Allied Properties Real Estate Investment Trust ("Allied") (TSX:

"AP.UN") today announced results for the three months ended

March 31, 2024.

Results

In the first quarter, Allied’s operating income

from continuing operations was $78 million, up 2% from the

comparable quarter last year. Allied’s net loss and comprehensive

loss was $19 million, in large part due to a fair value loss on

investment properties flowing from declines in development-property

valuations in Toronto, Edmonton and Montréal ($31 million) and

declines in rental-property valuations in Toronto ($88

million).

FFO(1) was $81 million (57.8 cents per unit),

in-line with $81 million (58.0 cents per unit) in the comparable

quarter last year. AFFO(1) was $75 million (53.7 cents per unit),

up slightly from $74 million (53.3 cents per unit) in the

comparable quarter last year. This resulted in FFO and AFFO pay-out

ratios(1) in the first quarter of 77.8% and 83.8%,

respectively.

Same Asset NOI(1) from Allied’s rental portfolio

was down 2.0% while Same Asset NOI from its total portfolio was up

2.9%, reflecting the productivity of its upgrade and development

portfolio.

Operations

Knowledge-based organizations continue to prefer

distinctive workspace in mixed-use, amenity-rich urban

neighbourhoods in Canada’s major cities. As a result, demand for

Allied’s workspace across the country continues to be evident and

quantifiable.

Allied conducted 300 lease tours in its rental

portfolio in the first quarter. Allied’s occupied and leased area

at the end of the quarter was 85.9% and 87.0%, respectively.

Allied leased a total of 538,923 square feet of

GLA in the first quarter, 526,684 square feet in its rental

portfolio and 12,239 square feet in its development portfolio. Of

the 526,684 square feet Allied leased in its rental portfolio,

192,303 square feet were vacant space, 164,649 square feet were

maturing in the quarter and 169,732 square feet were maturing after

the quarter.

Average in-place net rent per occupied square

foot held in the first quarter at $24.10. Allied continued to

achieve rent increases on renewal (up 4.7% ending-to-starting base

rent and up 9.7% average-to-average base rent).

Allied continues to focus on user experience

with a view to ensuring that its properties remain conducive to

human wellness, creativity, connectivity and diversity for the tens

of thousands of people in Canada’s major cities who use Allied

workspace daily. Allied completed its fourth consecutive annual

user-experience assessment with Grace Hill KingsleySurveys in late

2023. All rating areas improved over the prior year, and Allied

exceeded industry averages materially in most rating areas,

including the all-important net promoter score, which Allied

exceeded by 250%. Management expects these strong and quantifiable

results to support Allied’s ongoing leasing efforts in 2024.

Portfolio Optimization

While not minimizing the importance of near-term

results, Allied remains intensely focused on the longer-term

aspects of its commercial real estate business in a manner that

Management believes is in full alignment with equity and debt

investors. Management continues to believe strongly in urban

intensification and humanistic operation and is managing Allied’s

assets accordingly.

As part of a two-fold strategic objective in

2024, Allied will (i) continue the ongoing upgrade of its urban

workspace portfolio and (ii) establish its urban rental-residential

portfolio. In furtherance of this objective, Management pursued

three transactions in the first quarter (TELUS Sky in Calgary, 400

West Georgia in Vancouver and 19 Duncan in Toronto), two of which

closed at the onset of the second quarter and the third of which is

expected to close late in the second quarter.

As part of a related strategic objective in

2024, Allied will sell less-strategic properties in its portfolio

at IFRS value for aggregate proceeds of up to $200 million. In

furtherance of this objective, Management initiated the sale of

less-strategic properties in Montréal and Toronto in response to

unsolicited offers to purchase, with three properties in Montréal

expected to be sold early in the third quarter for aggregate

closing proceeds of approximately $64 million plus a potential

residential density bonus of up to $16 million on final rezoning of

one of the properties. For Allied, a less strategic property is

generally one that is smaller in size and not an integral part of a

major concentration or assembly of distinctive urban workspace in

its portfolio.

Outlook

Allied owns and operates three categories of

distinctive urban workspace in Canada’s major cities:

Allied Heritage (Class I workspace);

Allied Modern (workspace developed or redeveloped

in the last decade); and Allied Flex (workspace in

buildings on underutilized land to be redeveloped in the next

decade). In the first quarter, Management experienced strong and

quantifiable demand for all three categories of office space, as

well as strong and quantifiable engagement among users of Allied

workspace generally. Management expects this to underpin operating

results in 2024 that will fully support Allied’s current

distribution commitment.

