0000102037false--03-3100001020372023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________

FORM 8-K

____________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 1, 2023

____________________________________________

UNIVERSAL CORPORATION

(Exact name of registrant as specified in its charter)

____________________________________________

| | | | | | | | | | | | | | |

| Virginia | | 001-00652 | | 54-0414210 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| 9201 Forest Hill Avenue, | Richmond, | Virginia | | 23235 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code

(804) 359-9311

Not applicable

(Former name or former address, if changed since last report)

____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of each class | Trading Symbols | Name of Exchange on which registered |

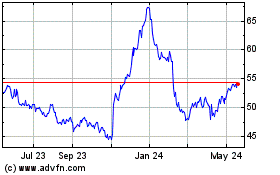

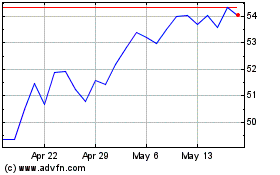

| Common Stock, no par value | UVV | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Universal Corporation (the “Company”) issued a press release on November 2, 2023, discussing its results for the quarter ended September 30, 2023. The press release is attached as Exhibit 99.1 and is incorporated by reference into this Item 2.02.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On November 1, 2023, the Board of Directors (the “Board”) of the Company amended and restated the Company’s Amended and Restated Bylaws (as amended and restated, the “Bylaws”), which changes are effective as of November 1, 2023. The Bylaws were amended to clarify and implement certain procedural and disclosure requirements for shareholders nominating individuals for election or reelection as directors at the Company’s annual or special meetings of shareholders in connection with the “universal proxy” rules adopted by the Securities and Exchange Commission pursuant to Rule 14a-19 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The amendments to the Bylaws also include other technical, clarifying, and modernizing revisions, including revisions to clarify and implement certain procedural and disclosure requirements for shareholders nominating an individual for election or reelection as a director or proposing business to be brought before an annual meeting of shareholders.

Specifically, the amendments to the Bylaws include requirements that a shareholder nominating an individual for election or reelection as a director (i) provide all information required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies pursuant to Section 14 of the Exchange Act; (ii) provide the nominee’s written consent to being named in the Company’s proxy card; (iii) satisfy all requirements of Rule 14a-19 and provide evidence thereof; and (iv) use a proxy card color other than white, which is reserved for the Company’s proxy card. In addition, the amendments to the Bylaws (i) require additional information from shareholders submitting nominations or proposals (including certain information related to securities ownership) and from any nominee, and (ii) modify the advance notice window for shareholders submitting director nominations and proposals (other than proposals pursuant to Rule 14a-8 under the Exchange Act). To be timely, a shareholder’s notice must be received at the Company’s principal executive offices not less than 120 days nor more than 150 days prior to the anniversary of the previous year’s annual meeting of shareholders.

The foregoing description of the amendments to the Bylaws does not purport to be complete and is qualified in its entirety by reference to the full text of the Bylaws, which is included as Exhibit 3.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 8.01. Other Events.

On November 2, 2023, the Company issued a press release announcing a quarterly dividend for the Company’s common stock. The press release is attached as Exhibit 99.2 and is incorporated by reference into this Item 8.01.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | |

| (d) | Exhibits | | |

| | | |

| No. | | Description |

| | | |

| 3.1 | | |

| | | |

| 99.1 | | |

| | | |

| 99.2 | | |

| | | |

| 101 | | Interactive Data File (submitted electronically herewith).* |

| | | |

| | | 101.INS XBRL Instance Document - the instance document does not appear in the Interactive Data File because its Inline XBRL tags are embedded within the Inline XBRL document. 101.SCH XBRL Taxonomy Extension Schema Document 101.CAL XBRL Taxonomy Extension Calculation Linkbase Document 101.DEF XBRL Taxonomy Extension Definition Linkbase Document 101.LAB XBRL Taxonomy Extension Label Linkbase Document 101.PRE XBRL Taxonomy Extension Presentation Linkbase Document In accordance with Rule 406T of Regulation S-T, the Inline XBRL related information in Exhibit 101 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section and shall not be part of any registration or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. |

| | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

__________

*Filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | UNIVERSAL CORPORATION |

| | (Registrant) |

| | | | |

| Date: | November 2, 2023 | By: | /s/ Preston D. Wigner | |

| | | Preston D. Wigner | |

| | | Vice President, General Counsel, and Secretary |

Exhibit Index

| | | | | | | | |

| Exhibit | | |

| Number | | Document |

| | |

| | |

| 3.1 | | |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 101 | | Interactive Data File (submitted electronically herewith).* |

| | |

| | 101.INS XBRL Instance Document - the instance document does not appear in the Interactive Data File because its Inline XBRL tags are embedded within the Inline XBRL document. 101.SCH XBRL Taxonomy Extension Schema Document 101.CAL XBRL Taxonomy Extension Calculation Linkbase Document 101.DEF XBRL Taxonomy Extension Definition Linkbase Document 101.LAB XBRL Taxonomy Extension Label Linkbase Document 101.PRE XBRL Taxonomy Extension Presentation Linkbase Document In accordance with Rule 406T of Regulation S-T, the Inline XBRL related information in Exhibit 101 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section and shall not be part of any registration or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

__________

*Filed herewith

Exhibit 3.1

AMENDED AND RESTATED BYLAWS

OF

UNIVERSAL CORPORATION

******

ARTICLE I

Shareholders

Section 1. Shareholders shall be those persons in whose names shares of the Company are registered in its share transfer records, and a listing of the names drawn from such records as of a record date shall serve as conclusive evidence as to those shareholders eligible to vote their shares at any meeting of the shareholders.

Section 2. Certificates evidencing shares of the Company shall only be issued for one or more full shares. Transfers of stock shall be made on the books of the Company only by the Shareholders of such stock, or by attorney lawfully constituted in writing, and, in the case of stock represented by a certificate, upon surrender of the certificate.

Section 3. The share transfer records of the Company shall not be closed following the declaration of a dividend on either the preferred or common shares. A record date shall be established in the resolution declaring such dividend or dividends and the transfer agent shall prepare a listing of the names of all the shareholders entitled to such dividend without actually closing the share transfer records for the transfer of shares.

Section 4. Shares of the Company’s stock may be certificated or uncertificated, as provided under Virginia law. All certificates of stock of the Company shall be numbered and shall be entered in the books of the Company as they are issued. They shall exhibit the holder’s name and number of shares and shall be signed by the Chairman of the Board, the President, or a Vice President of the Company and by its Secretary, or by any two officers duly authorized to perform this function by the Board of Directors. Any or all of the signatures on the certificate may be a facsimile.

Section 5. The annual meeting of the shareholders of the Company shall be held at its principal office located in Richmond, Virginia, or at such other place within or without the Commonwealth of Virginia as may from time to time be designated by the Board of Directors, on the second Tuesday in August of each year, or on such other day as shall be fixed by the Board of Directors, for the purpose of electing Directors and for the transaction of such other business as may properly come before the meeting. In order for business to be properly brought before an annual meeting of shareholders, it must be (a) specified in the notice of meeting (or any supplement thereto) given by or at the direction of the Board of Directors, (b) otherwise properly brought before the meeting by or at the direction of the Board of Directors, or (c) otherwise properly brought before the meeting by a shareholder.

In addition to any other applicable requirements, for business to be properly brought before an annual meeting by a shareholder, the shareholder must have given timely notice thereof in writing to the Secretary of the Company. To be timely, a shareholder’s notice must be delivered to or mailed and received at the principal office of the Company, not less than 120 days nor more than 150 days prior to the anniversary of the date of the Company’s immediately preceding annual meeting. In no event shall the public announcement of an adjournment or postponement of an annual meeting or the fact that an annual meeting is held after the anniversary of the preceding annual meeting commence a new time period for the giving of a shareholder’s notice as described above.

