SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D. C. 20549

FORM 6-K

REPORT

OF FOREIGN PRIVATE ISSUER

Pursuant

to Rule 13a-16 or 15d-16 of

the

Securities Exchange Act of 1934

For

the month of November 2024

Commission

File Number: 001-06439

SONY

GROUP CORPORATION

(Translation

of registrant’s name into English)

1-7-1 KONAN, MINATO-KU, TOKYO, 108-0075, JAPAN

(Address

of principal executive offices)

The

registrant files annual reports under cover of Form 20-F.

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F,

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

SONY GROUP CORPORATION

(Registrant)

|

| |

|

|

| |

By: |

|

/s/ Hiroki Totoki |

| |

|

|

(Signature) |

| |

Hiroki Totoki |

| |

President, Chief Operating Officer and |

| |

Chief Financial Officer |

Date:

November 25, 2024

List

of Materials

Documents

attached hereto:

Press

release: Determination of Final Terms of Stock Acquisition Rights for the Purpose of Granting Stock Options

1-7-1 Konan, Minato-ku

Tokyo, 108-0075 Japan

November 25, 2024

Determination of Final Terms of Stock Acquisition

Rights

for the Purpose of Granting Stock Options

Sony Group Corporation (the “Corporation”)

announced today that the final terms of the stock acquisition rights (“Stock Acquisition Rights”) for the purpose of granting

stock options, which issues were decided by the Representative Corporate Executive Officer of the Corporation on November 8, 2024, have

been fixed as set forth below.

1. The

Fifty-First Series of Stock Acquisition Rights (the “Stock Acquisition Rights” in this Section 1)

(1) Aggregate number of Stock Acquisition Rights:

28,670

(2) Persons to whom Stock Acquisition

Rights will be allocated and number of Stock Acquisition Rights to be allocated:

| |

Number of persons |

| |

(Number of Stock Acquisition Rights) |

| Corporate executive officers of the Corporation |

6 | |

(16,700) |

| Employees of the Corporation |

18 | |

(2,690) |

| Directors and officers of the subsidiaries of the Corporation |

10 | |

(2,390) |

| Employees of the subsidiaries of the Corporation |

144 | |

(6,890) |

| |

total: 178 | |

(total: 28,670) |

(3) Class and number

of shares to be issued or transferred upon exercise of Stock Acquisition Rights:

2,867,000 shares of common stock of the Corporation

The number of shares to be issued

or transferred upon exercise of each Stock Acquisition Right shall be 100 shares.

(4) Amount to be paid in exchange for the Stock Acquisition Rights:

81,700 yen per Stock Acquisition Right (817 yen

per share)

Amount to be paid

in exchange for the Stock Acquisition Rights will be the fair value of the Stock Acquisition Rights and will not be an amount that is

particularly favorable to the allottee of the Stock Acquisition Rights (the “Allottee” in this Section 1).

The payment of the amount to be paid

by the Allottee in exchange for the Stock Acquisition Rights multiplied by the Allottee’s allotted number of Stock Acquisition Rights

(the “Total Amount to be Paid” in this item (4) of Section 1) will be made by offsetting such amount against: (i) remuneration

claims, in an amount equal to the Total Amount to be Paid, which will be granted to the Allottee by the Corporation, if the Allottee is

a corporate executive officer or an employee of the Corporation, or, (ii) remuneration claims in an amount equal to the Total Amount to

be Paid, which will be granted to the Allottee by subsidiaries of the Corporation and assumed by the Corporation, if the Allottee is a

director, officer or an employee of a subsidiary of the Corporation. Therefore, no monetary payment will be made by the Allottee on the

Allotment Date for the purpose of paying the Total Amount to be Paid. However, these remuneration claims shall be granted on the condition

that the Allottee enters into an allocation agreement with the Corporation.

(5) Amount of assets to be contributed upon exercise of Stock Acquisition

Rights:

294,800 yen per Stock Acquisition Right

(2,948 yen per share) (Exercise Price)

2. The Fifty-Second Series of Stock Acquisition Rights (the “Stock

Acquisition Rights” in this Section 2)

(1) Aggregate number of Stock Acquisition Rights:

14,358

(2) Persons to whom Stock Acquisition

Rights will be allocated and number of Stock Acquisition Rights to be allocated:

| |

Number of persons |

| |

(Number of Stock Acquisition Rights) |

| Employees of the Corporation |

2 | |

(267) |

| Directors and officers of the subsidiaries of the Corporation |

5 | |

(6,975) |

| Employees of the subsidiaries of the Corporation |

15 | |

(7,116) |

| |

total: 22 | |

(total: 14,358) |

(3) Class and number

of shares to be issued or transferred upon exercise of Stock Acquisition Rights:

1,435,800 shares of common stock of the Corporation

The number of shares to be issued

or transferred upon exercise of each Stock Acquisition Right shall be 100 shares.

(4) Amount to be paid in exchange for the Stock Acquisition Rights:

641 U.S. dollars per Stock Acquisition Right (6.41

U.S. dollars per share)

Amount to be paid

in exchange for the Stock Acquisition Rights will be the fair value of the Stock Acquisition Rights and will not be an amount that is

particularly favorable to the allottee of the Stock Acquisition Rights (the “Allottee” in this Section 2).

The payment of the amount to be paid

by the Allottee in exchange for the Stock Acquisition Rights multiplied by the Allottee’s allotted number of Stock Acquisition Rights

(the “Total Amount to be Paid” in this item (4) of Section 2) will be made by offsetting such amount against: (i) remuneration

claims, in an amount equal to the Total Amount to be Paid, which will be granted to the Allottee by the Corporation, if the Allottee is

an employee of the Corporation, or, (ii) remuneration claims in an amount equal to the Total Amount to be Paid, which will be granted

to the Allottee by subsidiaries of the Corporation and assumed by the Corporation, if the Allottee is a director, officer or an employee

of a subsidiary of the Corporation. Therefore, no monetary payment will be made by the Allottee on the Allotment Date for the purpose

of paying the Total Amount to be Paid. However, these remuneration claims shall be granted on the condition that the Allottee enters into

an allocation agreement with the Corporation.

(5) Amount of assets to be contributed upon exercise of Stock Acquisition

Rights:

1,893 U.S. dollars per Stock Acquisition Right

(18.93 dollars per share) (Exercise Price)

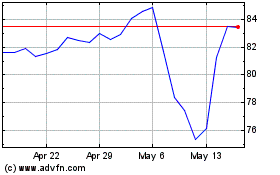

Sony (NYSE:SONY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sony (NYSE:SONY)

Historical Stock Chart

From Feb 2024 to Feb 2025