Dundee Precious Metals Inc. (TSX: DPM) (“DPM” or the “Company”)

announced its operating and financial results for the third quarter

and nine months ended September 30, 2024.

Third Quarter Highlights(Unless otherwise

stated, all monetary figures in this news release are expressed in

U.S. dollars, and all operational and financial information

contained in this news release is related to continuing

operations.)

-

On track to meet 2024 guidance: With production of

60,145 ounces of gold and 7.3 million pounds of copper in the third

quarter, and 190,516 ounces of gold and 21.9 million pounds of

copper in the first nine months of 2024, DPM is well-positioned to

achieve its annual production guidance.

-

Generating robust margins: Reported all-in

sustaining cost per ounce of gold sold1 of $1,005, and cost of

sales per ounce of gold sold2 of $1,265. All-in sustaining cost per

ounce of gold sold in the first nine months of 2024 was $859, and

is expected to be within the annual guidance range for the

year.

-

Advancing growth pipeline: The Čoka Rakita project

pre-feasibility study ("PFS") is progressing well, with infill

drilling completed and an updated Mineral Resource Estimate in

progress. The PFS is on track for completion in the first quarter

of 2025.

-

Free cash flow: Generated $70.9 million of free

cash flow1 and $52.5 million of cash provided from operating

activities from continuing operations.

-

Adjusted net earnings: Reported adjusted net

earnings1 of $46.2 million ($0.26 per share1) and net earnings from

continuing operations of $46.2 million ($0.26 per share).

-

Continued capital discipline: Returned $49.5

million, or 23% of free cash flow, to shareholders year-to-date

through dividends paid and shares repurchased.

-

Substantial liquidity for growth: Ended the

quarter with a strong balance sheet, including a total of $658.2

million of cash, a $150.0 million undrawn revolving credit

facility, and no debt.

-

High-grade copper-gold discoveries: Announced

high-grade copper-gold Dumitru Potok and Frasen discoveries, which

are located within one kilometre of the Čoka Rakita project.

-

Sale of Tsumeb smelter completed: DPM closed the

sale of the Tsumeb smelter for a net cash consideration of $15.9

million, subject to normal post-closing adjustments (“Tsumeb

Disposition”).

__________________1 All-in sustaining cost per

ounce of gold sold, free cash flow, adjusted net earnings and

adjusted basic earnings per share are non-GAAP financial measures

or ratios. These measures have no standardized meanings under IFRS

Accounting Standards (“IFRS”) and may not be comparable to similar

measures presented by other companies. Refer to the “Non-GAAP

Financial Measures” section commencing on page 13 of this news

release for more information, including reconciliations to IFRS

measures.2 Cost of sales per ounce of gold sold represents total

cost of sales for Chelopech and Ada Tepe, divided by total payable

gold in concentrate sold, while all-in sustaining cost per ounce of

gold sold includes treatment and freight charges, net of by-product

credits, all of which are reflected in revenue.

CEO Commentary

“We generated $213 million of free cash flow

year-to-date, demonstrating the quality of our assets, our low cost

structure and the benefit of higher metal prices,” said David Rae,

President and Chief Executive Officer. “We are well-positioned to

continue our ten-year track record of achieving our gold production

and all-in sustaining cost guidance.

“We continue to advance Čoka Rakita, our

high-grade, low-cost growth project in Serbia, with the PFS on

track for completion in Q1 2025. Our scout drilling programs

continue to return strong results confirming the large-scale

potential for further high-grade copper-gold mineralization, as

demonstrated by the Dumitru Potok and Frasen discoveries we

announced in September.

“DPM is in a unique position in the industry,

with a strong base of high-margin production driving significant

free cash flow generation, and the balance sheet strength to

internally fund our growth pipeline and exploration prospects while

continuing to return capital to shareholders.”

Use of non-GAAP Financial Measures

Certain financial measures referred to in this

news release are not measures recognized under IFRS and are

referred to as non-GAAP financial measures or ratios. These

measures have no standardized meanings under IFRS and may not be

comparable to similar measures presented by other companies. The

definitions established and calculations performed by DPM are based

on management’s reasonable judgment and are consistently applied.

These measures are intended to provide additional information and

should not be considered in isolation or as a substitute for

measures prepared in accordance with IFRS. Non-GAAP financial

measures and ratios, together with other financial measures

calculated in accordance with IFRS, are considered to be important

factors that assist investors in assessing the Company’s

performance. The Company uses the following non-GAAP financial

measures and ratios in this news release:

- mine cash cost

- cash cost per tonne of ore

processed

- mine cash cost of sales

- cash cost per ounce of gold

sold

- all-in sustaining cost

- all-in sustaining cost per ounce of

gold sold

- adjusted earnings before interest,

taxes, depreciation and amortization (“adjusted EBITDA”)

- adjusted net earnings

- adjusted basic earnings per

share

- cash provided from operating

activities, before changes in working capital

- free cash flow

- average realized metal prices

For a detailed description of each of the

non-GAAP financial measures and ratios used in this news release

and a detailed reconciliation to the most directly comparable

measure under IFRS, please refer to the “Non-GAAP Financial

Measures” section commencing on page 13 of this news release.