A shareholder’s notice to the Secretary shall set forth as to each matter the shareholder proposes to bring before the annual meeting (i) a brief description of the business desired to be brought before the annual meeting, including the complete text of any resolutions to be presented at the meeting with respect to such business, and the reasons for conducting such business at the annual meeting, (ii) the name and address, as they appear on the Company’s share transfer records, of the shareholder proposing such business and the beneficial owner, if any, on whose behalf the proposal is made, (iii) the class and number of shares of the Company which are beneficially owned by the shareholder and such beneficial owner, (iv) any material interest of the shareholder and such beneficial owner in such business, (v) a description

(including the names of any counterparties) of any agreement, arrangement, or understanding (including any derivative or short positions, profit interests, options, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of the shareholder’s notice by, or on behalf of, the shareholder and any other person on whose behalf the proposal is made, the effect or intent of which is to mitigate loss, manage risk or benefit resulting from share price changes of, or increase or decrease the voting power of the shareholder or any other person on whose behalf the proposal is made with respect to, shares of stock of the Company, (vi) a description (including the names of any counterparties) of any agreement, arrangement, or understanding with respect to such business between or among the shareholder or any other person on whose behalf the proposal is made and any of its affiliates or associates, and any others acting in concert with any of the foregoing, (vii) a representation regarding whether the shareholder or the beneficial owner or any of their respective affiliates or associates or others acting in concert therewith intends, or is part of a group which intends to deliver a proxy statement and/or form of proxy to any holders of the Company’s outstanding capital stock with respect to such proposal, (viii) any other information relating to such shareholder and beneficial owner or their respective affiliates or associates or others acting in concert therewith that would be required to be disclosed in a proxy statement and form of proxy or other filings required to be made in connection with solicitation of proxies for the proposal pursuant to Section 14 of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) and the rules and regulations promulgated thereunder, and (ix) a representation that the shareholder will notify the Company in writing of any changes to the information provided pursuant to clauses (iii), (v) and (vi) above that are in effect as of the record date for the relevant meeting promptly following the later of the record date or the date notice of the record date is first publicly disclosed. Notwithstanding anything in these Bylaws to the contrary, no business shall be conducted at an annual meeting except business brought in accordance with the procedures set forth in this Article I, Section 5 and Article II, Section 1, as applicable. The Chairman of an annual meeting shall, if the facts warrant, determine and declare to the meeting that an item of business was not properly brought before the meeting in accordance with the provisions of this Article I, Section 5 or Article II, Section 1, as applicable, and shall not be transacted.

Notwithstanding the foregoing provisions of this Section 5, a shareholder shall also comply with all applicable requirements of the Exchange Act and the rules and regulations thereunder with respect to the matters set forth in this Section 5.

Section 6. At the call of the Chairman of the Board, the President, or by order of the Board of Directors, a special meeting of the shareholders of the Company may be held at such time and place as shall be designated in the notice of the meeting.

Section 7. Written notice of an annual or special meeting of the shareholders shall be mailed to each shareholder of record entitled to vote under the provisions of the Articles of Incorporation of the Company as now in existence or as may be subsequently amended, at the address as it appears on the share transfer records of the Company, not less than ten nor more than sixty days before the meeting date, except as may otherwise be required by law. Notice of a special meeting shall state the purpose or purposes for which the meeting is called. Notice of any meeting of shareholders may be waived in writing or by attendance at the meeting in person or by proxy.

Section 8. At all meetings of the shareholders, a majority of the shares entitled to vote at the record date for such meeting, represented in person or by proxy, shall constitute a quorum, provided that when a specified item of business is required to be voted on by one or more classes of shares, voting as a class, the holders of a majority of the shares of each such class shall constitute a quorum for the transaction of such specified item of business. If no quorum shall be present, the meeting may, without further notice, be adjourned from time to time until a quorum shall be present. At all meetings of the shareholders, a shareholder may vote by proxy executed in writing (or in such manner prescribed by the Virginia Stock Corporation Act) by the shareholder, or by the shareholder’s duly authorized attorney-in-fact. Any shareholder directly or indirectly soliciting proxies from other shareholders must use a proxy card color other than white, which shall be reserved for exclusive use by the Board of Directors.

Section 9. The Chairman of the Board shall preside at all meetings of the shareholders and, in his absence, the President shall preside. All meetings of the shareholders shall be attended by the Secretary of

the Company, and he shall, ex officio, be the Secretary of such meetings. In his absence, a Secretary pro tempore may be appointed.

ARTICLE II

Board of Directors

Section 1. Only persons who are nominated in accordance with (i) the procedures set forth in this Article II, Section 1, or (ii) the requirements of Regulation 14A under the Exchange Act including, without limitation, the requirements of Rule 14a-19 (as such rule and regulations may be amended from time to time by the U.S. Securities and Exchange Commission (“SEC”) including any SEC Staff interpretations relating thereto), shall be eligible to serve as Directors. Nominations of persons for election to the Board of Directors of the Company may be made at an annual meeting of the shareholders (a) by or at the direction of the Board of Directors, or (b) by any shareholder of the Company who is a shareholder of record at the time of giving notice provided for in this Article II, Section 1, who shall be entitled to vote for the election of Directors at the meeting and who complies with the notice procedures set forth in this Article II, Section 1. The number of nominees a shareholder may nominate at an annual meeting of shareholders (or in the case of a shareholder giving notice on behalf of a beneficial owner, the number of nominees a shareholder may nominate for election at an annual meeting of shareholders on behalf of such beneficial owners) shall not exceed the number of Directors to be elected at such meeting, and for the avoidance of doubt, no shareholder shall be entitled to make additional or substitute nominations following the expiration of the time periods set forth in this Article II, Section 1.

Such nominations, other than those made by or at the direction of the Board of Directors, shall be made pursuant to timely notice in writing to the Secretary of the Company. To be timely, a shareholder’s notice shall be delivered to or mailed and received at the principal office of the Company not less than 120 days nor more than 150 days prior to the anniversary of the date of the Company’s immediately preceding annual meeting. In no event shall the public announcement of an adjournment or postponement of an annual meeting or the fact that an annual meeting is held after the anniversary of the preceding annual meeting commence a new time period for the giving of a shareholder’s notice as described above.

Such shareholder’s notice shall set forth (a) as to each person whom the shareholder proposes to nominate for election or re-election as a Director, all information relating to such person that is required to be disclosed in the solicitation of proxies for election of Directors, or is otherwise required, in each case pursuant to Regulation 14A of the Exchange Act (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a Director if elected); (b) the name and address, as they appear on the Company’s share transfer records, of the shareholder giving the notice and the beneficial owner, if any, on whose behalf the nomination is made, (c) the class and number of shares of the Company which are beneficially owned by such shareholder and such beneficial owner, (d) a representation that the shareholder is a holder of record of shares of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, (e) a description of all arrangements, understandings or relationships between the shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the shareholder, (f) a description (including the names of any counterparties) of any agreement, arrangement or understanding (including any derivative or short positions, profit interests, options, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of the shareholder’s notice by, or on behalf of, the shareholder and any other person on whose behalf the nomination is made, the effect or intent of which is to mitigate loss, manage risk or benefit resulting from share price changes of, or increase or decrease the voting power of the shareholder or any other person on whose behalf the nomination is made with respect to, shares of stock of the Company, (g) a description (including the names of any counterparties) of any agreement, arrangement or understanding with respect to such nomination between or among the shareholder or any other person on whose behalf the nomination is made and any of its affiliates or associates, and any others acting in concert with any of the foregoing, (h) a representation regarding whether the shareholder or the beneficial owner or any of their respective affiliates or associates or others acting in concert therewith intends, or is part of a group which intends, to solicit proxies in support of director nominees other than

