Teledyne Technologies Incorporated (NYSE:TDY):

- Orders exceeded sales for the fourth consecutive

quarter

- All-time record quarterly sales of $1,443.5 million, an

increase of 2.9% compared with last year

- Third quarter GAAP operating margin of 18.8% and third

quarter non-GAAP operating margin of 22.5%

- Record third quarter GAAP diluted earnings per share of

$5.54 and non-GAAP diluted earnings per share of $5.10

- Third quarter cash from operations of $249.8 million and

free cash flow of $228.7 million

- Raising full year 2024 GAAP diluted earnings per share

outlook to $17.28 to $17.42, compared with the prior outlook of

$15.87 to $16.13, and narrowing full year 2024 non-GAAP earnings

per share outlook to $19.35 to $19.45, compared with the prior

outlook of $19.25 to $19.45

- Capital deployment year-to-date through October 2024

includes estimated stock repurchases of approximately $354

million

- Quarter-end Consolidated Leverage Ratio of 1.7x

Teledyne today reported third quarter 2024 net sales of $1,443.5

million, compared with net sales of $1,402.5 million for the third

quarter of 2023, an increase of 2.9%. Net income attributable to

Teledyne was $262.0 million ($5.54 diluted earnings per share) for

the third quarter of 2024, compared with $198.6 million ($4.15

diluted earnings per share) for the third quarter of 2023, an

increase of 31.9%. The third quarter of 2024 included $49.8 million

of pretax acquired intangible asset amortization expense, $3.7

million of pretax FLIR integration costs and $61.7 million of FLIR

acquisition-related discrete income tax benefits. Excluding these

items, non-GAAP net income attributable to Teledyne for the third

quarter of 2024 was $241.3 million ($5.10 diluted earnings per

share). The third quarter of 2023 included $49.1 million of pretax

acquired intangible asset amortization expense, $5.8 million of

pretax FLIR integration costs and $1.0 million of FLIR

acquisition-related discrete income tax expense. Excluding these

items, non-GAAP net income attributable to Teledyne for the third

quarter of 2023 was $241.9 million ($5.05 diluted earnings per

share). Operating margin was 18.8% for both the third quarter of

2024 and 2023. Excluding pretax acquired intangible asset

amortization expense and pretax FLIR integration costs, non-GAAP

operating margin for the third quarter of 2024 was 22.5%, compared

with 22.8% for the third quarter of 2023.

“Teledyne achieved all-time record orders and sales in the third

quarter,” said Robert Mehrabian, Executive Chairman. “Revenue was

sequentially greater in each segment, allowing us to report overall

year-over-year growth as we expected. We continue to see robust

demand in our longer cycle defense, space, and energy businesses.

Furthermore, sales for most of our shorter cycle commercial

businesses have stabilized or are recovering, and year-over-year

comparisons have just begun to ease. We opportunistically

repurchased $354 million of stock over the last several months, and

we will continue to evaluate share repurchases against

acquisitions, for which the pipeline has recently improved.”

Review of Operations

Comparisons are with the third quarter of 2023, unless noted

otherwise.

Digital Imaging

The Digital Imaging segment’s third quarter 2024 net sales were

$768.4 million, compared with $775.8 million, a decrease of 1.0%.

Operating income was $123.9 million for the third quarter of 2024,

compared with $136.3 million, a decrease of 9.1%. The third quarter

of 2024 included $3.7 million of pretax FLIR integration costs

compared with $5.8 million. Acquired intangible amortization

expense for the third quarter of 2024 was $46.0 million compared

with $45.4 million. Excluding these items, non-GAAP operating

income for the third quarter of 2024 was $173.6 million, compared

with $187.5 million, a decrease of 7.4%.

The third quarter of 2024 net sales decreased primarily due to

lower sales of industrial automation imaging systems and X-ray

products, partially offset by higher sales of unmanned air systems,

surveillance systems, infrared detectors and commercial infrared

imaging systems. The third quarter of 2024 also included $10.8

million of incremental sales from recent acquisitions. The decrease

in operating income was primarily due to lower sales and

unfavorable product mix, including lower industrial automation

imaging systems sales.