Allied expects to continue (i) the ongoing

upgrade of its urban workspace portfolio, (ii) the ongoing

establishment of its urban rental-residential portfolio and (iii)

the sale of less-strategic properties in its portfolio. Management

expects that these portfolio optimization efforts will (i)

materially enhance the productivity of Allied’s national portfolio

of urban income-producing properties and (ii) continue the ongoing

strengthening of Allied’s debt-metrics, to which Allied remains

deeply committed.

Financial Measures

The following table summarizes GAAP financial

measures for the first quarter:

| |

For the three months ended March 31 |

|

(in thousands except for % amounts) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Continuing operations |

|

|

|

|

|

Rental revenue |

$ |

143,577 |

|

$ |

138,490 |

|

$ |

5,087 |

|

3.7 |

% |

|

Property operating costs |

$ |

(65,106 |

) |

$ |

(61,325 |

) |

$ |

(3,781 |

) |

(6.2 |

)% |

|

Operating income |

$ |

78,471 |

|

$ |

77,165 |

|

$ |

1,306 |

|

1.7 |

% |

|

Interest income |

$ |

14,759 |

|

$ |

9,744 |

|

$ |

5,015 |

|

51.5 |

% |

|

Interest expense |

$ |

(23,431 |

) |

$ |

(22,564 |

) |

$ |

(867 |

) |

(3.8 |

)% |

|

General and administrative expenses |

$ |

(6,498 |

) |

$ |

(6,170 |

) |

$ |

(328 |

) |

(5.3 |

)% |

|

Condominium marketing expenses |

$ |

(35 |

) |

$ |

(120 |

) |

$ |

85 |

|

70.8 |

% |

|

Amortization of other assets |

$ |

(378 |

) |

$ |

(370 |

) |

$ |

(8 |

) |

(2.2 |

)% |

|

Net income (loss) from joint venture |

$ |

752 |

|

$ |

(3,006 |

) |

$ |

3,758 |

|

125.0 |

% |

|

Fair value loss on investment properties and investment

properties held for sale |

$ |

(119,192 |

) |

$ |

(78,357 |

) |

$ |

(40,835 |

) |

(52.1 |

)% |

|

Fair value gain on Exchangeable LP Units |

$ |

29,641 |

|

$ |

— |

|

$ |

29,641 |

|

100.0 |

% |

|

Fair value gain (loss) on derivative

instruments |

$ |

7,148 |

|

$ |

(8,024 |

) |

$ |

15,172 |

|

189.1 |

% |

|

Net loss and comprehensive loss from continuing

operations |

$ |

(18,763 |

) |

$ |

(31,702 |

) |

$ |

12,939 |

|

40.8 |

% |

|

Net income and comprehensive income from discontinued

operations |

$ |

— |

|

$ |

18,019 |

|

$ |

(18,019 |

) |

(100.0 |

)% |

|

Net loss and comprehensive loss |

$ |

(18,763 |

) |

$ |

(13,683 |

) |

$ |

(5,080 |

) |

(37.1 |

)% |

|

|

|

|

|

|

The following table summarizes other financial

measures as at March 31, 2024, and March 31, 2023:

| |

As at March 31 |

|

(in thousands except for per unit and % amounts) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Investment properties