the Company’s nominees in accordance with Rule 14a-19 under the Exchange, and if so, naming the participants (as defined in Item 4 of Schedule 14A under the Exchange Act) in any such proxy solicitation, (i) any other information relating to such shareholder and beneficial owner or their respective affiliates or associates or others acting in concert therewith that would be required to be disclosed in a proxy statement and form of proxy or other filings required to be made in connection with solicitations of proxies for the election of directors in a contested election pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder, and (j) a representation that the shareholder will notify the Company in writing of any changes to the information provided pursuant to clauses (c), (f) and (g) above that are in effect as of the record date for the relevant meeting promptly following the later of the record date or the date notice of the record date is first publicly disclosed. The Company may require any proposed nominee to furnish such other information as it may reasonably require to determine the eligibility of such proposed nominee to serve as a Director of the Company under applicable law, the Articles of Incorporation or these Bylaws, or the independence of such proposed nominee. No person shall be eligible for election as a Director of the Company unless nominated in accordance with the procedures set forth in this Article II, Section 1, or Rule 14a-19 under the Exchange Act, as applicable. The Chairman of the meeting shall, if the facts warrant, determine and declare to the meeting that a nomination was not made in accordance with the provisions of this Article II, Section 1, or Rule 14a-19, as applicable, and the defective nomination shall be disregarded. Notwithstanding the foregoing provisions of this Article II, Section 1, a shareholder shall also comply with all applicable requirements of the Exchange Act and the rules and regulations thereunder with respect to the matters set forth in this Article II, Section 1.

In addition to the requirements set forth in this Article II, Section 1, unless otherwise required by law, no shareholder shall solicit proxies in support of director nominees other than the Company’s nominees unless such shareholder has complied with Rule 14a-19 promulgated under the Exchange Act in connection with the solicitation of such proxies in all respects, including but not limited to the minimum solicitation and notice requirements. If any shareholder (a) provides notice pursuant to Rule 14a-19(b) promulgated under the Exchange Act and (b) subsequently fails to comply with the requirements of Rule 14a-19(a)(2) and Rule 14a-19(a)(3) promulgated under the Exchange Act, then the Company shall disregard any proxies or votes solicited for the shareholder’s candidates. Upon request by the Company, if any shareholder provides notice pursuant to Rule 14a-19(b) promulgated under the Exchange Act, such shareholder shall deliver to the Company, no later than five business days prior to the applicable meeting, reasonable evidence that it has met the requirements of Rule 14a-19(a)(3) and 14a-19(b).

Section 2. The Board of Directors shall hold its meetings at such times and at such places within or without the Commonwealth of Virginia as it may from time to time designate, or if the Board has fixed no place, then at the principal office of the Company located in the City of Richmond, Virginia. A meeting may be called at any time by the Chairman, the President or by any three Directors. Meetings of the Board of Directors shall be held at least quarterly.

Section 3. Immediately following the annual meeting of the shareholders at which the Directors are elected, an organizational meeting of the Board of Directors shall be held for the purpose of electing the officers of the Company and for the transaction of any other business which may be brought before it relating to the management of the business and affairs of the Company. No notice other than this Bylaw provision shall be required for the holding of this organizational meeting and for the transaction of business at such meeting or any adjournment thereof.

Regular meetings of the Board of Directors may be held at such designated times and places as may be determined by the Board of Directors, and the notices of such regular meetings shall be in such form as may be prescribed by the Board of Directors.

Notice of the time and place of special meetings of the Board of Directors shall be given to each Director by the Secretary of the Company or in his absence or inability to act, by the President, or by the Treasurer or by such other officer as may be designated by the Executive Committee, orally or in writing, in person or by mail, private courier, telephone, telegraph, teletype, or other similar form of wire or wireless communication.

Notice of any meeting, regular or special, shall be deemed to have been duly given if delivered in whatever form and in sufficient time to permit the Director to whom the notice is given and received to attend the meeting using the ordinary and usual means of transportation normally available to the Director.

If upon the request of any three Directors, the Secretary or other designated officer of the Company shall fail or refuse to call a meeting of the Board of Directors, then the call may be given provided it is in writing and signed by the three Directors requesting the meeting. Such notice, when so given to each other member of the Board of Directors, shall be deemed to be proper notice of the meeting.

Section 4. A majority of the number of Directors fixed by the Bylaws shall constitute a quorum, but if upon a call for a meeting, there shall not be a quorum present, the Directors present may adjourn the meeting from time to time until a quorum is present. All questions coming before the Board of Directors shall be determined by the majority vote of the Directors present.

ARTICLE III

Committees

Section 1. The Board of Directors may designate three or more of their number, of whom the Chief Executive Officer shall ex officio be a member, to constitute an Executive Committee, which shall have and exercise all the powers of the Board that may be lawfully delegated, including the power to authorize the seal of the Company to be affixed to such documents as may require it. The acts and records of the Executive Committee shall at all times be subject to the supervision and control of the Board of Directors when in session. A majority of the number of members of the Executive Committee shall constitute a quorum, and all questions coming before the Executive Committee shall be determined by the majority vote of the members of the Committee.

Section 2. The Board of Directors shall elect from their number a Finance and Pension Investment Committee that shall have such membership requirements, duties and responsibilities as set forth in the Finance and Pension Investment Committee Charter adopted by the Board of Directors. This authority shall not cause the Finance and Pension Investment Committee to assume the role of “plan administrator”, “trustee”, or “custodian” for any employee benefit plan.

Section 3. The Board of Directors shall elect from their number an Audit Committee that shall have such membership requirements, duties and responsibilities as set forth in the Audit Committee Charter adopted by the Board of Directors.

Section 4. The Board of Directors shall elect from their number a Compensation Committee that shall have such membership requirements, duties and responsibilities as set forth in the Compensation Committee Charter adopted by the Board of Directors.

Section 5. The Board of Directors shall elect from their number a Nominating and Corporate Governance Committee that shall have such membership requirements, duties and responsibilities as set forth in the Nominating and Corporate Governance Committee Charter adopted by the Board of Directors.

Section 6. The Board of Directors may establish and charge with appropriate duties such other committees as it may deem necessary or desirable.

ARTICLE IV

Officers

Section 1. The Board of Directors, at the organizational meeting following the annual meeting of the shareholders, shall elect the Chief Executive Officer, such officers as may be required by law, and such other officers as they may deem proper. From time to time and as necessary, additional officers may be elected by the Board of Directors.

Section 2. The term of office of all officers shall be one year and until their respective successors are elected. Any officer may be removed from office by the Board of Directors at any time and with or without cause, unless otherwise stated by agreement in writing duly authorized by the Board of Directors. The officers of the Company shall have such duties as generally pertain to their respective offices, as well as such powers and duties as from time to time shall be conferred upon them by the Board of Directors.

Section 3. In case of the absence or inability to act or disqualification of any officer, his duties shall be discharged by his associate or assistant officer, and if there be none and no other provision has

been made therefor, the Board of Directors shall delegate his powers and duties to another officer or shall appoint some other person to act in his stead.

ARTICLE V

Emergency Provisions

Section 1. The provisions of this Article shall be effective only in the event of and during the period of an emergency. An emergency exists for purposes of this Article if a quorum of the Board of Directors cannot be readily assembled because of some catastrophic event.

Section 2. The officers and employees of the Company shall continue to conduct the affairs of the Company under such guidance from the Directors as may be available, except as to matters which by statute, notwithstanding the existence of the emergency, require approval of the Board of Directors and subject to conformance with any governmental directive during the emergency.

Section 3. Any senior officer or Director may call a meeting of the Board of Directors, and those who are present at the meeting shall constitute a quorum of the Board for the full conduct and management of the business and affairs of the Company. Notice of the meeting given to those Directors to whom it may readily be given under the existing circumstances shall be sufficient and may be given by such means as it is feasible at the time, including by publication or by radio.

Section 4. In the absence, disability or refusal to act of any officer, the Board of Directors may delegate such officer’s powers to any other officer, or to any Director for the time being.

ARTICLE VI

Checks and Notes

Section 1. All checks given by the Company in the course of its business shall be signed in such manner as prescribed from time to time by the Finance and Pension Investment Committee.

