SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

| Scully Royalty Ltd. |

| (Name of Issuer) |

| |

| Common Stock, par value $0.001 per share |

| (Title of Class of Securities) |

| Neil S. Subin, 2336 SE Ocean Blvd., Suite 400, Stuart, Florida 34996 (Tel.) (561) 287-5399 |

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) |

| |

December 11, 2023 |

|

| |

(Date of Event which Requires Filing of this Statement) |

|

| |

|

|

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box. ☐

Note. Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits.

See Rule 13d-7 for other parties to whom

copies are to be sent.

| * | The remainder of this cover page shall be filled out for

a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

(Continued on following pages)

| 1 |

NAME

OF REPORTING PERSON

Neil

S. Subin |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF-AF-OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United

States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

1,842,087(1) |

| 9 |

SOLE

DISPOSITIVE POWER

0(1) |

| 10 |

SHARED

DISPOSITIVE POWER

1,842,087(1) |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,842,087(1) |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

12.4%(2) |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| (1) |

Represents (i) 48,483 shares of common stock owned of record by MILFAM LLC; (ii) 31,033 shares of common stock owned of record by Catherine C. Miller Irrevocable Trust dtd 3/26/91; (iii) 44,911 shares of common stock owned of record by Catherine C Miller Trust A-3; (iv) 215,042 shares of common stock owned of record by Catherine Miller Trust C; (v) 20,658 shares of common stock owned of record by Kimberley S. Miller GST Trust dtd 12/17/1992; (vi) 188,687 shares of common stock owned of record by LIMFAM LLC; (vii) 163,005 shares of common stock owned of record by LIM III Estate LLC; (viii) 64,715 shares of common stock owned of record by Lloyd I. Miller Trust A-1; (ix) 28,355 shares of common stock owned of record by Trust D c/u Lloyd I. Miller Irrevocable Trust Amended and Restated September 20, 1983; (x) 5,330 shares of common stock owned of record by Lloyd I. Miller, III Irrevocable Trust dtd 12/31/91; (xi) 32,693 shares of common stock owned of record by Miller Great Grandchildren Trust; (xii) 176,735 shares of common stock owned of record by Susan F. Miller Spousal Trust A-4; (xiii) 176,734 shares of common stock owned of record by Miller Family Education and Medical Trust; (xiv) 150,282 shares of common stock owned of record by MILFAM I L.P.; (xv) 428,563 shares of common stock owned of record by MILFAM II L.P.; (xvi) 26,611 shares of common stock owned of record by MILFAM III LLC and (xvii) 40,250 shares of common stock owned of record by Susan F. Miller. Mr. Subin is the President and Manager of MILFAM LLC, which serves as manager, general partner, or advisor of a number of the foregoing entities formerly managed or advised by the late Lloyd I. Miller, III, and he also serves as trustee of a number of the foregoing trusts for the benefit of the family of the late Mr. Lloyd I. Miller, III, consequently, he may be deemed the beneficial owner of the shares specified in clauses (i) through (xvii) of the preceding sentence. Mr. Subin disclaims beneficial ownership of any shares other than to the extent he may have a pecuniary interest therein. |

| (2) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of Scully Royalty Ltd. (the “Issuer”) common stock outstanding as of November 21, 2023 (according to the

Issuer’s Form 6-K as filed with the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

MILFAM LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF-AF-OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

1,712,123(1) |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

1,712,123(1) |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,712,123(1) |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

11.6%(2) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) |

Represents (i) 44,911 shares of common stock owned of record by Catherine C Miller Trust A-3; (ii) 215,042 shares of common stock owned of record by Catherine Miller Trust C; (iii) 188,687 shares of common stock owned of record by LIMFAM LLC; (iv) 163,005 shares of common stock owned of record by LIM III Estate LLC; (v) 64,715 shares of common stock owned of record by Lloyd I. Miller Trust A-1; (vi) 176,735 shares of common stock owned of record by Susan F. Miller Spousal Trust A-4; (vii) 176,734 shares of common stock owned of record by Miller Family Education and Medical Trust; (viii) 150,282 shares of common stock owned of record by MILFAM I L.P.; (ix) 428,563 shares of common stock owned of record by MILFAM II L.P.; (x) 26,611 shares of common stock owned of record by MILFAM III LLC; and (xi) 48,483 shares of common stock owned of record by MILFAM LLC. MILFAM LLC serves as manager, general partner, or advisor of the foregoing entities formerly managed or advised by the late Lloyd I. Miller, III, consequently, it may be deemed the beneficial owner of the shares specified in clauses (i) through (xi) of the preceding sentence. MILFAM LLC disclaims beneficial ownership of any shares other than to the extent it may have a pecuniary interest therein. |

| (2) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

Alimco Re Ltd. |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

WC |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Islands of Bermuda |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