Key Operating and Financial Highlights from Continuing

Operations

|

$ millions, except where noted |

|

Three Months |

|

Nine Months |

|

|

2024 |

2023 |

Change |

|

2024 |

2023 |

Change |

|

Operating Highlights |

|

|

|

|

|

|

|

|

|

Ore Processed |

t |

711,090 |

738,614 |

(4 |

%) |

|

2,167,831 |

2,217,187 |

(2 |

%) |

| Metals contained in

concentrate produced: |

|

|

|

|

|

|

|

|

|

Gold |

|

|

|

|

|

|

|

|

|

Chelopech |

oz |

43,899 |

40,280 |

9 |

% |

|

125,128 |

120,001 |

4 |

% |

|

Ada Tepe |

oz |

16,246 |

33,822 |

(52 |

%) |

|

65,388 |

98,988 |

(34 |

%) |

|

Total gold in concentrate produced |

oz |

60,145 |

74,102 |

(19 |

%) |

|

190,516 |

218,989 |

(13 |

%) |

|

Copper |

Klbs |

7,318 |

7,228 |

1 |

% |

|

21,890 |

22,318 |

(2 |

%) |

| Payable metals in concentrate

sold: |

|

|

|

|

|

|

|

|

|

Gold |

|

|

|

|

|

|

|

|

|

Chelopech |

oz |

37,725 |

34,660 |

9 |

% |

|

105,142 |

99,586 |

6 |

% |

|

Ada Tepe |

oz |

15,503 |

32,955 |

(53 |

%) |

|

64,121 |

96,593 |

(34 |

%) |

|

Total payable gold in concentrate sold |

oz |

53,228 |

67,615 |

(21 |

%) |

|

169,263 |

196,179 |

(14 |

%) |

|

Copper |

Klbs |

6,484 |

6,699 |

(3 |

%) |

|

18,410 |

19,642 |

(6 |

%) |

| Cost of sales per tonne of ore

processed(1): |

|

|

|

|

|

|

|

|

|

Chelopech |

$/t |

79 |

63 |

25 |

% |

|

72 |

63 |

14 |

% |

|

Ada Tepe |

$/t |

136 |

138 |

(1 |

%) |

|

140 |

138 |

1 |

% |

| Cash cost per tonne of ore

processed(2): |

|

|

|

|

|

|

|

|

|

Chelopech |

$/t |

61 |

50 |

22 |

% |

|

57 |

50 |

14 |

% |

|

Ada Tepe |

$/t |

71 |

65 |

9 |

% |

|

69 |

66 |

5 |

% |

| Cost of sales per ounce of

gold sold(3) |

$/oz |

1,265 |

901 |

40 |

% |

|

1,151 |

934 |

23 |

% |

| All-in sustaining cost per

ounce of gold sold(2) |

$/oz |

1,005 |

911 |

10 |

% |

|

859 |

840 |

2 |

% |

|

Financial Highlights |

|

|

|

|

|

|

|

|

| Average realized

prices(2): |

|

|

|

|

|

|

|

|

|

Gold |

$/oz |

2,548 |

1,921 |

33 |

% |

|

2,347 |

1,933 |

21 |

% |

|

Copper |

$/lb |

4.24 |

3.72 |

14 |

% |

|

4.25 |

3.85 |

10 |

% |

| Revenue |

|

147.3 |

121.9 |

21 |

% |

|

427.9 |

380.8 |

12 |

% |

| Cost of sales |

|

67.3 |

60.9 |

10 |

% |

|

194.8 |

183.2 |

6 |

% |

| Earnings before income

taxes |

|

55.3 |

44.1 |

25 |

% |

|

181.8 |

147.2 |

23 |

% |

| Net earnings |

|

46.2 |

36.7 |

26 |

% |

|

156.5 |

129.9 |

20 |

% |

| Basic earnings per share |

$/sh |

0.26 |

0.20 |

30 |

% |

|

0.87 |

0.69 |

26 |

% |

| Adjusted EBITDA(2) |

|

68.5 |

59.6 |

15 |

% |

|

216.1 |

196.3 |

10 |

% |

| Adjusted net earnings(2) |

|

46.2 |

36.7 |

26 |

% |

|

149.6 |

129.9 |

15 |

% |

| Adjusted basic earnings per

share(2) |

$/sh |

0.26 |

0.20 |

30 |

% |

|

0.83 |

0.69 |

20 |

% |

| Cash provided from operating

activities |

|

52.5 |

70.1 |

(25 |

%) |

|

214.1 |

190.4 |

12 |

% |

| Free cash flow(2) |

|

70.9 |

46.1 |

54 |

% |

|

213.4 |

178.6 |

20 |

% |

| Capital expenditures

incurred(4): |

|

|

|

|

|

|

|

|

|

Sustaining(5) |

|

10.8 |

9.7 |

11 |

% |

|

24.4 |

23.1 |

5 |

% |

|

Growth and other(6) |

|

3.2 |

6.1 |

(48 |

%) |

|

15.1 |

19.4 |

(22 |

%) |

|

Total capital expenditures |

|

14.0 |

15.8 |

(11 |

%) |

|

39.5 |

42.5 |

(7 |

%) |

(1) Cost of sales per tonne of ore

processed represents cost of sales for Chelopech and Ada Tepe,

respectively, divided by tonnes of ore processed.(2) Cash cost

per ounce of gold sold, cash cost per tonne of ore processed,

all-in sustaining cost per ounce of gold sold, average realized

metal prices, adjusted EBITDA, adjusted net earnings, adjusted

basic earnings per share, and free cash flow are non-GAAP financial

measures or ratios. Refer to the “Non-GAAP Financial Measures”

section commencing on page 13 of this news release for more

information, including reconciliations to IFRS

measures.(3) Cost of sales per ounce of gold sold

represents total cost of sales for Chelopech and Ada Tepe, divided

by total payable gold in concentrate sold.(4) Capital

expenditures incurred were reported on an accrual basis and do not

represent the cash outlays for the capital

expenditures.(5) Sustaining capital expenditures are

generally defined as expenditures that support the ongoing

operation of the asset or business without any associated increase

in capacity, life of assets or future earnings. This measure is

used by management and investors to assess the extent of

non-discretionary capital spending being incurred by the Company

each period.(6) Growth capital expenditures are

generally defined as capital expenditures that expand existing

capacity, increase life of assets and/or increase future earnings.

This measure is used by management and investors to assess the

extent of discretionary capital spending being undertaken by the

Company each period.

Performance HighlightsA table

comparing production, sales and cash cost measures by asset for the

third quarter and first nine months ended September 30, 2024

against 2024 guidance is located on page 9 of this news

release.

In the third quarter of 2024, Chelopech

continued to deliver strong operating results. Gold production at

Ada Tepe was impacted by temporary operational challenges during

the quarter, which have been resolved. With strong year-to-date

results and production expected to increase in the fourth quarter,

both mines remain on track to achieve their respective 2024

production and cost guidance.

Highlights include the following:

Chelopech, Bulgaria: Gold

contained in gold-copper and pyrite concentrates produced in the

third quarter of 2024 was 9% higher than 2023 due primarily to

higher gold recoveries and ore grades. Gold contained in

gold-copper and pyrite concentrates produced in the first nine

months of 2024 was 4% higher than 2023 due primarily to higher gold

recoveries. Copper production in the third quarter and first nine

months of 2024 was comparable to 2023.

All-in sustaining cost per ounce of gold sold in

the third quarter and first nine months of 2024 was 43% and 30%

lower than 2023, respectively, due primarily to lower treatment

charges as a result of DPM having secured more favourable

commercial terms for the year under the current tight market for

copper concentrates, higher volumes of gold sold, and higher

by-product credits reflecting higher realized copper prices,

partially offset by higher labour cost, as well as lower cash

outlays for sustaining capital expenditures.

The Company is assessing the potential impact of

a proposed change by China’s tax authority to the applicability of

value-added taxes (“VAT”) and import duties on gold-copper

concentrates. While this change is not yet confirmed, and

Chelopech’s sales contracts currently provide that taxes and duties

in China are for the buyer’s account, the Company will continue to

monitor the situation and to assess any potential impact on the

future demand and commercial terms, including alternative buyers,

for Chelopech's gold-copper concentrates.

Ada Tepe, Bulgaria: Gold

contained in concentrate produced in the third quarter and first

nine months of 2024 was 52% and 34% lower than 2023, respectively,

due primarily to mining in lower grade zones in the first six

months of the year, in line with mine plan, and lower than expected

grades, recoveries and fleet availability in the third quarter. The

Company expects increased production in the fourth quarter as

mining has transitioned to an area of the pit with higher grades

and recoveries, and fleet availability has improved. Ada Tepe

remains on track to achieve its guidance for gold production.

All-in sustaining cost per ounce of gold sold in

the third quarter and first nine months of 2024 was 130% and 51%

higher than 2023, respectively, due primarily to lower volumes of

gold sold.

Consolidated Operating Highlights

Production: Gold contained in

concentrate produced in the third quarter and first nine months of

2024 was 19% and 13% lower than 2023, due primarily to lower gold

production at Ada Tepe, partially offset by higher gold recoveries

at Chelopech.

Copper production in the third quarter and first

nine months of 2024 was comparable to 2023.

Deliveries: Payable gold in

concentrate sold in the third quarter and first nine months of 2024

was 21% and 14% lower than 2023, consistent with lower gold

production.

Payable copper in concentrate sold in the third

quarter of 2024 was comparable to 2023. Payable copper in the first

nine months of 2024 was 6% lower than 2023, due primarily to the

timing of deliveries.

