SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or

13(e)(1)

of the Securities Exchange Act of 1934

H&E EQUIPMENT SERVICES, INC.

(Name of Subject Company (Issuer))

UR MERGER SUB VII CORPORATION

a wholly owned subsidiary of

UNITED RENTALS (NORTH AMERICA), INC.

a wholly owned subsidiary of

UNITED RENTALS, INC.

(Names of Filing Persons (Offerors))

Common Stock, par value $0.01 per share

(Title of Class of Securities)

404030108

(CUSIP Number of Class of Securities)

Joli Gross

UR Merger Sub VII Corporation

100 Stamford Place, Suite 700

Stamford, CT 06902

(203)-618-7342

(Name, address and telephone number of person authorized

to receive notices and communications on behalf of the filing person)

With a copy to:

Francis J. Aquila

Sullivan & Cromwell LLP

125 Broad Street

New

York, NY 10004

(212) 558-4000

CALCULATION OF FILING FEE

| Transaction Valuation* |

|

Amount of Filing Fee* |

| N/A |

|

N/A |

| * |

Pursuant to General Instruction D to Schedule TO, a filing fee is not required in connection with this filing as it relates solely to preliminary communications made before the commencement of a tender offer. |

¨ Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and

identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number,

or the Form or Schedule and the date of its filing.

| Amount Previously Paid: |

|

Not applicable |

|

|

|

Filing Party: |

|

Not applicable |

| |

|

|

|

|

| Form of Registration No. |

|

Not applicable |

|

|

|

Date Filed: |

|

Not applicable |

| x |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| x |

third-party tender offer subject to Rule 14d-1. |

| ¨ |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing

is a final amendment reporting the results of the tender offer: ¨

This filing relates solely to preliminary communications made before

the commencement of a tender offer for the outstanding shares of Common Stock, par value $0.01 per share, of H&E Equipment Services, Inc.

(“H&E”) by UR Merger Sub VII Corporation (“Merger Sub”), a wholly owned subsidiary of United Rentals (North

America), Inc. (“URNA”), which is a wholly owned subsidiary of United Rentals, Inc. (“URI”).

Additional Information

This communication is for information purposes only and not intended

to be a recommendation to buy, sell or hold securities and does not constitute an offer for the sale of, or the solicitation of an offer

to buy, securities in any jurisdiction, including the United States. Any such offer will only be made by means of a prospectus or offering

memorandum, and in compliance with applicable securities laws. At the time the tender offer is commenced, we will file, or will cause

to be filed, tender offer materials on Schedule TO with the SEC and H&E will file a Solicitation/Recommendation Statement on Schedule

14D-9 with the SEC, in each case with respect to the tender offer. The tender offer materials (including an offer to purchase, a related

letter of transmittal and other offer documents) and the solicitation/recommendation statement, as they may be amended from time to time,

will contain important information that should be read carefully when they become available and considered before any decision is made

with respect to the tender offer. Those materials and all other documents filed by, or caused to be filed by, URI and H&E with the

SEC will be available at no charge on the SEC’s website at www.sec.gov. The tender offer materials and related materials also may

be obtained for free (when available) under the “Financials—SEC Filings” section of our investor website at https://investors.unitedrentals.com/,

and the Solicitation/Recommendation Statement and such other documents also may be obtained for free (when available) from H&E under

the “Financial Information—SEC Filings” section of H&E’s investor website at https://investor.he-equipment.com/.

Item 12. Exhibits

Exhibit 99.1

Acquisition of H and E Equipment Services by United Rentals Call

Operator

Hello, and welcome to the H&E

Acquisition Call. Please be advised that this call is

being recorded. Before we begin,

please note that the tender offer has not yet commenced and none of the comments made on today's call is an offer to purchase or a solicitation

of an offer to sell securities or a recommendation to buy, sell, or hold securities. Once the tender offer is commenced, United Rentals

and H&E will make certain filings with the SEC. The filings will contain important information that should be read and considered

carefully before any decision is made with respect to the tender offer. The filings will be available at no charge on the SEC's website

and on the websites of United Rentals and H&E.

In addition, note that comments

made on today's call and responses to your questions contain forward-looking statements. The transaction being discussed today is subject

to a variety of risks and uncertainties, which should be considered carefully. A summary of these uncertainties is included in the safe

harbor statement contained in the investor presentation and press release related to the transaction.

