0000832988false00008329882024-09-262024-09-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 26, 2024

SIGNET JEWELERS LIMITED

(Exact name of registrant as specified in its charter)

Commission File Number: 1-32349

| | | | | |

| Bermuda | Not Applicable |

| (State or other jurisdiction of incorporation) | (IRS Employer Identification No.) |

Clarendon House

2 Church Street

Hamilton

HM11

Bermuda

(Address of principal executive offices, including zip code)

(441) 296 5872

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Shares of $0.18 each | | SIG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On October 1, 2024, Signet Jewelers Limited (the "Company") announced that, after twelve years at the Company, Virginia “Gina” C. Drosos is planning to retire as Chief Executive Officer and as a member of the Board of Directors of the Company (the “Board”), effective November 4, 2024 (the “Transition Date”). Following a thoughtful succession planning and search process, the Board has appointed J.K. Symancyk to succeed Ms. Drosos as Chief Executive Officer and join the Board as of the Transition Date. Following her retirement from these positions, Ms. Drosos will continue as an advisor through the end of the Company’s fiscal year to support a smooth transition.

Mr. Symancyk, age 52, brings over 30 years of retail industry experience. Since June 2018, Mr. Symancyk has served as President and Chief Executive Officer and as a director of PetSmart, Inc., a leading specialty pet retailer. Prior to PetSmart, Mr. Symancyk served as President and Chief Executive Officer of Academy Sports + Outdoors, a sporting goods retailer, and held many leadership roles at Meijer, a supercenter chain, including Group Vice President, EVP Chief Marketing Officer, Chief Operating Officer, and President.

Additionally, Mr. Symancyk currently serves as a member of the board of directors of Bath & Body Works, Inc., a publicly traded home and body care products retailer, since 2021, and the Retail Industry Leaders Association, a U.S. trade association for leading retailers. Previously, Mr. Symancyk served on the board of directors of Chewy, Inc., a publicly traded online retailer for pet products, from June 2018 through July 2021, and GameStop Corp., a publicly traded gaming and entertainment products retailer, from March 2020 to June 2021.

Chief Executive Officer Termination Protection Agreement

In connection with his appointment, Mr. Symancyk and the Company entered into a termination protection agreement, dated September 30, 2024, and effective as of the Transition Date (the “TPA”), setting forth certain key terms of his employment.

Mr. Symancyk’s initial compensation will include: (i) base salary of $1,400,000, subject to annual review and adjustment by the Board; (ii) an annual short-term incentive plan (“STIP”) bonus of 170% of his annual base salary at target performance (and up to 340% of the annual base salary at maximum performance), which will be pro-rated for the current performance year; (iii) annual consideration for long-term awards under the Company’s Amended and Restated 2018 Omnibus Incentive Plan (“LTIP”), with an initial expected award value of $7,000,000 for the grant to be made in Fiscal 2026.

In addition, in order to make him whole for certain forfeited compensation from his prior role, Mr. Symancyk will receive: (a) a signing bonus of $1,500,000, which the Company will recoup if Mr. Symancyk resigns other than for good reason (as defined in the TPA) or is terminated for cause (as defined in the TPA) within twelve months; and (b) an initial LTIP award of restricted stock units (“RSUs”) with a grant date value of $3,500,000, which will vest ratably over three years subject to continued employment or vest in full upon a resignation for good reason (the “Make Whole RSUs”). He will also receive a supplemental relocation payment of $75,000.

Under the TPA, Mr. Symancyk’s employment may be terminated by him for any reason upon 90 days’ prior written notice by Mr. Symancyk or by the Company at any time. However, the TPA also provides for the following payments upon certain terminations of employment, in each case subject to delivery by Mr. Symancyk (or his estate) of a release and continued compliance with confidentiality, non-compete, non-solicitation and other standard covenants.

