Net Revenue increased by 6% year over year to

$357 million

Net Income increased by 158% year over year to

$38 million, reflecting an 11% margin

Adjusted EBITDA grew 9% year over year to $91

million, reflecting a 26% margin

Full-year outlook adjusted to $1.410 billion to

$1.425 billion of Net Revenue and $325 million to $335 million of

Adjusted EBITDA1

Yelp Inc. (NYSE: YELP), the trusted platform that connects

people with great local businesses, today announced its financial

results for the second quarter ended June 30, 2024 in the Q2 2024

Shareholder Letter available on its Investor Relations website at

yelp-ir.com.

“Yelp delivered strong profitability and record net revenue in

the second quarter,” said Jeremy Stoppelman, Yelp’s co-founder and

chief executive officer. “The execution of our product-led strategy

continued to drive results, particularly in home services, which

grew approximately 15% year over year in the second quarter, as

well as in our self-serve channel, which saw revenue increase about

20% year over year to a record level. Looking ahead, we plan to

build upon our strong momentum in services as we remain focused on

executing against our robust product roadmap to deliver the best

experience for consumers and service pros.”

“Yelp delivered a solid second quarter with net revenue

increasing by 6% year over year to a record $357 million even as

challenges persisted in the operating environment for restaurants,

retail and other businesses,” said David Schwarzbach, Yelp’s chief

financial officer. “Net income margin increased six percentage

points and adjusted EBITDA margin increased one percentage point

from the previous year, reflecting our disciplined approach. We’re

particularly focused on the opportunity ahead in services to

deliver shareholder value over the long term.”

Quarterly Conference Call

Yelp will host a live Q&A session today at 2:00 p.m. Pacific

Time to discuss the second quarter financial results and outlook

for the third quarter and full year 2024. The webcast of the

Q&A can be accessed on the Yelp Investor Relations website at

yelp-ir.com. A replay of the webcast will be available at the same

website.

About Yelp

Yelp Inc. (yelp.com) is a community-driven platform that

connects people with great local businesses. Millions of people

rely on Yelp for useful and trusted local business information,

reviews and photos to help inform their spending decisions. As a

one-stop local platform, Yelp helps consumers easily discover,

connect and transact with businesses across a broad range of

categories by making it easy to request a quote for a service, book

a table at a restaurant, and more. Yelp was founded in San

Francisco in 2004.

Yelp intends to make future announcements of material financial

and other information through its Investor Relations website. Yelp

will also, from time to time, disclose this information through

press releases, filings with the Securities and Exchange

Commission, conference calls, or webcasts, as required by

applicable law.

Forward-Looking Statements

This press release contains forward-looking statements relating

to, among other things, Yelp’s future performance, including its

expected financial results for 2024 and its ability to drive

profitable growth and shareholder value over the long term, as well

as its plans to execute against its product roadmap and the

expected results of such plans, that are based on its current

expectations, forecasts, and assumptions that involve risks and

uncertainties.

Yelp’s actual results could differ materially from those

predicted or implied by such forward-looking statements and

reported results should not be considered as an indication of

future performance. Factors that could cause or contribute to such

differences include, but are not limited to:

- macroeconomic uncertainty — including related to inflation,

interest rates and supply chain issues, as well as severe weather

events — and its effect on consumer behavior, user activity and

advertiser spending;

- the prevalence of seasonal respiratory illnesses, impact of

fears or actual outbreaks of disease and any resulting changes in

consumer behavior, economic conditions or governmental

actions;

- Yelp’s ability to maintain and expand its base of advertisers,

particularly if advertiser turnover substantially worsens and/or

consumer demand significantly degrades;

- Yelp’s ability to drive continued growth through its strategic

initiatives;

- Yelp’s ability to continue to operate effectively with a

primarily remote work force and attract and retain key talent;

- Yelp’s limited operating history in an evolving industry;

and

- Yelp’s ability to generate and maintain sufficient high-quality

content from its users.

Factors that could cause or contribute to such differences also

include, but are not limited to, those factors that could affect

Yelp’s business, operating results and stock price included under

the captions “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” in

Yelp’s most recent Annual Report on Form 10-K and Quarterly Report

on Form 10-Q at yelp-ir.com or the SEC’s website at sec.gov.

_______________________________ 1 Yelp has not reconciled its

Adjusted EBITDA outlook to GAAP Net income (loss) under generally

accepted accounting principles in the United States (“GAAP”)

because it does not provide an outlook for GAAP Net income (loss)

due to the uncertainty and potential variability of Other income,

net and Provision for (benefit from) income taxes, which are

reconciling items between Adjusted EBITDA and GAAP Net income

(loss). Because Yelp cannot reasonably predict such items, a

reconciliation of the non-GAAP financial measure outlook to the

corresponding GAAP measure is not available without unreasonable

effort. We caution, however, that such items could have a

significant impact on the calculation of GAAP Net income (loss).

For more information regarding the non-GAAP financial measures

discussed in this release, please see “Non-GAAP Financial Measures”

below.