Please note that United Rentals

has no obligation and makes no commitment to update or publicly release any revisions to forward-looking statements in order to reflect

new information or subsequent events or changes in expectations. You should also note that today's call may include references to non-GAAP

terms such as adjusted EBITDA. Please refer to the back of the investor presentation to see the reconciliation from H&E's adjusted

EBITDA to net income.

Speaking today for United Rentals

is Matt Flannery, President and Chief Executive Officer; and Ted Grace, Chief Financial Officer. Today, for H&E is Brad Barber, Chief

Executive Officer of H&E.

I will now turn the call over

to Mr.Flannery. Mr.Flannery, you may begin.

Matthew J. Flannery

Thank you, operator, and good

morning, everyone. Thank you all for joining us on such short notice as we discuss today's announcement to acquire H&E in more detail.

And I have Ted here with me to review the transaction and to answer any questions you might have, and we have Brad Barber, the CEO of

H&E, on the line with us as well.

So, I'll start with a few high-level

remarks and then Ted will discuss the financials behind the transaction. Brad will say a few words and then we'll move on to Q&A,

which we want to keep solely focused on this transaction. Hopefully by now, you've had a chance to review both the press release and

the investor presentation, which laid out the compelling strategic and financial rationale for the deal. The opportunity to acquire H&E,

a company we've long respected, checks all three boxes we require when evaluating M&A: strategic; financial; and cultural.

Beyond adding important capacity that

will support our long-term growth potential, the deal provides compelling returns for our shareholders. And as you've heard me say many

times, growing the core is a key component of our strategy, and H&E will help us accelerate our growth more quickly than we could

achieve organically. Their footprint, customer base, and fleet are complementary to ours in many ways. The addition of H&E not only

enhances our core competencies in the construction and industrial sectors, but it also expands our capacity in key geographies.

Importantly, H&E's historically

GenRent focus will provide us the opportunity to drive cross-selling of our specialty offering, therefore providing significant revenue

synergies. As you've heard me discuss before, offering a one-stop shop across both GenRent and specialty is attractive to customers and

a key aspect of our value proposition.

Financially, we'll generate significant

free cash flow from the deal in year one, while the transaction should also be accretive to our earnings, revenue, and EBITDA, as we

put our M&A playbook to work and leverage approximately $130 million of cost synergies.

Additionally, we intend to quickly deleverage

the balance sheet towards the midpoint of our current targeted leverage range. And as such, we're pausing our share repurchases

consistent with what we've historically done with other large deals. And finally, and just as importantly, culturally, we both share

the same priorities. H&E is a well-known rental provider that's been around for many years. And over that time, I have no doubt

that many of you have spent time with their team and visited their branches and appreciate the compatibility of these two companies.

And this is a key aspect of long-term value creation, as we strive towards the same goal of supporting customers to drive profitable

growth.

Safety and serving the customer are

key tenets of H&E's DNA, just as they are for United. These seasoned operators will be an asset to our combined customer base,

and we look very forward to welcoming the H&E team to the United Rentals family.

In conclusion, we're very excited

about this deal and the opportunity to add roughly 160 new locations in over 30 states, and most importantly, welcoming 2,900 new employees

to team United. Large M&A is one of our core competencies, and this is another example of where we think we can help a business grow

profitably and create more shareholder value.

Ted, over to you.

William Ted Grace

Thanks, Matt, and good morning,

everyone. As Matt just said, we're really excited about this combination. He just walked through the two most important strategic considerations:

first, augmenting our ability to be the partner of choice for our customers; and secondly, providing important capacity to support our

long-term growth goals. So, I'll focus my comments on the financial highlights.

As you saw in our press release,

we've agreed to pay $92 per share for H&E. This translates to an aggregate purchase price of about $4.8 billion, including $1.4 billion

of net debt. Nominally, this translates to 6.9x LTM adjusted EBITDA of $696 million as of September. Adjusted for the $130 million of

cost synergies and $54 million of present value tax benefits, however, this translates to an adjusted multiple of 5.8x LTM adjusted EBITDA.

Beyond the cost synergies, we

also expect to realize other value streams, including cross-selling revenue benefits, which we currently estimate at $120 million by

year three, and fleet purchasing benefits. While the latter won't really impact EBITDA, our estimated 5% purchasing advantage will benefit

rental CapEx, capital intensity, and free cash flow.

Most importantly, looking at

the deal from a risk-adjusted returns perspective, we think this is a very attractive opportunity to put roughly $5 billion of capital

to work to benefit our shareholders. Looking at cash-on-cash returns, which as you know, is our preferred method for evaluating acquisitions,

our base model points to an IRR of better than 15% and an NPV of about $1.1 billion.