Section 2. All notes and bonds given by the Company in the course of its business shall be signed by any one of the Treasurer, Secretary, an Assistant Treasurer, or an Assistant Secretary, jointly together with any one of the Chairman, Vice Chairman, President, a Vice President, or by such other persons and in such manner as may be prescribed from time to time by the Finance and Pension Investment Committee of the Board of Directors.

ARTICLE VII

Corporate Seal

The corporate seal of the Company shall consist of two concentric circles, around the inner edge of which shall be engraved the words “UNIVERSAL CORPORATION, RICHMOND, VA.” and across the center thereof the word “SEAL” and the figures “1918.”

ARTICLE VIII

Use of Masculine

Whenever a masculine term is used in these Bylaws, it shall be deemed to include the feminine.

ARTICLE IX

Dividends

The Board of Directors may, subject to the provisions of the Articles of Incorporation of the Company, annually, semi-annually, quarterly or monthly, declare dividends as it may deem prudent.

ARTICLE X

Amendments

These Bylaws may be altered, amended or repealed by vote of the majority of the whole number of Directors at any meeting of the Board of Directors, or by the shareholders at any annual meeting of the shareholders of the Company, or at any special meeting when due notice of such proposed amendment has been given, subject to the provisions of the Articles of Incorporation of the Company.

Amended and Restated November 1, 2023

Exhibit 99.1

P.O. Box 25099 ~ Richmond, VA 23260 ~ Phone: (804) 359-9311 ~ Fax: (804) 254-3584

______________________________________________________________________________________________________

P R E S S R E L E A S E

| | | | | | | | | | | |

| CONTACT: | Universal Corporation Investor Relations | RELEASE: | 4:16 p.m. ET |

| Phone: (804) 359-9311 | | |

| Fax: (804) 254-3584 | | |

| Email: investor@universalleaf.com | | |

Universal Corporation Reports Second Quarter Results

Richmond, VA November 2, 2023 / PRNEWSWIRE

___________________________________________________________________________________

George C. Freeman, III, Chairman, President, and Chief Executive Officer of Universal Corporation (NYSE:UVV), stated, “Our fiscal year 2024 is developing very well with operating income for the six months and quarter ended September 30, 2023, up 30% and 46%, respectively, compared to the six months and quarter ended September 30, 2022. Gross profit margins also rebounded nicely in the first half of fiscal year 2024, compared with the same period in fiscal year 2023, with our ingredients companies making a positive contribution. Our Tobacco Operations segment delivered strong performance in the first half of fiscal year 2024 on robust demand for leaf tobacco from our customers. Results for the Ingredients Operations segment were also up in the second quarter of fiscal year 2024, compared to the same quarter in the prior fiscal year. This segment saw some supply chain normalization, which stabilized demand from certain of our customers and generated better results in the second quarter of fiscal year 2024, compared to the first quarter of fiscal year 2024 when the segment experienced soft customer demand.

“Strong demand for leaf tobacco from our customers and a favorable tobacco product mix benefited our results for the first half of fiscal year 2024. Leaf tobacco margins improved in the first half of fiscal year 2024, despite lower leaf tobacco sales volumes, as we had fewer shipments of lower margin tobacco, compared to the first half of fiscal year 2023. Segment operating income for our Tobacco Operations segment was up 46% and 55% for the six months and quarter ended September 30, 2023, respectively, compared to the six months and quarter ended September 30, 2022. Our uncommitted tobacco inventory level of 12% at September 30, 2023, remained low, and global leaf tobacco supply continues to be tight for all types of tobacco. Looking ahead, we continue to expect that similar to fiscal year 2023, our

Universal Corporation

Page 2

tobacco shipments will be strongly weighted to the second half of the fiscal year 2024. We also believe our uncommitted tobacco inventory levels will remain low for the rest of fiscal year 2024.

“We were pleased to see demand from certain customers for our ingredients products stabilizing in the quarter ended September 30, 2023. Although results for the Ingredients Operations segment were lower in the six months ended September 30, 2023, compared to the six months ended September 30, 2022, we believe that our customers have been working through their excess inventory levels, and raw material prices, such as apple prices, are coming down. While navigating evolving market dynamics, we remain focused on and encouraged by both our core and new business opportunities with existing and first-time ingredients customers. We continue to strongly believe that our commercial and research and development efforts coupled with our expanded range of capabilities that we can offer our customers due to our ongoing investments in our ingredients platform will strengthen our business for the future.

“Our costs continued to be elevated in the first half of fiscal year 2024, compared to the first half of fiscal year 2023. Interest expense was up over $13 million primarily on higher interest rates, and green tobacco prices were also higher. Despite the higher costs, we have been able to reduce our debt levels in fiscal year 2024. At September 30, 2023, our net debt levels, which we define as the sum of notes payable and overdrafts, long-term debt, and customer advances and deposits, less cash and cash equivalents, declined by about $70 million, compared to our net debt levels at September 30, 2022.

“Universal has a fundamental responsibility to its stakeholders to achieve high standards of environmental performance to support sustainable operations, which we demonstrate through our supplier engagement and disclosures on climate change, water stewardship, and forestry. Our record is highlighted by 15 years of participation in CDP disclosure, the establishment of science-based targets, and recognition by CDP as a Supplier Engagement Leader. To add to our commitment to environmental sustainability, we have committed to water stewardship throughout our operations. To Universal, water stewardship is water usage that is socially and culturally equitable, environmentally sustainable, economically beneficial, and achieved through a multi‐stakeholder process. Our Nominating and Corporate Governance Committee and our management team have approved a Water Stewardship policy to guide and publicly commit to water stewardship through our global operations.”

Universal Corporation

Page 3

| | | | | | | | | | | | | | | | | | | | | | | |

| FINANCIAL HIGHLIGHTS | | | | | | | |

| Six Months Ended September 30, | | Change |

| (in millions of dollars, except per share data) | 2023 | | 2022 | | $ | | % |

| | | | | | | |

| Consolidated Results | | | | | | | |

| Sales and other operating revenue | $ | 1,156.2 | | | $ | 1,080.8 | | | $ | 75.4 | | | 7 | % |

| Cost of goods sold | $ | 938.0 | | | $ | 890.8 | | | $ | 47.1 | | | 5 | % |

| Gross Profit Margin | 18.9 | % | | 17.6 | % | | | | 130 bps |

| Selling, general and administrative expenses | $ | 149.3 | | | $ | 138.8 | | | $ | 10.5 | | | 8 | % |

| | | | | | | |

| Operating income (loss) | $ | 66.3 | | | $ | 51.2 | | | $ | 15.2 | | | 30 | % |

| | | | | | | |

| Diluted earnings (loss) per share (as reported) | $ | 1.04 | | | $ | 1.15 | | | $ | (0.11) | | | (10) | % |

| Adjusted diluted earnings (loss) per share (non-GAAP)* | $ | 1.13 | | | $ | 1.13 | | | $ | — | | | — | % |

| Segment Results | | | | | | | |

| Tobacco operations sales and other operating revenues | $ | 998.6 | | | $ | 918.1 | | | $ | 80.5 | | | 9 | % |

| Tobacco operations operating income | $ | 61.3 | | | $ | 41.9 | | | $ | 19.4 | | | 46 | % |

| Ingredients operations sales and other operating revenues | $ | 157.6 | | | $ | 162.7 | | | $ | (5.1) | | | (3) | % |

| Ingredient operations operating income (loss) | $ | 2.8 | | | $ | 9.1 | | | $ | (6.3) | | | (69) | % |

*See Reconciliation of Certain Non-GAAP Financial Measures in Other Items below.

