The NICO Project is one of the few advanced

cobalt developments in the world to meet the growing demand in

lithium-ion batteries powering electric vehicles and portable

electronics

Fortune Minerals Limited (TSX: FT) (OTCQB: FTMDF)

(“Fortune” or the “Company”)

(www.fortuneminerals.com) is pleased to report on the C$3.8 billion

of financial support for Critical Minerals announced in last week’s

Government of Canada budget for 2022 (“2022 Budget”). The

funds are being allocated to accelerate domestic production and

processing of Critical Minerals, particularly cobalt, nickel and

lithium used in the manufacture of lithium-ion rechargeable

batteries for electric vehicles (“EV’s”), portable

electronics, and stationary storage cells to make electricity use

more eficient. Fortune’s 100%-owned NICO cobalt-gold-bismuth-copper

project (“NICO Project”) is a vertically integrated Critical

Minerals development comprised of a planned open pit and

underground mine and mill in Canada’s Northwest Territories

(“NWT”) and a planned hydrometallurgical refinery in

Alberta. The NICO Project is one of the few advanced cobalt

development assets in the world that can be developed in the

timelines required to meet current cathode chemistries and will

benefit from implementation of these programs. The Mineral Reserves

for the NICO deposit also include 1.1 million ounces of gold, 12%

of global bismuth reserves, and copper as a minor by-product.

Like our news? Click-to-tweet.

The 2022 Budget recognizes the importance of a stronger domestic

raw material supply chain for North American industries involved in

the transition to new technologies and the growing green economy.

Greater geographic vertical integration of raw material supplies

will capture more value-added processing in Canada, reduce risks

and costs associated with long and unreliable supply chains, and

will provide munafacturers with a transparent source of Critical

Minerals produced with Canadian environmental-social governance

(“ESG”) values. Critical Mineral developments can be

encumbered by higher capital costs due to the requirement for

downstream process plants that come with additional permitting and

regulatory risks. Some northern projects are also impacted by an

infrastructure deficit that requires additional investment by

companies to construct their own facilities. The 2022 Budget

provides financial supports to address many of these concerns.

2022 Budget Critical Mineral Support Highlights:

- C$1.5 billion to invest in new Critical Minerals projects, with

priorities for mineral processing, materials manufacturing, and

recycling for key mineral and metal products in the battery and

rare-earths supply chains;

- C$80 million for public geoscience and exploration programs to

help find the next generation of Critical Minerals deposits;

- Doubling of the Mineral Exploration Tax Credit (“METC”)

for targeted Critical Minerals, including nickel, copper, cobalt,

rare earths and uranium;

- C$1.5 billion for infrastructure investments to unlock new

mineral projects in key regions;

- C$144 million for research and development to support

responsible extraction and processing of Critical Minerals;

- C$10 million renewal for the Centre of Excellence on Critical

Minerals for three additional years;

- C$40 million to support northern regulatory processes to review

and permit Critical Minerals projects;

- C$70 million for global partnerships to promote Canadian mining

leadership;

- C$15 billion to support the Canada Growth Fund to restructure

supply chains in areas important to Canada's future prosperity

including the natural resources sector.

Fortune is encouraged that the 2022 Budget allocates significant

funding to align with government policy objectives to grow the

domestic Critical Minerals supply chain. The Company is currently

engaged with the Canadian and Alberta governments to secure their

support for an accelerated development of the NICO Project. Fortune

was recently invited by Invest In Canada to present at a an

investment conference in Dubai that included a pre-recorded

introduction to the NICO Project (access video here.).

NICO Project:

The NICO Project is an advanced development stage asset to

provide a reliable North American source of three Critical Minerals

(cobalt, bismuth and copper). Fortune has expended more than C$135

million to advance the NICO Project from an in-house discovery to a

near-term producer with a 20-year supply of Critical Minerals. The

Company has received environmental assessment approval and the Type

“A” Water License to construct and operate the NICO mine and

concentrator. Recent completion of the C$200 million Tlicho public

highway to the community of Whati is a key enabler for the NICO

development. This road, together with the spur road Fortune plans

to construct, will allow metal concentrates to be trucked to Hay

River or Enterprise, NWT for railway delivery to the Company’s

planned refinery in Alberta. An important economic attribute of

NICO ores is a high concentration ratio from simple flotation,

which allows the mill feed to be reduced to ~4% of the original

mass for lower cost transportation and downstream processing of a

homogeneous sulphide concentrate at the refinery.

