares” of each

Fund’s Prospectus. The dividend rate paid on the RVMTP Shares is

expected to be the SIFMA Municipal Swap Index plus 1.30%, depending

on the long-term rating most recently assigned by the applicable

ratings agency to such RVMTP Shares.

|

Fund |

NYSE Ticker |

Issuance of RVMTP Shares |

|

Number of Shares |

Total Proceeds |

|

PIMCO California Municipal Income Fund |

PCQ |

1,020 |

$102,000,000 |

|

PIMCO California Municipal Income Fund II |

PCK |

900 |

$90,000,000 |

|

PIMCO California Municipal Income Fund III |

PZC |

810 |

$81,000,000 |

|

PIMCO Municipal Income Fund |

PMF |

1,340 |

$134,000,000 |

|

PIMCO Municipal Income Fund II |

PML |

2,530 |

$253,000,000 |

|

PIMCO Municipal Income Fund III |

PMX |

1,240 |

$124,000,000 |

|

PIMCO New York Municipal Income Fund |

PNF |

410 |

$41,000,000 |

|

PIMCO New York Municipal Income Fund II |

PNI |

500 |

$50,000,000 |

|

PIMCO New York Municipal Income Fund III |

PYN |

260 |

$26,000,000 |

The information on or accessible through

www.pimco.com/closedendfunds is not incorporated by reference

herein.

About PIMCO

PIMCO was founded in 1971 in Newport Beach,

California and is one of the world’s premier fixed income

investment managers. Today we have offices across the globe and

3,000+ professionals united by a single purpose: creating

opportunities for investors in every environment. PIMCO is owned by

Allianz S.E., a leading global diversified financial services

provider.

Except for the historical information and

discussions contained herein, statements contained in this news

release constitute forward-looking statements. These statements may

involve a number of risks, uncertainties and other factors that

could cause actual results to differ materially, including the

performance of financial markets, the investment performance of

PIMCO's sponsored investment products and separately managed

accounts, general economic conditions, future acquisitions,

competitive conditions and government regulations, including

changes in tax laws. Readers should carefully consider such

factors. Further, such forward-looking statements speak only on the

date at which such statements are made. PIMCO undertakes no

obligation to update any forward-looking statements to reflect

events or circumstances after the date of such statement.

This material has been distributed for

informational purposes only and should not be considered as

investment advice or a recommendation of any particular security,

strategy or investment product. No part of this material may be

reproduced in any form, or referred to in any other publication,

without express written permission. PIMCO is a trademark of Allianz

Asset Management of America LLC in the United States and throughout

the world. PIMCO Investments LLC, 1633 Broadway, New York, NY

10019, is a company of PIMCO. ©2024, PIMCO

For information on the Tender Offers:Financial

Advisors: (800) 628-1237Shareholders: (844) 337-4626 or (844)

33-PIMCOPIMCO Media Relations: (212) 597-1054

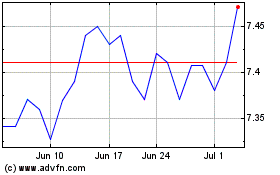

PIMCO NY Muni Income (NYSE:PNI)

Historical Stock Chart

From Jan 2025 to Feb 2025

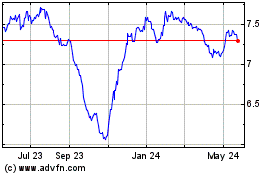

PIMCO NY Muni Income (NYSE:PNI)

Historical Stock Chart

From Feb 2024 to Feb 2025