Instrumentation

The Instrumentation segment’s third quarter 2024 net sales were

$349.8 million, compared with $329.1 million, an increase of 6.3%.

Operating income was $96.3 million for the third quarter of 2024,

compared with $85.5 million, an increase of 12.6%.

The third quarter of 2024 net sales increase resulted from a

$31.9 million increase in sales of marine instrumentation primarily

due to stronger offshore energy and defense markets, partially

offset by a $7.2 million decrease in sales of electronic test and

measurement instrumentation as well as a $4.0 million decrease in

sales of environmental instrumentation. The third quarter of 2024

also included $7.2 million of incremental sales from recent

acquisitions. The increase in operating income primarily reflected

the impact of higher marine instrumentation sales as well as

favorable marine instrumentation product mix and improved marine

instrumentation margins.

Aerospace and Defense Electronics

The Aerospace and Defense Electronics segment’s third quarter

2024 net sales were $200.2 million, compared with $183.3 million,

an increase of 9.2%. Operating income was $56.3 million for the

third quarter of 2024, compared with $49.4 million, an increase of

14.0%.

The third quarter of 2024 net sales reflected higher sales of

$12.6 million for defense electronics and $4.3 million for

aerospace electronics. The increase in operating income primarily

reflected the impact of higher sales and favorable product mix.

Engineered Systems

The Engineered Systems segment’s third quarter 2024 net sales

were $125.1 million, compared with $114.3 million, an increase of

9.4%. Operating income was $12.9 million for the third quarter of

2024, compared with $10.9 million, an increase of 18.3%.

The third quarter of 2024 net sales reflected higher sales of

$10.2 million for engineered products and $0.6 million for energy

systems. The higher sales for engineered products primarily

reflected increased sales from electronic manufacturing services

products. The increase in operating income was driven primarily by

higher net sales.

Additional Financial Information

Cash Flow

Cash provided by operating activities was $249.8 million for the

third quarter of 2024 compared with $278.2 million, with the

decrease driven primarily by higher income tax payments in the

third quarter of 2024. Depreciation and amortization expense for

both the third quarter of 2024 and 2023 was $76.9 million.

Stock-based compensation expense for the third quarter of 2024 was

$8.7 million compared with $8.0 million.

Capital expenditures for the third quarter of 2024 were $21.1

million compared with $23.0 million. Teledyne received $5.0 million

from the exercise of stock options in the third quarter of 2024

compared with $12.2 million.

During the third quarter of 2024, the Company repurchased

approximately 0.3 million shares for $138.8 million, bringing the

year-to-date repurchases to $332.6 million through the end of

September 2024.

As of September 29, 2024, net debt was $2,237.0 million which is

calculated as total debt of $2,798.0 million, net of cash and cash

equivalents of $561.0 million. As of December 31, 2023, net debt

was $2,596.6 million representing total debt of $3,244.9 million,

net of cash and cash equivalents of $648.3 million.

As of September 29, 2024, $1,171.1 million was available under

the $1.20 billion credit facility, after reductions of $28.9

million in outstanding letters of credit.

Third Quarter

2024

2023

Free Cash Flow

Cash provided by operating activities

$

249.8

$

278.2

Capital expenditures for property, plant

and equipment

(21.1

)

(23.0

)

Free cash flow

$

228.7

$

255.2

Income Taxes

The effective tax rate for the third quarter of 2024 was

negative 2.8%, compared with 19.2%. The third quarter of 2024

reflected net discrete income tax benefits of $62.3 million

compared with $6.1 million, with the third quarter of 2024 benefits

primarily related to the resolution of an uncertain tax position

related to a pre-acquisition FLIR tax matter.

Other

Corporate expense was $18.7 million for the third quarter of

2024 compared with $17.8 million. Non-service retirement benefit

income was $2.8 million for the third quarter of 2024 compared with

$3.1 million. Interest expense, net of interest income, was $15.7

million for the third quarter of 2024 compared with $18.4 million,

with the decrease due to reduced outstanding borrowings compared to

the third quarter of 2023.