Net income for the six months ended September 30, 2023, was $26.1 million, or $1.04 per diluted share, compared with $28.7 million, or $1.15 per diluted share, for the six months ended September 30, 2022. Excluding restructuring and impairment costs and certain other non-recurring items, detailed in Other Items below, net income increased by $0.2 million and diluted earnings per share were flat for the six months ended September 30, 2023, compared to the six months ended September 30, 2022. Operating income of $66.3 million for the six months ended September 30, 2023, increased by $15.2 million, compared to operating income of $51.2 million for the six months ended September 30, 2022. Adjusted operating income, detailed in Other Items below, of $68.9 million increased by $17.8 million for the first half of fiscal year 2024, compared to adjusted operating income of $51.2 million for the first half of fiscal year 2023.

Net income for the quarter ended September 30, 2023, was $28.1 million, or $1.12 per diluted share, compared with $21.9 million, or $0.88 per diluted share, for the quarter ended September 30, 2022. Excluding restructuring and impairment costs and certain other non-recurring items, detailed in Other Items below, net income and diluted earnings per share increased by $8.4 million and $0.33, respectively, for the quarter ended September 30, 2023, compared to the quarter ended September 30, 2022. Operating income of $55.3 million for the quarter ended September 30, 2023, increased by $17.4 million, compared to operating income of $37.9 million for the quarter ended September 30, 2022. Adjusted operating income, detailed in Other Items below, of $57.9 million increased by $20.0 million for the second quarter of fiscal year 2024, compared to adjusted operating income of $37.9 million for the second quarter of fiscal year 2023.

Consolidated revenues increased by $75.4 million to $1.2 billion and decreased slightly by $12.5 million to $638.5 million, respectively, for the six months and quarter ended September 30, 2023, compared to the same periods in fiscal year 2023. These changes were largely due to lower tobacco sales volumes but higher tobacco sales prices and a favorable product mix in the Tobacco Operations segment.

Universal Corporation

Page 4

TOBACCO OPERATIONS

Operating income for the Tobacco Operations segment increased by $19.4 million to $61.3 million and by $18.6 million to $52.4 million, respectively, for the six months and quarter ended September 30, 2023, compared with the six months and quarter ended September 30, 2022. Tobacco Operations segment operating income was up despite lower tobacco sales volumes largely on a more favorable product mix in the six months and quarter ended September 30, 2023, compared to the same periods in the prior fiscal year, when a large amount of lower margin carryover tobacco crops were shipped. Carryover crop shipments were significantly lower while current crop shipments were higher in both South America and Africa in the six months and quarter ended September 30, 2023, compared to the same periods in fiscal year 2023. In Europe, sales volumes and revenues were up due to shipment timing in the six months and quarter ended September 30, 2023, compared to the same periods in the prior fiscal year. In Asia, our operations also saw an improved product mix in the six months and quarter ended September 30, 2023, compared to the six months and quarter ended September 30, 2022. Equity earnings from our oriental tobacco joint venture were down significantly in the six months and quarter ended September 30, 2023, compared to the same periods in the prior fiscal year, on unfavorable foreign currency comparisons and higher interest expenses. Selling, general, and administrative expenses for the Tobacco Operations segment were higher in the six months ended September 30, 2023, compared to six months ended September 30, 2022, primarily on higher compensation costs partially offset by favorable foreign currency comparisons. In the quarter ended September 30, 2023, selling, general, and administrative expenses were down, compared to the quarter ended September 30, 2022, largely on favorable foreign currency comparisons. Revenues for the Tobacco Operations segment of $998.6 million for the six months ended September 30, 2023, and $554.7 million for the quarter ended September 30, 2023, were up $80.5 million and down $15.4 million, respectively, compared to the same periods in the prior fiscal year. These changes were largely due to lower tobacco sales volumes, higher tobacco sales prices, and a favorable product mix.

INGREDIENTS OPERATIONS

Operating income for the Ingredients Operations segment was $2.8 million and $4.8 million, respectively, for the six months and quarter ended September 30, 2023, compared to $9.1 million and $4.5 million, respectively for the six months and quarter ended September 30, 2022. Operating income for the Ingredients Operations segment was up slightly for the quarter ended September 30, 2023, compared to the quarter end September 30, 2022, on the stabilization of sales volumes for certain customers. Results for our Ingredients Operations segment were down in the six months ended September 30, 2023, compared to the six months ended September 30, 2022, on lower demand due to customers continuing to carry high inventory levels. Prices for some key raw materials were down in the six months ended September 30, 2023, compared to the six months ended September 30, 2022. Inventory write-downs for the Ingredients Operations segment were higher in the six months ended September 30, 2023, compared to the same period in the prior fiscal year, on the changes in customer demand and new crop raw material prices. Selling, general, and administrative expenses for this segment increased in the six months and quarter ended September 30, 2023, compared to the same periods in the prior fiscal year, largely on higher labor costs and investments in product development capabilities. For the quarter ended September 30, 2023, revenues for the Ingredients Operations segment of $83.8 million were up $2.9 million, compared to the quarter ended September 30, 2022, largely on higher sales volumes partly from new business. Revenues for the Ingredients Operations segment of $157.6 million for six months ended September 30, 2023, compared to the six months ended September 30, 2022, were down $5.1 million, largely on lower sales volumes and sales prices.

Universal Corporation

Page 5

OTHER ITEMS

Cost of goods sold in the six months ended September 30, 2023, increased by 5% to $938.0 million, compared with the six months ended September 30, 2022, largely due to higher green tobacco costs. Cost of goods sold in the quarter ended September 30, 2023, decreased by 6% to $506.8 million, compared with the quarter ended September 30, 2022, primarily on changes in tobacco sales volumes and product mix. Selling, general, and administrative costs for the six months ended September 30, 2023, increased by $10.5 million to $149.3 million, compared to the six months ended September 30, 2022, on higher compensation costs partially offset by favorable foreign currency comparisons. Selling, general, and administrative costs for the quarter ended September 30, 2023, increased by $1.4 million to $73.8 million, compared to the same period in the prior fiscal year, largely on favorable foreign currency comparisons offset by higher compensation costs and provisions on advances to suppliers. Interest expense for the six months and quarter ended September 30, 2023, compared to the same periods in the prior fiscal year, increased by $13.6 million to $32.6 million and by $4.8 million to $17.1 million, respectively, on increased costs from higher interest rates.

For both the six months and quarter ended September 30, 2023, our effective tax rate on pre-tax income was 21.5%. For the six months and quarter ended September 30, 2022, our effective tax rate on pre-tax income was 31.1% and 25.5%, respectively. The consolidated effective income tax rate for the six months ended September 30, 2022, was affected by the sale of our idled Tanzania operations in the quarter ended June 30, 2022, which resulted in $1.1 million of additional income taxes. Without this item, the consolidated effective income tax rate for the six months ended September 30, 2022, would have been approximately 27.5%. Additionally, the sale of our idled Tanzania operations resulted in a $1.8 million reduction to consolidated interest expense related to an uncertain tax position.