(1) |

$ |

9,303,305 |

|

$ |

9,691,030 |

|

$ |

(387,725 |

) |

(4.0 |

)% |

|

Unencumbered investment properties

(2) |

$ |

8,634,755 |

|

$ |

8,388,680 |

|

$ |

246,075 |

|

2.9 |

% |

|

Total Assets

(1) |

$ |

10,475,397 |

|

$ |

11,968,357 |

|

$ |

(1,492,960 |

) |

(12.5 |

)% |

|

Cost of PUD as a % of GBV

(2) |

|

11.1 |

% |

|

11.5 |

% |

|

— |

|

(0.4 |

)% |

|

NAV per unit

(3) |

$ |

44.84 |

|

$ |

50.41 |

|

$ |

(5.57 |

) |

(11.0 |

)% |

|

Debt

(1) |

$ |

3,719,172 |

|

$ |

4,340,919 |

|

$ |

(621,747 |

) |

(14.3 |

)% |

|

Total indebtedness ratio

(2) |

|

35.9 |

% |

|

36.5 |

% |

|

— |

|

(0.6 |

)% |

|

Annualized Adjusted EBITDA

(2) |

$ |

386,012 |

|

$ |

411,980 |

|

$ |

(25,968 |

) |

(6.3 |

)% |

|

Net debt as a multiple of Annualized Adjusted

EBITDA

(2) |

9.4x |

10.5x |

(1.1x) |

— |

|

|

Interest coverage ratio including interest capitalized and

excluding financing prepayment costs - three months

trailing

(2) |

2.8x |

2.4x |

0.4x |

— |

|

|

Interest coverage ratio including interest capitalized and

excluding financing prepayment costs - twelve months

trailing

(2) |

2.6x |

2.8x |

(0.2x) |

— |

|

(1) This measure is presented on an IFRS

basis.(2) This is a non-GAAP measure and includes the results of

the continuing operations and the discontinued operations. Refer to

the Non-GAAP Measures section below.(3) Prior to Allied's

conversion to an open-end trust, net asset value per unit ("NAV per

unit") was calculated as total equity as at the corresponding

period ended, divided by the actual number of Units and class B

limited partnership units of Allied Properties Exchangeable Limited

Partnership ("Exchangeable LP Units") outstanding at period end.

With Allied's conversion to an open-end trust on June 12, 2023, NAV

per unit is calculated as total equity plus the value of

Exchangeable LP Units as at the corresponding period ended, divided

by the actual number of Units and Exchangeable LP Units. The

rationale for including the value of Exchangeable LP Units is

because they are economically equivalent to Units, receive

distributions equal to the distributions paid on the Units and are

exchangeable, at the holder's option, for Units.

Non-GAAP Measures

Management uses financial measures based on

International Financial Reporting Standards ("IFRS" or "GAAP") and

non-GAAP measures to assess Allied's performance. Non-GAAP measures

do not have any standardized meaning prescribed under IFRS, and

therefore, should not be construed as alternatives to net income or

cash flow from operating activities calculated in accordance with

IFRS. Refer to the Non-GAAP Measures section on page 16 of the

MD&A as at March 31, 2024, available on www.sedarplus.ca,

for an explanation of the composition of the non-GAAP measures used

in this press release and their usefulness for readers in assessing

Allied's performance. Such explanation is incorporated by reference

herein.

The following table summarizes non-GAAP

financial measures for the first quarter:

| |

For the three months ended March 31 |

|

(in thousands except for per unit and % amounts)(1) |

|

2024 |

|

|

2023 |

|

Change |

% Change |

|

Adjusted EBITDA |

$ |

96,503 |

|

$ |

102,995 |

|

$ |

(6,492 |

) |

(6.3 |

)% |

|

Same Asset NOI - rental portfolio |

$ |

76,493 |

|

$ |

78,091 |

|

$ |

(1,598 |

) |

(2.0 |

)% |

|

Same Asset NOI - total portfolio |

$ |

84,227 |

|

$ |

81,865 |

|

$ |

2,362 |

|

2.9 |

% |

|

FFO |

$ |

81,149 |

|

$ |

81,175 |

|

$ |

(26 |

) |

— |

% |

|

FFO per unit (diluted) |

$ |

0.581 |

|

$ |

0.581 |

|

$ |

— |

|

— |

% |

|

FFO pay-out ratio |

|

77.5 |

% |

|

77.5 |

% |

|

— |

|

— |

% |

|

All amounts below are excluding condominium related items,

financing prepayment costs, and the mark-to-market adjustment on

unit-based compensation: |

|

FFO |

$ |

80,794 |

|

$ |

81,085 |

|

$ |

(291 |

) |

(0.4 |

)% |

|

FFO per unit (diluted) |

$ |

0.578 |

|

$ |

0.580 |

|

$ |

(0.002 |

) |

(0.3 |

)% |

|

FFO pay-out ratio |

|

77.8 |

% |

|

77.6 |

% |

|

— |

|

0.2 |

% |

|

AFFO |

$ |

75,054 |

|

$ |

74,482 |

|

$ |

572 |

|

0.8 |

% |

|

AFFO per unit (diluted) |

$ |

0.537 |

|

$ |

0.533 |

|

$ |

0.004 |

|

0.8 |

% |

|

AFFO pay-out ratio |

|

83.8 |

% |

|

84.4 |

% |

|

— |

|

(0.6 |

)% |

|

|

|

|

|

|

(1) These non-GAAP measures include the results

of the continuing operations and the discontinued operations

(except for Same Asset NOI - rental portfolio, which only includes

continuing operations).