In January, 2022, Fortune entered into an option agreement with

JFSL Field Services ULC, a wholly-owned subsidiary of a large

international engineering company, to purchase a former steel

fabrication plant, located in Lamont County within Alberta’s

Industrial Heartland northeast of Edmonton. The plant has 40,000

square feet of serviced shops and buildings located close to

sources of reagents, services and a commutable labour pool to

materially reduce costs for the hydrometallurgical refinery.

Critical Minerals:

The Canadian and United States (“U.S.”) governments have

signed a Joint Action Plan on Critical Mineral Collaboration to

enable greater North American production of the minerals identified

as critical to economic and national security. Minerals considered

critical for this purpose have essential use in important

industrial and defense applications, cannot be easily substituted,

and their supply chains are threatened by geographic concentration

of production and/or geopolitical risks.

In addition to the support announced in the 2022 Budget, U.S.

President Joe Biden recently invoked the Defense Production Act

(“DPA”) to accelerate the build-out of a domestic battery

materials supply chain. The measure is being tailored to future

energy metals such as cobalt, lithium and nickel as energy

transitions from fossil fuels to renewables. "To promote the

national defense, the United States must secure a reliable and

sustainable supply of such strategic and critical materials," said

President Biden. The U.S. relies on imports for Critical Minerals,

often from what Biden termed "unreliable foreign sources". Demand

for battery materials is set to increase exponentially in the

coming years as automakers increase EV production and build out the

required capacity. The DPA is intended as a federal government

accelerator for a domestic battery metals supply chain that is

still in its infancy. The real significance of invoking the DPA,

however, is that it elevates battery metals to the top of the U.S.

critical materials supply list. Further, U.S. domestic investment

is expected to go hand in hand with mineral alliances, particularly

with the European Union, Australia and Canada, the latter which

itself is preparing a major investment drive into the battery

supply chain.

Cobalt is an ‘Energy Metal’ due to its primary consumption in

lithium-ion batteries. It is also consumed in aerospace, magnet and

cutting tool alloys, and pigments and catalysts needed in chemical

processes. The cobalt market is currently more than 160,000 tonnes

of refined metal, although analysts project that consumption will

grow to between 300,000 and 400,000 tonnes by the end of this

decade, primarily due to demand from EV’s. More than 70% of cobalt

mine production is currently sourced from the Democratic Republic

of the Congo, more than half of which is controlled by Chinese

state-owned corporations. China also controls 68% of cobalt

refinery production and 80% of cobalt chemical supply.

Bismuth is also a Critical Mineral with unique properties,

including low melting temperature, high density and it is one of

the few metals that expands when cooled, properties that are

leveraged by the automotive industry for glass frits,

anti-corrosion coatings, and metallic paints and pigments. Bismuth

is non-toxic and has anti-bacterial properties making it ideal for

use in pharmaceuticals such as Pepto-Bismol® and some medical

devices. The bismuth market is approximately 20,000 tonnes per

annum, but has growing demand as an ‘Eco-Metal’ and environmentally

safe replacement for lead in solders, galvanizing and brass alloys,

free-machining steel and aluminum, paint, glass, ceramic glazes,

radiation shielding, cosmetics, solar voltaics, ammunition, and

fishing sinkers. Many of these applications have been developed

because of legislation banning or restricting the use of toxic

metals including lead. China controls approximately 75% of current

bismuth mine and refinery production and the NICO deposit contains

the World’s largest known Mineral Reserve.

Copper is also identified as a Critical Mineral by Canada. The

gold contained in the NICO deposit provides a countercyclical and

highly liquid co-product.

For more detailed information about the NICO Mineral Reserves

and certain technical information in this news release, please

refer to the Technical Report on the NICO Project, entitled

"Technical Report on the Feasibility Study for the

NICO-Gold-Cobalt-Bismuth-Copper Project, Northwest Territories,

Canada", dated April 2, 2014 and prepared by Micon International

Limited which has been filed on SEDAR and is available under the

Company's profile at www.sedar.com.

The disclosure of scientific and technical information contained

in this news release has been approved by Robin Goad, M.Sc.,

P.Geo., President and Chief Executive Officer of Fortune, who is a

"Qualified Person" under National Instrument 43-101.