Outlook

Based on its current outlook, the company’s management believes

that fourth quarter 2024 GAAP diluted earnings per share will be in

the range of $4.27 to $4.41 and full year 2024 GAAP diluted

earnings per share will be in the range of $17.28 to $17.42. The

company’s management further believes that fourth quarter 2024

non-GAAP diluted earnings per share will be in the range of $5.13

to $5.23 and full year 2024 non-GAAP diluted earnings per share

will be in the range of $19.35 to $19.45. The non-GAAP outlook

excludes acquired intangible asset amortization for all

acquisitions, FLIR integration costs and FLIR acquisition-related

tax matters.

Use of Non-GAAP Financial Measures

We report our financial results in accordance with generally

accepted accounting principles in the United States (“GAAP”). We

supplement the reporting of our financial results determined under

GAAP with certain non-GAAP financial measures. The non-GAAP

financial measures presented provides management, financial

analysts, and investors with additional useful information in

evaluating the performance of the company. The non-GAAP financial

measures should be considered in addition to, and not as a

substitute for, financial measures prepared in accordance with

GAAP. Further details on reasons that we use non-GAAP financial

measures, a reconciliation of these measures to the most directly

comparable GAAP measures, and other information relating to these

measures are included following our GAAP financial statements.

Forward-Looking Statements Cautionary Notice

This earnings release contains forward-looking statements, as

defined in the Private Securities Litigation Reform Act of 1995,

with respect to management’s beliefs about the financial condition,

results of operations, acquisitions and product synergies,

integration costs, tax matters and businesses of Teledyne in the

future. Forward-looking statements involve risks and uncertainties,

are based on the current expectations of the management of Teledyne

and are subject to uncertainty and changes in circumstances.

The forward-looking statements contained herein may include

statements relating to sales, sales growth, stock-based

compensation expense, tax rates, anticipated capital expenditures,

stock repurchases, product developments and other strategic

options. Forward-looking statements generally are accompanied by

words such as “projects”, “intends”, “expects”, “anticipates”,

“targets”, “estimates”, “will” and words of similar import that

convey the uncertainty of future events or outcomes. All statements

made in this communication that are not historical in nature should

be considered forward-looking. By its nature, forward-looking

information is not a guarantee of future performance or results and

involves risks and uncertainties because it relates to events and

depends on circumstances that will occur in the future.

Actual results could differ materially from these

forward-looking statements. Many factors could change anticipated

results, including: changes in relevant tax and other laws; foreign

currency exchange risks; rising interest rates; risks associated

with indebtedness, as well as our ability to reduce indebtedness

and the timing thereof; the impact of semiconductor and other

supply chain shortages; higher inflation, including wage

competition and higher shipping costs; labor shortages and

competition for skilled personnel; the inability to develop and

market new competitive products; inherent uncertainties involved in

the estimates and judgments used in the preparation of financial

statements and the providing of estimates of financial measures, in

accordance with U.S. GAAP and related standards; disruptions in the

global economy; the ongoing conflict in Israel and neighboring

regions, including related protests, attacks on defense contractors

and suppliers and the disruption to global shipping routes; the

ongoing conflict between Russia and Ukraine, including the impact

to energy prices and availability, especially in Europe; customer

and supplier bankruptcies; changes in demand for products sold to

the defense electronics, instrumentation, digital imaging, energy

exploration and production, commercial aviation, semiconductor and

communications markets; funding, continuation and award of

government programs; cuts to defense spending resulting from

existing and future deficit reduction measures or changes to U.S.

and foreign government spending and budget priorities triggered by

inflation, rising interest costs, and economic conditions; impacts

from the United Kingdom’s exit from the European Union;

uncertainties related to the 2024 U.S. Presidential election; the

imposition and expansion of, and responses to, trade sanctions and

tariffs; the continuing review and resolution of FLIR’s trade

compliance and tax matters; escalating economic and diplomatic

tension between China and the United States; threats to the

security of our confidential and proprietary information, including

cybersecurity threats; risks related to artificial intelligence;

natural and man-made disasters, including those related to or

intensified by climate change; and our ability to achieve emission

reduction targets and decrease our carbon footprint. Lower oil and

natural gas prices, as well as instability in the Middle East or

other oil producing regions, and new regulations or restrictions

relating to energy production, including those implemented in

response to climate change, could further negatively affect our

businesses that supply the oil and gas industry. Weakness in the

commercial aerospace industry negatively affects the markets of our

commercial aviation businesses. The recent machinist strike at

Boeing as well as the ongoing issues with Boeing’s 737 MAX product

line could result in manufacturing delays and lower sales of our

products to Boeing. In addition, financial market fluctuations

affect the value of the company’s pension assets. Changes in the

policies of U.S. and foreign governments, including economic

sanctions, could result, over time, in reductions or realignment in

defense or other government spending and further changes in

programs in which the company participates.

