All amounts are in USD unless stated

otherwise

- After-tax NPV5% of $1.4

billion, IRR of 21% and payback of 3.8 years at $1,950/oz base case gold price (long-term

consensus)

- After-tax NPV5% of $2.5

billion, IRR of 31% and payback of 2.0 years at $2,500/oz spot gold price

- Average annual gold production of 353,000 ounces at an AISC of

$986/oz for 12.7 years

- Startup capital cost of $936

million and sustaining capital of $537 million over the life of mine

- ESIA submission targeted by year end while progressing towards

a Feasibility Study for Q1-2025

- An average of 1,260 direct permanent jobs to be created from

the Oko West Project

BROSSARD, QC, Sept. 9,

2024 /PRNewswire/ - G Mining Ventures Corp.

("GMIN" or the "Corporation") (TSX: GMIN) (OTCQX:

GMINF) is pleased to announce the results of its 2024 Preliminary

Economic Assessment Study (the "PEA" or the "Study")

for the development of its wholly owned Oko West Gold Project,

located in Guyana ("Oko" or

the "Project").

The PEA, completed by G Mining Services Inc. ("GMS") as

lead consultant, supported by other engineering consultants,

confirms robust economics for a low-cost, large-scale, conventional

open pit ("OP") and underground ("UG") mining and

milling operation, with operating costs below industry averages, in

addition to a high rate of return. The Project is ideally sequenced

to leverage the strong macroeconomic conditions including a strong

gold ("Au") price, lower inflation, and Guyana's rapidly developing economy.

Louis-Pierre Gignac, President

& Chief Executive Officer, commented: "The Oko PEA,

based on the long-term consensus gold price of $1,950 per ounce, outlines a high-production,

long-life, high-margin operation with an after-tax NPV5%

of $1.4 billion and IRR of 21%. Oko

is ideally sequenced to benefit from GMIN's regional footprint,

development expertise, anticipated free cashflow from our

in-production Tocantinzinho Gold Mine in Brazil and historically high gold prices. GMIN

announced last week commercial production at Tocantinzinho,

delivering our first operating mine on-time and on-budget, and we

will seek to repeat this success with Oko using essentially the

same team. I am excited that this exceptionally positive PEA only

captures a snapshot of the potential value of Oko, as we continue

to explore the prospective land package and evaluate

value-enhancement opportunities for improved economics in a

feasibility study planned for the first quarter of 2025. I look

forward to the tremendous shared-value creation for our

stakeholders, including the country of Guyana."

PEA Overview

Oko is planned as a mix of conventional OP mine and mechanized

long hole open stoping UG mine, with on-site treatment of the mined

material processed through a conventional circuit consisting of

comminution, gravity concentration, cyanide leach and adsorption

via carbon-in-leach ("CIL"), carbon elution and gold

recovery circuits. The OP mine will have a Life of Mine

("LOM") of 15 years, including 2 years of pre-stripping,

from 4 pit phases, while the UG mine will have a LOM of 13 years,

including 2 years of development, in 3 zones. The mill will operate

for 13 years.

The PEA is derived using the Corporation's mineral resource

estimate effective as at February 7, 2024 (the "MRE").

The effective date of the PEA is September

4, 2024, and a NI 43-101 compliant technical report (the

"Technical Report") will be filed on the Corporation's

website and under its SEDAR+ profile within 45 days of this news

release.

Table 1: Oko West Preliminary Economic

Assessment Highlights

|

Description

|

Units

|

Figure

|

|

Production

Data

|

|

|

|

OP Mill Feed

Tonnage

|

Mt

|

61

|

|

UG Mill Feed

Tonnage

|

Mt

|

15

|

|

Total Mineralized

Material Mined

|

Mt

|

75

|

|

Total Waste Mined (OP

and UG)

|

Mt

|

367

|

|

Total Tonnage Mined (OP

and UG)

|

Mt

|

443

|

|

Strip

Ratio

|

waste : mineralized

material

|

6.0

|

|

Average Milling

Throughput

|

Mt/year

|

6.0

|

|

Average Milling

Throughput

|

tpd

|

16,110

|

|

Gold Head

Grade

|

g/t

|

2.00

|

|

OP Head

Grade

|

g/t

|

1.72

|

|

UG Head

Grade

|

g/t

|

3.19

|

|

Contained

Gold

|

koz

|

4,848

|

|

Average

Recovery

|

%

|

92.8 %

|

|

Total Gold

Production

|

koz

|

4,500

|

|

Mine

Life

|

years

|

12.7

|

|

Average Annual Gold

Production

|

oz

|

353,000

|

|

Operating Costs

(Average LOM)

|

|

|

|

Total Site

Costs

|

USD/oz

|

$728

|

|

Government

Royalties

|

USD/oz

|

$126

|

|

Total Operating

Cost

|

USD/oz

|

$853

|

|

AISC

|

USD/oz

|

$986

|

|

Capital

Costs

|

|

|

|

Total Upfront

Capital Cost

|

USD

MM

|

$936

|

|

Initial UG Capital

Costs (Sustaining Capital)