166,320 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

166,320 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

166,320 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

1.1%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

Catherine C. Miller Irrevocable Trust dtd 3/26/91 |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

31,033 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

31,033 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

31,033 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.2%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

Catherine C Miller Trust A-3 |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

44,911 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

44,911 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

44,911 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.3%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

Catherine Miller Trust C |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

215,042 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

215,042 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

215,042 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

1.5%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

Kimberley S. Miller GST Trust dtd 12/17/1992 |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

20,658 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

20,658 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

20,658 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.1%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

LIMFAM LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

WC |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

188,687 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

188,687 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

188,687 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

1.3%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

LIM III Estate LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

163,005 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

163,005 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

163,005 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

1.1%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

Lloyd I. Miller Trust A-1 |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

64,715 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

64,715 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

64,715 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.4%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

Trust D c/u Lloyd I. Miller Irrevocable Trust Amended and Restated September 20, 1983 |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

28,355 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

28,355 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

28,355 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.2%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

Lloyd I. Miller, III Irrevocable Trust dtd 12/31/91 |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

5,330 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

5,330 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,330 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.0%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

Miller Great Grandchildren Trust |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

32,693 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

32,693 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

32,693 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.2%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

Susan F. Miller Spousal Trust A-4 |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

176,735 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

176,735 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

176,735 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

1.2%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

Miller Family Education and Medical Trust |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

176,734 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

176,734 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

176,734 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

1.2%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

MILFAM I L.P. |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

WC |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

150,282 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

150,282 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

150,282 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

1.0%(1) |

| 14 |

TYPE

OF REPORTING PERSON

PN |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

MILFAM II L.P. |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

WC |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

428,563 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

428,563 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

428,563 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

3.3%(1) |

| 14 |

TYPE

OF REPORTING PERSON

PN |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

MILFAM III LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☐

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

WC |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

26,611 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

26,611 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

26,611 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.2%(1) |

| 14 |

TYPE

OF REPORTING PERSON

OO |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

| 1 |

NAME

OF REPORTING PERSON

Susan F. Miller |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

(a)

☒

(b) ☐ |

| 3 |

SEC

USE ONLY

|

| 4 |

SOURCE

OF FUNDS

PF |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

☐

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

40,250 |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| 10 |

SHARED

DISPOSITIVE POWER

40,250 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

40,250 |

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.3%(1) |

| 14 |

TYPE

OF REPORTING PERSON

IN |

| (1) | The percentage reported in this Schedule 13D is based upon

14,822,251 shares of the Issuer common stock outstanding as of November 21, 2023 (according to the Issuer’s Form 6-K as filed with

the Securities and Exchange Commission on December 1, 2023). |

EXPLANATORY

NOTE

Certain

of the shares of common stock of the Issuer to which this Schedule 13D (this “Schedule 13D”) relates were

previously reported by the certain Reporting Persons (as defined below) on Schedule 13G/A filed with the SEC on February 7, 2022.

The shares held by the Miller Entities (as defined below) do not include those shares held by Alimco Re Ltd. Mr. Subin, MILFAM LLC

and the Miller Entities on the one hand, and Alimco Re Ltd. on the other hand, respectively disclaim (i) the existence of, and

membership in, a “group” under Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, and (ii) beneficial

ownership of the securities reported by the other reporting persons. This Schedule 13D is also being filed to report that the

Reporting Persons have nominated directors for election at the upcoming Annual General Meeting of Shareholders of the Issuer, to be

held on December 29, 2023. This Schedule 13D shall be deemed to be a conversion of the Schedule 13G/A set

forth above.

