Teledyne Technologies Incorporated (NYSE:TDY) (“Teledyne”) and

Micropac Industries, Inc. (OTC:MPAD) (“Micropac”) jointly announced

today that they have entered into a definitive merger agreement

that provides for the merger of Micropac with a wholly-owned

subsidiary of Teledyne. Pursuant to the terms of the merger

agreement, Teledyne will acquire all of the issued and outstanding

common shares of Micropac for $20.00 per share payable in cash,

without interest and subject to required withholding taxes. The

all-cash transaction values Micropac at approximately $57.3

million, taking into account Micropac’s net debt as of August 24,

2024.

The transaction was unanimously approved by the Boards of

Directors of Teledyne and Micropac, acting upon the recommendation

of a special committee established by Micropac’s Board and

comprised of independent directors. Stockholders of Micropac

holding approximately 75% of the outstanding shares of common stock

have approved the merger agreement by written consent, and the

transaction is expected to close by the end of 2024, subject to

customary closing conditions.

Micropac, founded in 1963, designs and manufactures

microelectronic circuits, optoelectronic components, and sensor and

display assemblies, primarily for military, aerospace, and medical

applications.

“We will be delighted to welcome Micropac and its employees to

the Teledyne family,” said Robert Mehrabian, Executive Chairman of

Teledyne. “Micropac’s products are complementary to our own, and we

serve common customers in defense, space and healthcare

markets.”

“Micropac is proud to be joining Teledyne, and we view the

combination as a natural next step in Micropac’s evolution,” said

Mark King, Chairman, President and Chief Executive Officer of

Micropac. “We are looking forward to leveraging Teledyne’s

additional market reach and technical capabilities, while

maintaining the Micropac name and continuing to operate from our

new state-of-the-art facility in Garland, Texas.”

Mesirow Financial, Inc. is acting as financial advisor to

Micropac, and Haynes and Boone, LLP is serving as legal counsel to

Micropac. McGuireWoods LLP is serving as legal counsel to

Teledyne.

About Teledyne

Teledyne is a leading provider of sophisticated digital imaging

products and software, instrumentation, aerospace and defense

electronics, and engineered systems. Teledyne’s operations are

primarily located in the United States, Canada, the United Kingdom,

and Western and Northern Europe. For more information, visit

Teledyne’s website at www.teledyne.com.

About Micropac

Founded in 1963, Micropac is a diversified, high technology

company located in Garland, Texas, specializing in high reliability

microcircuit products and electronic assemblies, power products,

sensors, displays, optical data transport products and

optoelectronic components and assemblies. Micropac develops and

manufactures complete custom designs to meet specific customer

applications and requirements. Our products are being used

throughout the world in a wide variety of military/aerospace,

space, medical and industrial applications. Visit www.micropac.com

for more information.

Additional Information and Where to Find It

In connection with the proposed acquisition, Micropac intends to

file relevant materials with the SEC, including Micropac’s

information statement in preliminary and definitive form. Micropac

stockholders are strongly advised to read all relevant documents

filed with the SEC, including Micropac’s information statement,

because they will contain important information about the proposed

transaction. These documents will be available at no charge on the

SEC’s website at www.sec.gov. In addition, documents will also be

available for free from Micropac by contacting its investor

relations department at +1.972.272.3571.

Cautionary Statement Regarding Forward Looking

Statements

This release contains forward-looking statements, as defined in

the Private Securities Litigation Reform Act of 1995, with respect

to management’s beliefs about the financial condition, results of

operations and businesses of Teledyne and Micropac in the future.

Forward-looking statements involve risks and uncertainties, are

based on the current expectations of the management of Teledyne and

Micropac and are subject to uncertainty and changes in

circumstances. The forward-looking statements contained herein may

include statements about the expected effects of Teledyne’s

proposed acquisition of Micropac, the anticipated timing and scope

of the proposed transaction and anticipated synergies related to

the proposed transaction, and other strategic options.

Forward-looking statements generally are accompanied by words such

as “projects”, “intends”, “expects”, “anticipates”, “targets”,

“estimates”, “will” and words of similar import that convey the

uncertainty of future events or outcomes. All statements made in

this communication that are not historical in nature should be

considered forward-looking. By its nature, forward-looking

information is not a guarantee of future performance or results and

involves risks and uncertainties because it relates to events and

depends on circumstances that will occur in the future.

Actual results could differ materially from these

forward-looking statements. Many factors could change anticipated

results, including the occurrence of any event, change or other

circumstances that could give rise to the right of Teledyne or

Micropac or both to terminate the merger agreement; the outcome of

any legal proceedings that may be instituted against Teledyne or

Micropac in connection with the merger agreement; the failure to

satisfy any of the conditions to the proposed transaction on a

timely basis or at all; the inability to complete the acquisition

and integration of Micropac successfully, to retain customers and

key employees and to achieve operating synergies, including the

possibility that the anticipated benefits of the proposed

transaction are not realized when expected or at all, including as

a result of the impact of, or problems arising from, the

integration of the two companies or as a result of the strength of

the economy and competitive factors in the areas where Teledyne and

Micropac do business; the possibility that the proposed transaction

may be more expensive to complete than anticipated, including as a

result of unexpected factors or events; the parties’ ability to

meet expectations regarding the timing, completion and accounting

and tax treatments of the proposed transaction; changes in relevant

tax and other laws; the inability to develop and market new

competitive products; inherent uncertainties involved in the

estimates and judgments used in the preparation of financial

statements and the providing of estimates of financial measures, in

accordance with U.S. GAAP and related standards; and operating

results of Micropac being lower than anticipated.

Additional factors that could cause results to differ materially

from those described above can be found in Teledyne’s Annual Report

on Form 10-K for the year ended December 31, 2023, and its

Quarterly Reports on Form 10-Q for the periods ended March 31, June

30 and September 29, 2024, all of which are on file with the SEC

and available in the “Investors” section of Teledyne’s website,

teledyne.com, under the heading “Investor Information” and in other

documents Teledyne files with the SEC, and in Micropac’s Annual

Report on Form 10-K for the year ended November 30, 2023, and its

Quarterly Reports on Form 10-Q for the periods ended February 24,

May 25 and August 24, 2024, all of which are on file with the SEC

and in other documents Micropac files with the SEC.

All forward-looking statements speak only as of the date they

are made and are based on information available at that time.

Neither Teledyne nor Micropac assumes any obligation to update

forward-looking statements to reflect circumstances or events that

occur after the date the forward-looking statements were made or to

reflect the occurrence of unanticipated events except as required

by federal securities laws. As forward-looking statements involve

significant risks and uncertainties, caution should be exercised

against placing undue reliance on such statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104687195/en/

Jason VanWees +1.805.373.4542

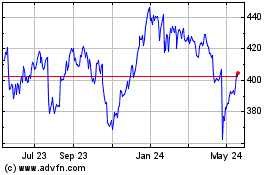

Teledyne Technologies (NYSE:TDY)

Historical Stock Chart

From Dec 2024 to Jan 2025

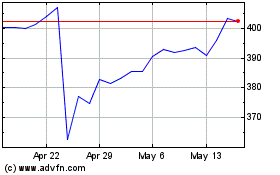

Teledyne Technologies (NYSE:TDY)

Historical Stock Chart

From Jan 2024 to Jan 2025