Kimco Realty® (“Kimco” or the “Company”) (NYSE: KIM), North

America’s largest publicly traded owner and operator of open-air,

grocery-anchored shopping centers and a growing portfolio of

mixed-use assets, and RPT Realty (“RPT”) (NYSE: RPT), a

publicly traded owner and operator of a national portfolio of

open-air shopping center destinations principally located in top

U.S. markets, today announced a definitive merger agreement under

which RPT will be acquired by Kimco in an all-stock transaction

valued at approximately $2 billion, including the assumption of

debt and preferred stock. Upon closing, Kimco expects to have a pro

forma equity market capitalization of approximately $13 billion and

a total enterprise value of approximately $22 billion.

Under the terms of the merger agreement, RPT

shareholders will receive 0.6049 of a newly-issued Kimco share for

each RPT share they own, representing a total consideration of

approximately $11.34 per RPT share based on Kimco’s closing share

price on August 25, 2023. This represents a 19% premium to RPT’s

closing share price on August 25, 2023. At closing, Kimco

stockholders and RPT shareholders are expected to own approximately

92% and 8% of the combined company, respectively. The board of

directors of Kimco and the board of trustees of RPT both

unanimously approved the transaction. The transaction is expected

to close in the beginning of 2024, subject to RPT shareholder

approval and other customary closing conditions.

“This transaction presents another exciting

opportunity for our Company to deepen our presence in key Coastal

and Sun Belt markets, while accelerating our growth at an

attractive valuation,” said Conor Flynn, CEO of Kimco.

“Approximately 70% of RPT’s portfolio aligns with our key strategic

markets. Furthermore, their substantial pipeline of signed, but not

yet open leases and 20% or greater mark-to-market leasing spread

across the portfolio, will drive higher growth for the combined

company. The transaction is immediately accretive to FFO and the

addition of these properties further positions Kimco as the

country’s premier owner and operator of open-air, grocery-anchored

shopping centers and mixed-use assets.”

Brian Harper, President and CEO of RPT, added,

“Since joining RPT five years ago, the team and I have worked

tirelessly to create long-term stakeholder value by curating the

portfolio towards Coastal and Sun Belt markets, while delivering

exceptional leasing results and prudently managing the balance

sheet. After carefully considering the merits of this transaction,

we believe that aligning with Kimco, a leader in the

grocery-anchored shopping center space, is in the best interest of

our stakeholders, given the multiple synergies that can be realized

as a combined company. We also believe this transaction delivers an

attractive share price premium that offers our shareholders the

opportunity to participate in a larger, more liquid and diversified

company that is well positioned to deliver long-term value.”

The transaction will add 56 open-air shopping

centers, including 43 wholly-owned and 13 joint venture assets,

comprising 13.3 million square feet of gross leasable area, to

Kimco’s existing portfolio of 528 properties. In addition, the

Company will acquire RPT’s 6% stake in a 49-property net lease

joint venture. Beyond strengthening Kimco’s presence in its key

markets, today’s transaction is expected to provide embedded growth

opportunities, including those associated with redevelopment. Kimco

has identified a limited group of Midwest properties within RPT’s

portfolio that it views as not consistent with its strategy that it

expects to divest over time.

Adam Gallistel, Head of Americas Real Estate for

GIC, said, “Our longstanding and successful joint venture with RPT

has provided GIC a unique opportunity to own high-quality,

grocery-anchored shopping centers with a distinguished

organization. We are thankful to Brian Harper and the entire RPT

team for many years of successful partnership. Looking ahead, we’re

excited to combine GIC's extensive history of real estate investing

with Kimco's deep expertise as a leading owner and operator of

open-air shopping centers and mixed-use assets in the U.S., to

continue delivering on the strong long-term opportunities in this

space."

Summary of Strategic

BenefitsThe acquisition is expected to result in a number

of benefits, including:

- Earnings

Accretion and Net Operating Income (NOI) Growth

Opportunities: The transaction is expected to be

immediately accretive to key financial and operating metrics,

including initial cost savings synergies of approximately $34

million. Kimco is well positioned to unlock embedded value in the

portfolio by increasing portfolio occupancy, marking leases to

market, realizing the 330-basis point spread in RPT’s existing

signed not open lease pipeline, and creating value through future

redevelopment opportunities to drive future NOI growth.