While the company’s growth strategy includes possible

acquisitions, we cannot provide any assurance as to when, if or on

what terms any acquisitions will be made. Acquisitions involve

various inherent risks, such as, among others, our ability to

integrate acquired businesses, retain key management and customers

and achieve identified financial and operating synergies. There are

additional risks associated with acquiring, owning and operating

businesses internationally, including those arising from U.S. and

foreign government policy changes or actions and exchange rate

fluctuations.

Additional factors that could cause results to differ materially

from those described above can be found in Teledyne’s Annual Report

on Form 10-K for the year ended December 31, 2023, as well as

subsequent Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K, all of which are on file with the SEC and available in

the “Investors” section of Teledyne’s website, teledyne.com, under

the heading “Investor Information” and in other documents Teledyne

files with the SEC.

All forward-looking statements speak only as of the date they

are made and are based on information available at that time.

Teledyne assumes no obligation to update forward-looking statements

to reflect circumstances or events that occur after the date the

forward-looking statements were made or to reflect the occurrence

of unanticipated events except as required by federal securities

laws. As forward-looking statements involve significant risks and

uncertainties, caution should be exercised against placing undue

reliance on such statements.

A live webcast of Teledyne’s third quarter earnings conference

call will be held at 11:00 a.m. (Eastern) on Wednesday, October 23,

2024. To access the call, go to

www.teledyne.com/investors/events-and-presentations approximately

ten minutes before the scheduled start time. A replay will also be

available for one month starting at 12:00 p.m. (Eastern) on

Wednesday, October 23, 2024.

TELEDYNE TECHNOLOGIES

INCORPORATED

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

FOR THE THIRD QUARTER AND NINE

MONTHS ENDED

SEPTEMBER 29, 2024 AND OCTOBER

1, 2023

(Unaudited - in millions, except

per share amounts)

Third Quarter

Third Quarter

Nine

Months

Nine

Months

2024

2023

2024

2023

Net sales

$

1,443.5

$

1,402.5

$

4,167.7

$

4,210.5

Costs and expenses:

Costs of sales

823.9

797.2

2,375.6

2,394.2

Selling, general and administrative

299.1

291.9

891.8

905.3

Acquired intangible asset amortization

49.8

49.1

148.3

148.1

Total costs and expenses

1,172.8

1,138.2

3,415.7

3,447.6

Operating income (loss)

270.7

264.3

752.0

762.9

Interest and debt income (expense),

net

(15.7

)

(18.4

)

(44.2

)

(61.7

)

Gain (loss) on debt extinguishment

—

—

—

1.6

Non-service retirement benefit income

(expense), net

2.8

3.1

8.2

9.3

Other income (expense), net

(2.7

)

(2.9

)

(3.7

)

(7.4

)

Income (loss) before income taxes

255.1

246.1

712.3

704.7

Provision (benefit) for income taxes

(a)

(7.1

)

47.3

90.7

141.6

Net income (loss) including noncontrolling

interest

262.2

198.8

621.6

563.1

Less: Net income (loss) attributable to

noncontrolling interest

0.2

0.2

0.9

0.5

Net income (loss) attributable to

Teledyne

$

262.0

$

198.6

$

620.7

$

562.6

Diluted earnings per common share

$

5.54

$

4.15

$

13.01

$

11.75

Weighted average diluted common shares

outstanding

47.3

47.9

47.7

47.9

(a)

The third quarter of 2024 includes net

discrete income tax benefits of $62.3 million and the first nine

months of 2024 includes net discrete income tax benefits of $67.4

million. The third quarter of 2023 includes net discrete income tax

benefits of $6.1 million and the first nine months of 2023 includes

net discrete income tax benefits of $14.1 million.