About Fortune Minerals:

Fortune is a Canadian mining company focused on developing the

NICO cobalt-gold-bismuth-copper Critical Minerals project in the

NWT and Alberta. Fortune also owns the satellite Sue-Dianne

copper-silver-gold deposit located 25 km north of the NICO deposit

and is a potential future source of incremental mill feed to extend

the life of the NICO mill and concentrator.

Follow Fortune Minerals: Click here to subscribe to

Fortune’s email list. Click here to follow Fortune on LinkedIn.

@FortuneMineral on Twitter.

This press release contains forward-looking information and

forward-looking statements within the meaning of applicable

securities legislation. This forward-looking information includes

statements with respect to, among other things, the development of

the NICO Project and the proposed hydrometallurgical refinery, the

potential for expansion of the NICO Deposit and the Company’s plans

to develop the NICO Project. Forward-looking information is based

on the opinions and estimates of management as well as certain

assumptions at the date the information is given (including, in

respect of the forward-looking information contained in this press

release, assumptions regarding: the Company’s ability to complete

construction of a NICO Project refinery; the Company’s ability to

arrange the necessary financing to continue operations and develop

the NICO Project; the support of the federal and/or provincial

government for the NICO Project; the receipt of all necessary

regulatory approvals for the construction and operation of the NICO

Project and the related hydrometallurgical refinery and the timing

thereof; growth in the demand for cobalt; the time required to

construct the NICO Project; and the economic environment in which

the Company will operate in the future, including the price of

gold, cobalt and other by-product metals, anticipated costs and the

volumes of metals to be produced at the NICO Project). However,

such forward-looking information is subject to a variety of risks

and uncertainties and other factors that could cause actual events

or results to differ materially from those projected in the

forward-looking information. These factors include the risks that

the 2021 drill program may not result in a meaningful expansion of

the NICO Deposit, the COVID-19 pandemic may interfere with the

Company’s ability to conduct the drill program, the Company may not

be able to complete the purchase of the JSFL site and secure a site

for the construction of a refinery, the Company may not be able to

finance and develop NICO on favourable terms or at all,

uncertainties with respect to the receipt or timing of required

permits, approvals and agreements for the development of the NICO

Project, including the related hydrometallurgical refinery, the

construction of the NICO Project may take longer than anticipated,

the Company may not be able to secure offtake agreements for the

metals to be produced at the NICO Project, the Sue-Dianne Property

may not be developed to the point where it can provide mill feed to

the NICO Project, the inherent risks involved in the exploration

and development of mineral properties and in the mining industry in

general, the market for products that use cobalt or bismuth may not

grow to the extent anticipated, the future supply of cobalt and

bismuth may not be as limited as anticipated, the risk of decreases

in the market prices of cobalt, bismuth and other metals to be

produced by the NICO Project, discrepancies between actual and

estimated Mineral Resources or between actual and estimated

metallurgical recoveries, uncertainties associated with estimating

Mineral Resources and Reserves and the risk that even if such

Mineral Resources prove accurate the risk that such Mineral

Resources may not be converted into Mineral Reserves once economic

conditions are applied, the Company’s production of cobalt, bismuth

and other metals may be less than anticipated and other operational

and development risks, market risks and regulatory risks. Readers

are cautioned to not place undue reliance on forward-looking

information because it is possible that predictions, forecasts,

projections and other forms of forward-looking information will not

be achieved by the Company. The forward-looking information

contained herein is made as of the date hereof and the Company

assumes no responsibility to update or revise it to reflect new

events or circumstances, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220412005460/en/

Fortune Minerals Limited Troy Nazarewicz Investor

Relations Manager info@fortuneminerals.com Tel: (519) 858-8188

www.fortuneminerals.com

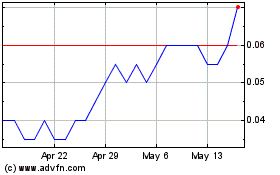

Fortune Minerals (TSX:FT)

Historical Stock Chart

From Jan 2025 to Feb 2025

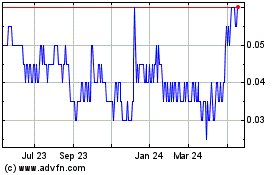

Fortune Minerals (TSX:FT)

Historical Stock Chart

From Feb 2024 to Feb 2025