The following tables reconcile the non-GAAP

measures to the most comparable IFRS measures for the three months

ended March 31, 2024, and the comparable period in 2023. These

terms do not have any standardized meaning prescribed under IFRS

and may not be comparable to similarly titled measures presented by

other publicly traded entities.

The following table reconciles Allied's net loss

and comprehensive loss to Adjusted EBITDA, a non-GAAP measure, for

the three months ended March 31, 2024 and March 31,

2023.

| |

Three months ended |

|

|

|

March 31, 2024 |

March 31, 2023 |

|

|

Net loss and comprehensive loss for the period |

$ |

(18,763 |

) |

$ |

(13,683 |

) |

|

|

Interest expense |

|

23,431 |

|

|

24,335 |

|

|

|

Amortization of other assets |

|

437 |

|

|

370 |

|

|

|

Amortization of improvement allowances |

|

9,572 |

|

|

8,368 |

|

|

|

Fair value loss on investment properties and investment properties

held for sale (1) |

|

119,004 |

|

|

75,791 |

|

|

|

Fair value gain on Exchangeable LP Units |

|

(29,641 |

) |

|

— |

|

|

|

Fair value (gain) loss on derivative instruments |

|

(7,148 |

) |

|

8,024 |

|

|

|

Mark-to-market adjustment on unit-based compensation |

|

(389 |

) |

|

(210 |

) |

|

|

Adjusted EBITDA (2) |

$ |

96,503 |

|

$ |

102,995 |

|

|

(1) Includes Allied's proportionate share of the

equity accounted investment's fair value gain on investment

properties of $188 for the three months ended March 31, 2024

(March 31, 2023 - fair value loss on investment properties of

$4,023).(2) The Adjusted EBITDA for the three months ended March

31, 2023 includes the Urban Data Centre segment which was

classified as a discontinued operation from Q4 2022 until its

disposition in August 2023.

The following table reconciles operating income to

net operating income, a non-GAAP measure, for the three months

ended March 31, 2024 and March 31, 2023.

| |

Three months ended |

|

| |

March 31, 2024 |

March 31, 2023 |

|

|

Operating income, IFRS basis |

$ |

78,471 |

|

$ |

77,165 |

|

|

|

Add: investment in joint venture |

|

610 |

|

|

1,009 |

|

|

|

Operating income, proportionate basis |

$ |

79,081 |

|

$ |

78,174 |

|

|

|

Amortization of improvement allowances (1)(2) |

|

9,572 |

|

|

8,238 |

|

|

|

Amortization of straight-line rent (1)(2) |

|

(1,498 |

) |

|

(1,779 |

) |

|

|

NOI from continuing operations |

$ |

87,155 |

|

$ |

84,633 |

|

|

|

NOI from discontinued operations |

$ |

— |

|

$ |

13,069 |

|

|

|

Total NOI |

$ |

87,155 |

|

$ |

97,702 |

|

|

(1) Includes Allied's proportionate share of the

equity accounted investment of the following amounts for the three

months ended March 31, 2024: amortization improvement

allowances of $179 (March 31, 2023 - $183) and amortization of

straight-line rent of $(45) (March 31, 2023 - $(48)). (2)

Excludes the Urban Data Centre segment which was classified as a

discontinued operation starting in Q4 2022. For the three months

ended March 31, 2024, the Urban Data Centre segment's

amortization of improvement allowances was $nil (March 31,

2023 - $130). For the three months ended March 31, 2024, the

Urban Data Centre segment's amortization of straight-line rent was

$nil (March 31, 2023 - $(262)).