Universal Corporation

Page 6

Reconciliation of Certain Non-GAAP Financial Measures

The following table sets forth certain non-recurring items included in reported results to reconcile adjusted net income to net income attributable to Universal Corporation:

| | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Operating Income Reconciliation | |

| Three Months Ended September 30, | | Six Months Ended September 30, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| As Reported: Consolidated operating income | $ | 55,312 | | | $ | 37,886 | | | $ | 66,347 | | | $ | 51,152 | |

| | | | | | | |

| | | | | | | |

Restructuring and impairment costs(1) | 2,599 | | | — | | | 2,599 | | | — | |

| | | | | | | |

| As Adjusted operating income (Non-GAAP) | $ | 57,911 | | | $ | 37,886 | | | $ | 68,946 | | | $ | 51,152 | |

| | | | | | | |

| Adjusted Net Income Attributable to Universal Corporation and Adjusted Diluted Earnings Per Share Reconciliation |

| | | | | | | |

| (in thousands except for per share amounts) | Three Months Ended September 30, | | Six Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| As Reported: Net income attributable to Universal Corporation | $ | 28,128 | | | $ | 21,855 | | | $ | 26,064 | | | $ | 28,685 | |

| | | | | | | |

| | | | | | | |

Restructuring and impairment costs(1) | 2,599 | | | — | | | 2,599 | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Interest expense reversal on uncertain tax position from sale of operations in Tanzania | — | | | — | | | — | | | (1,816) | |

| | | | | | | |

| Total of Non-GAAP adjustments to income before income taxes | 2,599 | | | — | | | 2,599 | | | (1,816) | |

| | | | | | | |

| Non-GAAP adjustments to income taxes | | | | | | | |

| Income tax benefit from restructuring and impairment costs | (465) | | | — | | | (465) | | | — | |

| Income tax expense from sale of operations in Tanzania | — | | | — | | | — | | | 1,132 | |

| | | | | | | |

| Total of income tax impacts for Non-GAAP adjustments to income before income taxes | (465) | | | — | | | (465) | | | 1,132 | |

| | | | | | | |

| As adjusted: Net income attributable to Universal Corporation (Non-GAAP) | $ | 30,262 | | | $ | 21,855 | | | $ | 28,198 | | | $ | 28,001 | |

| As reported: Diluted earnings per share | $ | 1.12 | | | $ | 0.88 | | | $ | 1.04 | | | $ | 1.15 | |

| As adjusted: Diluted earnings per share (Non-GAAP) | $ | 1.21 | | | $ | 0.88 | | | $ | 1.13 | | | $ | 1.13 | |

(1) Restructuring and impairment costs are included in Consolidated operating income in the consolidated statements of income, but excluded for purposes of Adjusted operating income, Adjusted net income available to Universal Corporation, and Adjusted diluted earnings per share.

Universal Corporation

Page 7

Additional information

Amounts described as net income (loss) and earnings (loss) per diluted share in the previous discussion are attributable to Universal Corporation and exclude earnings related to non-controlling interests in subsidiaries. Adjusted operating income (loss), adjusted net income (loss) attributable to Universal Corporation, adjusted diluted earnings (loss) per share, and the total for segment operating income (loss) referred to in this discussion are non-GAAP financial measures. These measures are not financial measures calculated in accordance with GAAP and should not be considered as substitutes for operating income (loss), net income (loss) attributable to Universal Corporation, diluted earnings (loss) per share, cash from operating activities or any other operating or financial performance measure calculated in accordance with GAAP, and may not be comparable to similarly-titled measures reported by other companies. A reconciliation of adjusted operating income (loss) to consolidated operating (income), adjusted net income (loss) attributable to Universal Corporation to consolidated net income (loss) attributable to Universal Corporation and adjusted diluted earnings (loss) per share to diluted earnings (loss) per share are provided in Other Items above. In addition, we have provided a reconciliation of the total for segment operating income (loss) to consolidated operating income (loss) in Note 3 "Segment Information" to the consolidated financial statements. Management evaluates the consolidated Company and segment performance excluding certain significant charges or credits. We believe these non-GAAP financial measures, which exclude items that we believe are not indicative of our core operating results, provide investors with important information that is useful in understanding our business results and trends.

This release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company cautions readers that any statements contained herein regarding financial condition, results of operation, and future business plans, operations, opportunities, and prospects for its performance are forward-looking statements based upon management’s current knowledge and assumptions about future events, and involve risks and uncertainties that could cause actual results, performance, or achievements to be materially different from any anticipated results, prospects, performance, or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, impacts of the COVID-19 pandemic and subvariants; success in pursuing strategic investments or acquisitions and integration of new businesses and the impact of these new businesses on future results; product purchased not meeting quality and quantity requirements; our reliance on a few large customers; its ability to maintain effective information technology systems and safeguard confidential information; anticipated levels of demand for and supply of its products and services; costs incurred in providing these products and services including increased transportation costs and delays attributed to global supply chain challenges; timing of shipments to customers; higher inflation rates; changes in market structure; government regulation and other stakeholder expectations; economic and political conditions in the countries in which we and our customers operate, including the ongoing impacts from international conflicts, such as the conflict in Ukraine; product taxation; industry consolidation and evolution; changes in exchange rates and interest rates; impacts of regulation and litigation on its customers; industry-specific risks related to its plant-based ingredient businesses; exposure to certain regulatory and financial risks related to climate change; changes in estimates and assumptions underlying its critical accounting policies; the promulgation and adoption of new accounting standards, new government regulations and interpretation of existing standards and regulations; and general economic, political, market, and weather conditions. Actual results, therefore, could vary from those expected. A further list and description of these risks, uncertainties, and other factors can be found in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2023, and in other documents the Company files with the Securities and Exchange Commission. This information should be read in conjunction with the Annual Report on Form 10-K for the years ended March 31, 2023. The Company cautions investors not to place undue reliance on any forward-looking statements as these statements speak only as of the date when made, and it undertakes no obligation to update any forward-looking statements made.

At 5:00 p.m. (Eastern Time) on November 2, 2023, the Company will host a conference call to discuss these results. Those wishing to listen to the call may do so by visiting www.universalcorp.com at that time. A replay of the webcast will be available at that site through February 2, 2024. A taped replay of the call will be available through November 16, 2023, by dialing (877) 674-7070. The confirmation number to access the replay is 801368.

Universal Corporation

Page 8

Universal Corporation (NYSE: UVV), headquartered in Richmond, Virginia, is a global business-to-business agri-products supplier to consumer product manufacturers, operating in over 30 countries on five continents. We strive to be the supplier of choice for our customers by leveraging our farmer base, our commitment to a sustainable supply chain, and our ability to provide high-quality, customized, traceable, value-added agri-products essential for our customers’ requirements. We find innovative solutions to serve our customers and have been meeting their agri-product needs for more than 100 years. Our principal focus since our founding in 1918 has been tobacco, and we are the leading global leaf tobacco supplier. Through our plant-based ingredients platform, we provide a variety of value-added manufacturing processes to produce high-quality, specialty vegetable- and fruit-based ingredients as well as botanical extracts and flavorings for the food and beverage end markets. For more information, visit www.universalcorp.com.

Universal Corporation

Page 9

UNIVERSAL CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(in thousands of dollars, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Six Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (Unaudited) | | (Unaudited) |

| Sales and other operating revenues | | $ | 638,484 | | | $ | 650,984 | | | $ | 1,156,206 | | | $ | 1,080,806 | |

| Costs and expenses | | | | | | | | |

| Cost of goods sold | | 506,767 | | | 540,725 | | | 937,977 | | | 890,829 | |

| Selling, general and administrative expenses | | 73,806 | | | 72,373 | | | 149,283 | | | 138,825 | |

| | | | | | | | |

| Restructuring and impairment costs | | 2,599 | | | — | | | 2,599 | | | — | |

| | | | | | | | |

| Operating income | | 55,312 | | | 37,886 | | | 66,347 | | | 51,152 | |

| Equity in pretax earnings (loss) of unconsolidated affiliates | | (713) | | | 416 | | | (4,879) | | | (137) | |

| Other non-operating income (expense) | | 728 | | | (77) | | | 1,453 | | | (139) | |

| Interest income | | 953 | | | 93 | | | 2,318 | | | 330 | |

| Interest expense | | 17,053 | | | 12,270 | | | 32,596 | | | 18,994 | |

| Income before income taxes and other items | | 39,227 | | | 26,048 | | | 32,643 | | | 32,212 | |

| Income taxes | | 8,439 | | | 6,642 | | | 7,016 | | | 10,005 | |

| Net income | | 30,788 | | | 19,406 | | | 25,627 | | | 22,207 | |

| Less: net loss (income) attributable to noncontrolling interests in subsidiaries | | (2,660) | | | 2,449 | | | 437 | | | 6,478 | |

| Net income attributable to Universal Corporation | | $ | 28,128 | | | $ | 21,855 | | | $ | 26,064 | | | $ | 28,685 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Earnings per share: | | | | | | | | |

| Basic | | $ | 1.13 | | | $ | 0.88 | | | $ | 1.05 | | | $ | 1.16 | |

| Diluted | | $ | 1.12 | | | $ | 0.88 | | | $ | 1.04 | | | $ | 1.15 | |

See accompanying notes.

