Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

27 November 2024 - 4:53AM

Edgar (US Regulatory)

|

Royal Bank of Canada

Market Linked Securities

|

Filed Pursuant

to Rule 433

Registration Statement

No. 333-275898

|

|

Market Linked Securities—Leveraged Upside Participation

and Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to an ETF Basket

due June 3, 2030

Term Sheet dated November 26, 2024 |

Summary of Terms

|

|

Hypothetical Payout Profile*

|

| Issuer: |

Royal Bank of Canada |

| Basket: |

An equally weighted basket (the “Basket”) consisting of the Energy Select Sector SPDR® Fund (the “XLE Fund”) (33.33%), the Financial Select Sector SPDR® Fund (the “XLF Fund”) (33.33%) and the Health Care Select Sector SPDR® Fund (the “XLV Fund”) (33.34%) (each, a “basket component”) |

| Pricing Date: |

November 26, 2024 |

| Issue Date: |

December 2, 2024 |

| Calculation Day: |

May 29, 2030 |

| Stated Maturity Date: |

June 3, 2030 |

| Face Amount: |

$1,000 per security |

| Maturity Payment Amount (per security): |

· if

the ending level is greater than the starting level:

$1,000 + ($1,000 × basket return × upside participation

rate);

· if

the ending level is less than or equal to the starting level, but greater than or equal to the threshold level:

$1,000; or

· if

the ending level is less than the threshold level:

$1,000 + [$1,000 × (basket return + buffer amount)] |

| Threshold Level: |

85.00, which is equal to 85% of the starting level |

| Buffer Amount: |

15% |

| Upside Participation Rate: |

At least 106% (to be determined on the pricing date) |

| Basket Return: |

(ending level – starting level) / starting level |

| Starting Level: |

Set equal to 100 on the pricing date |

| Ending Level: |

100 × [1 + (the sum of, for each basket component, its component return times its basket weighting)] |

| Component Return: |

With respect to each basket component: (final component value – initial component value) / initial component value |

| Initial Component Value: |

With respect to each basket component, the closing value of that basket component on the pricing date |

| Final Component Value: |

With respect to each basket component, the closing value of that basket component on the calculation day |

| Calculation Agent: |

RBC Capital Markets, LLC (“RBCCM”), an affiliate of the issuer |

| Denominations: |

$1,000 and any integral multiple of $1,000 |

| Agent Discount: |

Up to 3.62%; dealers, including those using the trade name Wells Fargo Advisors (“WFA”), may receive a selling concession of up to 3.00% and WFA may receive a distribution expense fee of 0.12%. In addition, selected dealers may receive a fee of up to 0.30% for marketing and other services. |

| CUSIP: |

78017GZB0 |

* Assumes an upside participation rate equal to the lowest possible

upside participation rate that may be determined on the pricing date

If the ending level is less than the threshold level, you will

have 1-to-1 downside exposure to the decrease in the value of the Basket in excess of the buffer amount and will lose up to 85% of the

face amount of your securities at maturity.

The issuer’s initial estimated value of the securities as of

the pricing date is expected to be between $900.00 and $946.00 per $1,000 in principal amount, which is less than the public offering

price. The final pricing supplement relating to the securities will set forth the issuer’s estimate of the initial value of the

securities as of the pricing date. The market value of the securities at any time will reflect many factors, cannot be predicted with

accuracy, and may be less than this amount. See “Estimated Value of the Securities” in the accompanying preliminary pricing

supplement for further information.

Preliminary Pricing Supplement:

https://www.sec.gov/Archives/edgar/data/1000275/000095010324016735/dp221097_424b2

-wfceln278bskt.htm

The securities have complex features and investing in the securities

involves risks not associated with an investment in conventional debt securities. See “Selected Risk Considerations” in this

term sheet and the accompanying preliminary pricing supplement and “Risk Factors” in the accompanying product supplement.

This introductory term sheet

does not provide all of the information that an investor should consider prior to making an investment decision.

Investors should carefully review the accompanying

preliminary pricing supplement, product supplement, prospectus supplement and prospectus before making a decision to invest in the securities.