•If the Company terminates his employment without cause: Mr. Symancyk will be entitled to receive: (i) payments equal to 1.5 times his base salary; (ii) payments equal to 1.5 times his target annual STIP bonus; (iii) a payment equal to the STIP bonus he would be entitled to receive based on actual performance, pro-rated for the time of employment during the performance cycle; (iv) vesting of performance-based LTIP awards based on actual performance, and pro-rated for the time of employment; (v) vesting of time-based LTIP awards, pro-rated for the time of employment; (vi) vesting in full of any unvested portion of the Make Whole RSUs; and (vii) cash payments toward COBRA coverage for up to 12 months.

•If a termination without cause or resignation for good reason (as defined in the TPA) occurs within one year following a change of control: Mr. Symancyk would be entitled to receive the same benefits as a termination without cause, except that: (i) time-based LTIP awards will fully vest and performance-based LTIP awards will vest on a pro-rated basis based on actual achievement of the performance goals, with such goals also pro-rated for any shortened performance period; and (ii) the COBRA contributions would be increased from 12 months to 18 months.

•If his employment is terminated by reason of death or disability: Mr. Symancyk would be entitled to receive: (i) a payment equal to the target STIP bonus for such year, pro-rated for the time of employment during the performance cycle; (ii) vesting of performance-based LTIP awards held for at least six months, based on target performance, pro-

rated for the time of employment; and (iii) vesting of time-based LTIP awards held for at least six months, pro-rated for the time of employment. Upon the death of Mr. Symancyk, the Company would pay to his estate the same benefits described in the preceding sentence, plus payments equal to half of his then-current base salary.

•If his employment is terminated by reason of his qualifying retirement (achieving age 60 and 5 years of service): Mr. Symancyk would be entitled to receive: (i) a payment equal to the target STIP bonus for such year, pro-rated for the time of employment during the performance cycle and based on actual achievement; and (ii) continued vesting of LTIP awards held for at least six months, subject to the achievement of any performance conditions.

The foregoing summary of the TPA does not purport to be complete and is subject to, and qualified in its entirety by the copy of the TPA that will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended November 2, 2024 (the “Q3 Form 10-Q”) and is incorporated by reference into this Item 5.02. Mr. Symancyk will also be included within the Company’s standard form of Deed of Indemnity for Directors, a copy of which is on file with the Securities and Exchange Commission and a full description of which is incorporated by reference to the Company’s most recent definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on May 16, 2024.

There are no arrangements or understanding between Mr. Symancyk and any other persons or entities with respect to his appointment and no family relationships between Mr. Symancyk and any of the Company’s directors, executive officers, or persons nominated or chosen by the Company to become a director or executive officer. Mr. Symancyk has not been involved in any related person transactions with the Company that would require disclosure under Item 404(a) of Regulation S-K.

Transition Agreement

Ms. Drosos and the Company entered into a letter agreement (the “Letter Agreement”), pursuant to which (i) she provided notice of her retirement as CEO and from the Board as of the Transition Date and the termination of her amended and restated termination protection agreement, dated March 15, 2022 (the “Drosos TPA”) upon termination of employment, and (ii) she will remain a full-time non-executive employee of the Company to provide transitional support to Mr. Symancyk through February 1, 2025. Ms. Drosos’s annual base salary and employee benefit plan eligibility will remain unchanged through the remainder of her employment by the Company and she will receive the retirement benefits to which she is entitled and remain subject to the post-termination covenants under the Drosos TPA.

The foregoing summary does not purport to be complete and is subject to, and qualified in its entirety by, reference to the full text of the Letter Agreement, which will be filed as an exhibit to the Q3 Form 10-Q and is incorporated by reference into this Item 5.02.

Chief Financial and Operating Officer Role

On October 1, 2024, the Company also announced that the Board appointed Joan Hilson, 65, the Company’s Chief Financial, Strategy and Services Officer, to the expanded role of Chief Financial and Operating Officer, effective as of November 4, 2024. In her new role, Ms. Hilson will oversee the supply chain and digital banner teams in addition to her existing finance, strategy and services business responsibilities.