This condensed consolidated financial

statement was prepared in accordance with U.S. GAAP

TELEDYNE TECHNOLOGIES

INCORPORATED

SUMMARY OF SEGMENT NET SALES

AND OPERATING INCOME

FOR THE THIRD QUARTER AND NINE

MONTHS ENDED

SEPTEMBER 29, 2024 AND OCTOBER

1, 2023

(Unaudited - $ in millions)

Third Quarter

Third Quarter

% Change

Nine

Months

Nine

Months

% Change

2024

2023

2024

2023

Net sales:

Digital Imaging

$

768.4

$

775.8

(1.0

)%

$

2,248.6

$

2,341.6

(4.0

)%

Instrumentation

349.8

329.1

6.3

%

1,013.7

991.0

2.3

%

Aerospace and Defense Electronics

200.2

183.3

9.2

%

580.3

542.5

7.0

%

Engineered Systems

125.1

114.3

9.4

%

325.1

335.4

(3.1

)%

Total net sales

$

1,443.5

$

1,402.5

2.9

%

$

4,167.7

$

4,210.5

(1.0

)%

Operating income (loss):

Digital Imaging

$

123.9

$

136.3

(9.1

)%

$

351.2

$

383.1

(8.3

)%

Instrumentation

96.3

85.5

12.6

%

269.5

247.6

8.8

%

Aerospace and Defense Electronics

56.3

49.4

14.0

%

165.3

149.6

10.5

%

Engineered Systems

12.9

10.9

18.3

%

23.1

32.4

(28.7

)%

Corporate expense

(18.7

)

(17.8

)

5.1

%

(57.1

)

(49.8

)

14.7

%

Operating income (loss)

270.7

264.3

2.4

%

752.0

762.9

(1.4

)%

Interest and debt income (expense),

net

(15.7

)

(18.4

)

(14.7

)%

(44.2

)

(61.7

)

(28.4

)%

Gain (loss) on debt extinguishment

—

—

—

%

—

1.6

(100.0

)%

Non-service retirement benefit income

(expense), net

2.8

3.1

(9.7

)%

8.2

9.3

(11.8

)%

Other income (expense), net

(2.7

)

(2.9

)

(6.9

)%

(3.7

)

(7.4

)

(50.0

)%

Income (loss) before income taxes

255.1

246.1

3.7

%

712.3

704.7

1.1

%

Provision (benefit) for income taxes

(a)

(7.1

)

47.3

(115.0

)%

90.7

141.6

(35.9

)%

Net income (loss) including noncontrolling

interest

262.2

198.8

31.9

%

621.6

563.1

10.4

%

Less: Net income (loss) attributable to

noncontrolling interest

0.2

0.2

—

%

0.9

0.5

80.0

%

Net income (loss) attributable to

Teledyne

$

262.0

$

198.6

31.9

%

$

620.7

$

562.6

10.3

(a)

The third quarter of 2024 includes net

discrete income tax benefits of $62.3 million and the first nine

months of 2024 includes net discrete income tax benefits of $67.4

million. The third quarter of 2023 includes net discrete income tax

benefits of $6.1 million and the first nine months of 2023 includes

net discrete income tax benefits of $14.1 million.

This condensed consolidated financial

statement was prepared in accordance with U.S. GAAP.

TELEDYNE TECHNOLOGIES

INCORPORATED

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited – in millions)

September 29, 2024

December 31, 2023

ASSETS

Cash and cash equivalents

$

561.0

$

648.3

Accounts receivable and unbilled

receivables, net

1,261.1

1,202.1

Inventories, net

964.8

917.7

Prepaid expenses and other current

assets

203.3

213.3

Total current assets

2,990.2

2,981.4

Property, plant and equipment, net

758.3

777.0

Goodwill and acquired intangible assets,

net

10,279.3

10,280.9

Prepaid pension assets

215.6

203.3

Other assets, net

287.5

285.3

Total assets

$

14,530.9

$

14,527.9

LIABILITIES AND EQUITY

Accounts payable

$

445.7

$

384.7

Accrued liabilities

900.6

781.3

Current portion of long-term debt

150.1

600.1

Total current liabilities

1,496.4

1,766.1

Long-term debt, net of current portion

2,647.9

2,644.8

Other long-term liabilities

786.9

891.2

Total liabilities

4,931.2

5,302.1

Redeemable noncontrolling interest

5.5

4.6

Total stockholders’ equity

9,594.2

9,221.2

Total liabilities and equity

$

14,530.9

$

14,527.9

This condensed consolidated financial

statement was prepared in accordance with U.S. GAAP.