Cost measures: Cost of sales in

the third quarter and first nine months of 2024 increased 10% and

6%, respectively, compared to 2023, due primarily to higher labour

costs.

All-in sustaining cost per ounce of gold sold in

third quarter and first nine months of 2024 was 10% and 2% higher

than 2023, respectively, due primarily to lower volumes of gold

sold, higher share-based compensation expenses reflecting DPM’s

strong share price performance, and higher labour costs, partially

offset by lower treatment charges at Chelopech and higher

by-product credits as a result of higher realized copper

prices.

Capital expenditures:

Sustaining capital expenditures incurred in the third quarter and

first nine months of 2024 were comparable to 2023.

Growth and other capital expenditures incurred

during the third quarter and first nine months of 2024 decreased

48% and 22%, respectively, compared to 2023, due primarily to lower

expenditures related to the Loma Larga gold project, as

expected.

Consolidated Financial Highlights

Financial results in the third quarter and first

nine months of 2024 reflected higher realized metal prices and

lower treatment charges at Chelopech, partially offset by lower

volumes of gold sold at Ada Tepe and higher planned exploration and

evaluation expenses.

Revenue: Revenue in the third

quarter and first nine months of 2024 was 21% and 12% higher than

2023, respectively, due primarily to higher realized metal prices

and lower treatment charges at Chelopech, partially offset by lower

volumes of gold sold at Ada Tepe.

Net earnings:

Net earnings from continuing operations in the third quarter and

first nine months of 2024 increased 26% and 20%, respectively,

compared to 2023 due primarily to higher revenue and interest

income, partially offset by higher planned exploration and

evaluation expenses, higher labour costs including higher

share-based compensation expenses reflecting DPM’s strong share

performance, and higher income taxes.

Adjusted net earnings: Adjusted

net earnings from continuing operations in the third quarter and

first nine months of 2024 increased 26% and 15%, respectively,

compared to 2023 due primarily to the same factors affecting net

earnings from continuing operations, with the exception of

adjusting items primarily related to the net termination fee

received from Osino Resources Corp. (“Osino”).

Cash provided from operating

activities: Cash provided from operating activities of

continuing operations in the third quarter of 2024 was 25% lower

than 2023 due primarily to the timing of deliveries and subsequent

receipt of cash, partially offset by higher earnings generated from

continuing operations in the quarter. Cash provided from operating

activities of continuing operations in the first nine months of

2024 was 12% higher than 2023 due primarily to higher earnings

generated from continuing operations in the period and the timing

of payments to suppliers, partially offset by the timing of

deliveries and subsequent receipt of cash.

Free cash flow: Free cash flow

from continuing operations in the third quarter and first nine

months of 2024 was 54% and 20% higher than 2023, respectively, due

primarily to higher earnings generated in the periods. Free cash

flow is calculated before changes in working capital.

Balance Sheet Strength and Financial

Flexibility

The Company continues to maintain a strong

financial position, with a growing cash position, no debt and an

undrawn $150 million revolving credit facility.

Cash and cash equivalents increased from $595.3

million as at December 31, 2023 to $658.2 million as at September

30, 2024 due primarily to earnings generated in the period, and

cash proceeds from the disposition of Osino shares and the Tsumeb

smelter, partially offset by a net cash outflow of $94.8 million

related to the DPM Tolling Agreement, cash outlays for capital

expenditures, payments for shares repurchased under the Normal

Course Issuer Bid (“NCIB”) and dividends paid.

Return of Capital to Shareholders

In line with its disciplined capital allocation

framework, DPM continues to return excess capital to shareholders,

which currently includes a sustainable quarterly dividend and

periodic share repurchases under the NCIB.

During the first nine months of 2024, the

Company returned a total of $49.5 million to shareholders through

dividends paid of $21.7 million, as well as payments for shares

repurchased of $27.8 million following the renewal of the NCIB in

late March.

Share Repurchases

During the nine months ended September 30, 2024,

the Company purchased a total of 3,399,511 shares with a total cost

of $28.3 million at an average price per share of $8.32

(Cdn$11.36).

The actual timing and number of common shares

that may be purchased under the NCIB will be undertaken in

accordance with DPM’s capital allocation framework, having regard

for such things as DPM’s financial position, business outlook and

ongoing capital requirements, as well as its share price and

overall market conditions.

Quarterly Dividend

On November 5, 2024, the Company declared a

dividend of $0.04 per common share payable on January 15, 2025

to shareholders of record on December 31, 2024.

Development Projects Update

Čoka Rakita, Serbia

DPM continues to focus on advancing the

high-quality Čoka Rakita project, which has rapidly progressed

since the announcement of the initial discovery in January

2023.

The PFS remains on track for completion in the

first quarter of 2025. At the end of the third quarter, the PFS

design and engineering was approximately 80% complete. Market and

vendor engagement for pricing and cost estimates has commenced and

will continue into the fourth quarter. During the third quarter of

2024, the PFS infill drilling program was completed, whereby

results continued to confirm the continuity of the high-grade

mineralization, and an updated Mineral Resource estimate is

underway. In addition, the geotechnical and hydrogeological

drilling program, which will support the PFS design and cost

estimates, is nearing completion.

In parallel, permitting activities have

continued to advance. Environmental and other baseline studies,

which form part of the environmental and social impact assessment,

are ongoing and expected to be submitted in early 2026. Permitting

preparation activities are underway, with a detailed timeline

focused on supporting commencement of construction in mid-2026.

The Company has had a local presence in Serbia

since 2004, has developed strong relationships in the region, and

will continue its proactive engagement with all stakeholders as the

project advances.

The Company has planned to spend a total of $30

million to $35 million for the Čoka Rakita project in 2024, with

$17.3 million incurred in the first nine months of the year as a

result of the timing of expenditures.

Loma Larga, Ecuador

At the Loma Larga gold project in Ecuador, the

Company continued to progress activities related to permitting and

stakeholder relations. The Company continues to support the

government in fulfilling the requirements of the August 2023 ruling

by the Provincial Court of Azuay in connection with the

Constitutional Protective Action that was filed in 2022. In October

2024, the baseline ecosystem and water studies, as required by the

ruling, were submitted to the court by the Ministry of Environment,

Water and Ecological Transition. On October 31, 2024, the

environmental consultation process was completed, with local

communities voting overall in favour of the development of the

project. Issuance of the environmental licence is expected once the

prior informed indigenous consultation is concluded.

The Company maintains a constructive

relationship with government institutions and other stakeholders

involved with the development of the project.

The Company has budgeted between $10 million and

$11 million for the project in 2024, with $8.4 million incurred in

the first nine months of the year.

Exploration

Čoka Rakita, Serbia

Exploration activities in Serbia continued to

focus on an accelerated drilling program at the Čoka Rakita

licence, as well as scout drilling at the Dumitru Potok and Frasen

targets, with 28,775 metres completed during the third quarter of

2024.

In September 2024, DPM reported results from

drilling at the high-grade copper-gold Dumitru Potok and Frasen

discoveries, which are located approximately one kilometre north of

the Čoka Rakita project. Results at Dumitru Potok confirm the

presence of high-grade copper-gold-silver stratabound skarn

mineralization, with drilling demonstrating a continuous zone of

strong mineralization along a 250-metre corridor open to the north,

south and east. At Frasen, drilling returned manto-like

carbonate-hosted replacement and skarn copper-gold mineralization

at the conglomerate-marble contact over an area of 700 metres by

500 metres at Frasen West, with the potential to extend this zone

southeast towards to the stratabound skarn copper-gold

mineralization intersected by deep drilling at Čoka Rakita

North.