Ms. Hilson joined the Company in March 2019 and became Chief Financial Officer in April 2019, Chief Strategy Officer in March 2021 and Chief Services Officer in November 2022. Before joining the Company, Ms. Hilson served as the Executive Vice President, Chief Financial and Operating Officer of David’s Bridal, Inc., a wedding gown and formal wear retailer, for five years. Prior to that, she served as the Chief Financial Officer of American Eagle Outfitters, a publicly traded clothing retailer, and held several roles within Limited Brands, a publicly traded clothing and specialty retailer, including Chief Financial Officer of the Victoria’s Secret stores division.

Executive Retention Awards

To incentivize the retention of our executive team through the leadership transition, the Human Capital Management and Compensation Committee of the Board granted special retention RSU awards to Ms. Hilson, Jamie Singleton, the Company’s Group President, Chief Consumer Officer, and Rebecca Wooters, the Company’s Chief Digital Officer, in each case effective as of October 1, 2024. The retention awards will have a grant date value that is approximately equivalent to such recipient’s annual LTIP award for the current fiscal year, or $2,500,000 for Ms. Hilson, $2,500,000 for Ms. Singleton, and $1,100,000 for Ms. Wooters. Each retention award will be eligible to vest in full on the six-month anniversary of the grant date, in the case of Ms. Hilson and Ms. Singleton, or nine-month anniversary of the grant date, in the case of Ms. Wooters, subject to the applicable recipient’s continued employment in good standing on such vesting date. The award will terminate without vesting if the recipient fails to be in good standing or is terminated for cause prior to the vesting date and will vest in full if the recipient is terminated without cause prior to the applicable vesting date. The foregoing summary does not purport to be complete and is

subject to, and qualified in its entirety by, reference to the full text of the form of retention award agreement, which will be filed as an exhibit to the Q3 Form 10-Q and is incorporated by reference into this Item 5.02.

Item 7.01 Regulation FD Disclosure

On October 1, 2024, the Company issued a press release announcing the leadership succession plan described above in Item 5.02. A copy of the press release is attached as Exhibit 99.1 and incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01, including Exhibit 99.1, is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly stated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits | | | | | | | | |

| Exhibit Number | | Description of Exhibit |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | SIGNET JEWELERS LIMITED |

| | | | | | |

Date: | | October 1, 2024 | | By: | | /s/ Stash Ptak |

| | | | Name: | | Stash Ptak |

| | | | Title: | | General Counsel and SVP of Legal, Compliance and Risk |

Signet Jewelers CEO Virginia C. Drosos Announces Plans to Retire in November 2024

J.K. Symancyk Appointed Company’s Next CEO

Joan Hilson Appointed to Expanded Role of Chief Financial and Operating Officer

Leadership Transition is Culmination of Board’s Long-Term Succession Planning

HAMILTON, Bermuda, October 1, 2024 – Signet Jewelers Limited (“Signet” or the “Company”) (NYSE:SIG), the world’s largest retailer of diamond jewelry, which includes Kay Jewelers, Zales, Jared and Banter by Piercing Pagoda, today announced that, after twelve years at the Company, Virginia “Gina” C. Drosos is planning to retire as Chief Executive Officer and as a member of the Board of Directors ("Board"), effective November 4, 2024. Following a thoughtful succession planning and search process, the Board has appointed J.K. Symancyk to succeed Drosos as Chief Executive Officer, and he will also join the Board at that time. Following her retirement, Drosos will continue as an advisor through the end of the Company’s fiscal year to support a smooth transition.

The Company also today announced that it has expanded responsibilities for Joan Hilson, Chief Financial, Strategy and Services Officer. In her new role as Chief Financial and Operating Officer, Hilson will oversee supply chain and Blue Nile and James Allen along with her current oversight of Rocksbox, finance, strategy, real estate and the Services business. Hilson has served as Chief Financial Officer of Signet since 2019 and has been instrumental in the Company’s transformation.