TELEDYNE TECHNOLOGIES

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

FOR THE THIRD QUARTER AND NINE

MONTHS ENDED

SEPTEMBER 29, 2024 AND OCTOBER

1, 2023

(Unaudited - $ in millions,

except per share amounts)

Third Quarter 2024

Third Quarter 2023

Income (loss) before income

taxes

Net (loss) income attributable

to Teledyne

Diluted earnings per common

share

Income (loss) before income

taxes

Net (loss) income attributable

to Teledyne

Diluted earnings per common

share

GAAP

$

255.1

$

262.0

$

5.54

$

246.1

$

198.6

$

4.15

Adjusted for specified items:

FLIR integration costs

3.7

2.8

0.06

5.8

4.5

0.09

Acquired intangible asset amortization

49.8

38.2

0.80

49.1

37.8

0.79

FLIR acquisition-related tax matters

—

(61.7

)

(1.30

)

—

1.0

0.02

Non-GAAP

$

308.6

$

241.3

$

5.10

$

301.0

$

241.9

$

5.05

Nine Months 2024

Nine Months 2023

Income (loss) before income

taxes

Net (loss) income attributable

to Teledyne

Diluted earnings per common

share

Income (loss) before income

taxes

Net (loss) income attributable

to Teledyne

Diluted earnings per common

share

GAAP

$

712.3

$

620.7

$

13.01

$

704.7

$

562.6

$

11.75

Adjusted for specified items:

FLIR integration costs

6.9

5.3

0.11

5.8

4.5

0.09

Acquired intangible asset amortization

148.3

113.5

2.38

148.1

114.0

2.37

FLIR acquisition-related tax matters

—

(61.2

)

(1.28

)

—

1.7

0.04

Non-GAAP

$

867.5

$

678.3

$

14.22

$

858.6

$

682.8

$

14.25

Third Quarter 2024

Third Quarter 2023

Operating income

(loss)

Operating margin

Operating income

(loss)

Operating margin

GAAP

$

270.7

18.8

%

$

264.3

18.8

%

Adjusted for specified items:

FLIR integration costs

3.7

5.8

Acquired intangible asset amortization

49.8

49.1

Non-GAAP

$

324.2

22.5

%

$

319.2

22.8

%

Nine Months 2024

Nine Months 2023

Operating income

(loss)

Operating margin

Operating income

(loss)

Operating margin

GAAP

$

752.0

18.0

%

$

762.9

18.1

%

Adjusted for specified items:

FLIR integration costs

6.9

5.8

Acquired intangible asset amortization

148.3

148.1

Non-GAAP

$

907.2

21.8

%

$

916.8

21.8

%

TELEDYNE TECHNOLOGIES

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(Unaudited - in millions)

Third Quarter 2024

GAAP Operating Income

(loss)

Acquired intangible asset

amortization

FLIR integration costs

Non-GAAP Operating Income

(loss)

Digital Imaging

$

123.9

$

46.0

$

3.7

$

173.6

Instrumentation

96.3

3.6

—

99.9

Aerospace and Defense Electronics

56.3

0.2

—

56.5

Engineered Systems

12.9

—

—

12.9

Corporate expense

(18.7

)

—

—

(18.7

)

Total

$

270.7

$

49.8

$

3.7

$

324.2

Third Quarter 2023

GAAP Operating Income

(loss)

Acquired intangible asset

amortization

FLIR integration costs

Non-GAAP Operating Income

(loss)

Digital Imaging

$

136.3

$

45.4

$

5.8

$

187.5

Instrumentation

85.5

3.5

—

89.0

Aerospace and Defense Electronics

49.4

0.2

—

49.6

Engineered Systems

10.9

—

—

10.9

Corporate expense

(17.8

)

—

—

(17.8

)

Total

$

264.3

$

49.1

$

5.8

$

319.2

Nine Months 2024

GAAP Operating Income

(loss)