NOT A BANK DEPOSIT AND NOT INSURED OR GUARANTEED BY THE FDIC OR ANY

OTHER GOVERNMENTAL AGENCY

Selected Risk Considerations

The risks set forth below are discussed in detail in the “Selected

Risk Considerations” section in the accompanying preliminary pricing supplement and the “Risk Factors” section in the

accompanying product supplement. Please review those risk disclosures carefully.

Risks Relating To The Terms And Structure Of The Securities

| · | If The Ending Level Is Less Than The Threshold Level, You Will Lose Up To

85% Of The Face Amount Of Your Securities At Maturity. |

| · | The Securities Do Not Pay Interest, And Your Return On The Securities May

Be Lower Than The Return On A Conventional Debt Security Of Comparable Maturity. |

| · | Changes In The Value Of One Basket Component May Be Offset By Changes In

The Values Of The Other Basket Components. |

| · | Payments On The Securities Are Subject To Our Credit Risk, And Market Perceptions

About Our Creditworthiness May Adversely Affect The Market Value Of The Securities. |

| · | The U.S. Federal Income Tax Consequences Of An Investment In The Securities

Are Uncertain. |

Risks Relating To The Estimated Value Of The Securities And Any

Secondary Market

| · | There May Not Be An Active Trading Market For The Securities And Sales In

The Secondary Market May Result In Significant Losses. |

| · | The Initial Estimated Value Of The Securities Will Be Less Than The Original

Offering Price. |

| · | The Initial Estimated Value Of The Securities Is Only An Estimate, Calculated

As Of The Time The Terms Of The Securities Are Set. |

| · | The Value Of The Securities Prior To Stated Maturity Will Be Affected By

Numerous Factors, Some Of Which Are Related In Complex Ways. |

Risks Relating To Conflicts Of Interest

| · | Our Economic Interests And Those Of Any Dealer Participating In The Offering

Are Potentially Adverse To Your Interests. |

Risks Relating To The Basket Components

| · | The Equity Securities Composing The XLE Fund Are Concentrated In The Energy

Sector. |

| · | The Equity Securities Composing The XLF Fund Are Concentrated In The Financial

Sector. |

| · | The Equity Securities Composing The XLV Fund Are Concentrated In The Health

Care Sector. |

| · | Investing In The Securities Is Not The Same As Investing In The Basket Components

Or The Securities Held By The Basket Components. |

| · | Historical Values Of A Basket Component Should Not Be Taken As An Indication

Of The Future Performance Of That Basket Component During The Term Of The Securities. |

| · | Changes That Affect A Basket Component Or Its Fund Underlying Index May Adversely

Affect The Value Of The Securities And The Maturity Payment Amount. |

| · | We And Our Affiliates Have No Affiliation With Any Basket Component Sponsor

Or Fund Underlying Index Sponsor And Have Not Independently Verified Their Public Disclosure Of Information. |

| · | An Investment Linked To The Shares Of A Basket Component Is Different From

An Investment Linked To Its Fund Underlying Index. |

| · | There Are Risks Associated With A Basket Component. |

| · | Anti-dilution Adjustments Relating To The Shares Of A Basket Component Do

Not Address Every Event That Could Affect Such Shares. |

| · | We Cannot Control Actions By Any Of The Unaffiliated Companies Whose Securities

Are Held By A Basket Component Or Included In Its Fund Underlying Index. |

The issuer has filed a registration statement (including a prospectus)

with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration

statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You

may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, any underwriter or any dealer participating

in the offering will arrange to send you the prospectus if you request it by calling your financial advisor or by calling Royal Bank of

Canada toll-free at 1-877-688-2301.

As used in this term sheet, “Royal Bank of Canada,” “we,”

“our” and “us” mean only Royal Bank of Canada. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing

Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers and non-bank affiliates

of Wells Fargo & Company.

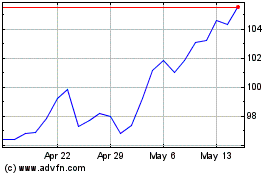

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Oct 2024 to Nov 2024

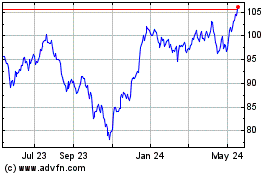

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Nov 2023 to Nov 2024