Additionally, drilling has commenced at the

Valja Saka and Dumitru West prospects, targeting the stratigraphy

in the area known for porphyry and skarn mineralization.

The Company has budgeted between $20 million and

$22 million for Serbian exploration activities, with $15.6

million spent in the first nine months of the year.

Chelopech, Bulgaria

DPM remains committed to extending the life of

the Chelopech mine through its focused in-mine exploration program

which targets resource development. During the third quarter of

2024, the Company completed 8,195 metres of exploration drilling,

which included infill and extensional drilling aimed at discovering

new mineralization along identified geological trends as well as

testing potential exploration targets.

The Company successfully completed the defence

of the Geological Report for the Brevene exploration licence at the

end of June 2024. DPM expects to obtain the Geological Discovery

certificate in the fourth quarter of 2024, which provides a

one-year extension of the exploration rights for the Brevene

licence to complete additional work targeting a Commercial

Discovery.

Ada Tepe, Bulgaria

During the third quarter of 2024, exploration

activities at the Ada Tepe camp were focused on target delineation

at the Krumovitsa exploration licence, including systematic

geological mapping, geophysical surveys, stream sediments, soil and

rock sampling, scout drilling and 3D modelling and

interpretation.

A scout drilling campaign is ongoing at the

Krumovitsa licence with a total of 5,169 meters of drilling

completed during the quarter. At the Kupel prospect, additional

drilling is ongoing to delineate the extension of a conceptually

modelled vein structure.

Permitting at the Kara Tepe prospect, which is

located on the Chiriite exploration licence, is ongoing and

drilling is planned to start in November 2024, focused on

skarn/carbonate replacement gold targets.

2024 Guidance and Three-year Outlook

With solid operating performance from the

Chelopech and Ada Tepe mines in the first nine months of 2024, DPM

is on track to meet its 2024 guidance for both mining operations,

including expected gold production of 245,000 to 285,000 ounces,

copper production of 29 to 34 million pounds, and an all-in

sustaining cost of $790 to $930 per ounce of gold sold.

Selected Production, Delivery and Cost

Performance versus Guidance

|

|

|

Q3 2024 |

YTD September 2024 |

2024Consolidated Guidance |

|

|

Chelopech |

Ada Tepe |

Consolidated |

Chelopech |

Ada Tepe |

Consolidated |

|

Ore processed |

Kt |

512.8 |

198.3 |

711.1 |

1,593.0 |

574.8 |

2,167.8 |

2,800 – 3,000 |

| Metals contained in

concentrate produced |

|

|

|

|

|

|

|

|

|

Gold |

Koz |

43.9 |

16.2 |

60.1 |

125.1 |

65.4 |

190.5 |

245 – 285 |

|

Copper |

Mlbs |

7.3 |

– |

7.3 |

21.9 |

– |

21.9 |

29 – 34 |

| Payable metals in concentrate

sold |

|

|

|

|

|

|

|

|

|

Gold |

Koz |

37.7 |

15.5 |

53.2 |

105.1 |

64.1 |

169.2 |

210 – 245 |

|

Copper |

Mlbs |

6.5 |

– |

6.5 |

18.4 |

– |

18.4 |

23 – 27 |

| All-in

sustaining cost per ounce of gold sold |

$/oz |

638 |

1,171 |

1,005 |

659 |

767 |

859 |

790 –930 |

For additional information regarding the

Company's detailed guidance for 2024 and current three-year

outlook, please refer to the “Three-Year Outlook” section of the

MD&A.

Tsumeb Disposition

On August 30, 2024, the Company announced the

closing of the sale of the Tsumeb smelter to a subsidiary of

Sinomine Resource Group Co. Ltd. (“Sinomine”) for a net cash

consideration received of $15.9 million, subject to normal

post-closing adjustments.

Short-Term Tolling

Arrangement

In July 2024, IXM S.A. (“IXM”) elected to

terminate the existing tolling agreement it had with Tsumeb (the

“IXM Tolling Agreement”) as a result of Tsumeb's pending change of

control. Consequently, DPM agreed to step into IXM's position for a

period ending four months following closing of the sale (the

“Financing Period”).

Pursuant to the IXM Tolling Agreement, the cash

value of all unprocessed concentrates and contractual secondary

materials owed by Tsumeb to IXM became due and payable as a result

of the termination of the agreement. On August 29, 2024, Tsumeb

settled the estimated cash value with IXM and simultaneously, DPM

purchased this inventory from Tsumeb for a total cost of $61.9

million paid in cash. In addition, Tsumeb transferred to DPM the

metal units under the estimated metal recoverable as at August 29,

2024 for a non-cash value of $16.7 million, for which DPM expects

to recover the cash value through the future sale of blister to IXM

and/or through the buyback of the inventory by Sinomine at the end

of the Financing Period.

On August 29, 2024, DPM also entered into the

DPM Tolling Agreement on substantially the same commercial terms as

the IXM Tolling Agreement for the Financing Period. Pursuant to the

DPM Tolling Agreement, DPM will purchase new-metal bearing

materials and sell the copper blister produced by Tsumeb until the

end of the DPM Tolling Agreement, at which time Sinomine is

contractually obligated to pay DPM for all DPM owned

inventories.

DPM does not expect that this tolling

arrangement will have a significant impact on its profit or loss

during the Financing Period as the inventory purchases and the

corresponding blister sales are mostly contracted at the same fixed

prices with IXM.

Third Quarter 2024 Results Conference

Call and Webcast

At 9 a.m. EST on Wednesday, November 6,

2024, DPM will host a conference call and audio webcast to discuss

the results, followed by a question-and-answer session. To

participate via conference call, register in advance at the link

provided below to receive the dial-in information as well as a

unique PIN code to access the call.

The call registration and webcast details are as

follows:

|

Conference call date and time |

Wednesday, November 6, 20249 a.m. EST |

|

Call registration |

https://register.vevent.com/register/BIac23bda751e7458f8d6d9286815e87cf |

|

Webcast link |

https://edge.media-server.com/mmc/p/otfiyh29 |

|

Replay |

Archive will be available on www.dundeeprecious.com |

This news release and DPM’s unaudited condensed

interim financial statements and MD&A for the three and nine

months ended September 30, 2024 are posted on the Company’s website

at www.dundeeprecious.com and have been filed on SEDAR+ at

www.sedarplus.ca.

Qualified Person

The technical and scientific information in this

news release has been prepared in accordance with Canadian

regulatory requirements set out in National Instrument 43-101

Standards of Disclosure for Mineral Projects (“NI 43-101”) of the

Canadian Securities Administrators and the Canadian Institute of

Mining, Metallurgy and Petroleum Definition Standards for Mineral

Resources and Mineral Reserves, and has been reviewed and approved

by Ross Overall, B.Sc. (Applied Geology), Director, Corporate

Technical Services, of DPM, who is a Qualified Person as defined

under NI 43-101, and who is not independent of the Company.

About Dundee Precious

Metals

Dundee Precious Metals Inc. is a Canadian-based

international gold mining company with operations and projects

located in Bulgaria, Serbia and Ecuador. The Company’s purpose is

to unlock resources and generate value to thrive and grow together.