Universal Corporation

Page 10

UNIVERSAL CORPORATION

CONSOLIDATED BALANCE SHEETS

(in thousands of dollars)

| | | | | | | | | | | | | | | | | | | | |

| | September 30, | | September 30, | | March 31, |

| | 2023 | | 2022 | | 2023 |

| | (Unaudited) | | (Unaudited) | | |

| ASSETS | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | $ | 99,683 | | | $ | 58,855 | | | $ | 64,690 | |

| Accounts receivable, net | | 368,924 | | | 469,406 | | | 402,073 | |

| Advances to suppliers, net | | 105,637 | | | 106,475 | | | 170,801 | |

| Accounts receivable—unconsolidated affiliates | | 55,409 | | | 51,179 | | | 12,210 | |

| Inventories—at lower of cost or net realizable value: | | | | | | |

| Tobacco | | 1,086,240 | | | 968,167 | | | 833,876 | |

| Other | | 212,268 | | | 234,581 | | | 202,907 | |

| Prepaid income taxes | | 23,918 | | | 14,820 | | | 16,493 | |

| | | | | | |

| Other current assets | | 95,634 | | | 87,910 | | | 99,840 | |

| Total current assets | | 2,047,713 | | | 1,991,393 | | | 1,802,890 | |

| | | | | | |

| Property, plant and equipment | | | | | | |

| Land | | 26,262 | | | 23,998 | | | 24,926 | |

| Buildings | | 316,180 | | | 300,925 | | | 311,138 | |

| Machinery and equipment | | 705,977 | | | 659,409 | | | 689,220 | |

| | 1,048,419 | | | 984,332 | | | 1,025,284 | |

| Less accumulated depreciation | | (691,811) | | | (643,584) | | | (674,122) | |

| | 356,608 | | | 340,748 | | | 351,162 | |

| Other assets | | | | | | |

| Operating lease right-of-use assets | | 36,318 | | | 43,278 | | | 40,505 | |

| Goodwill, net | | 213,856 | | | 213,803 | | | 213,922 | |

| Other intangibles, net | | 74,475 | | | 86,129 | | | 80,101 | |

| Investments in unconsolidated affiliates | | 70,618 | | | 70,878 | | | 76,184 | |

| Deferred income taxes | | 16,192 | | | 18,180 | | | 13,091 | |

| Pension asset | | 10,650 | | | 12,740 | | | 9,984 | |

| Other noncurrent assets | | 35,342 | | | 36,848 | | | 51,343 | |

| | 457,451 | | | 481,856 | | | 485,130 | |

| | | | | | |

| Total assets | | $ | 2,861,772 | | | $ | 2,813,997 | | | $ | 2,639,182 | |

See accompanying notes.

Universal Corporation

Page 11

UNIVERSAL CORPORATION

CONSOLIDATED BALANCE SHEETS

(in thousands of dollars)

| | | | | | | | | | | | | | | | | | | | |

| | September 30, | | September 30, | | March 31, |

| | 2023 | | 2022 | | 2023 |

| | (Unaudited) | | (Unaudited) | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | |

| Current liabilities | | | | | | |

| Notes payable and overdrafts | | $ | 301,379 | | | $ | 582,382 | | | $ | 195,564 | |

| Accounts payable | | 70,737 | | | 63,823 | | | 83,213 | |

| Accounts payable—unconsolidated affiliates | | 166 | | | — | | | 5,830 | |

| Customer advances and deposits | | 166,505 | | | 12,644 | | | 3,061 | |

| Accrued compensation | | 26,772 | | | 20,944 | | | 33,108 | |

| Income taxes payable | | 4,494 | | | 4,589 | | | 3,274 | |

| Current portion of operating lease liabilities | | 10,469 | | | 10,735 | | | 11,404 | |

| Accrued expenses and other current liabilities | | 120,623 | | | 103,330 | | | 106,533 | |

| Current portion of long-term debt | | — | | | — | | | — | |

| Total current liabilities | | 701,145 | | | 798,447 | | | 441,987 | |

| | | | | | |

| Long-term debt | | 617,086 | | | 518,923 | | | 616,809 | |

| Pensions and other postretirement benefits | | 42,378 | | | 49,398 | | | 42,769 | |

| Long-term operating lease liabilities | | 22,804 | | | 27,905 | | | 25,540 | |

| Other long-term liabilities | | 15,769 | | | 15,302 | | | 32,512 | |

| Deferred income taxes | | 45,082 | | | 49,289 | | | 42,613 | |

| Total liabilities | | 1,444,264 | | | 1,459,264 | | | 1,202,230 | |

| | | | | | |

| Shareholders’ equity | | | | | | |

| Universal Corporation: | | | | | | |

| Preferred stock: | | | | | | |

| Series A Junior Participating Preferred Stock, no par value, 500,000 shares authorized, none issued or outstanding | | — | | | — | | | — | |

| | | | | | |

| Common stock, no par value, 100,000,000 shares authorized 24,558,493 shares issued and outstanding at September 30, 2023 (24,555,361 at September 30, 2022 and 24,555,361 at March 31, 2023) | | 339,241 | | | 333,540 | | | 337,247 | |

| Retained earnings | | 1,119,615 | | | 1,080,920 | | | 1,136,898 | |

| Accumulated other comprehensive loss | | (74,667) | | | (89,606) | | | (77,057) | |

| Total Universal Corporation shareholders' equity | | 1,384,189 | | | 1,324,854 | | | 1,397,088 | |

| Noncontrolling interests in subsidiaries | | 33,319 | | | 29,879 | | | 39,864 | |

| Total shareholders' equity | | 1,417,508 | | | 1,354,733 | | | 1,436,952 | |

| | | | | | |

| Total liabilities and shareholders' equity | | $ | 2,861,772 | | | $ | 2,813,997 | | | $ | 2,639,182 | |

See accompanying notes.

Universal Corporation

Page 12

UNIVERSAL CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of dollars) | | | | | | | | | | | | | | |

| | Six Months Ended September 30, |

| | 2023 | | 2022 |

| | (Unaudited) |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

| Net income | | $ | 25,627 | | | $ | 22,207 | |

| Adjustments to reconcile net income (loss) to net cash used by operating activities: | | | | |

| Depreciation and amortization | | 29,009 | | | 28,294 | |

| | | | |

| Net provision for losses (recoveries) on advances to suppliers | | 3,835 | | | (1,034) | |

| Inventory writedowns | | 2,870 | | | 7,654 | |

| Stock-based compensation expense | | 5,711 | | | 5,304 | |

| Foreign currency remeasurement (gain) loss, net | | 7,528 | | | 6,191 | |

| Foreign currency exchange contracts | | 2,563 | | | 13,562 | |

| Deferred income taxes | | (3,560) | | | (7,144) | |

| Equity in net loss (income) of unconsolidated affiliates, net of dividends | | 3,135 | | | (18) | |

| Restructuring and impairment costs | | 2,599 | | | — | |

| Restructuring payments | | (806) | | | — | |

| | | | |

| | | | |

| Other, net | | 1,012 | | | 1,913 | |

| Changes in operating assets and liabilities, net: | | (68,989) | | | (423,177) | |

| Net cash provided (used) by operating activities | | 10,534 | | | (346,248) | |

| | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | |

| Purchase of property, plant and equipment | | (32,630) | | | (26,588) | |

| Proceeds from sale of business, net of cash held by the business | | 3,757 | | | 1,168 | |

| | | | |

| Proceeds from sale of property, plant and equipment | | 713 | | | 1,644 | |

| | | | |

| Net cash used by investing activities | | (28,160) | | | (23,776) | |

| | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Issuance of short-term debt, net | | 105,649 | | | 399,924 | |