Introduction

This

Schedule 13D is filed with the SEC on behalf of (i) Neil S. Subin; (ii) MILFAM LLC; (iii) Alimco Re Ltd., (“Alimco

Re”); (iv) Catherine C. Miller Irrevocable Trust dtd 3/26/91; (v) Catherine C Miller Trust A-3; (vi) Catherine Miller

Trust C; (vii) Kimberley S. Miller GST Trust dtd 12/17/1992; (viii) LIMFAM LLC; (ix) LIM III Estate LLC; (x) Lloyd I. Miller Trust

A-1; (xi) Trust D c/u Lloyd I. Miller Irrevocable Trust Amended and Restated September 20, 1983; (xii) Lloyd I. Miller, III

Irrevocable Trust dtd 12/31/91; (xiii) Miller Great Grandchildren Trust; (xiv) Susan F. Miller Spousal Trust A-4; (xv) Miller

Family Education and Medical Trust (xvi) MILFAM I L.P.; (xvii) MILFAM II L.P.; (xviii) MILFAM III LLC; and (xix) Susan F. Miller

(each person and entity named in items (i) through (xix), collectively, the “Reporting Persons”, the entities

named in items (iv) through (xviii) together, the “Miller Entities”) relating to the common stock of the

Issuer.

Item

1. Security and Issuer

This

Schedule 13D relates to the common stock of the Issuer, whose principal executive offices are located at Room 2103 Shanghai Mart Tower,

2299 Yan An Road West, Changning District, Shanghai China 200336.

Item

2. Identity and Background

(a),

(b), (c) and (f). This statement is filed by:

(i) Mr.

Subin, whose principal business address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. Mr. Subin’s principal occupation

is investing assets held, among others, by or on behalf of or for the benefit of the Miller Entities and other entities. Mr. Subin is

a United States citizen.

(ii) MILFAM

LLC, whose principal executive offices are located at 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. The principal business of

MILFAM LLC is managing and investing assets held, among others, by or on behalf of or for the benefit of, and advising, certain of the

Miller Entities and other entities. MILFAM LLC is a limited liability company formed under the laws of Delaware. Mr. Subin is the manager

of MILFAM LLC.

(iii) Alimco

Re, whose principal executive offices are located at c/o Strategic Risk Solutions, Cumberland House, 6th Floor, 1 Victoria Street, Hamilton

HM 12, Bermuda. The principal business of Alimco Re is reinsurance. Alimco Re is a corporation formed under the laws of the Islands of

Bermuda.

(iv) Catherine

C. Miller Irrevocable Trust dtd 3/26/91, whose principal address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. Catherine C.

Miller Irrevocable Trust dtd 3/26/91 is a trust for the benefit of the Miller Family. To the extent such concept is applicable, the trust

is a United States citizen. Mr. Subin is the trustee of Catherine C. Miller Irrevocable Trust dtd 3/26/91.

(v) Catherine

C Miller Trust A-3, whose principal address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. Catherine C Miller Trust A-3 is

a trust for the benefit of the Miller Family. To the extent such concept is applicable, the trust is a United States citizen. MILFAM

LLC is the Investment Advisor of Catherine C Miller Trust A-3.

(vi) Catherine

Miller Trust C, whose principal address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. Catherine Miller Trust C is a trust

for the benefit of the Miller Family. To the extent such concept is applicable, the trust is a United States citizen. MILFAM LLC is the

Investment Advisor of Catherine Miller Trust C.

(vii) Kimberley

S. Miller GST Trust dtd 12/17/1992, whose principal address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. Kimberley S. Miller

GST Trust dtd 12/17/1992 is a trust for the benefit of the Miller Family. To the extent such concept is applicable, the trust is a United

States citizen. Mr. Subin is the trustee of Kimberley S. Miller GST Trust dtd 12/17/1992.

(viii) LIMFAM

LLC, whose principal address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. The principal business of LIMFAM LLC is to hold

investments. LIMFAM LLC is a limited liability company formed under the laws of Delaware. MILFAM LLC is the manager of LIMFAM LLC.

(ix)

LIM Estate, whose principal address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996.

The principal business of LIM Estate is to hold investments. LIM Estate is a limited liability company formed under the laws of Delaware.

MILFAM LLC is the manager of LIM Estate.

(x) Lloyd

I. Miller Trust A-1, whose principal address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. Lloyd I. Miller Trust A-1 is a

trust for the benefit of the Miller Family. To the extent such concept is applicable, the trust is a United States citizen. MILFAM LLC

is the Investment Advisor of Lloyd I. Miller Trust A-1.