This overall purpose is supported by a foundation of core values,

which guides how the Company conducts its business and informs a

set of complementary strategic pillars and objectives related to

ESG, innovation, optimizing our existing portfolio, and growth. The

Company’s resources are allocated in-line with its strategy to

ensure that DPM delivers value for all of its stakeholders. DPM’s

shares are traded on the Toronto Stock Exchange (symbol: DPM).

For further information, please contact:

|

David RaePresident & Chief Executive

OfficerTel: (416) 365-5191investor.info@dundeeprecious.com |

Navin DyalChief Financial OfficerTel: (416)

365-5191investor.info@dundeeprecious.com |

Jennifer CameronDirector, Investor RelationsTel:

(416) 219-6177jcameron@dundeeprecious.com |

| |

|

|

Cautionary Note Regarding Forward

Looking Statements

This news release contains “forward looking

statements” or “forward looking information” (collectively,

“Forward Looking Statements”) that involve a number of risks and

uncertainties. Forward Looking Statements are statements that are

not historical facts and are generally, but not always, identified

by the use of forward looking terminology such as “plans”,

“expects”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “guidance”, “outlook”, “intends”, “anticipates”,

“believes”, or variations of such words and phrases or that state

that certain actions, events or results “may”, “could”, “would”,

“might” or “will” be taken, occur or be achieved, or the negative

of any of these terms or similar expressions. The Forward Looking

Statements in this news release relate to, among other things:

forecasted results of production in 2024 and the ability of the

Company to meet previously provided guidance in respect thereof;

potential changes in Chinese tax laws or regulations and, if

implemented, their anticipated effect on the Company’s existing

sales arrangements for Chelopech's gold-copper concentrates to

purchasers in China; the settlement of post-closing adjustments

related to the Tsumeb Disposition; payments of dividends and

repurchases of shares pursuant to NCIB, including the number of

shares that may be repurchased thereunder; expected cash flows; the

price of gold, copper, and silver; estimated capital costs, all-in

sustaining costs, operating costs and other financial metrics,

including those set out in the outlook and guidance provided by the

Company; currency fluctuations; results of economic studies; the

intention to complete the PFS in respect of the Čoka Rakita project

and the anticipated timing thereof; anticipated steps in the

continued development of the Čoka Rakita project, including

exploration, permitting activities, environmental assessments, and

stakeholder engagement, and the timing for completion and

anticipated results thereof; the development of the Loma Larga gold

project, including the completion of the prior informed indigenous

consultation process, and the anticipated timing and results

thereof; exploration activities at the Company’s operating and

development properties and the anticipated results thereof;

permitting requirements, the ability of the Company to obtain such

permits, and the anticipated timing thereof; statements under the

heading “2024 Guidance and Three-year Outlook”; the ability of the

Company to recover the cash value of metal units transferred by

Tsumeb to the Company and the anticipated timing thereof;

expectations regarding the effects of the transactions contemplated

by the DPM Tolling Agreement on the Company’s profit or loss during

the Financing Period; and receipt of amounts owing to the Company

by Sinomine for Company-owned inventory at Tsumeb and the timing

thereof.

Forward Looking Statements are based on certain

key assumptions and the opinions and estimates of management and

Qualified Person (in the case of technical and scientific

information), as of the date such statements are made, and they

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any other future

results, performance or achievements expressed or implied by the

Forward Looking Statements. In addition to factors already

discussed in this news release, such factors include, among others:

fluctuations in metal prices and foreign exchange rates; risks

arising from the current inflationary environment and the impact on

operating costs and other financial metrics, including risks of

recession; the commencement, continuation or escalation of

geopolitical and/or intrastate conflicts and crises, including

without limitation, in Ukraine, the Middle East, Ecuador, and other

jurisdictions from time to time, and their direct and indirect

effects on the operations of DPM; risks arising from counterparties

being unable to or unwilling to fulfill their contractual

obligations to the Company; the speculative nature of mineral

exploration, development and production, including changes in

mineral production performance, exploitation and exploration

results; the Company’s dependence on its operations at the

Chelopech mine and Ada Tepe mine; the potential effects of changes

in Chinese tax laws or regulations which may result in VAT and

import duties being levied on sales of Chelopech gold concentrates

to purchasers in China; possible inaccurate estimates relating to

future production, operating costs and other costs for operations;

possible variations in ore grade and recovery rates; inherent

uncertainties in respect of conclusions of economic evaluations,

economic studies and mine plans; uncertainties with respect to the

timing of the PFS; the Company’s dependence on continually

developing, replacing and expanding its mineral reserves; potential

impacts of the transactions contemplated by the DPM Tolling

Agreement on the Company’s profit or loss during the Financing

Period; uncertainties and risks inherent to developing and

commissioning new mines into production, which may be subject to

unforeseen delays; risks related to the possibility that future

exploration results will not be consistent with the Company’s

expectations, that quantities or grades of reserves will be

diminished, and that resources may not be converted to reserves;

risks associated with the fact that certain of the Company's

initiatives are still in the early stages and may not materialize;

changes in project parameters, including schedule and budget, as

plans continue to be refined; risks related to the financial

results of operations, changes in interest rates, and the Company's

ability to finance its operations; the impact of global liquidity

and credit availability on the timing of cash flows and the values

of assets and liabilities based on projected future cash flows;

uncertainties inherent with conducting business in foreign

jurisdictions where corruption, civil unrest, political instability

and uncertainties with the rule of law may impact the Company’s

activities; accidents, labour disputes and other risks inherent to

the mining industry; failure to achieve certain cost savings; risks

related to the Company's ability to manage environmental and social

matters, including risks and obligations related to closure of the

Company's mining properties; risks related to climate change,

including extreme weather events, resource shortages, emerging

policies and increased regulations relating to related to

greenhouse gas emission levels, energy efficiency and reporting of

risks; land reclamation and mine closure requirements, and costs

associated therewith; the Company's controls over financial

reporting and obligations as a public company; delays in obtaining

governmental approvals or financing or in the completion of

development or construction activities; opposition by social and

non-governmental organizations to mining projects; uncertainties

with respect to realizing the anticipated benefits from the

development of the Loma Larga or Čoka Rakita projects;

cyber-attacks and other cybersecurity risks; competition in the

mining industry; exercising judgment when undertaking impairment

assessments; claims or litigation; limitations on insurance

coverage; changes in values of the Company's investment portfolio;

changes in laws and regulations, including with respect to taxes,

and the Company's ability to successfully obtain all necessary

permits and other approvals required to conduct its operations;

employee relations, including unionized and non-union employees,

and the Company's ability to retain key personnel and attract other

highly skilled employees; effects of changing tax laws in several

jurisdictions; ability to successfully integrate acquisitions or

complete divestitures; unanticipated title disputes; volatility in

the price of the common shares of the Company; potential dilution

to the common shares of the Company; damage to the Company’s

reputation due to the actual or perceived occurrence of any number

of events, including negative publicity with respect to the

Company’s handling of environmental matters or dealings with

community groups, whether true or not; risks related to holding

assets in foreign jurisdictions; conflicts of interest between the

Company and its directors and officers; the timing and amounts of

dividends; there being no assurance that the Company will purchase

additional common shares of the Company under the NCIB as well as

those risk factors discussed or referred to in the Company’s annual

MD&A and annual information form for the year ended December

31, 2023, the MD&A, and other documents filed from time to time

with the securities regulatory authorities in all provinces and

territories of Canada and available on SEDAR+ at

www.sedarplus.ca.