Same Asset NOI, a non-GAAP measure, is measured as

the net operating income for the properties that Allied owned and

operated for the entire duration of both the current and

comparative period.

| |

Three months ended |

Change |

| |

March 31, 2024 |

March 31, 2023 |

$ |

% |

|

Rental Portfolio - Same Asset NOI |

$ |

76,493 |

$ |

78,091 |

$ |

(1,598 |

) |

(2.0 |

)% |

|

Development Portfolio - Same Asset NOI |

$ |

6,473 |

$ |

2,479 |

$ |

3,994 |

|

161.1 |

% |

|

Total Portfolio - Same Asset NOI |

$ |

84,227 |

$ |

81,865 |

$ |

2,362 |

|

2.9 |

% |

|

Acquisitions |

$ |

— |

$ |

— |

$ |

— |

|

|

|

Dispositions |

|

8 |

|

13,520 |

|

(13,512 |

) |

|

|

Lease terminations |

|

8 |

|

193 |

|

(185 |

) |

|

|

Development fees and corporate items |

|

2,912 |

|

2,124 |

|

788 |

|

|

|

Total NOI |

$ |

87,155 |

$ |

97,702 |

$ |

(10,547 |

) |

(10.8 |

)% |

The following tables reconcile Allied's net loss

and comprehensive loss to FFO, FFO excluding condominium related

items, financing prepayment costs, and the mark-to-market

adjustment on unit-based compensation, AFFO, and AFFO excluding

condominium related items, financing prepayment costs, and the

mark-to-market adjustment on unit-based compensation, which are

non-GAAP measures, for the three months ended March 31, 2024,

and March 31, 2023.