(xi)

Trust D c/u Lloyd I. Miller Irrevocable Trust Amended and Restated September 20, 1983, whose principal address is 2336 SE Ocean

Blvd, Suite 400, Stuart, Florida 34996. Trust D c/u Lloyd I. Miller Irrevocable Trust Amended and Restated September 20, 1983 is a

trust for the benefit of the Miller Family. To the extent such concept is applicable, the trust is a United States citizen. Mr.

Subin is the trustee of Trust D c/u Lloyd I. Miller Irrevocable Trust Amended and Restated September 20, 1983.

(xii)

Lloyd I. Miller, III Irrevocable Trust dtd 12/31/91, whose principal address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996.

Lloyd I. Miller, III Irrevocable Trust dtd 12/31/91 is a trust for the benefit of the Miller Family. To the extent such concept is

applicable, the trust is a United States citizen. Mr. Subin is the trustee of Lloyd I. Miller, III Irrevocable

Trust dtd 12/31/91.

(xiii)

Miller Great Grandchildren Trust, whose principal address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. Miller Great

Grandchildren Trust is a trust for the benefit of the Miller Family. To the extent such concept is applicable, the trust is a

United States citizen. Mr. Subin is the trustee of Miller Great Grandchildren Trust.

(xiv) Susan

F. Miller Spousal Trust A-4, whose principal address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. Susan F. Miller Spousal

Trust A-4 is a trust for the benefit of the Miller Family. To the extent such concept is applicable, the trust is a United States citizen.

Mr. Subin is the trustee of Susan F. Miller Spousal Trust A-4.

(xv) Miller

Family Education and Medical Trust, whose principal address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. Miller Family Education

and Medical Trust is a trust for the benefit of the Miller Family. To the extent such concept is applicable, the trust is a United States

citizen. Mr. Subin is the trustee of Miller Family Education and Medical Trust.

(xvi)

MILFAM I L.P, whose principal executive offices are located at 2336 SE Ocean Blvd, Suite 400,

Stuart, Florida 34996. The principal business of MILFAM I L.P. is as an investment fund. MILFAM I L.P. is a limited partnership formed

under the laws of Delaware. MILFAM LLC is the general partner of MILFAM I L.P.

(xvii)

MILFAM II L.P., whose principal executive offices are located at 2336 SE Ocean Blvd, Suite

400, Stuart, Florida 34996. The principal business of MILFAM II L.P. is as an investment fund. MILFAM II L.P. is a limited partnership

formed under the laws of Delaware. MILFAM LLC is the general partner of MILFAM II L.P.

(xviii)

MILFAM III LLC, whose principal executive offices are located at 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. The principal

business of MILFAM III LLC is as an investment fund. MILFAM III LLC is a limited liability company formed under the laws of Delaware.

MILFAM LLC is the manager of MILFAM III LLC.

(xix) Susan

F. Miller, whose principal business address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996. Ms. Miller’s principal occupation

is homemaker. Ms. Miller is a United States citizen.

Additional

Information

The

names, addresses and principal occupations of each of Alimco Re’s executive officers and board of directors

and any other persons ultimately in control of those entities are set forth below.

Alimco Re

John Christopher Dougherty, Chief Executive Officer, whose principal business address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996.

Mr. Dougherty’s principal occupation is management of Alimco and its subsidiaries. Mr. Dougherty, is a United States citizen.

Jonathan

Marcus, Director, whose principal business address is 2336 SE Ocean Blvd, Suite 400, Stuart, Florida 34996.

Mr. Marcus’ principal occupation is the management of Alimco and its subsidiaries. Mr. Marcus is a United States citizen.

Robert

Forness, Director, whose principal business address is 16 Burnaby Street, Hamilton Bermuda. Mr. Forness’ principal occupation is

as Chief Executive Officer of Multi-Strat Holdings Ltd, a reinsurance firm headquartered in Bermuda. Mr. Forness is a United States citizen.

Dennis

Johnson, Director, whose principal business address is 2928 Armfield Ave., Burlington, North Carolina 27215. Mr. Johnson’s principal

occupation is as an advisor to the insurance industry. Mr. Johnson is a United States citizen.

(d)

No

Reporting Person has during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

To the knowledge of the Reporting Persons, no person specified by Instruction C has, during the last five years, been convicted in a

criminal proceeding (excluding traffic violations or similar misdemeanors).

(e)

No

Reporting Person, during the last five years, was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction

and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

To

the knowledge of the Reporting Persons, no persons specified by Instruction C, during the last five years, was a party to a civil proceeding

of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree

or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or

finding any violation with respect to such laws.

