VICI Properties Inc. Announces New $2.5 Billion Unsecured Credit Facility

05 February 2025 - 12:00AM

Business Wire

Extends Maturity to 2029

VICI Properties Inc. (NYSE: VICI) (“VICI Properties” or the

“Company”), today announced the effectiveness of its new $2.5

billion multicurrency unsecured revolving credit facility (the

“Revolving Credit Facility”) that replaced its existing, and now

terminated, unsecured revolving credit facility of the same size.

The Revolving Credit Facility was substantially oversubscribed with

strong support from 15 financial institutions.

The Revolving Credit Facility matures on February 3, 2029 and

can be extended for two successive six-month terms or one

twelve-month term. Based on a pricing grid and the Company’s

current credit ratings and leverage ratios, the Revolving Credit

Facility currently bears interest at a rate of 85.0 basis points

over the SOFR rate or, in the case of borrowings in a foreign

currency, the corresponding index rate for such currency. In

addition, based on the Company’s current credit ratings and

leverage ratios, the Revolving Credit Facility requires the payment

of a facility fee of 20.0 basis points of total commitments. The

Company has an option to increase the Revolving Credit Facility by

up to $1.0 billion, to the extent that any one or more lenders

(from the syndicate or otherwise) agree to provide such additional

credit extensions.

David Kieske, Executive Vice President and CFO, said, “We

greatly appreciate the continued capital support of our bank group

and the confidence they have in our business. This new facility

maintains our depth of liquidity and multicurrency financing

flexibility for our investment grade balance sheet to take

advantage of potential investment opportunities.”

Wells Fargo Securities, LLC. and JPMorgan Chase Bank, N.A.

served as the Joint Bookrunners on the Revolving Credit Facility

with Wells Fargo Bank, N.A. acting as the Administrative Agent.

BofA Securities, Inc., Citibank, N.A. and JPMorgan Chase Bank, N.A.

served as the Syndication Agents. Wells Fargo Securities, LLC.,

BofA Securities, Inc., Citibank, N.A., JPMorgan Chase Bank, N.A.,

Barclays Bank PLC, Goldman Sachs Bank USA, Mizuho Bank, Ltd.,

Sumitomo Mitsui Banking Corporation, and Truist Bank served as the

Joint Lead Arrangers. Barclays Bank PLC, Goldman Sachs Bank USA,

Mizuho Bank, Ltd., Sumitomo Mitsui Banking Corporation, Truist

Bank, Bank of Nova Scotia, BNP Paribas, Capital One National

Association, Citizens Bank, N.A., Deutsche Bank AG New York Branch

and Morgan Stanley Senior Funding Inc. served as Documentation

Agents.

About VICI Properties

VICI Properties Inc. is an S&P 500® experiential real estate

investment trust that owns one of the largest portfolios of

market-leading gaming, hospitality, wellness, entertainment and

leisure destinations, including Caesars Palace Las Vegas, MGM Grand

and the Venetian Resort Las Vegas, three of the most iconic

entertainment facilities on the Las Vegas Strip. VICI Properties

owns 93 experiential assets across a geographically diverse

portfolio consisting of 54 gaming properties and 39 other

experiential properties across the United States and Canada. The

portfolio is comprised of approximately 127 million square feet and

features approximately 60,300 hotel rooms and over 500 restaurants,

bars, nightclubs and sportsbooks. Its properties are occupied by

industry-leading gaming, leisure and hospitality operators under

long-term, triple-net lease agreements. VICI Properties has a

growing array of real estate and financing partnerships with

leading operators in other experiential sectors, including Cabot,

Canyon Ranch, Chelsea Piers, Great Wolf Resorts, Homefield,

Kalahari Resorts and Lucky Strike Entertainment. VICI Properties

also owns four championship golf courses and approximately 33 acres

of undeveloped and underdeveloped land adjacent to the Las Vegas

Strip. VICI Properties’ goal is to create the highest quality and

most productive experiential real estate portfolio through a

strategy of partnering with the highest quality experiential place

makers and operators. For additional information, please visit

www.viciproperties.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. You can identify these

statements by our use of the words “assumes,” “believes,”

“estimates,” “expects,” “guidance,” “intends,” “plans,” “projects,”

and similar expressions that do not relate to historical matters.

All statements other than statements of historical fact are

forward-looking statements. You should exercise caution in

interpreting and relying on forward-looking statements because they

involve known and unknown risks, uncertainties, and other factors

which are, in some cases, beyond the Company’s control and could

materially affect actual results, performance, or achievements.

Important risk factors that may affect the Company’s business,

results of operations and financial position (including those

stemming from the COVID-19 pandemic and changes in the economic

conditions as a result thereof and risks relating to the Company’s

pending transactions) are detailed from time to time in the

Company’s filings with the Securities and Exchange Commission. The

Company does not undertake any obligation to update or revise any

forward-looking statement, whether as a result of new information,

future events, or otherwise, except as may be required by

applicable law.

Press Release Category: Capital Markets

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250204298198/en/

Investor Contacts: Investors@viciproperties.com (646)

949-4631

Or

David Kieske EVP, Chief Financial Officer

DKieske@viciproperties.com

Moira McCloskey SVP, Capital Markets

MMcCloskey@viciproperties.com

LinkedIn: www.linkedin.com/company/vici-properties-inc

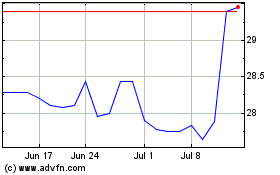

Vici Properties (NYSE:VICI)

Historical Stock Chart

From Jan 2025 to Feb 2025

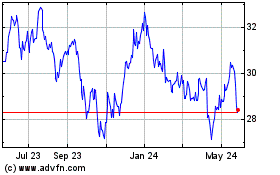

Vici Properties (NYSE:VICI)

Historical Stock Chart

From Feb 2024 to Feb 2025