| |

Three months ended |

|

|

March 31, 2024 |

March 31, 2023 |

Change |

|

Net loss and comprehensive loss from continuing operations |

$ |

(18,763 |

) |

$ |

(31,702 |

) |

$ |

12,939 |

|

|

Net income and comprehensive income from discontinued

operations |

|

— |

|

|

18,019 |

|

|

(18,019 |

) |

|

Adjustment to fair value of investment properties and investment

properties held for sale |

|

119,192 |

|

|

71,768 |

|

|

47,424 |

|

|

Adjustment to fair value of Exchangeable LP Units |

|

(29,641 |

) |

|

— |

|

|

(29,641 |

) |

|

Adjustment to fair value of derivative instruments |

|

(7,148 |

) |

|

8,024 |

|

|

(15,172 |

) |

|

Incremental leasing costs |

|

2,711 |

|

|

2,240 |

|

|

471 |

|

|

Amortization of improvement allowances |

|

9,393 |

|

|

8,185 |

|

|

1,208 |

|

|

Amortization of property, plant and equipment (1) |

|

100 |

|

|

100 |

|

|

— |

|

|

Distributions on Exchangeable LP Units |

|

5,314 |

|

|

— |

|

|

5,314 |

|

|

Adjustments relating to joint venture: |

|

|

|

|

Adjustment to fair value on investment properties |

|

(188 |

) |

|

4,023 |

|

|

(4,211 |

) |

|

Amortization of improvement allowances |

|

179 |

|

|

183 |

|

|

(4 |

) |

|

Interest expense(2) |

|

— |

|

|

335 |

|

|

(335 |

) |

|

FFO |

$ |

81,149 |

|

$ |

81,175 |

|

$ |

(26 |

) |

|

Condominium marketing costs |

|

35 |

|

|

120 |

|

|

(85 |

) |

|

Mark-to-market adjustment on unit-based compensation |

|

(390 |

) |

|

(210 |

) |

|

(180 |

) |

|

FFO excluding condominium related items, financing

prepayment costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

80,794 |

|

$ |

81,085 |

|

$ |

(291 |

) |

|

Amortization of straight-line rent |

|

(1,453 |

) |

|

(1,993 |

) |

|

540 |

|

|

Regular leasing expenditures |

|

(1,587 |

) |

|

(1,126 |

) |

|

(461 |

) |

|

Regular and recoverable maintenance capital expenditures |

|

(750 |

) |

|

(1,868 |

) |

|

1,118 |

|

|

Incremental leasing costs (related to regular leasing

expenditures) |

|

(1,898 |

) |

|

(1,568 |

) |

|

(330 |

) |

|

Adjustment relating to joint venture: |

|

|

|

|

Amortization of straight-line rent |

|

(45 |

) |

|

(48 |

) |

|

3 |

|

|

Regular leasing expenditures |

|

(7 |

) |

|

— |

|

|

(7 |

) |

|

AFFO excluding condominium related items, financing

prepayment costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

75,054 |

|

$ |

74,482 |

|

$ |

572 |

|

|

|

|

|

|

|

Weighted average number of units (3) |

|

|

|

|

Basic |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

|

Diluted |

|

139,765,128 |

|

|

139,765,128 |

|

|

— |

|

| |

|

|

|

|

Per unit - basic |

|

|

|

|

FFO |

$ |

0.581 |

|

$ |

0.581 |

|

$ |

— |

|

|

FFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

0.578 |

|

$ |

0.580 |

|

$ |

(0.002 |

) |

|

AFFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

0.537 |

|

$ |

0.533 |

|

$ |

0.004 |

|

| |

|

|

|

|

Per unit - diluted |

|

|

|

|

FFO |

$ |

0.581 |

|

$ |

0.581 |

|

$ |

— |

|

|

FFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

0.578 |

|

$ |

0.580 |

|

$ |

(0.002 |

) |

|

AFFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

$ |

0.537 |

|

$ |

0.533 |

|

$ |

0.004 |

|

| |

|

|

|

|

Pay-out Ratio |

|

|

|

|

FFO |

|

77.5 |

% |

|

77.5 |

% |

|

0.0 |

% |

|

FFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

|

77.8 |

% |

|

77.6 |

% |

|

0.2 |

% |

|

AFFO excluding condominium related items, financing prepayment

costs, and the mark-to-market adjustment on unit-based

compensation |

|

83.8 |

% |

|

84.4 |

% |

|

(0.6 |

)% |

(1) Property, plant and equipment relates to

owner-occupied property.(2) This amount represents interest expense

on Allied's joint venture investment in TELUS Sky and is not

capitalized under IFRS, but is allowed as an adjustment under

REALPAC's definition of FFO. (3) The weighted average number of

units includes Units and Exchangeable LP Units. The Exchangeable LP

Units were re-classified from non-controlling interests in equity

to liabilities in the unaudited condensed consolidated financial

statements on Allied's conversion to an open-end trust on June 12,

2023.

Cautionary Statements

This press release may contain forward-looking

statements with respect to Allied, its operations, strategy,

financial performance and condition, and the assumptions underlying

any of the foregoing. These statements generally can be identified

by use of forward-looking words such as "forecast", “outlook”,

“may”, “will”, “expect”, “estimate”, “anticipate”, “intends”,

“believe”, “assume” or “continue” or the negative thereof or

similar variations. The forward-looking statements in this press

release are not guarantees of future results, operations or

performance and are based on estimates and assumptions that are

subject to risks and uncertainties, including those described under

“Risks and Uncertainties” in Allied’s Annual MD&A, which is

available at www.sedarplus.ca. Those risks and uncertainties

include risks associated with financing and interest rates, access

to capital, general economic conditions and lease roll-over.

Allied’s actual results and performance discussed herein could

differ materially from those expressed or implied by such

statements. These cautionary statements qualify all forward-looking

statements attributable to Allied and persons acting on its behalf.

All forward-looking statements speak only as of the date of this

press release and, except as required by applicable law, Allied has

no obligation to update such statements.

About Allied

Allied is a leading owner-operator of

distinctive urban workspace in Canada’s major cities. Allied’s

mission is to provide knowledge-based organizations with workspace

that is sustainable and conducive to human wellness, creativity,

connectivity and diversity. Allied’s vision is to make a continuous

contribution to cities and culture that elevates and inspires the

humanity in all people.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

Cecilia C. WilliamsPresident & Chief Executive

Officer(416) 977-9002cwilliams@alliedreit.com

Nanthini MahalingamSenior Vice President &

Chief Financial Officer(416) 977-9002nmahalingam@alliedreit.com

______________________(1) This is a non-GAAP

measure and includes the results of the continuing operations and

the discontinued operations (except for Same Asset NOI, which only

includes continuing operations). Refer to the Non-GAAP Measures

section below.

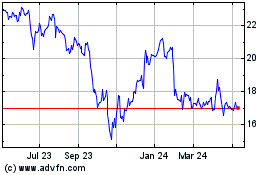

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Dec 2024 to Jan 2025

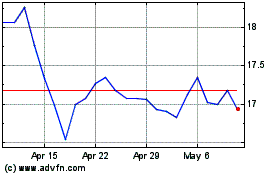

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Jan 2024 to Jan 2025