Acquired intangible asset

amortization

FLIR integration costs

Non-GAAP Operating Income

(loss)

Digital Imaging

$

351.2

$

137.2

$

6.9

$

495.3

Instrumentation

269.5

10.5

—

280.0

Aerospace and Defense Electronics

165.3

0.6

—

165.9

Engineered Systems

23.1

—

—

23.1

Corporate expense

(57.1

)

—

—

(57.1

)

Total

$

752.0

$

148.3

$

6.9

$

907.2

Nine Months 2023

GAAP Operating Income

(loss)

Acquired intangible asset

amortization

FLIR integration costs

Non-GAAP Operating Income

(loss)

Digital Imaging

$

383.1

$

136.8

$

5.8

$

525.7

Instrumentation

247.6

10.7

—

258.3

Aerospace and Defense Electronics

149.6

0.6

—

150.2

Engineered Systems

32.4

—

—

32.4

Corporate expense

(49.8

)

—

—

(49.8

)

Total

$

762.9

$

148.1

$

5.8

$

916.8

TELEDYNE TECHNOLOGIES

INCORPORATED

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(Unaudited - in millions, except

per share amounts)

September 29, 2024

December 31, 2023

Current portion of long-term debt

$

150.1

$

600.1

Long-term debt

2,647.9

2,644.8

Total debt - non-GAAP

2,798.0

3,244.9

Less cash and cash equivalents

(561.0

)

(648.3

)

Net debt - non-GAAP

$

2,237.0

$

2,596.6

Fourth Quarter 2024

Twelve Months 2024

Low

High

Low

High

GAAP Diluted Earnings Per Common Share

Outlook

$

4.27

$

4.41

$

17.28

$

17.42

Adjusted for specified items:

FLIR integration costs

$

0.04

$

0.02

$

0.15

$

0.13

Acquired intangible asset amortization

$

0.82

$

0.80

$

3.20

$

3.18

FLIR acquisition-related tax matters

$

—

$

—

$

(1.28

)

$

(1.28

)

Non-GAAP Diluted Earnings Per Common

Share Outlook

$

5.13

$

5.23

$

19.35

$

19.45

Explanation of Non-GAAP Financial Measures

We report our financial results in accordance with GAAP.

However, management believes that, in order to more fully

understand our short-term and long-term financial and operational

trends, and to aid in comparability with our competitors, investors

and financial analysts may wish to consider the impact of certain

items resulting from our acquisitions which have an infrequent or

non-recurring impact on operations or assist in understanding our

operations pre-acquisition. Accordingly, we present non-GAAP

financial measures as a supplement to the financial measures we

present in accordance with GAAP. These non-GAAP financial measures

provide management, investors and financial analysts with

additional means to understand and evaluate the operating results

and trends in our ongoing business by adjusting for certain

expenses and benefits. Management believes these non-GAAP financial

measures also provide additional means of evaluating

period-over-period operating performance. In addition, management

understands that some investors and financial analysts find this

information helpful in analyzing our financial and operational

performance and comparing this performance to our peers and

competitors. The company’s diluted earnings per common share

outlook guidance is also presented on a non-GAAP basis.

The non-GAAP financial measures are not meant to be considered

superior to, or a substitute for, our financial statements prepared

in accordance with GAAP. There are material limitations associated

with non-GAAP financial measures because they exclude charges that

have an effect on our reported results and, therefore, should not

be relied upon as the sole financial measures by which to evaluate

our financial results. Management compensates and believes that

investors should compensate for these limitations by viewing the

non-GAAP financial measures in conjunction with the GAAP financial

measures. In addition, the non-GAAP financial measures included in

this earnings announcement may be different from, and therefore may

not be comparable to, similar measures used by other companies. The

non-GAAP financial measures are also used by our management to

evaluate our operating performance and benchmark our results

against our historical performance and the performance of our

peers.

Our non-GAAP measures are as follows:

Non-GAAP income before income taxes, net income and diluted

earnings per common share

These non-GAAP measures provided a supplemental view of income

before taxes, net income, and diluted earnings per common share.