From an IRR perspective, I'll

note this is well above our cost of capital and consistent with the other large GenRent deals we've done, including BlueLine, Neff, and

NES.

As we also highlighted in the

press release, we expect the deal to be accretive to both EPS and free cash flow in year one. On a related note -- our note -- sorry,

our plan is to issue standalone guidance later this month and then update guidance after we close, which is currently expected to be

in late Q1. A few other points I'll make quickly.

On the funding side, while we

have a committed bridge facility that ensures sufficient liquidity to close a deal, our plan is to fund the deal through a pretty straightforward

combination of new debts and ABL capacity.

Looking at the balance sheet,

our proforma leverage ratio will be about 2.3x, which is to say comfortably within our targeted range of 1.5x to 2.5x. That said, our

intent is to focus on deleveraging after we close. Consistent with prior deals, we will be pausing our share repurchase plan and rechanneling

cash with the goal of reducing our leverage to around 2x within 12 months of closing.

Importantly, this will not impact

our dividend or our dividend policy, which we continue to view as a critical part of our capital allocation strategy. Combined, these

steps reflect our continued commitment to a smart and disciplined capital allocation strategy that we believe will continue to unlock

value for our shareholders.

Finally, on the mechanical side

of things, I'll mention that we expect to launch our tender for H&E shares within 10 business days. We are targeting to close

by the end of Q1 2025, and we plan to report our fourth quarter results on January 29th and

host our call on January 30th.

So, with that, let me hand the

call over to Brad, after which we'll go to Q&A. Brad?

Bradley W. Barber

Thank you, Ted. Good morning,

all.

Matt and Ted, I want to

thank you both for offering me the opportunity to join you on this morning's call. On behalf of our outstanding employee base here at

H&E and our investors, this is an exciting time, and we look forward to seeing this win-win opportunity through the finalization

of the acquisition.

So, at this point, I'm going

to turn it back to you guys, and I guess, we'll open up to Q&A, but thank you again so much for having us and welcoming the H&E

team to your organization.

Matthew J. Flannery

Great. Thanks, Brad. Operator,

you can open it up to Q&A.

Questions And Answers Operator

(Question And Answer)

The floor is now open for your

questions. (Operator Instructions) Our first question will come from David Raso with Evercore ISI. Please go ahead.

Q - David Raso

Hi. Thank you for taking my question.

I mean, the deal, I think, pretty clearly has solid merits financially for URI, but I'm curious how you see the mix of H&E's

customers, their end markets, how that maybe changes your, let's call it, medium-term organic growth profile. The spirit of the question,

of course is, we're still seeing relatively solid trends in megaprojects, national account-driven business. But there's more uncertainty

around general construction trends just given the rising interest rates. So, I'm just curious how this combination you think impacts

your organic growth profile over the medium term, and I'd also be curious how maybe it impacts your thoughts on CapEx? Thank you.

A- Matthew J. Flannery

Great. Thanks, David. So,

when we think about H&E, right, we're talking about a quality company here. So, whenever we do an overlapping deal, and

specifically in GenRent, where we have a pretty robust footprint, you're really adding capacity. Well, this is

quality capacity. So, when we're thinking about the three ways in which you get capacity of people, fleet, and facilities, we're

very, very pleased and happy to be able to get this opportunity. That capacity is going to not just only fill the customer base at

H&E serving, but these are very fungible assets that are alike in brand and a very consistent fleet profile with what we

purchased, and it's a little bit on the younger side compared to the rest of the industry. So, we view this as an opportunity to

continue to serve the customers at H&E serving, as well as have capacity to continue to serve our customer base.

And there's not as much

differentiation here as one would think. I mean, sometimes people homogenize the local market. I'm going to let Brad speak to it,

but they're not out there serving a man in a truck or a homeowner on the weekends. They're serving the largest mechanical

contractors, steel erectors that are in our industry. We may have a little bit heavier national account base. Certainly, we should

because of our footprint and the breadth of our offering, but not terribly different in the way we go to

market from that perspective. So, we feel good about this opportunity.

From a CapEx perspective, it really

depends on as we go through the execution of the actual integration. We always model in some revenue attrition. Whether that revenue

attrition hits the 15% that we model, or we do a little bit better or a little bit worse, right, will depend on how our CapEx uses change.

But the reason I say that is when you think about attrition, and this is for customers that generally want to have two choices, right,

to have purchasing methodology. Because these assets are fungible, we'll use that fleet to either spur more growth, right, to our base

business or to replace CapEx we would have spent otherwise. So, that's the way we see the interplay here, David.

