Primerica Household Budget Index™: Inflation Continues to Disproportionately Impact Middle-Income Americans, Continuing an 18-Month Trend

26 February 2025 - 4:00PM

Business Wire

The latest Primerica Household Budget Index™ (HBI™), a monthly

economic snapshot measuring the impact of inflation on

middle-income households alongside their wages, found the average

purchasing power for necessities fell to 99.7% in January, a 0.6%

decrease from a month ago but a 0.3% increase from a year ago.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250225940689/en/

The latest Primerica Household Budget

Index™ (HBI™), a monthly economic snapshot measuring the impact of

inflation on middle-income households alongside their wages, found

the average purchasing power for necessities fell to 99.7% in

January, a 0.6% decrease from a month ago but a 0.3% increase from

a year ago. The rising cost of auto insurance, gasoline and

utilities accounted for the most recent erosion in purchasing power

demonstrated by the HBI™ in January. (Photo: Business Wire)

The rising cost of auto insurance, gasoline and utilities

accounted for the most recent erosion in purchasing power

demonstrated by the HBI™ in January. Gasoline prices, which had

been falling, reversed course in January rising 1.8%. Auto

insurance rose 2.2% over the month and nearly 12% over the past 12

months.

“Household necessity goods reflected in the Household Budget

Index™ account for over 30% of middle-income families’ budgets,”

said Amy Crews Cutts, Ph.D., CBE®, an economist who consults for

Primerica. “Looking at how these expenses fluctuate month-to-month

and over time gives a clearer picture of how these families can be

disproportionately impacted by rising costs.”

The Consumer Price Index (CPI) that measures inflation for a

comprehensive basket of goods for all U.S. households came in at

3.0% in January. Adjusting the CPI to narrow the impact of

inflation to focus specifically on middle-income households,

increases its impact to an estimated 3.6% year-over-year.

Further narrowing the CPI to assess the impact of inflation on

the cost of middle-income household necessity items as used in the

HBI™ (food, utilities, gas, auto insurance, and health care) the

estimated adjusted CPI measure shows an increase of 4.4%

year-over-year. This highlights the disproportionate impact

inflation has on middle-income families as reflected in the

HBI™.

For more information on the Primerica Household Budget Index™,

visit www.householdbudgetindex.com.

About the Primerica Household Budget Index™ (HBI™)

The Primerica Household Budget Index™ (HBI™) is constructed

monthly on behalf of Primerica by its chief economic consultant Amy

Crews Cutts, PhD, CBE®. The index measures the purchasing power of

middle-income families with household incomes from $30,000 to

$130,000 and is developed using data from the U.S. Bureau of Labor

Statistics, the U.S. Bureau of the Census, and the Federal Reserve

Bank of Kansas City. The index looks at the cost of necessities

including food, gas, auto insurance, utilities, and health care and

earned income to track differences in inflation and wage

growth.

The HBI™ uses January 2019 as its baseline, with the value set

to 100% at that point in time.

Periodically, prior HBI™ values may be modified due to revisions

in the CPI series and Consumer Expenditure Survey releases by the

U.S. Bureau of Labor Statistics (BLS). Beginning with the December

2024 release of the index, the expenditure weights have been

updated to the most recent (Q1 2024) data and auto insurance has

been added to the group of necessity items. For more information,

visit householdbudgetindex.com.

About Primerica, Inc.

Primerica, Inc., headquartered in Duluth, GA, is a leading

provider of financial products and services to middle-income

households in North America. Independent licensed representatives

educate Primerica clients about how to better prepare for a more

secure financial future by assessing their needs and providing

appropriate solutions through term life insurance, which we

underwrite, and mutual funds, annuities and other financial

products, which we distribute primarily on behalf of third parties.

We insured over 5.5 million lives and had approximately 3.0 million

client investment accounts on December 31, 2024. Primerica, through

its insurance company subsidiaries, was the #2 issuer of Term Life

insurance coverage in the United States and Canada in 2023.

Primerica stock is included in the S&P MidCap 400 and the

Russell 1000 stock indices and is traded on The New York Stock

Exchange under the symbol “PRI”. For more information, visit

www.primerica.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225940689/en/

Media Contact: Gana Ahn 678-431-9266 Email:

Gana.Ahn@primerica.com Investor Contact: Nicole Russell

470-564-6663 Email: Nicole.Russell@primerica.com

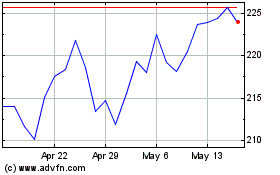

Primerica (NYSE:PRI)

Historical Stock Chart

From Jan 2025 to Feb 2025

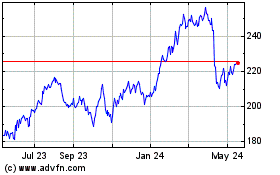

Primerica (NYSE:PRI)

Historical Stock Chart

From Feb 2024 to Feb 2025