The reader has been cautioned that the foregoing

list is not exhaustive of all factors and assumptions which may

have been used. Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in Forward

Looking Statements, there may be other factors that cause actions,

events or results not to be anticipated, estimated or intended.

There can be no assurance that Forward Looking Statements will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. The

Company’s Forward Looking Statements reflect current expectations

regarding future events and speak only as of the date hereof. Other

than as it may be required by law, the Company undertakes no

obligation to update Forward Looking Statements if circumstances or

management’s estimates or opinions should change. Accordingly,

readers are cautioned not to place undue reliance on Forward

Looking Statements.

Non-GAAP Financial Measures

Certain financial measures referred to in this

news release are not measures recognized under IFRS and are

referred to as non-GAAP financial measures or ratios. These

measures have no standardized meanings under IFRS and may not be

comparable to similar measures presented by other companies. The

definitions established and calculations performed by DPM are based

on management’s reasonable judgment and are consistently applied.

These measures are used by management and investors to assist with

assessing the Company’s performance, including its ability to

generate sufficient cash flow to meet its return objectives and

support its investing activities and debt service obligations. In

addition, the Human Capital and Compensation Committee of the Board

of Directors uses certain of these measures, together with other

measures, to set incentive compensation goals and assess

performance. These measures are intended to provide additional

information and should not be considered in isolation or as a

substitute for measures prepared in accordance with IFRS. Non-GAAP

financial measures and ratios, together with other financial

measures calculated in accordance with IFRS, are considered to be

important factors that assist investors in assessing the Company’s

performance.

Cash Cost and All-in Sustaining Cost

Measures

Mine cash cost; mine cash cost of sales; and

all-in sustaining cost are non-GAAP financial measures. Cash cost

per tonne of ore processed; cash cost per ounce of gold sold; and

all-in sustaining cost per ounce of gold sold are non-GAAP ratios.

These measures capture the important components of the Company’s

production and related costs. Management and investors utilize

these metrics as an important tool to monitor cost performance at

the Company’s operations. In addition, the Human Capital and

Compensation Committee of the Board of Directors uses certain of

these measures, together with other measures, to set incentive

compensation goals and assess performance.

The following tables provide a reconciliation of

the Company’s cash cost per tonne of ore processed to its cost of

sales:

|

$ thousands |

|

Three Months |

|

Nine Months |

|

unless otherwise indicated |

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

Chelopech |

| Ore processed |

t |

512,836 |

|

543,264 |

|

|

1,592,986 |

|

1,640,282 |

|

| Cost of sales |

|

40,311 |

|

34,021 |

|

|

114,054 |

|

103,525 |

|

| Add/(deduct): |

|

|

|

|

|

|

|

Depreciation and amortization |

|

(8,088 |

) |

(6,950 |

) |

|

(23,742 |

) |

(20,218 |

) |

|

Change in concentrate inventory |

|

(1,019 |

) |

(31 |

) |

|

491 |

|

(747 |

) |

|

Mine cash cost(1) |

|

31,204 |

|

27,040 |

|

|

90,803 |

|

82,560 |

|

|

Cost of sales per tonne of ore processed(2) |

$/t |

79 |

|

63 |

|

|

72 |

|

63 |

|

| Cash

cost per tonne of ore processed(2) |

$/t |

61 |

|

50 |

|

|

57 |

|

50 |

|

|

|

|

|

|

|

|

|

| Ada

Tepe |

| Ore processed |

t |

198,254 |

|

195,350 |

|

|

574,845 |

|

576,905 |

|

| Cost of sales |

|

27,000 |

|

26,900 |

|

|

80,722 |

|

79,701 |

|

| Deduct: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

(12,882 |

) |

(14,133 |

) |

|

(40,933 |

) |

(41,673 |

) |

|

Change in concentrate inventory |

|

(74 |

) |

(50 |

) |

|

(78 |

) |

(149 |

) |

|

Mine cash cost(1) |

|

14,044 |

|

12,717 |

|

|

39,711 |

|

37,879 |

|

|

Cost of sales per tonne of ore processed(2) |

$/t |

136 |

|

138 |

|

|

140 |

|

138 |

|

| Cash

cost per tonne of ore processed(2) |

$/t |

71 |

|

65 |

|

|

69 |

|

66 |

|

(1) Cash costs are reported in U.S.

dollars, although the majority of costs incurred are denominated in

non-U.S. dollars, and consist of all production related expenses

including mining, processing, services, royalties and general and

administrative.(2) Represents cost of sales and mine

cash cost, respectively, divided by tonnes of ore processed.

The following table provides, for the periods

indicated, a reconciliation of the Company’s cash cost per ounce of

gold sold and all-in sustaining cost per ounce of gold sold to its

cost of sales:

|

$ thousands, unless otherwise indicatedFor the three months

ended September 30, 2024 |

|

Chelopech |

|

Ada Tepe |

|

Total |

|

|

Cost of sales(1) |

|

40,311 |

|

27,000 |

|

67,311 |

|

| Add/(deduct): |

|

|

|

|

|

Depreciation and amortization |

|

(8,088 |

) |

(12,882 |

) |

(20,970 |

) |

|

Treatment charges, transportation and other related selling

costs(2) |

|

16,476 |

|

621 |

|

17,097 |

|

|

By-product credits(3) |

|

(28,549 |

) |

(196 |

) |

(28,745 |

) |

|

Mine cash cost of sales |

|

20,150 |

|

14,543 |

|

34,693 |

|

| Rehabilitation related

accretion and depreciation expenses(4) |

|

10 |

|

297 |

|

307 |

|

| Allocated general and

administrative expenses(5) |

|

- |

|

- |

|

11,295 |

|

| Cash outlays for sustaining

capital expenditures(6) |

|

3,435 |

|

3,103 |

|

6,538 |

|

| Cash

outlays for leases(6) |

|

463 |

|

206 |

|

669 |

|

|

All-in sustaining cost |

|

24,058 |

|

18,149 |

|

53,502 |

|

|

Payable gold in concentrate sold(7) |

oz |

37,725 |

|

15,503 |

|

53,228 |

|

| Cost of sales per ounce of

gold sold(8) |

$/oz |

1,069 |

|

1,742 |

|

1,265 |

|

| Cash cost per ounce of gold

sold(8) |

$/oz |

534 |

|

938 |

|

652 |

|

| All-in

sustaining cost per ounce of gold sold(8) |

$/oz |

638 |

|

1,171 |

|

1,005 |

|

|

$ thousands, unless otherwise indicatedFor the three months ended

September 30, 2023 |

|

Chelopech |

|

Ada Tepe |

|

Total |

|

|

Cost of sales(1) |

|

34,021 |

|

26,900 |

|

60,921 |

|

| Add/(deduct): |

|

|

|

|

|

Depreciation and amortization |

|

(6,950 |

) |

(14,133 |

) |

(21,083 |

) |

|

Treatment charges, transportation and other related selling

costs(2) |

|

32,479 |

|

1,591 |

|

34,070 |

|

|

By-product credits(3) |

|

(25,752 |

) |

(304 |

) |

(26,056 |

) |

|

Mine cash cost of sales |

|

33,798 |

|

14,054 |

|

47,852 |

|

| Rehabilitation related

accretion expenses(4) |

|

300 |

|

300 |

|

600 |

|

| Allocated general and

administrative expenses(5) |

|

- |

|

- |

|

5,981 |

|

| Cash outlays for sustaining

capital expenditures(6) |

|

4,469 |

|

2,260 |

|

6,729 |

|

| Cash

outlays for leases(6) |

|

257 |

|

173 |

|

430 |

|

|

All-in sustaining cost |

|

38,824 |

|

16,787 |

|

61,592 |

|

|

Payable gold in concentrate sold(7) |

oz |

34,660 |

|

32,955 |

|

67,615 |

|

| Cost of sales per ounce of

gold sold(8) |

$/oz |

982 |

|

816 |

|

901 |

|

| Cash cost per ounce of gold

sold(8) |

$/oz |

975 |

|

426 |

|

708 |

|

| All-in

sustaining cost per ounce of gold sold(8) |

$/oz |

1,120 |

|

509 |

|

911 |

|

(1) Included in cost of sales were

share-based compensation expenses of $0.6 million (2023 – $0.3

million) in the third quarter of 2024.(2) Represent

revenue deductions for treatment charges, refining charges,

penalties, freight and final settlements to adjust for any

differences relative to the provisional invoice.