Q -

David Raso

Okay. Thank you. And lastly,

can you just give us a little color on how the deal came together, and maybe any thoughts on any potential impediments to the deal closing?

Thoughts on Hart-Scott-Rodino or go-shop here, however you want to describe any potential impediments to the deal closing. I noticed

you said you expected to close by the end of the first quarter.

A - Matthew J. Flannery

Yes. So, certainly, this will

need to get regulatory approvals and all that. We have experience here, and we feel really good about our process, and we'll be filing

that jointly, right? Both companies need to file that later this week. So, that part of the step.

The go-shop is just good governance

from H&E's Board. So, that's just something that we'll have to get through. We think we put a very compelling offer here on the table

and a good win-win situation. So, we'll let that play out, but not something we're overly concerned about.

From how this came about,

we've obviously known of each other, each companies for quite some time. These are two really strong brands

in the space. We got together probably in earnest talking about this back in Q3 of '24, and it's just progressed as we've gone

along, and it's been great to deal with Brad and John and their team in putting this deal together. And I think we've really created

a win-win situation here.

Q - David Raso

I appreciate the time. Thank

you.

A - Matthew J. Flannery

Thank you, David.

Operator

Thank you. Our next question

will come from Rob Wertheimer with Melius Research. Please go ahead.

Q - Rob Wertheimer

Thanks. Good morning,

everybody. Matt, I wonder if you could talk just a bit about your thoughts on the cross-sell of the specialty into the H&E

customer base. Just how -- for one, just on your forecasted revenue synergies, which is

not, I guess, in your multiple calculation, how penetrated that assumption gets? I don't actually know if it takes you one,

two, three, five years just to sort of educate the customer base and get sales and everything crossing over.

So, how far does that assumption

go versus your current mix? And then I assume there's already, and you talked about this in the attrition, there's probably some specialty

business you're selling into H&E customers now. Were you able to calculate how big a deal that is? Is this complete white space?

I mean, maybe just talk through that opportunity. Thank you.

A - Matthew J. Flannery

Yes. So, on the latter part of

that, the way we model it, just for clarity is, that $120 million isn't the total opportunity that we would see if we did a customer

profile and what lookalike customers spend in specialty. And when we get under the hood, we'll refine it even more when we get to look

more at the customer data. Obviously, we don't want to gun jump, we don't want to get ahead of any kind of regulatory approval. So, we're

very cautious and smart there. But we've done this quite a few times. So, this is very similar to what we've done in previous deals.

But the way that this goes about is you could imagine that that's only a portion of the lookalike model opportunity for this customer

set. We don't need a 100% penetration on the opportunity.

I don't know, Ted, we haven't

shared what percentage, but --

A - William Ted Grace

It gets factored down considerably (Multiple

Speakers).

A - Matthew J. Flannery

Yes, less than half,

certainly. So, we won't go any further than that. So, that's the way it's modeled. But then specifically about how we see this

opportunity, and like most GenRent deals, H&E does have some specialty business, I don't want to discount that, but it's

less than 5% of their total fleet offerings that they have. They have a little bit of trench and power and a little bit of pump. So,

this is really, when you think about our broader offering and the depth of our offering and the

scale of our offering, this is a great opportunity, as it has been in other GenRent deals.

Q - Rob Wertheimer

Okay. Thank you.

A - Matthew J. Flannery

Thanks, Rob.

Operator

Thank you. Our next question

will come from Jerry Revich with Goldman Sachs. Please go ahead.

Q - Jerry Revich

Yes. Hi. Good morning, everyone,

and congratulations. I'm wondering if I can ask, the planned integration plan here, given just the high margin and dollar utilization

profile of this business, how different is the integration plan versus the last couple of general rental deals that you folks laid out?

And can you touch on how much your local density would improve for the base URI business just by laying on the complementary pieces of

this business? Thanks.

A - Matthew J. Flannery

Yes. Thanks, Jerry. So, as

we talked about in my prepared remarks, right, this is a very complementary business to ours, and they're in key geography. So, we

think in the end-market that we want to grow more, that we want to have -- be able to feed more customer

demand. And this is very complementary to that, not just from the fleet profile, from what the customers expect, but even,

and this is getting to your integration question, when we start putting the teams together, right, the mechanics from both sides are

going to be very familiar with this fleet. This is really going to help.