“On behalf of the Board, I would like to thank Gina for her tremendous leadership and many contributions to Signet throughout her tenure as CEO and service as a director,” said Helen McCluskey, Chair of Signet’s Board of Directors. “As CEO, Gina led Signet in its transformation journey with strategic clarity, disciplined decision-making and a purpose-driven mindset. Under her leadership, in the last five years the Company expanded its market share by nearly 50% and significantly grew its digital presence. During Gina's tenure as CEO, she and the team increased e-commerce sales fourfold and transformed the Company’s financial results, reducing gross debt outstanding by over 90%, nearly doubling liquidity, and over the last four years expanding adjusted operating margin almost 70%1 – all helping to drive Signet’s Total Shareholder Return near the top of its retail peer group for the past one, three, and five years. Further, Gina has advanced the Company’s culture, with recognitions by Great Place to Work and Fortune’s Best Workplaces in Retail. We wish Gina all the best in her well-deserved retirement.”

“It has been a true honor to serve Signet for the past twelve years as a member of the Board and the past seven as CEO. With the ongoing successful execution of our Inspiring Brilliance strategy and the path established for our next phase of growth, now is the right time for this planned leadership transition,” said Drosos. “I am proud of and thankful for our team and partners. Together, we have delivered strong results and transformed Signet into a purpose-inspired and modern jewelry industry leader – creating a truly connected commerce shopping experience, a strong financial platform, and a diverse, inclusive, and winning culture. The Company is poised to deliver a brilliant future with long-term, sustainable growth. I look forward to working with J.K., the Signet team, and the Board to ensure a smooth transition.”

McCluskey continued, “The leadership transition announced today is the result of a thoughtful, planned succession process by Gina and our Board. We are excited to welcome J.K. as the Company’s next CEO. He is a strong leader with more than three decades of experience across the retail industry and proven expertise in driving strategic growth, focusing on the customer, and developing and sustaining high performing leadership teams that deliver results. J.K. has overseen the expansion of large-scale businesses with multi-branded portfolios as well as services businesses, and brings important merchandising and operational skills to the role. We are confident he is the ideal CEO to build on the team’s progress in establishing Signet as the growth and innovation leader of the jewelry industry. We are also excited to recognize Joan Hilson’s contributions, particularly in creating a strong financial foundation and growing services portfolio. We look forward to her making an even larger impact in her expanded role as Chief Financial and Operating Officer.”

Symancyk said, “I am honored to join Signet as its next CEO and continue advancing the strategy that Gina and the team have established. Signet’s position as a leading global jewelry retailer with a diverse portfolio of renowned brands provides a competitively advantaged foundation for continued growth. I am passionate about serving customers and I recognize the emotional connection of Signet’s customers when they are making a jewelry purchase. One of the key attributes that drew me to Signet is its purpose-driven and agile culture and focus on putting its team members and customers first. I am focused on working with Gina and the executive team, along with the Board, through the transition and look forward to capturing the opportunities ahead.”

1 Denotes a non-GAAP financial measure, which is defined in the Company’s Form 8-K furnished to the U.S. Securities and Exchange Commission (“SEC") on June 13, 2024.

About J.K. Symancyk

Symancyk brings over 30 years of retail industry experience across a diverse range of categories and has spent his career in large-scale organizations. Symancyk most recently served for six years as CEO of PetSmart, Inc., overseeing a growth plan and accelerating the company’s leadership through proprietary brand development, services expansion, loyalty program creation, and digital and supply chain capabilities enhancements. Previously, Symancyk served as CEO of Academy Sports + Outdoors from 2015 to 2018, where he led a return to growth and strategic positioning for the company’s initial public offering, refining the merchandise strategy and resetting major infrastructure to support a national omnichannel footprint. From 2006 to 2015, Symancyk held roles of increasing responsibility at Meijer, a supercenter chain throughout the Midwest, including Group Vice President, EVP Chief Marketing Officer, Chief Operating officer and President. Symancyk began his career with 12 years at Walmart where he held various leadership roles, ultimately serving from 2004 to 2006 as Divisional Merchandise Manager, Sam’s Club Division. Symancyk currently is a member of the Retail Industry Leaders Association and serves on the Board of Directors of Bath & Body Works, Inc. He previously served as a director at Chewy, Inc., from April 2019 to July 2021, and GameStop Corp., from March 2020 to June 2021. Symancyk graduated with a bachelor’s degree from the University of Arkansas at Fayetteville. Symancyk will be based at Signet’s offices in Dallas, TX.