(3) Represent copper and silver

revenue.(4) Included in cost of sales and finance cost

in the condensed interim consolidated statements of earnings

(loss).(5) Represent an allocated portion of DPM’s

general and administrative expenses, including share-based

compensation expenses of $5.4 million (2023 – $0.8 million) for the

third quarter of 2024, based on Chelopech’s and Ada Tepe’s

proportion of total revenue, including revenue from discontinued

operations. Allocated general and administrative expenses are

reflected in consolidated all-in sustaining cost per ounce of gold

sold and are not reflected in the cost measures for Chelopech and

Ada Tepe. (6) Included in cash used in investing

activities and financing activities, respectively, in the condensed

interim consolidated statements of cash

flows.(7) Includes payable gold in pyrite concentrate

sold in the third quarter of 2024 of 8,731 ounces (2023 – 11,606

ounces).(8) Represents cost of sales, mine cash cost of

sales and all-in sustaining cost, respectively, divided by payable

gold in concentrate sold.

|

$ thousands, unless otherwise indicatedFor the nine months

ended September 30, 2024 |

|

Chelopech |

|

Ada Tepe |

|

Total |

|

|

Cost of sales(1) |

|

114,054 |

|

80,722 |

|

194,776 |

|

| Add/(deduct): |

|

|

|

|

|

Depreciation and amortization |

|

(23,742 |

) |

(40,933 |

) |

(64,675 |

) |

|

Treatment charges, transportation and other related selling

costs(2) |

|

49,836 |

|

1,582 |

|

51,418 |

|

|

By-product credits(3) |

|

(81,323 |

) |

(779 |

) |

(82,102 |

) |

|

Mine cash cost of sales |

|

58,825 |

|

40,592 |

|

99,417 |

|

| Rehabilitation related

accretion and depreciation expenses(4) |

|

159 |

|

970 |

|

1,129 |

|

| Allocated general and

administrative expenses(5) |

|

- |

|

- |

|

27,059 |

|

| Cash outlays for sustaining

capital expenditures(6) |

|

9,459 |

|

7,070 |

|

16,529 |

|

| Cash

outlays for leases(6) |

|

803 |

|

544 |

|

1,347 |

|

|

All-in sustaining cost |

|

69,246 |

|

49,176 |

|

145,481 |

|

|

Payable gold in concentrate sold(7) |

oz |

105,142 |

|

64,121 |

|

169,263 |

|

| Cost of sales per ounce of

gold sold(8) |

$/oz |

1,085 |

|

1,259 |

|

1,151 |

|

| Cash cost per ounce of gold

sold(8) |

$/oz |

559 |

|

633 |

|

587 |

|

| All-in

sustaining cost per ounce of gold sold(8) |

$/oz |

659 |

|

767 |

|

859 |

|

|

$ thousands, unless otherwise indicatedFor the nine months ended

September 30, 2023 |

|

Chelopech |

|

Ada Tepe |

|

Total |

|

|

Cost of sales(1) |

|

103,525 |

|

79,701 |

|

183,226 |

|

| Add/(deduct): |

|

|

|

|

|

Depreciation and amortization |

|

(20,218 |

) |

(41,673 |

) |

(61,891 |

) |

|

Treatment charges, transportation and other related selling

costs(2) |

|

73,404 |

|

4,157 |

|

77,561 |

|

|

By-product credits(3) |

|

(78,102 |

) |

(932 |

) |

(79,034 |

) |

|

Mine cash cost of sales |

|

78,609 |

|

41,253 |

|

119,862 |

|

| Rehabilitation related

accretion expenses(4) |

|

920 |

|

897 |

|

1,817 |

|

| Allocated general and

administrative expenses(5) |

|

- |

|

- |

|

21,541 |

|

| Cash outlays for sustaining

capital expenditures(6) |

|

13,712 |

|

6,226 |

|

19,938 |

|

| Cash

outlays for leases(6) |

|

812 |

|

729 |

|

1,541 |

|

|

All-in sustaining cost |

|

94,053 |

|

49,105 |

|

164,699 |

|

|

Payable gold in concentrate sold(7) |

oz |

99,586 |

|

96,593 |

|

196,179 |

|

| Cost of sales per ounce of

gold sold(8) |

$/oz |

1,040 |

|

825 |

|

934 |

|

| Cash cost per ounce of gold

sold(8) |

$/oz |

789 |

|

427 |

|

611 |

|

| All-in

sustaining cost per ounce of gold sold(8) |

$/oz |

944 |

|

508 |

|

840 |

|

(1) Included in cost of sales were

share-based compensation expenses of $1.3 million (2023 - $1.4

million) in the first nine months of 2024.(2) Represents

revenue deductions for treatment charges, refining charges,

penalties, freight and final settlements to adjust for any

differences relative to the provisional invoice.

(3) Represents copper and silver

revenue.(4) Included in cost of sales and finance cost

in the condensed interim consolidated statements of earnings

(loss).(5) Represents an allocated portion of DPM’s

general and administrative expenses, including share-based

compensation expenses of $11.0 million 2023 – $7.1 million) in the

first nine months of 2024, based on Chelopech and Ada Tepe’s

proportion of total revenue, including revenue from discontinued

operations. Allocated general and administrative expenses are

reflected in consolidated all-in sustaining cost per ounce of gold

sold and are not reflected in the cost measures for Chelopech and

Ada Tepe. (6) Included in cash used in investing

activities and financing activities, respectively, in the condensed

interim consolidated statements of cash

flows.(7) Includes payable gold in pyrite concentrate

sold in 2024 of 26,251 ounces (2023 – 29,032

ounces).(8) Represents cost of sales, mine cash cost of

sales and all-in sustaining cost, respectively, divided by payable

gold in concentrate sold.

Adjusted net earnings and adjusted basic

earnings per share

Adjusted net earnings is a non-GAAP financial

measure and adjusted basic earnings per share is a non-GAAP ratio

used by management and investors to measure the underlying

operating performance of the Company. Presenting these measures

from period to period helps management and investors evaluate

earnings trends more readily in comparison with results from prior

periods.

Adjusted net earnings are defined as net

earnings, adjusted to exclude specific items that are significant,

but not reflective of the underlying operations of the Company,

including:

- impairment

charges or reversals thereof;

- unrealized and

realized gains or losses related to investments carried at fair

value;

- significant tax

adjustments not related to current period earnings; and

- non-recurring or

unusual income or expenses that are either not related to the

Company’s operating segments or unlikely to occur on a regular

basis.