We'll just add a little bit of

some of our technology and processes that we've been able to invest in over the years that might help further integrate and drive more

productivity and efficiencies out of the shops. But overall, this integration is really going to be very smooth from a quality go-to-market

perspective. This is a quality shop. This is an organization that sells strong value, strong customer service, and values their employees.

So, we think from an integration perspective, this will be a little bit easier from a people and customer go-to-market integration than

some of the previous.

Q - Jerry Revich

Super. And then separately, Ted,

on the balance sheet, you mentioned obviously pausing the stock buyback program. How does this impact the way you're thinking about additional

M&A, if additional opportunities come up? Would you take the leverage ratio higher? Can you talk about how this impacts potential

for additional M&A, if at all?

A - William Ted Grace

Yes. Thanks for the question,

Jerry. So certainly, our focus in the immediate term is going to be getting that leverage down. So, I would say from the standpoint

of large scale M&A or larger scale M&A, probably reasonable to assume that we'd put anything on pause, get to that integration,

get the balance sheet back closer to that neutral position in the midpoint of the range we talk about. Could there be smaller opportunities

on the specialty side, for example? Conceivably, but here again, we've gone out of our way to demonstrate this discipline on the balance

sheet side, and I think people should be calibrated to expect that here.

A - Matthew J. Flannery

Yes. And this isn't just a leverage

question, right? This is a big deal. This is a big integration, and we want to make sure we're focused on doing a great job with it to

serve our customers and to serve employees from both organizations. So, that'll be a big focus for us operationally.

Q -

Jerry Revich

Thank you.

A - Matthew J. Flannery

Thanks, Jerry.

Operator

Thank you. Our next question

will come from Steven Fisher with UBS. Please go ahead.

Q - Steven M. Fisher

Thanks, and congratulations.

I think, Matt, you mentioned about the deal helping you become or be the partner of choice for your customers, and we've already assumed

that or viewed United Rentals as the key partner of choice for their customers. So, were there things that you found that customers have

been asking that just kind of revealed some holes that you had in your business that you think can now be filled through this transaction?

A - Matthew J. Flannery

Yes, Steve. I wouldn't say holes,

but it'd be dismissive to, frankly, everybody else in the industry, but certainly to a 60-year-old quality company like this, that they

don't have relationships and a strong history with customers that we can now get access to and leverage, right, our one-stop shop offering.

So, we see that as the real value, but also the capacity that I spoke to a few times here and the quality of this capacity just to help

serve more of demand that's in the end markets we feel really good about.

Q - Steven M. Fisher

Okay. Fair enough. And then is

there a certain sort of level of market activity or framing for their industrial production or non-res construction that you've assumed

for the next couple of years that, that really make the synergies and the metric works as you've laid them out?

A - William Ted Grace

So, certainly we've modeled this

a lot of different ways. You've got multiple scenarios. It's one of the ways we really think about risk-adjusted returns on invested

capital. We don't get into the details.I think you know Matt alluded to the fact that we put a stake in the ground about '25. We do feel

it's a growth year. I would say based on everything we've seen since today, if we didn't have comfort with where things were, you probably

wouldn't see us underwrite this transaction.

So, we won't get into front-running

'25 guidance and obviously we don't get into multi-year framing of the outlook, but we continue to be positive. Our customers continue

to be positive. When we look at key indicators, we think those also continue to flash green. So, easier to say that qualitatively than

answer it quantitatively, Steve, but we can dig into any of that.

Q - Steven M. Fisher

Great. Congrats to all.

A- Matthew J. Flannery

Thanks, Steve.

Operator

Thank you. Our next question

will come from Tami Zakaria with JPMorgan. Please go ahead.

Q - Tami Zakaria

Hey, good morning. Thank you

so much. I have one question about the footprint. So, could you comment on the footprint of H&E as it relates to URl's existing branches,

and is there any significant overlap that you may have to close or merge some locations? And how does this change your pre-acquisition

plan of cold starts that you had for the next few years?

Operator

Mr.Flannery, do you have this

muted? And Mr.Flannery and team, are you still with us? Looks like we have lost our speakers. Please stand by while I reconnect. Again

this is your operator, please remain on the line, while we get our speakers back on the call. Thank you. Please stand by. Excuse me,

everyone, we do ask that you please remain on the line. As we gather our speakers, please remain on the line.

A - Matthew J. Flannery

Hello? Operator, can you guys

hear us? This is Matt Flannery.

Operator

Yes, sir, we can hear you loud

and clear.