YELP INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(Unaudited)

June 30, 2024

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

252,435

$

313,911

Short-term marketable securities

132,376

127,485

Accounts receivable, net

153,869

146,147

Prepaid expenses and other current

assets

44,999

36,673

Total current assets

583,679

624,216

Property, equipment and software, net

70,616

68,684

Operating lease right-of-use assets

40,679

48,573

Goodwill

102,488

103,886

Intangibles, net

6,974

7,638

Other non-current assets

160,542

161,726

Total assets

$

964,978

$

1,014,723

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

117,762

$

132,809

Operating lease liabilities — current

35,082

39,234

Deferred revenue

5,229

3,821

Total current liabilities

158,073

175,864

Operating lease liabilities —

long-term

32,535

48,065

Other long-term liabilities

39,023

41,260

Total liabilities

229,631

265,189

Stockholders’ equity:

Common stock

—

—

Additional paid-in capital

1,848,677

1,786,667

Treasury stock

(806

)

(282

)

Accumulated other comprehensive loss

(14,134

)

(12,202

)

Accumulated deficit

(1,098,390

)

(1,024,649

)

Total stockholders’ equity

735,347

749,534

Total liabilities and stockholders’

equity

$

964,978

$

1,014,723

YELP INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net revenue

$

357,016

$

337,126

$

689,768

$

649,564

Costs and expenses:

Cost of revenue(1)

30,677

30,184

58,032

56,243

Sales and marketing(1)

150,293

139,150

298,084

286,605

Product development(1)

82,080

85,030

173,307

173,227

General and administrative(1)

44,634

53,405

89,866

99,914

Depreciation and amortization

9,585

10,615

19,515

21,420

Total costs and expenses

317,269

318,384

638,804

637,409

Income from operations

39,747

18,742

50,964

12,155

Other income, net

10,322

5,898

18,046

11,110

Income before income taxes

50,069

24,640

69,010

23,265

Provision for income taxes

12,033

9,911

16,820

9,714

Net income attributable to common

stockholders

$

38,036

$

14,729

$

52,190

$

13,551

Net income per share attributable to

common stockholders

Basic

$

0.56

$

0.21

$

0.77

$

0.19

Diluted

$

0.54

$

0.21

$

0.73

$

0.19

Weighted-average shares used to compute

net income per share attributable to common stockholders

Basic

67,815

69,256

68,187

69,537

Diluted

70,444

71,238

71,574

71,645

(1) Includes stock-based compensation

expense as follows:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Cost of revenue

$

1,397

$

1,346

$

2,798

$

2,728

Sales and marketing

8,618

8,607

17,317

17,721

Product development

22,534

24,974

46,187

50,841

General and administrative

8,665

8,653

17,622

18,547

Total stock-based compensation

$

41,214

$

43,580

$

83,924

$

89,837

YELP INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Six Months Ended June

30,

2024

2023

Operating Activities

Net income

$

52,190

$

13,551

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

19,515

21,420

Provision for doubtful accounts

23,957

14,636

Stock-based compensation

83,924

89,837

Amortization of right-of-use assets

7,662

15,699

Deferred income taxes

(2,109

)

(42,148

)

Amortization of deferred contract cost

12,321

11,716

Asset impairment

—

3,555

Other adjustments, net

(2,995

)

(64

)

Changes in operating assets and

liabilities:

Accounts receivable

(31,679

)

(34,389

)

Prepaid expenses and other assets

(14,914

)

12,156

Operating lease liabilities

(19,434

)

(20,943

)

Accounts payable, accrued liabilities and

other liabilities

(15,894

)

37,225

Net cash provided by operating

activities

112,544

122,251

Investing Activities

Purchases of marketable securities —

available-for-sale

(53,301

)

(82,491

)

Sales and maturities of marketable

securities — available-for-sale

49,095

50,613

Purchases of other investments

(2,500

)

—

Purchases of property, equipment and

software

(16,574

)

(15,153

)

Other investing activities

234

146

Net cash used in investing activities

(23,046

)

(46,885

)

Financing Activities

Proceeds from issuance of common stock for

employee stock-based plans

13,436

26,095

Taxes paid related to the net share

settlement of equity awards

(41,190

)

(38,201

)

Repurchases of common stock

(122,657

)

(100,000

)

Payment of issuance costs for credit

facility

—

(799

)

Net cash used in financing activities

(150,411

)

(112,905

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(295

)

1,175

Change in cash, cash equivalents and

restricted cash

(61,208

)

(36,364

)

Cash, cash equivalents and restricted cash

— Beginning of period

314,002

307,138

Cash, cash equivalents and restricted cash

— End of period

$

252,794

$

270,774

Non-GAAP Financial Measures

This press release and statements made during the above

referenced webcast may include information relating to Adjusted

EBITDA, Adjusted EBITDA margin and Free cash flow, each of which

the Securities and Exchange Commission has defined as a “non-GAAP

financial measure.”