- Increased

Scale in High-Growth Target Markets: RPT’s assets that

align with Kimco’s key target markets are nearly 90%

grocery-anchored, based on pro-rata annual base rent, and provide a

strong NOI growth profile. These assets will further enhance

Kimco’s strategic presence in Sun Belt and Coastal markets that

benefit from positive demographic and migration trends. The

addition of Mary Brickell Village in Miami offers significant value

creation potential through leasing and tenant remerchandising,

mixed-use redevelopment, as well as expanding Kimco’s Signature

Series® portfolio.

- Expanded

Partnership Opportunities: RPT’s existing joint venture

relationships, the largest of which is GIC, a leading sovereign

wealth fund, provide significant opportunity for continued growth

via investments in grocery-anchored shopping centers and mixed-use

assets.

- Maintains

Balance Sheet Strength: The Company believes that the

transaction will be leverage neutral, preserving financial

flexibility and capacity to invest while creating additional

value.

Leadership and

OrganizationThere are no anticipated changes to Kimco’s

executive management team or board of directors. RPT is expected to

align the timing of its regular quarterly dividend payments to

Kimco’s during the pendency of the acquisition. The transaction is

generally expected to be non-taxable to shareholders of both

companies.

J.P. Morgan is acting as financial advisor and

Wachtell, Lipton, Rosen & Katz is acting as legal advisor to

Kimco. Lazard is acting as financial advisor and Goodwin Procter

LLP is acting as legal advisor to RPT. ICR, LLC is serving as

communications advisor to Kimco. Prosek Partners is serving as

communications advisor to RPT.

Presentation and Conference

CallThe companies will host a joint conference call on

August 28, 2023 at 8:30 AM ET to discuss the proposed transaction.

The conference call-in number is 1-877-704-4453 (Domestic) or

1-201-389-0920 (International), or interested parties can join the

live webcast of the conference call by accessing the Investor

Relations section of each company’s website at www.kimcorealty.com

or www.rptrealty.com.

A presentation providing additional details

about the transaction and replay of the conference call will be

posted when available on the respective companies’ websites under

the Investor Relations sections.

About Kimco RealtyKimco Realty®

(NYSE:KIM) is a real estate investment trust (REIT) headquartered

in Jericho, N.Y. that is North America’s largest publicly traded

owner and operator of open-air, grocery-anchored shopping centers

and a growing portfolio of mixed-use assets. The Company’s

portfolio is primarily located in the first-ring suburbs of the top

major metropolitan markets, including those in attractive coastal

markets and rapidly expanding Sun Belt cities, with a tenant mix

focused on essential, necessity-based goods and services that drive

multiple shopping trips per week. Kimco Realty is also committed to

leadership in environmental, social and governance (ESG) issues and

is a recognized industry leader in these areas. Publicly traded on

the NYSE since 1991, and included in the S&P 500 Index, the

Company has specialized in shopping center ownership, management,

acquisitions, and value enhancing redevelopment activities for more

than 60 years. As of June 30, 2023, the Company owned interests in

528 U.S. shopping centers and mixed-use assets comprising 90

million square feet of gross leasable space. For further

information, please visit www.kimcorealty.com.

About RPT RealtyRPT Realty owns

and operates a national portfolio of open-air shopping destinations

principally located in top U.S. markets. The company's shopping

centers offer diverse, locally-curated consumer experiences that

reflect the lifestyles of their surrounding communities and meet

the modern expectations of the company's retail partners. RPT is a

fully integrated and self-administered REIT publicly traded on the

New York Stock Exchange (the “NYSE”). The common shares of RPT, par

value $0.01 per share (the “common shares”) are listed and traded

on the NYSE under the ticker symbol “RPT”. As of June 30, 2023, the

company's property portfolio (the "aggregate portfolio") consisted

of 43 wholly-owned shopping centers, 13 shopping centers owned

through its grocery-anchored joint venture, and 49 retail

properties owned through its net lease joint venture, which

together represent 14.9 million square feet of gross leasable area

(“GLA”). As of June 30, 2023, RPT’s pro-rata share of the aggregate

portfolio was 93.2% leased. For additional information about the

company please visit www.rptrealty.com.