A- Matthew J. Flannery

All right. Well, we dialed in

a cell phone. Are we back on live here?

Operator

We are back live. We do have

a few more questions in queue. I can proceed if you're ready.

A - Matthew J. Flannery

Yes, absolutely. Sorry about

that everyone. We had an outage here. Hasn't happened to us in my tenure, but Tami, you asked the barn burner of a question there, is

the way we left it off. So, I was in the middle of answering it, when people came in and told us you can't hear us. So, I'll

just pick up from there operator with Tami had asked a question about the footprint.

And you could see that on Slide

6 of our investor deck, where there is certainly we have markets, where we have stores in the same place that H&E does, but that's

going to help us to serve more capacity. In instances where we have more capacity than we think the market needs, we may repurpose some

facilities, to your point, about cold starts like we've done historically to open up a specialty offering in that market.

But we're going to wait till

we get to the integration process and we have the field teams from both organizations deciding what we need to do and what's the best

go-to-market with the capacity that we have. There's not -- we have models up-top side, but that's not something that we decide up in

Stamford. That's something that we do at the ground level, because those are the folks closest to serve that market.

Operator

Thank you. Our next question

will come from Jamie Cook with Truist Securities. Please go ahead.

Q - Jamie Cook

Hi, good morning, and congrats

on both sides. I guess a question, Ted, just trying to understand, obviously H&E is a high-quality asset, but just your thought process,

or Matt, your thought process right now on doing a larger deal in GenRent versus specialty, just given GenRent is the area that's seeing

decelerating growth. Was it just nothing materialized of size in specialty, or is it just H&E made sense now? And I'm just trying

to understand, too, are you trying to call a bottom, I mean, on the GenRent side and that the market is too negative?

And then my second question,

if you could just elaborate on any, I guess, investment required associated with this deal that we should be cognizant of that could

potentially weigh more so on margins in 2025? Thanks.

A- William Ted Grace

Sure. So, on the second part

of your question, certainly not anything that we're concerned about or contemplated or modeled that's a concern. On the first part

of why now, why GenRent, we've talked about 2025 being a growth year for a standalone, and we'll still give that guidance on the

29th with our call on the 30th to discuss it of this month. But we think the growth prospects for the future are still positive, and

we wouldn't be doing this deal otherwise. And we think this added quality capacity that we're

getting is going to help us meet that demand. And this is a multi-year view here, right?

We're not going to talk about

calling the bottom or get into anything like that. Our crystal ball is not any clearer than anybody else's, other than what we hear from

our team and our customers that are on the ground. And we feel that adding this capacity at this time is just a smart move for us. There's

not a lean against specialty or towards GenRent. We are constantly working the pipeline. And this was the best use and opportunity for

capital deployment that we saw that can help meet our growth goals and give a good return to shareholders.

Q - Jamie Cook

Thank you.

A- William Ted Grace

Thank you.

Operator

Thank you. Our next question will come from Ken Newman

with KeyBanc Capital Markets. Please go ahead.

Q - Kenneth Newman

Hey, good morning, guys. Congrats

on the deal.

A- Matthew J. Flannery

Thanks.

Q - Kenneth Newman

Maybe for my first question, I

wanted to follow-up on the specialty cross-sell synergy target. I'm curious, do you think that's more of a back half-weighted

ramp on that three-year time horizon? And the reason I ask that is, because I imagine you and HEES have already locked in bill slots

with all your major OEMs for 2025.

So, just trying to get a sense of what's

the ability to start filling in those branches, those key branches with new specialty equipment in '25, or just maybe more broadly,

your opportunity to maybe renegotiate some of the orders you may have already placed for '25 now that you have a bigger buying presence

over those suppliers?

A- Matthew J. Flannery

Yes, it's a fair point. But I

just want to remind everybody, we feel the supply chain, other than some very minor percentage of niche products, is largely back intact.

So, we don't think the supply is going to be an issue here. I think just making sure that we go through the integration, make sure that

we take care of the business that we acquired, and then moving forward as we continue to earn the trust of the customers and the team

of, hey, this is what else we have to offer. So, it will be more, I want to say back half-weighted, but outside of the first six

months, right, just from that, that reality of how you go to market in general. But outside of that, you could see it pretty evenly earned

as we go through once we get through the initial integration.

A - William Ted Grace

Yes, Ken, what we've said there

historically is it does tend to build momentum, right? I mean, you get through the first phase of integration and managing through that,

and then you help everybody understand how to most effectively cross-sell. And so, you can understand that, that then drives more effectiveness

as you get from year one to year two, and then ultimately the goals we set for year three.