Item

3. Source and Amount of Funds or Other Consideration

Mr. Subin is the President

and Manager of MILFAM LLC, which serves as manager, general partner, or advisor of a number of entities formerly managed or advised by

the late Lloyd I. Miller, III. Mr. Subin also serves as trustee of a number of trusts for the benefit of the family of Mr. Miller (the

“Miller Family”).

The aggregate purchase price of the 1,842,087 shares

beneficially owned by Mr. Subin, as manager of MILFAM LLC serving as manager, general partner, or advisor of a number of entities formerly

managed or advised by the late Lloyd I. Miller, III, and as trustee of the trusts for the benefit of the Miller Family, is approximately

$12,746,468.03, excluding brokerage commissions.

The aggregate purchase price of the 166,320 shares

owned by Alimco Re Ltd. is approximately $282,286.48, excluding brokerage commissions.

The sources of funds for each Reporting Person are set forth on the

cover page of this Schedule 13D and are incorporated by reference into this Item 3.

Item

4. Purpose of the Transaction

The

common stock owned by the Reporting Persons was initially acquired for investment purposes. Recently, the Reporting Persons decided to

take an activist investment position in respect of their investment and have nominated four (4) director nominees for election

at the upcoming Annual General Meeting of Shareholders of the Issuer, to be held on December 29, 2023. As of the date of this filing,

other than submitting its director nominees, the Reporting Persons have not come to any conclusions about their objectives for the Issuer,

its board or management, or otherwise with respect to their involvement with the Issuer.

The

Reporting Persons intend to review their investment in the Issuer on a continuing basis and will routinely monitor a wide variety of

investment considerations, including, without limitation, current and anticipated future trading prices for the common stock, the Issuer’s

financial position, operations, assets, prospects, strategic direction and business and other developments affecting the Issuer. The

Reporting Persons may from time to time take such actions with respect to its investment in the Issuer as they deem appropriate, including,

without limitation, (i) acquiring additional shares or disposing of some or all of the shares of common stock (or other securities of

the Issuer); (ii) changing their current intentions with respect to any or all matters referred to in this Item 4; and/or (iii) engaging

in hedging, derivative or similar transactions with respect to any securities of the Issuer. Any acquisition or disposition of the Issuer’s

securities may be made by means of open-market purchases or dispositions, privately negotiated transactions, and direct acquisitions

from or dispositions to the Issuer.

As

of the date of this filing, except as set forth in this Schedule 13D, the Reporting Persons currently do not have any plans

or proposals that relate to or would result in activities described in subparagraphs (a) through (j) of Item 4 of Schedule 13D.

Item

5. Interest in Securities of the Issuer

(a)

See rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of shares of common stock and percentages of

the shares of common stock beneficially owned by each Reporting Person. The percentage reported in this Schedule 13D is based upon 14,822,251

shares of common stock outstanding as of November 21, 2023, according to the Issuer’s Form 6-K as filed with the Securities and

Exchange Commission on December 1, 2023.

(b)

See rows (7) through (10) of the cover pages to this Schedule 13D for the number of shares of common stock as to which each Reporting

Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition.

(c)

Not Applicable.

(d)

Not Applicable.

(e)

Not Applicable.

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

The

information set forth in Item 4 of this Schedule 13D is hereby incorporated by reference into this Item 6.

Item

7. Materials to be Filed as Exhibits:

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Dated:

December 11, 2023

| |

/s/ Neil S. Subin |

| |

Neil S. Subin |

| |

|

|

| |

MILFAM LLC |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

|

|

| |

ALIMCO RE LTD. |

| |

|

|

| |

By: |

/s/ J Christopher

Dougherty |

| |

Name: |

J Christopher

Dougherty |

| |

Title: |

CEO |

| |

|

|

| |

CATHERINE

C. MILLER IRREVOCABLE TRUST DTD 3/26/91 |

| |

|

|

| |

By: |

/s/ Neil S.

Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

CATHERINE

C. MILLER TRUST A-3 |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

Investment Advisor |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

CATHERINE

MILLER TRUST C |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

Investment Advisor |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

|

|

| |

KIMBERLEY

S. MILLER GST TRUST DTD 12/17/1992 |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

LIMFAM LLC |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

Manager |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

|

|

| |

LIM III ESTATE LLC |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

Manager |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

|

|

| |

LLOYD I.