| | | | |

| | | | |

| Dividends paid to noncontrolling interests | | (5,845) | | | (6,825) | |

| | | | |

| | | | |

| Repurchase of common stock | | (4,744) | | | (3,448) | |

| | | | |

| Dividends paid on common stock | | (39,108) | | | (38,594) | |

| | | | |

| Other | | (2,963) | | | (1,869) | |

| Net cash provided (used) by financing activities | | 52,989 | | | 349,188 | |

| | | | |

| Effect of exchange rate changes on cash, restricted cash and cash equivalents | | (370) | | | (1,957) | |

| Net increase (decrease) in cash, restricted cash and cash equivalents | | 34,993 | | | (22,793) | |

| Cash, restricted cash and cash equivalents at beginning of year | | 64,690 | | | 87,648 | |

| | | | |

| Cash, restricted cash and cash equivalents at end of period | | $ | 99,683 | | | $ | 64,855 | |

| | | | |

| Supplemental Information: | | | | |

| Cash and cash equivalents | | $ | 99,683 | | | $ | 58,855 | |

| Restricted cash (Other noncurrent assets) | | — | | | 6,000 | |

| Total cash, restricted cash and cash equivalents | | $ | 99,683 | | | $ | 64,855 | |

See accompanying notes.

Universal Corporation

Page 13

NOTE 1. BASIS OF PRESENTATION

Universal Corporation, which together with its subsidiaries is referred to herein as “Universal” or the “Company,” is a global business-to-business agri-products supplier to consumer product manufacturers. The Company is the leading global leaf tobacco supplier and provides high-quality plant-based ingredients to food and beverage end markets. Because of the seasonal nature of the Company’s business, the results of operations for any fiscal quarter will not necessarily be indicative of results to be expected for other quarters or a full fiscal year. All adjustments necessary to state fairly the results for the period have been included and were of a normal recurring nature. These financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2023 (the “2023 Annual Report on Form 10-K”).

NOTE 2. EARNINGS PER SHARE

The following table sets forth the computation of basic and diluted earnings per share:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Six Months Ended September 30, |

| (in thousands, except share and per share data) | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Basic Earnings Per Share | | | | | | | | |

| Numerator for basic earnings per share | | | | | | | | |

| Net income attributable to Universal Corporation | | $ | 28,128 | | | $ | 21,855 | | | $ | 26,064 | | | $ | 28,685 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Denominator for basic earnings per share | | | | | | | | |

| Weighted average shares outstanding | | 24,869,697 | | | 24,779,237 | | | 24,855,974 | | | 24,774,126 | |

| | | | | | | | |

| Basic earnings per share | | $ | 1.13 | | | $ | 0.88 | | | $ | 1.05 | | | $ | 1.16 | |

| | | | | | | | |

| Diluted Earnings Per Share | | | | | | | | |

| Numerator for diluted earnings per share | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net income attributable to Universal Corporation | | $ | 28,128 | | | $ | 21,855 | | | $ | 26,064 | | | $ | 28,685 | |

| | | | | | | | |

| Denominator for diluted earnings per share: | | | | | | | | |

| Weighted average shares outstanding | | 24,869,697 | | | 24,779,237 | | | 24,855,974 | | | 24,774,126 | |

| Effect of dilutive securities | | | | | | | | |

| | | | | | | | |

| Employee and outside director share-based awards | | 145,672 | | | 160,190 | | | 141,925 | | | 163,365 | |

| Denominator for diluted earnings per share | | 25,015,369 | | | 24,939,427 | | | 24,997,899 | | | 24,937,491 | |

| | | | | | | | |

| Diluted earnings per share | | $ | 1.12 | | | $ | 0.88 | | | $ | 1.04 | | | $ | 1.15 | |

Universal Corporation

Page 14

NOTE 3. SEGMENT INFORMATION

The Company conducts operations across two reportable operating segments, Tobacco Operations and Ingredients Operations.

The Tobacco Operations segment activities involve selecting, procuring, processing, packing, storing, shipping, and financing leaf tobacco for sale to, or for the account of, manufacturers of consumer tobacco products throughout the world. Through various operating subsidiaries located in tobacco-growing countries around the world and significant ownership interests in unconsolidated affiliates, the Company processes and/or sells flue-cured and burley tobaccos, dark air-cured tobaccos, and oriental tobaccos. Flue-cured, burley, and oriental tobaccos are used principally in the manufacture of cigarettes, and dark air-cured tobaccos are used mainly in the manufacture of cigars, pipe tobacco, and smokeless tobacco products. Some of these tobacco types are also increasingly used in the manufacture of non-combustible tobacco products that are intended to provide consumers with an alternative to traditional combustible products. The Tobacco Operations segment also provides physical and chemical product testing and smoke testing for tobacco customers. A substantial portion of the Company’s Tobacco Operations' revenues are derived from sales to a limited number of large, multinational cigarette and cigar manufacturers.

The Ingredients Operations segment provides its customers with a broad variety of plant-based ingredients for both human and pet consumption. The Ingredients Operations segment utilizes a variety of value-added manufacturing processes converting raw materials into a wide spectrum of fruit and vegetable juices, concentrates, dehydrated products, flavors, and botanical extracts. Customers for the Ingredients Operations segment include large multinational food and beverage companies, smaller independent manufacturers, and retail organizations. FruitSmart, Silva, and Shank's are the primary operations for the Ingredients Operations segment. FruitSmart manufactures fruit and vegetable juices, purees, concentrates, essences, fibers, seeds, seed oils, and seed powders. Silva is primarily a dehydrated product manufacturer of fruit and vegetable based flakes, dices, granules, powders, and blends. Shank's manufactures flavors and botanical extracts and also offers bottling and custom packaging for customers.

The Company currently evaluates the performance of its segments based on operating income after allocated overhead expenses, plus equity in the pretax earnings (loss) of unconsolidated affiliates. Operating results for the Company’s reportable segments for each period presented in the consolidated statements of income and comprehensive income were as follows.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Six Months Ended September 30, |

| (in thousands of dollars) | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| SALES AND OTHER OPERATING REVENUES | | | | | | | | |

| Tobacco Operations | | $ | 554,653 | | | $ | 570,030 | | | $ | 998,561 | | | $ | 918,093 | |

| Ingredients Operations | | 83,831 | | | 80,954 | | | 157,645 | | | 162,713 | |

| Consolidated sales and other operating revenues | | $ | 638,484 | | | $ | 650,984 | | | $ | 1,156,206 | | | $ | 1,080,806 | |

| | | | | | | | |

| OPERATING INCOME | | | | | | | | |

| Tobacco Operations | | $ | 52,387 | | | $ | 33,790 | | | $ | 61,270 | | | $ | 41,906 | |

| Ingredients Operations | | 4,811 | | | 4,512 | | | 2,797 | | | 9,109 | |

| Segment operating income | | 57,198 | | | 38,302 | | | 64,067 | | | 51,015 | |

Deduct: Equity in pretax (earnings) loss of unconsolidated affiliates (1) | | 713 | | | (416) | | | 4,879 | | | 137 | |

Restructuring and impairment costs (2) | | (2,599) | | | — | | | (2,599) | | | — | |

| | | | | | | | |

| | | | | | | | |

| Consolidated operating income | | $ | 55,312 | | | $ | 37,886 | | | $ | 66,347 | | | $ | 51,152 | |

(1)Equity in pretax earnings (loss) of unconsolidated affiliates is included in segment operating income (Tobacco Operations), but is reported below consolidated operating income and excluded from that total in the consolidated statements of income and comprehensive income.

(2)Restructuring and impairment costs are excluded from segment operating income, but are included in consolidated operating income in the consolidated statements of income and comprehensive income.

Exhibit 99.2

P.O. Box 25099 ~ Richmond, VA 23260 ~ phone: (804) 359-9311 ~ fax (804) 254-3584