Q - Kenneth

Newman

Right. No, that makes sense.

Just for my follow-up, I know we've talked a little bit about the local market mix earlier in the call, but I know fees also plays

a smaller role in some of these larger megaprojects as well. And I'm curious if you think there's any material overlap on the megaproject

side. And if so, how do you think about the opportunities to leverage from combining those rental contracts in the same site?

A - William Ted Grace

Yes, we're not really thinking

of it that way. We're thinking about it from a go-forward. We're all going to serve the business that we've got written today. So, this

is really from a go-forward perspective, having the same quality, fungible assets of the right brands compatible with our go-to-market

and being able to take care of future businesses more the way we'd look at that.

Q - Kenneth Newman

Makes sense. Thanks.

A - William Ted Grace

Thanks.

Operator

(Operator Instructions) Our next question comes from

Angel Castillo with Morgan Stanley. Please go ahead.

Q - Angel

Castillo

Thanks, and good morning, everyone.

Congratulations on the deal announcement. Just wanted to touch on the EPS accretion. I was wondering if you could give us a little bit

more of a bridge or color in terms of what interest rates are you assuming here in terms of the leverage? And particularly as we think

about year one, this being EPS and accretive, could you just kind of talk about maybe the timing of the synergies? You just mentioned

some on the cross-selling, but maybe on the cost side, how much of that maybe you anticipate in the first year and again, maybe how would

you think about some of the other below the line items?

A - William Ted Grace

Yes, Angel, thanks for the

question. On the one hand, we obviously want to be as helpful as possible, and on the other hand, there's some things that are just

going to be more appropriate to answer at close. So, in terms of walking people through the math, if it's okay, we're going to wait

till then. Obviously, we've got to get to the market to fund this, so we'll be dependent on

where the market is. We've made assumptions. We feel good about that. But obviously, we don't want to get ahead of ourselves in that

regard.

In terms of the cost synergies, I'd

say the same thing. If you're just trying to play with numbers for the time being, I'd say, we've probably said historically, assume

a 50-50 weighting in year one, year two. But as we get to close, certainly we'll do our best to refine all of this for you.

Q - Angel Castillo

Understood. And then maybe just

wanted to go back to some of the CapEx discussion that you mentioned. I understand some of it is kind of based on attrition or some of

the other kind of puts and takes of what happens. But I think there was a comment on the slides about 5% purchasing kind of benefits

here or synergies.

Could you just talk about ultimately, I

guess, is that just lower cost on your CapEx? And then as you think about the younger fleet of H&E, do you anticipate to essentially

age that to closer to where you tend to run your businesses, or is there something about the mix of the assets there that maybe requires

a different approach?

A - William Ted Grace

So, in terms of the purchasing

synergies, it's really just kind of the scale benefit we have, and we've seen this historically. So, on the first part, I think,

that's really kind of where you see it. And again, it's not so much a P&L impact. It's really kind of a fleet acquisition cost perspective.

So, benefits, as I mentioned, kind of CapEx, cash flow, capital intensity.

Sorry, the second part on the purchasing

was what? In terms of fleet age?

Q - Angel Castillo

Yes.

A - William Ted Grace

Yes. I mean, when you blend them in,

it's -- they're obviously coming in at a younger age, call it, sub-41. I think we were nominally about 50 in the third quarter. Apples-to-apples, when you back out our specialty, we'd be in the upper 40s. Yes, but it's not going to drive a huge shift in it and there really

is not the plan to re-age the combined fleets any meaningful way.

A - Matthew J. Flannery

Yes, Angel, we have a Rental Useful

Life, right, program that we use, including the disposal value, and we'll continue to run that over their asset base.

Q - Angel Castillo

Understood. Thank you.

A - Matthew J. Flannery

Thanks.

Operator

Thank you. Our next question

will come from Steven Ramsey with Thompson Research Group. Please go ahead.

Q - Steven

Ramsey

Good morning. Wanted to think

about how H&E's GenRent revenue has had outperformed your core GenRent revenue for the last bit of time. I'm curious what you think

accounts for that divergence and then learnings you can take and apply to the larger enterprise?

A- William Ted Grace

Yes. I don't think we're really

going to comment on kind of their historical numbers too much there, Steve. But certainly, as is the case with every acquisition, when

we go in, we know there's things we're going to learn from the other party, and that certainly will be the case here. But in terms of

comparing and contrasting, I'm not sure could help you too much there.