About Signet and Safe Harbor Statement:

Signet Jewelers Limited is the world's largest retailer of diamond jewelry. As a Purpose-driven and sustainability-focused company, Signet is a participant in the United Nations Global Compact and adheres to its principles-based approach to responsible business. Signet operates approximately 2,700 stores primarily under the name brands of Kay Jewelers, Zales, Jared, Banter by Piercing Pagoda, Diamonds Direct, Blue Nile, James Allen, Rocksbox, Peoples Jewellers, H. Samuel, and Ernest Jones. Further information on Signet is available at www.signetjewelers.com. See also www.kay.com, www.zales.com, www.jared.com, www.banter.com, www.diamondsdirect.com, www.bluenile.com, www.jamesallen.com, www.rocksbox.com, www.peoplesjewellers.com, www.hsamuel.co.uk, www.ernestjones.co.uk.

This release contains statements which are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based upon management's beliefs and expectations as well as on assumptions made by and data currently available to management, appear in a number of places throughout this document and include statements regarding, among other things, results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate. The use of the words "expects," "intends," "anticipates," "estimates," "predicts," "believes," "should," "potential," "may," "preliminary," "forecast," "objective," "plan," or "target," and other similar expressions are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to a number of risks and uncertainties which could cause the actual results to not be realized, including, but not limited to: difficulty or delay in executing or integrating an acquisition, including Diamonds Direct and Blue Nile; executing other major business or strategic initiatives, such as expansion of the services business, realizing the benefits of our restructuring plans or new transformation strategies that the Company may develop in the future; the impact of the Israel-Hamas conflict on the operations of our quality control and technology centers in Israel; the negative impacts that public health crisis, disease outbreak, epidemic or pandemic has had, and could have in the future, on our business, financial condition, profitability and cash flows, including without limitation risks relating to shifts in consumer spending away from the jewelry category, trends toward more experiential purchases such as travel, disruptions in the dating cycle caused by the COVID-19 pandemic and the pace at which such impacts on engagements are expected to recover, and the Company’s ability to capture market share of the bridal category upon the recovery of engagements; general economic or market conditions, including impacts of inflation or other pricing environment factors on our commodity costs (including diamonds) or other operating costs; a prolonged slowdown in the growth of the jewelry market or a recession in the overall economy; financial market risks; a decline in consumer discretionary spending or deterioration in consumer financial position; disruptions in our supply chain; our ability to attract and retain labor; our ability to optimize our transformation strategies; changes to regulations relating to customer credit; disruption in the availability of credit for customers and customer inability to meet credit payment obligations, which has occurred and may continue to deteriorate; our ability to achieve the benefits related to the outsourcing of the credit portfolio, including due to technology disruptions and/or disruptions arising from changes to or termination of the relevant outsourcing agreements, as well as a potential increase in credit costs due to the current interest rate environment; deterioration in the performance of individual businesses or of our market value relative to its book value, resulting in further impairments of long-lived assets or intangible assets or other adverse financial consequences; the volatility of our stock price; the impact of financial covenants, credit ratings or interest volatility on our ability to borrow; our ability to maintain adequate levels of liquidity for our cash needs, including debt obligations, payment of dividends, planned share repurchases (including future Preferred Share conversions, execution of accelerated

