Black Iron Not Impacted by Proposed United States Steel Tariffs

06 March 2018 - 12:38AM

Black Iron Inc. (“Black Iron” or the “Company”) (TSX:BKI)

(OTC:BKIRF) (FRANKFURT:BIN) responds to statements made by the

President of the United States (“U.S.”), Donald Trump, who has

indicated his intention to impose a 25% import duty on steel.

The Company does not anticipate that these duties, once

implemented, will have any significant impact on global iron ore

prices despite being a main component of steel given the U.S. only

consumes approximately 6% of total global steel produced, as

explained below. The Company does not expect the proposed

tariffs on steel to have an adverse impact to the value of the

Company’s Shymanivske Iron Ore Project (“Shymanivske” or the

“Project”) given the very conservative US$62 per tonne benchmark

priced used in the Company’s Preliminary Economic Assessment to

estimate the after tax unlevered 36% Internal Rate of Return on the

Project as compared to today’s 25% higher benchmark iron ore price

of US$78 per tonne. Full details regarding the Company’s

Preliminary Economic Assessment can be found in the NI 43-101

compliant technical report entitled “Preliminary Economic

Assessment of the Re-scoped Shymanivske Iron Ore Deposit” effective

November 21, 2017 under the Company's profile on SEDAR at

www.sedar.com.

In general, these proposed duties are most

likely to result in an increase in prices to the American consumer

for domestically produced goods such as cars, soda cans and

building materials. It is also expected to directly impact

the main exporters of steel to the U.S. including Canada, Brazil,

South Korea, Mexico and Russia as seen in Figure

1: http://www.globenewswire.com/NewsRoom/AttachmentNg/96896adb-fe07-4759-8cb0-2bbabc7818f3.

Based on statistics compiled by the World Steel

Association, global production of steel is approximately 1.6

billion tonnes per year. The U.S. produces approximately 79

million tonnes per year and is a net importer of 22 million tonnes

per year, which in aggregate is only 6% of global production.

China, which supplies less than 1% of the steel imported into the

U.S., produced 808 million tonnes in 2016. China’s production

comprises 50% of global steel production and the Company believes

that it is the country to focus on when analysing iron ore

prices. Given that the proposed U.S. tariff is not expected

to have an impact on China’s steel production and therefore China’s

demand for iron ore, it is not likely to have any impact on the

global price of iron ore.

In China, the demand for high grade iron ore is

likely to increase given the new environmental regulations imposed

in November 2017 which have already resulted in numerous domestic

iron ore miners being forced to shut down due to the low quality of

iron ore produced. The new environmental regulations are

driving a shift towards higher quality iron ore both in terms of

iron content and use of pellets/pellet feed. These higher quality

iron products require less coal to be burnt in the production of

steel which is a large component of multiple products used in

everyday life ranging from utensils to cars and building

structures. Black Iron expects to produce an ultra high-grade

premium 68% iron ore product from the Project. This ultra

high-grade product is within the top 4% of global production based

on grade and highly desirable for China’s steel mills given the new

Chinese regulations.

The Company continues to advance the acquisition

of the Shymanivske surface rights as well as working to secure

off-take agreements as part of the path to construction of the

Project. The Company will provide an update on the progress

of these items very soon.

About Black IronBlack Iron is

an iron ore exploration and development company, advancing its 100%

owned Shymanivske project located in Kryviy Rih, Ukraine. The

Shymanivske project contains a NI 43-101 compliant resource

estimated to be 646 Mt Measured and Indicated mineral resources,

consisting of 355 Mt Measured mineral resources grading 31.6% total

iron and 18.8% magnetic iron, and Indicated mineral resources of

290 Mt grading 31.1% total iron and 17.9% magnetic iron, using a

cut-off grade of 10% magnetic iron. Additionally, the Shymanivske

project contains 188 Mt of Inferred mineral resources grading 30.1%

total iron and 18.4% magnetic iron. The Shymanivske project is

surrounded by five other operating mines, including ArcelorMittal's

iron ore complex. Please visit the Company's website at

www.blackiron.com for more information.

The technical and scientific contents of this

press release have been prepared under the supervision of and have

been reviewed and approved by Matt Simpson, P.Eng., CEO of Black

Iron, who is a Qualified Person as defined by NI 43-101.

| For

more information, please contact: |

| |

|

| Lisa

Doddridge |

Matt

Simpson |

| Vice President,

Strategic Communications |

Chief Executive

Officer |

| Tel: +1 (416)

309-2698 |

Tel: +1 (416)

309-2138 |

|

info@blackiron.com |

|

Forward-Looking InformationThis

press release contains forward-looking information. Forward-looking

information is based on what management believes to be reasonable

assumptions, opinions and estimates of the date such statements are

made based on information available to them at that time, including

those factors discussed in the section entitled ‘‘Risk Factors’’ in

the Company’s annual information form for the year ended December

31, 2016 or as may be identified in the Company’s public disclosure

from time to time, as filed under the Company’s profile on SEDAR at

www.sedar.com. Forward-looking information may include, but

is not limited to, statements with respect to the Project, the

impact of tariffs on the price of Steel, the demand for steel

globally and in China, the mineralization of the Project, the

results of the PEA, the realization of the PEA, the expectations of

future cash flows, the expected economics forecast, the

geo-political climate in Ukraine, the Company’s ability to obtain

the requisite land rights for the Project and other requisite

permits or approvals, and future plans for the Company’s

development. Generally, forward looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: general business, economic, competitive, geopolitical

and social uncertainties; the actual results of current exploration

activities; other risks of the mining industry and the risks

described in the annual information form of the Company. Although

the Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward looking information. The Company

does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

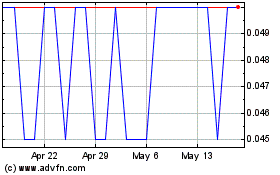

Black Iron (TSX:BKI)

Historical Stock Chart

From Jan 2025 to Feb 2025

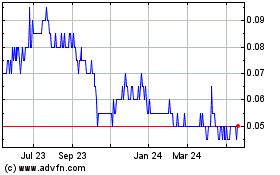

Black Iron (TSX:BKI)

Historical Stock Chart

From Feb 2024 to Feb 2025