Forward Looking StatementsThis

communication contains certain “forward-looking” statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended. Kimco intends

such forward-looking statements to be covered by the

safe harbor provisions

for forward-looking statements contained in the

Private Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with the safe harbor

provisions. Forward-looking statements, which are based on certain

assumptions and describe Kimco’s future plans, strategies and

expectations, are generally identifiable by use of the words

“believe,” “expect,” “intend,” “commit,” “anticipate,” “estimate,”

“project,” “will,” “target,” “plan”, “forecast” or similar

expressions. Forward-looking statements regarding Kimco and RPT,

include, but are not limited to, statements related to the

anticipated acquisition of RPT and the anticipated timing and

benefits thereof and other statements that are not historical

facts. These forward-looking statements are based on each of the

companies’ current plans, objectives, estimates, expectations and

intentions and inherently involve significant risks and

uncertainties. You should not rely on forward-looking statements

since they involve known and unknown risks, uncertainties and other

factors which, in some cases, are beyond Kimco’s and RPT’s control

and could materially affect actual results, performances or

achievements. Factors which may cause actual results to differ

materially from current expectations include, but are not limited

to, risks and uncertainties associated with: Kimco’s and RPT’s

ability to complete the proposed transaction on the proposed terms

or on the anticipated timeline, or at all, including risks and

uncertainties related to securing the necessary RPT shareholder

approval and satisfaction of other closing conditions to consummate

the proposed transaction; the occurrence of any event, change or

other circumstance that could give rise to the termination of the

definitive transaction agreement relating to the proposed

transaction; risks related to diverting the attention of Kimco and

RPT management from ongoing business operations; failure to realize

the expected benefits of the proposed transaction; significant

transaction costs and/or unknown or inestimable liabilities; the

risk of shareholder litigation in connection with the proposed

transaction, including resulting expense or delay; the ability to

successfully integrate the operations of Kimco and RPT following

the closing of the transaction and the risk that such integration

may be more difficult, time-consuming or costly than expected;

risks related to future opportunities and plans for the combined

company, including the uncertainty of expected future financial

performance and results of the combined company following

completion of the proposed transaction; effects relating to the

announcement of the proposed transaction or any further

announcements or the consummation of the proposed transaction on

the market price of Kimco’s common stock or RPT’s common shares or

on each company’s respective relationships with tenants, employees

and third-parties; the ability to attract, retain and motivate key

personnel; the possibility that, if Kimco does not achieve the

perceived benefits of the proposed transaction as rapidly or to the

extent anticipated by financial analysts or investors, the market

price of Kimco’s common stock could decline; general adverse

economic and local real estate conditions; the impact of

competition; the inability of major tenants to continue paying

their rent obligations due to bankruptcy, insolvency or a general

downturn in their business; the reduction in income in the event of

multiple lease terminations by tenants or a failure of multiple

tenants to occupy their premises in a shopping center; the

potential impact of e-commerce and other changes in consumer buying

practices, and changing trends in the retail industry and

perceptions by retailers or shoppers, including safety and

convenience; the availability of suitable acquisition, disposition,

development and redevelopment opportunities, the costs associated

with purchasing and maintaining assets and risks related to

acquisitions not performing in accordance with our expectations;

the ability to raise capital by selling assets; disruptions and

increases in operating costs due to inflation and supply chain

issues; risks associated with the development of mixed-use

commercial properties, including risks associated with the

development, and ownership of non-retail real estate; changes in

governmental laws and regulations, including, but not limited to

changes in data privacy, environmental (including climate change),

safety and health laws, and management’s ability to estimate the

impact of such changes; valuation and risks related to joint

venture and preferred equity investments and other investments;

valuation of marketable securities and other investments, including

the shares of Albertsons Companies, Inc. common stock held by

Kimco; impairment charges; criminal cybersecurity attacks

disruption, data loss or other security incidents and breaches;

impact of natural disasters and weather and climate-related events;

pandemics or other health crises, such as COVID-19; the ability to

attract, retain and motivate key personnel; financing risks, such

as the inability to obtain equity, debt or other sources of

financing or refinancing on favorable terms or at all; the level

and volatility of interest rates and management’s ability to

estimate the impact thereof; changes in the dividend policy for

Kimco’s common and preferred stock and Kimco’s ability to pay

dividends at current levels; unanticipated changes in the intention

or ability to prepay certain debt prior to maturity and/or hold

certain securities until maturity; Kimco’s and RPT’s ability to

continue to maintain their respective status as a REIT for United

States federal income tax purposes and potential risks and

uncertainties in connection with their respective UPREIT structure;