A- Matthew J. Flannery

Yes. As you can imagine, as they've

been growing their footprint and doing more cold-starts, right, that's been helping spur some of their growth, which is great.

It's more facilities, more capacity that they've built that we get to add to the team. So, we're·· well, once again, can't

say it enough times that we're joining here with a quality company, so we feel good about bringing them on board.

Q - Steven Ramsey

For sure. Okay. And then one last one

to circle back to the specialty cross-sell. It seems like a relatively conservative estimate on that penetration level to what

you •· what United does. I'm curious if there's any constraints to reaching your levels of specialty penetration over the

longer-term, or if the end market breakout, the difference in H&E versus you accounts for some of that?

A- William Ted Grace

Yes, I'm not sure how you

might be looking at this. But what I would tell you is, if you were to think about that three-year target as a function of LTM revenue,

it would be on the order of about 8%. If you were to look at the most analogous deals we've done, which we would say are NES, Neff, and

BlueLine, they probably averaged a little less than 6%. So, it's actually, call it, a third higher on a relative basis. And what that

reflects, as much as anything, is we've added more lines of specialty, right? So, if you went back years ago, we wouldn't have had maps,

obviously. We wouldn't have mobile storage, and we wouldn't have ROS. So, really, it's just kind of adding more lines of business that

we think should improve the relative opportunity there.

Q - Steven Ramsey

Excellent. Thank you.

Operator

Thank you. It appears we have

no further questions in queue at this time. I'm sorry, we do have one question we'll take from the line of Scott Schneeberger with Oppenheimer.

Please go ahead.

Q - Scott Schneeberger

Thanks. Yes, guys.

Just two, I'll ask them both up front. One on the go-shop. That's not•· I don't believe that's common for you all in

the past. Just any comments a bit level deeper than beyond what David asked there about how that came to be and your anticipation?

And then also, kind of following

on the revenue synergies, long-term, it seems like, yes, there's a potential upside to what you put out there today. Near-term though,

could there be·· like with past GenRent acquisitions in the near-term, could there be some dis-synergies on revenue, on

some transactional business? Just any thoughts there. No need for quantification. I know we'll get that in a few weeks, but just on those

two. Thanks, guys.

A - William Ted Grace

Yes, sure. So, on the first one

on the go-shop, it's just something that, that the H&E Board and their leadership team felt was good governance, something they should

do, as this was not an auction, but a bilateral deal and something that was a one-on-one communication. So, we're fine with that. We

feel good we put together a compelling bid. We're not worried about that.

And then on the revenue dis-synergies, I

did state it earlier. Yes, we've modeled in a 15% revenue dis-synergy, as we do with all our deals. And then the execution, once we get

through the integration, we'll see how that works. But we'll repurpose that asset. Let's just use the 15% number.

It's really just a top-line situation.

We'll repurpose those assets and get CapEx savings, or we'll do better than that attrition, and we'll have a little more growth

than we originally modeled in. So, either way, we feel very comfortable. We've had a lot of experience with the reality that there'll

be some dis-synergies in the early going, and then we'll move on from there. So, not anything

we're concerned about, and all figured into our model, which is still with the dis-synergies netting mid-teens internal rate of return.

So, feeling good about that.

Q - Scott Schneeberger

Great. Thanks. Congratulations.

A - William Ted Grace

Thanks.

Operator

Thank you. At this

time, I will turn the call back to Matt Flannery for any additional or closing remarks.

A - Matthew J. Flannery

Great. Thank you, operator, and

thank you all for your patience as we had a little technical difficulty here. This is the first time for everything, but we really appreciate

your time, and I'm glad you could join us today. Our website has an investor presentation with the details from this transaction. And

as always, Elizabeth is available to answer your questions. So, until we speak again on January 30th, stay safe and take care.

Operator, you can now end the

call.

Operator

Thank you. This does conclude

today's call. Thank you for your participation. You may disconnect at any time. Have a wonderful day.

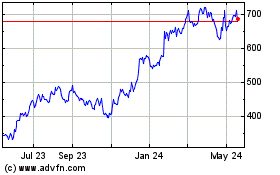

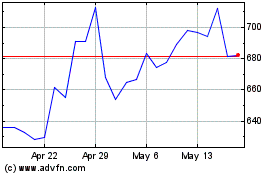

United Rentals (NYSE:URI)

Historical Stock Chart

From Feb 2025 to Mar 2025

United Rentals (NYSE:URI)

Historical Stock Chart

From Mar 2024 to Mar 2025