MILLER TRUST A-1 |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

Investment Advisor |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

Trust

D c/u Lloyd I. Miller Irrevocable Trust Amended and Restated September 20, 1983 |

| |

|

|

| |

By: |

/s/ Neil S.

Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

Lloyd I. Miller, III Irrevocable Trust

dtd 12/31/91 |

| |

|

|

| |

By: |

/s/ Neil S.

Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

Miller

Great Grandchildren Trust |

| |

|

|

| |

By: |

/s/ Neil S.

Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

SUSAN F. MILLER SPOUSAL TRUST |

| |

|

|

| |

By: |

/s/ Neil S.

Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

MILLER FAMILY EDUCATION AND MEDICAL

TRUST |

| |

|

|

| |

By: |

/s/ Neil S.

Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

MILFAM I L.P. |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

General Partner |

| |

|

|

| |

By: |

/s/ Neil S.

Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

|

|

| |

MILFAM II L.P. |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

General Partner |

| |

|

|

| |

By: |

/s/ Neil S.

Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

MILFAM III LLC |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

Manager |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

|

|

| |

/s/ Susan F. Miller |

| |

Susan F. Miller |

Exhibit

1

JOINT

FILING AGREEMENT

December

11, 2023

The

undersigned hereby agree as follows:

(i)

Each of them is individually eligible to use the Schedule 13D to which this Exhibit is attached, and such Schedule 13D is filed on behalf

of each of them; and

(ii)

Each of them is responsible for the timely filing of such Schedule 13D and any amendments thereto, and for the completeness and accuracy

of the information concerning such person contained therein; but none of them is responsible for the completeness or accuracy of the

information concerning the other persons making the filing, unless such person knows or has reason to believe that such information is

inaccurate.

Date:

December 11, 2023

| |

/s/ Neil S. Subin |

| |

Neil S. Subin |

| |

|

|

| |

MILFAM LLC |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

|

|

| |

ALIMCO RE LTD. |

| |

|

|

| |

By: |

/s/ J Christopher

Dougherty |

| |

Name: |

J Christopher

Dougherty |

| |

Title: |

CEO |

| |

|

|

| |

CATHERINE

C. MILLER IRREVOCABLE TRUST DTD 3/26/91 |

| |

|

|

| |

By: |

/s/ Neil S.

Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

CATHERINE

C. MILLER TRUST A-3 |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

Investment Advisor |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

CATHERINE

MILLER TRUST C |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

Investment Advisor |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

|

|

| |

KIMBERLEY

S. MILLER GST TRUST DTD 12/17/1992 |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

LIMFAM LLC |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

Manager |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

|

|

| |

LIM III ESTATE LLC |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

Manager |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

|

|

| |

LLOYD I.

MILLER TRUST A-1 |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

Investment Advisor |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

Trust D c/u Lloyd I. Miller Irrevocable Trust

Amended |

| |

and Restated September 20, 1983 |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

Lloyd I. Miller, III Irrevocable Trust dtd 12/31/91 |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

Miller Great Grandchildren Trust |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

SUSAN F. MILLER SPOUSAL TRUST |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

MILLER FAMILY EDUCATION AND MEDICAL

TRUST |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Trustee |

| |

|

|

| |

MILFAM I L.P. |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

General Partner |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

|

|

| |

MILFAM II L.P. |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

General Partner |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

MILFAM III LLC |

| |

|

|

| |

By: |

MILFAM LLC |

| |

Its: |

Manager |

| |

|

|

| |

By: |

/s/ Neil S. Subin |

| |

Name: |

Neil S. Subin |

| |

Title: |

Manager |

| |

|

|

| |

/s/ Susan F. Miller |

| |

Susan F. Miller |

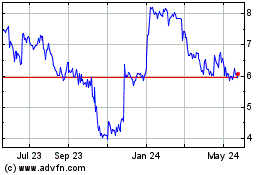

Scully Royalty (NYSE:SRL)

Historical Stock Chart

From Nov 2024 to Dec 2024

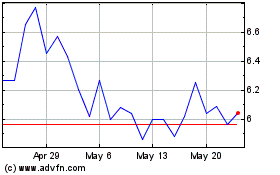

Scully Royalty (NYSE:SRL)

Historical Stock Chart

From Dec 2023 to Dec 2024