and the other risks and uncertainties affecting Kimco and RPT,

including those described from time to time under the caption “Risk

Factors” and elsewhere in Kimco’s and RPT’s Securities and Exchange

Commission (“SEC”) filings and reports, including Kimco’s Annual

Report on Form 10-K for the year ended December 31, 2022, RPT’s

Annual Report on Form 10-K for the year ended December 31, 2022,

and future filings and reports by either company. Moreover, other

risks and uncertainties of which Kimco or RPT are not currently

aware may also affect each of the companies’ forward-looking

statements and may cause actual results and the timing of events to

differ materially from those anticipated. The forward-looking

statements made in this communication are made only as of the date

hereof or as of the dates indicated in the forward-looking

statements, even if they are subsequently made available by Kimco

or RPT on their respective websites or otherwise. Neither Kimco nor

RPT undertakes any obligation to update or supplement any

forward-looking statements to reflect actual results, new

information, future events, changes in its expectations or other

circumstances that exist after the date as of which the

forward-looking statements were made.

Important Additional Information and

Where to Find ItIn connection with the proposed

transaction, Kimco will file with the SEC a registration statement

on Form S-4 to register the shares of Kimco common stock to be

issued in connection with the proposed transaction. The

registration statement will include a proxy statement/prospectus

which will be sent to the shareholders of RPT seeking their

approval of their respective transaction-related proposals.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION

STATEMENT ON FORM S-4 AND THE RELATED PROXY STATEMENT/PROSPECTUS,

AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY

OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION

WITH THE PROPOSED TRANSACTION, WHEN THEY BECOME AVAILABLE, BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT KIMCO, RPT AND THE

PROPOSED TRANSACTION.

Investors and security holders may obtain copies

of these documents free of charge through the website maintained by

the SEC at www.sec.gov or from Kimco at its website,

kimcorealty.com, or from RPT at its website, rptrealty.com.

Documents filed with the SEC by Kimco will be available free of

charge by accessing Kimco’s website at kimcorealty.com under the

heading Investors or, alternatively, by directing a request to

Kimco at IR@kimcorealty.com or 500 North Broadway Suite 201,

Jericho, New York 11753, telephone: (866) 831-4297, and documents

filed with the SEC by RPT will be available free of charge by

accessing RPT’s website at rptrealty.com under the heading

Investors or, alternatively, by directing a request to RPT at

invest@rptrealty.com or 19 West 44th Street, Suite 1002, New York,

NY 10036, telephone: (516) 869-9000.

Participants in the

SolicitationKimco and RPT and certain of their respective

directors, trustees and executive officers and other members of

management and employees may be deemed to be participants in the

solicitation of proxies from the shareholders of RPT in respect of

the proposed transaction under the rules of the SEC. Information

about Kimco’s directors and executive officers is available in

Kimco’s proxy statement dated March 15, 2023 for its 2023 Annual

Meeting of Stockholders. Information about RPT’s trustees and

executive officers is available in RPT’s proxy statement dated

March 16, 2023 for its 2023 Annual Meeting of Shareholders. Other

information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests, by

security holdings or otherwise, will be contained in the proxy

statement/prospectus and other relevant materials to be filed with

the SEC regarding the proposed transaction when they become

available. Investors should read the proxy statement/prospectus

carefully when it becomes available before making any voting or

investment decisions. You may obtain free copies of these documents

from Kimco or RPT using the sources indicated above.

No Offer or SolicitationThis

communication shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act.

CONTACT:David F. BujnickiSenior

Vice President, Investor Relations and StrategyKimco Realty

Corporation1-866-831-4297dbujnicki@kimcorealty.com

Vin ChaoManaging Director - FinanceRPT

Realty1-212-221-1752vchao@rptrealty.com

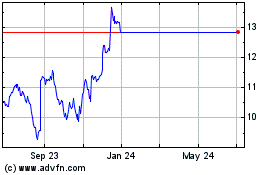

Rithm Property (NYSE:RPT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rithm Property (NYSE:RPT)

Historical Stock Chart

From Dec 2023 to Dec 2024