share repurchases and the payment of related excise taxes) and capital expenditures as well as the ability of our customers, suppliers and lenders to access sources of liquidity to provide for their own cash needs; potential regulatory changes; future legislative and regulatory requirements in the US and globally relating to climate change, including any new climate related disclosure or compliance requirements, such as those recently issued in the state of California or adopted by the SEC; exchange rate fluctuations; the cost, availability of and demand for diamonds, gold and other precious metals, including any impact on the global market supply of diamonds due to the ongoing Israel-Hamas conflict, the potential sale or divestiture of the De Beers Diamond Company and its diamond mining operations by parent company Anglo-American plc, and the ongoing Russia-Ukraine conflict or related sanctions; stakeholder reactions to disclosure regarding the source and use of certain minerals; scrutiny or detention of goods produced in certain territories resulting from trade restrictions; seasonality of our business; the merchandising, pricing and inventory policies followed by us and our ability to manage inventory levels; our relationships with suppliers including the ability to continue to utilize extended payment terms and the ability to obtain merchandise that customers wish to purchase; the failure to adequately address the impact of existing tariffs and/or the imposition of additional duties, tariffs, taxes and other charges or other barriers to trade or impacts from trade relations; the level of competition and promotional activity in the jewelry sector; our ability to optimize our multi-year strategy to gain market share, expand and improve existing services, innovate and achieve sustainable, long-term growth; the maintenance and continued innovation of our OmniChannel retailing and ability to increase digital sales, as well as management of digital marketing costs; changes in consumer attitudes regarding jewelry and failure to anticipate and keep pace with changing fashion trends; changes in the costs, retail prices, supply and consumer acceptance of, and demand for gem quality lab-created diamonds and adequate identification of the use of substitute products in our jewelry; ability to execute successful marketing programs and manage social media; the ability to optimize our real estate footprint, including operating in attractive trade areas and accounting for changes in consumer traffic in mall locations; the performance of and ability to recruit, train, motivate and retain qualified team members - particularly store associates in regions experiencing low unemployment rates and key executive talent during periods of leadership transition, such as the recent appointment of a new Chief Executive Officer; management of social, ethical and environmental risks; ability to deliver on our environmental, social and governance goals; the reputation of Signet and its banners; inadequacy in and disruptions to internal controls and systems, including related to the migration to new information technology systems which impact financial reporting; risks associated with the Company’s use of artificial intelligence; security breaches and other disruptions to our or our third-party providers’ information technology infrastructure and databases; an adverse development in legal or regulatory proceedings or tax matters, including any new claims or litigation brought by employees, suppliers, consumers or shareholders, regulatory initiatives or investigations, and ongoing compliance with regulations and any consent orders or other legal or regulatory decisions; failure to comply with labor regulations; collective bargaining activity; changes in corporate taxation rates, laws, rules or practices in the US and other jurisdictions in which our subsidiaries are incorporated, including developments related to the tax treatment of companies engaged in Internet commerce or deductions associated with payments to foreign related parties that are subject to a low effective tax rate; risks related to international laws and Signet being a Bermuda corporation; risks relating to the outcome of pending litigation; our ability to protect our intellectual property or assets including cash which could be affected by failure of a financial institution or conditions affecting the banking system and financial markets as a whole; changes in assumptions used in making accounting estimates relating to items such as extended service plans; or the impact of weather-related incidents, natural disasters, organized crime or theft, increased security costs, strikes, protests, riots or terrorism, acts of war (including the ongoing Russia-Ukraine and Israel-Hamas conflicts), or another public health crisis or disease outbreak, epidemic or pandemic on our business.

For a discussion of these and other risks and uncertainties which could cause actual results to differ materially from those expressed in any forward looking statement, see the “Risk Factors” and “Forward-Looking Statements” sections of Signet’s Fiscal 2024 Annual Report on Form 10-K filed with the SEC on March 21, 2024 and quarterly reports on Form 10-Q and the “Safe Harbor Statements” in current reports on Form 8-K filed with the SEC. Signet undertakes no obligation to update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

Investors:

Rob Ballew

Senior Vice President, Investor Relations

robert.ballew@signetjewelers.com

or

investorrelations@signetjewelers.com

Media:

Colleen Rooney

Chief Communications & ESG Officer

+1-330-668-5932

colleen.rooney@signetjewelers.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

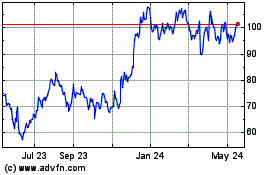

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Oct 2024 to Nov 2024

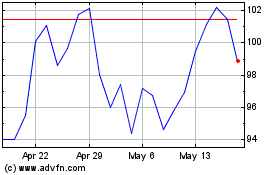

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Nov 2023 to Nov 2024