We define Adjusted EBITDA as net income (loss), adjusted to

exclude: provision for (benefit from) income taxes; other income,

net; depreciation and amortization; stock-based compensation

expense; and, in certain periods, certain other income and expense

items, such as material litigation settlements, impairment charges

and fees related to shareholder activism, and other items that we

deem not to be indicative of our ongoing operating performance. We

define Adjusted EBITDA margin as Adjusted EBITDA divided by net

revenue. We define Free cash flow as net cash provided by (used in)

operating activities, less cash used for purchases of property,

equipment and software.

Adjusted EBITDA and Free cash flow, which are not prepared under

any comprehensive set of accounting rules or principles, have

limitations as analytical tools and you should not consider them in

isolation or as substitutes for analysis of Yelp’s financial

results as reported in accordance with generally accepted

accounting principles in the United States (“GAAP”). In particular,

Adjusted EBITDA and Free cash flow should not be viewed as

substitutes for, or superior to, net income (loss) or net cash

provided by (used in) operating activities prepared in accordance

with GAAP as measures of profitability or liquidity. Some of these

limitations are:

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized may have to be replaced

in the future, and Adjusted EBITDA does not reflect all cash

capital expenditure requirements for such replacements or for new

capital expenditure requirements;

- Adjusted EBITDA does not reflect changes in, or cash

requirements for, Yelp’s working capital needs;

- Adjusted EBITDA does not reflect the impact of the recording or

release of valuation allowances or tax payments that may represent

a reduction in cash available to Yelp;

- Adjusted EBITDA does not consider the potentially dilutive

impact of equity-based compensation;

- Adjusted EBITDA does not take into account certain income and

expense items, such as material litigation settlements, impairment

charges and fees related to shareholder activism, or other costs

that management determines are not indicative of ongoing operating

performance;

- Free cash flow does not represent the total residual cash flow

available for discretionary purposes because it does not reflect

our contractual commitments or obligations; and

- other companies, including those in Yelp’s industry, may

calculate Adjusted EBITDA and Free cash flow differently, which

reduces their usefulness as comparative measures.

Because of these limitations, you should consider Adjusted

EBITDA, Adjusted EBITDA margin and Free cash flow alongside other

financial performance measures, including net income (loss), net

cash provided by (used in) operating activities and Yelp’s other

GAAP results.

The following is a reconciliation of net income to Adjusted

EBITDA, as well as the calculation of net income margin and

Adjusted EBITDA margin, for each of the periods indicated (in

thousands, except percentages; unaudited):

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Reconciliation of Net Income to

Adjusted EBITDA:

Net income

$

38,036

$

14,729

$

52,190

$

13,551

Provision for income taxes

12,033

9,911

16,820

9,714

Other income, net(1)

(10,322

)

(5,898

)

(18,046

)

(11,110

)

Depreciation and amortization

9,585

10,615

19,515

21,420

Stock-based compensation

41,214

43,580

83,924

89,837

Litigation settlement(2)(3)

—

11,000

—

11,000

Asset impairment(2)

—

—

—

3,555

Fees related to shareholder

activism(2)

569

—

1,168

—

Adjusted EBITDA

$

91,115

$

83,937

$

155,571

$

137,967

Net revenue

$

357,016

$

337,126

$

689,768

$

649,564

Net income margin

11

%

4

%

8

%

2

%

Adjusted EBITDA margin

26

%

25

%

23

%

21

%

(1)

Includes the release of a $3.1 million

reserve related to a one-time payroll tax credit.

(2)

Recorded within general and administrative

expenses on our condensed consolidated statements of

operations.

(3)

Represents the loss contingency recorded

in connection with the agreement to settle a putative class action

lawsuit asserting claims under the California Invasion of Privacy

Act. For additional information, see our most recently filed

Quarterly Report on Form 10-Q.

The following is a reconciliation of net cash provided by

operating activities to Free cash flow for each of the periods

indicated (in thousands; unaudited):

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Reconciliation of Net Cash Provided by

Operating Activities to Free Cash Flow:

Net cash provided by operating

activities

$

39,689

$

48,007

$

112,544

$

122,251

Purchases of property, equipment and

software

(9,587

)

(7,635

)

(16,574

)

(15,153

)

Free cash flow

$

30,102

$

40,372

$

95,970

$

107,098

Net cash used in investing activities

$

(16,644

)

$

(9,605

)

$

(23,046

)

$

(46,885

)

Net cash used in financing activities

$

(66,577

)

$

(58,199

)

$

(150,411

)

$

(112,905

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808033964/en/

Investor Relations Contact: Kate Krieger ir@yelp.com

Press Contact: Amber Albrecht press@yelp.com

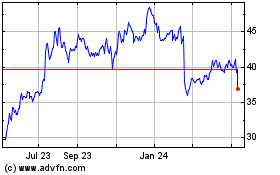

Yelp (NYSE:YELP)

Historical Stock Chart

From Oct 2024 to Nov 2024

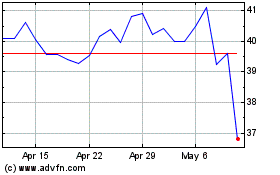

Yelp (NYSE:YELP)

Historical Stock Chart

From Nov 2023 to Nov 2024