These non-GAAP measures exclude certain FLIR acquisition

integration-related costs, acquired intangible asset amortization,

the remeasurement of deferred taxes related to acquired intangible

assets due to changes in tax laws, and the tax benefits or costs

related to the settlement or other resolution of the FLIR tax

reserves. We also adjust for any post-acquisition interest on

certain income tax reserves related to FLIR. We adjust for any

income tax impact related to these items to take into account the

tax treatment and related tax rate and changes in tax rates that

apply to each adjustment in the applicable tax jurisdiction.

Generally, this results in the tax impact at the U.S. marginal tax

rate for certain adjustments, including the majority of

amortization of intangible assets, whereas the tax impact of other

adjustments, including transaction expenses, depend on whether the

amounts are deductible in the respective tax jurisdictions and the

applicable tax rates in those jurisdictions. We believe these

measures provide investors and management with additional means to

understand and evaluate the operating results of our business by

adjusting for certain expenses and benefits and present an

alternative view of our performance compared to prior periods.

Non-GAAP operating income and operating margin

We define non-GAAP operating margin as non-GAAP operating income

divided by net sales. These non-GAAP measures exclude certain FLIR

acquisition integration-related costs and acquired intangible asset

amortization. We believe these measures provide investors and

management with additional means to understand and evaluate the

operating results of our business by adjusting for certain expenses

and other items and present an alternative view of our performance

compared to prior periods.

Non-GAAP total debt and net debt

We define non-GAAP total debt as the sum of current portion of

long-term debt and other debt and long-term debt. We define net

debt as the difference between non-GAAP total debt less cash and

cash equivalents. The company believes that this non-GAAP

information is useful to assist investors and management in

analyzing the company’s liquidity.

Non-GAAP diluted earnings per common share outlook

These non-GAAP measures represent our earnings per common share

outlook for the third quarter of 2024 and total year 2024 on a

fully diluted basis, excluding certain FLIR integration costs,

acquired intangible asset amortization for all acquisitions and

FLIR acquisition-related tax matters.

Non-GAAP cash provided by operations and free cash

flow

We define free cash flow as cash provided by operating

activities (a measure prescribed by GAAP) less capital expenditures

for property, plant and equipment. We believe that this non-GAAP

information is useful to assist management and the investment

community in analyzing the company’s ability to generate cash

flow.

Non-GAAP line items used in tables

Management excludes the effect of each of the acquisition

related items identified below to arrive at the applicable non-GAAP

financial measure referenced in the tables for the reasons set

forth below with respect to that item:

- Acquired intangible asset

amortization – We believe that excluding the amortization of

acquired intangible assets, which primarily represents purchased

technology and customer relationships, as well as purchase order

and contract backlog, provides an alternative way for investors to

compare our operations pre-acquisition to those post-acquisition

and to those of our competitors that have pursued internal growth

strategies. However, we note that companies that grow internally

will incur costs to develop intangible assets that will be expensed

in the period incurred, which may make a direct comparison more

difficult.

- FLIR integration costs – Included

in our GAAP presentation of cost of sales and selling, general and

administrative expenses are expenses (or benefits) incurred in

connection with further integration-related costs related to the

FLIR acquisition such as facility consolidation costs, facility

lease impairments and employee separation costs. We exclude these

costs from our non-GAAP measures because we believe it does not

reflect our ongoing financial performance.

- FLIR acquisition-related tax

matters – Included in our tax provision is post-acquisition

interest on certain income tax reserves related to FLIR, as well as

the tax benefits or costs related to the settlement or other

resolution of the FLIR tax reserves. We exclude these impacts from

our non-GAAP measures because we believe it does not reflect our

ongoing financial performance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023909530/en/

Jason VanWees (805) 373-4542

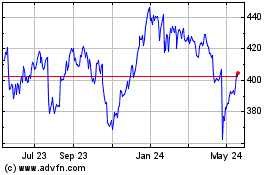

Teledyne Technologies (NYSE:TDY)

Historical Stock Chart

From Dec 2024 to Jan 2025

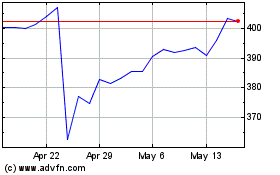

Teledyne Technologies (NYSE:TDY)

Historical Stock Chart

From Jan 2024 to Jan 2025