The following table provides a reconciliation of

adjusted net earnings to net earnings:

|

$ thousands, except per share amounts |

|

Three Months |

|

Nine Months |

|

Ended September 30, |

|

2024 |

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

| Continuing

Operations: |

|

|

|

|

|

|

| Net earnings |

|

46,203 |

36,694 |

|

156,478 |

|

129,932 |

| Deduct: |

|

|

|

|

|

|

|

Net termination fee received from Osino, net of income taxes of

$nil |

|

- |

- |

|

(6,901 |

) |

- |

|

Adjusted net earnings |

|

46,203 |

36,694 |

|

149,577 |

|

129,932 |

|

Basic earnings per share |

$/sh |

0.26 |

0.20 |

|

0.87 |

|

0.69 |

|

Adjusted basic earnings per share |

$/sh |

0.26 |

0.20 |

|

0.83 |

|

0.69 |

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure

used by management and investors to measure the underlying

operating performance of the Company’s operating segments.

Presenting these measures from period to period helps management

and investors evaluate earnings trends more readily in comparison

with results from prior periods. In addition, the Human Capital and

Compensation Committee of the Board of Directors uses adjusted

EBITDA, together with other measures, to set incentive compensation

goals and assess performance.

Adjusted EBITDA excludes the following from

earnings before income taxes:

- depreciation and

amortization;

- interest

income;

- finance

cost;

- impairment

charges or reversals thereof;

- unrealized and

realized gains or losses related to investments carried at fair

value; and

- non-recurring or

unusual income or expenses that are either not related to the

Company’s operating segments or unlikely to occur on a regular

basis.

The following table provides a reconciliation of

adjusted EBITDA to earnings before income taxes:

|

$ thousands |

Three Months |

|

Nine Months |

|

Ended September 30, |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

Continuing Operations: |

| Earnings before income

taxes |

55,271 |

|

44,105 |

|

|

181,770 |

|

147,249 |

|

| Add/(deduct): |

|

|

|

|

|

|

Depreciation and amortization |

21,636 |

|

21,719 |

|

|

66,580 |

|

63,631 |

|

|

Finance costs |

821 |

|

827 |

|

|

2,223 |

|

2,542 |

|

|

Interest income |

(9,223 |

) |

(7,000 |

) |

|

(27,565 |

) |

(17,079 |

) |

|

Net termination fee received from Osino |

- |

|

- |

|

|

(6,901 |

) |

- |

|

|

Adjusted EBITDA |

68,505 |

|

59,651 |

|

|

216,107 |

|

196,343 |

|

Cash provided from operating activities,

before changes in working capital

Cash provided from operating activities, before

changes in working capital, is a non-GAAP financial measure defined

as cash provided from operating activities excluding changes in

working capital as set out in the Company’s consolidated statements

of cash flows. This measure is used by the Company and investors to

measure the cash flow generated by the Company’s operating segments

prior to any changes in working capital, which at times can distort

performance.

Free cash flow

Free cash flow is a non-GAAP financial measure

defined as cash provided from operating activities, before changes

in working capital which includes changes in share-based

compensation liabilities, less cash outlays for sustaining capital

expenditures, mandatory principal repayments and interest payments

related to debt and leases. This measure is used by the Company and

investors to measure the cash flow available to fund growth capital

expenditures, dividends and share repurchases.

The following table provides a reconciliation of

cash provided from operating activities, before changes in working

capital and free cash flow to cash provided from operating

activities:

|

$ thousands |

Three Months |

|

Nine Months |

|

Ended September 30, |

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

Continuing Operations: |

| Cash provided from operating

activities |

52,489 |

|

70,090 |

|

|

214,082 |

|

190,358 |

|

| Excluding: |

|

|

|

|

|

|

Changes in working capital |

16,165 |

|

(15,355 |

) |

|

23,387 |

|

12,872 |

|

|

Cash provided from operating activities, before changes in working

capital |

68,654 |

|

54,735 |

|

|

237,469 |

|

203,230 |

|

| Cash outlays for sustaining

capital expenditures(1) |

(7,432 |

) |

(7,503 |

) |

|

(18,743 |

) |

(21,394 |

) |

| Principal repayments related

to leases |

(1,508 |

) |

(586 |

) |

|

(3,633 |

) |

(2,043 |

) |

| Interest payments(1) |

(492 |

) |

(595 |

) |

|

(1,191 |

) |

(1,214 |

) |

| Other

non-cash items |

11,700 |

|

- |

|

|

(500 |

) |

- |

|

|

Free cash flow |

70,922 |

|

46,051 |

|

|

213,402 |

|

178,579 |

|

(1) Included in cash used in investing and financing

activities, respectively, in the condensed interim consolidated

statements of cash flows.

Average realized metal

prices

Average realized gold and copper prices are

non-GAAP ratios used by management and investors to highlight the

price actually realized by the Company relative to the average

market price, which can differ due to the timing of sales, hedging

and other factors.

Average realized gold and copper prices

represent the average per unit price recognized in the Company’s

consolidated statements of earnings (loss) prior to any deductions

for treatment charges, refining charges, penalties, freight and

final settlements to adjust for any differences relative to the

provisional invoice.

The following table provides a reconciliation of

the Company’s average realized gold and copper prices to its

revenue:

|

$ thousands, unless otherwise stated |

|

Three Months |

|

Nine Months |

|

Ended September 30, |

|

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|

Total revenue |

|

147,262 |

|

121,866 |

|

|

427,891 |

|

380,752 |

|

| Add/(deduct): |

|

|

|

|

|

|

|

Treatment charges and other deductions(1) |

|

17,097 |

|

34,070 |

|

|

51,418 |

|

77,561 |

|

|

Silver revenue |

|

(1,246 |

) |

(1,110 |

) |

|

(3,856 |

) |

(3,439 |

) |

|

Revenue from gold and copper |

|

163,113 |

|

154,826 |

|

|

475,453 |

|

454,874 |

|

| Revenue from gold |

|

135,634 |

|

129,881 |

|

|

397,191 |

|

379,279 |

|

| Payable gold in concentrate

sold |

oz |

53,228 |

|

67,615 |

|

|

169,263 |

|

196,179 |

|

| Average realized gold price

per ounce |

$/oz |

2,548 |

|

1,921 |

|

|

2,347 |

|

1,933 |

|

| Revenue from copper |

|

27,479 |

|

24,945 |

|

|

78,262 |

|

75,595 |

|

| Payable copper in concentrate

sold |

Klbs |

6,484 |

|

6,699 |

|

|

18,410 |

|

19,642 |

|

| Average

realized copper price per pound |

$/lb |

4.24 |

|

3.72 |

|

|

4.25 |

|

3.85 |

|

(1) Represent revenue deductions for

treatment charges, refining charges, penalties, freight and final

settlements to adjust for any differences relative to the

provisional invoice.

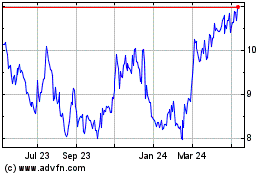

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Dec 2024 to Jan 2025

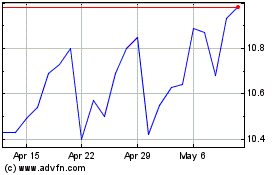

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jan 2024 to Jan 2025