Exclusive Networks: Successful Syndication and Finalisation of the Group's Refinancing

10 December 2024 - 4:00AM

Business Wire

Regulatory News:

Exclusive Networks (Euronext Paris: EXN), a global leader in

cybersecurity, announced on July 24, 2024 that a consortium

comprising Clayton Dubilier & Rice and Everest UK HoldCo

Limited, an entity controlled by the Permira funds and the majority

shareholder of Exclusive Networks (the "Company"), were

contemplating to acquire a majority shareholding in the Company,

which would be followed by a simplified mandatory tender offer on

the remaining Company shares and, should the legal conditions be

met, the implementation of a squeeze-out following the offer (the

"Transaction").

In the context of the Transaction, and as also described in the

press release of July 24, 2024, it is contemplated that the Company

and its subsidiary Everest SubBidCo enter into new facilities

agreement in order to, among others, finance the payment of the

exceptional distribution approved by the shareholders meeting of

October 31, 2024, and generally to refinance the existing

indebtedness of the Group.

On November 4 and 29, 2024, the board of directors of the

Company approved the corresponding senior facilities agreement

under which the Company and Everest SubBidCo are borrowers (the

"Senior Facilities Agreement") and the intercreditor

agreement (the "Intercreditor Agreement").

This Senior Facilities Agreement comprises (i) a term loan made

available to Everest SubBidCo divided into EUR and USD tranches of

maximum principal amounts of EUR 607,000,000 and USD 267,000,000

(respectively) and the USD tranche term loan is also made available

to Etna US Finco 1 LLC, (ii) two deferred term loans made available

to Everest SubBidCo for a combined maximum principal amount of EUR

235,000,000, and (iii) a revolving credit facility made available

to, among others, the Company and Everest SubBidCo for a maximum

principal amount of EUR 235,000,000.

A term loan divided into EUR and USD tranches of maximum

principal amounts of EUR 300,000,000 and USD 133,000,000

(respectively) is also made available to Etna French Bidco and, in

respect of the USD tranche, Etna US Finco 2 LLC to finance the

acquisition of control of the Company, the tender offer and, as the

case may be, the squeeze-out that will follow within the

Transaction.

The syndication of these facilities was successfully finalised

on December 5, 2024.

The Senior Facilities Agreement and the Intercreditor Agreement

have therefore been executed on December 8, 2024 in accordance with

the aforementioned prior approvals of the board of directors of the

Company.

Information on the Senior Facilities Agreement and the

Intercreditor Agreement is available in the "Regulated Agreement"

section of the "Governance Documents" page of the Company's website

https://ir.exclusive-networks.com/governance-documents/

About Exclusive Networks

Exclusive Networks (EXN) is a global cybersecurity specialist

that provides partners and end-customers with a wide range of

services and product portfolios via proven routes to market. With

offices in over 45 countries and the ability to serve customers in

over 170 countries, we combine a local perspective with the scale

and delivery of a single global organization.

Our best-in-class vendor portfolio is carefully curated with all

leading industry players. Our services range from managed security

to specialist technical accreditation and training and capitalize

on rapidly evolving technologies and changing business models. For

more information visit www.exclusive-networks.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241209853280/en/

CONTACTS EXCLUSIVE NETWORKS

Nicolas Leroy Global Head of Communications

ir@exclusive-networks.com

Media FTI Consulting

Emily Oliver/ Jamie Ricketts +33 (0)1 47 03 68 19

exclusivenetworks@fticonsulting.com

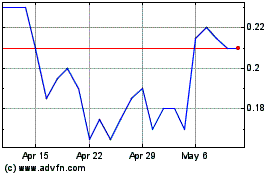

Excellon Resources (TSX:EXN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Excellon Resources (TSX:EXN)

Historical Stock Chart

From Dec 2023 to Dec 2024