|

USD

MM

|

$124

|

|

OP and UG

Sustaining Capital

|

USD

MM

|

$413

|

|

Life of Mine Sustaining

Capital

|

USD MM

|

$537

|

|

Closure

Costs

|

USD MM

|

$37

|

|

Total Capital

Costs

|

USD MM

|

$1,510

|

|

Financial

Evaluation

|

|

|

|

Gold Price

Assumption

|

USD/oz

|

$1,950

|

|

After-Tax NPV

5%

|

USD

MM

|

$1,367

|

|

After-Tax

IRR

|

%

|

21 %

|

|

Payback

|

Years

|

3.8

|

Table 2: Sensitivity Analysis

|

|

Downside

|

Base

|

Spot

|

|

Scenario

|

|

Case

|

Case

|

Case

|

|

Gold Price

|

USD/oz

USD MM

|

$1,600

|

$1,950

|

$2,500

|

|

After Tax

NPV5%

|

$639

|

$1,367

|

$2,502

|

|

Payback

|

Years

|

5.9 Years

|

3.8

Years

|

2.0 Years

|

|

After-Tax

IRR

|

%

|

13 %

|

21 %

|

31 %

|

|

Average Annual

EBITDA

|

USD MM

|

$264

|

$376

|

$554

|

|

Average Annual Free

Cash Flow

|

USD MM

|

$188

|

$272

|

$406

|

|

LOM EBITDA

|

USD MM

|

$3,452

|

$4,924

|

$7,238

|

|

LOM Free Cash

Flow

|

USD MM

|

$1,475

|

$2,584

|

$4,325

|

|

Note: Average annual

figures represent the 12.7-year operating period.

|

|

Table 3: Sensitivity Analysis cont'd

|

After

Tax

|

Average

Annual

|

|

Gold

Price

|

NPV5%

|

IRR

|

Payback

|

EBITDA

|

FCF

|

|

(USD/oz)

|

(USD

M)

|

( %)

|

(years)

|

(USD

M)

|

(USD

M)

|

|

$1,300

|

($4)

|

5 %

|

10.4

|

$167

|

$115

|

|

$1,400

|

$214

|

8 %

|

8.3

|

$199

|

$139

|

|

$1,500

|

$427

|

10 %

|

6.9

|

$231

|

$163

|

|

$1,600

|

$639

|

13 %

|

5.9

|

$264

|

$188

|

|

$1,700

|

$849

|

15 %

|

5.2

|

$296

|

$212

|

|

$1,800

|

$1,057

|

18 %

|

4.5

|

$328

|

$236

|

|

$1,900

|

$1,264

|

20 %

|

4.0

|

$360

|

$260

|

|

$1,950

|

$1,367

|

21 %

|

3.8

|

$376

|

$272

|

|

$2,000

|

$1,471

|

22 %

|

3.6

|

$392

|

$285

|

|

$2,100

|

$1,677

|

24 %

|

3.3

|

$425

|

$309

|

|

$2,200

|

$1,883

|

26 %

|

3.0

|

$457

|

$333

|

|

$2,300

|

$2,090

|

27 %

|

2.0

|

$489

|

$357

|

|

$2,400

|

$2,296

|

29 %

|

2.0

|

$521

|

$382

|

|

$2,500

|

$2,502

|

31 %

|

2.0

|

$554

|

$406

|

|

$2,600

|

$2,708

|

33 %

|

2.0

|

$586

|

$430

|

|

Note: Average annual

figures represent the 12.7-year operating period.

|

|

Property Description, Location and Access

Oko is an advanced-stage gold development project, which

straddles the Cuyuni-Mazaruni Mining Districts (administrative

Region 7) in north central Guyana,

South America. The Project is

located approximately 100 kilometres ("km") southwest of

Georgetown, the capital city of

Guyana and approximately 70 km

from Bartica, the capital city of Region 7 (Figure 2). The Project

comprises one Prospecting Licence ("PL") issued to Reunion Gold

Inc., GMIN's indirect 100%-owned Guyanese subsidiary, on

September 23, 2022. The PL is valid

for three years and is renewable for up to two years. The PL has a

surface area of approximately 10,890 acres (4,407 hectares).

In March 2024, an option agreement

was entered into for the Northwest extension mining permits,

consisting of three medium-scale mining permits ("MPMS") adjacent

to the PL. That agreement is valid for five years with a possible

two-year extension. In August 2024,

another agreement was concluded to purchase additional MPMS from a

private group of individuals for the Eastern and Southern

extensions to the PL.

The Project can be accessed via numerous methods: helicopter

direct from Ogle airport to the site, fixed-wing plane from Ogle

airport to Bartica airstrip, or by car and then speedboat. From the

town of Itabali at the confluence of the Cuyuni and Mazaruni

rivers, one can use the Puruni or the Aremu laterite roads, using

four-wheel drive vehicles. Bartica is accessible by a 20-minute

direct flight from the Ogle airport in Georgetown or by road and boat from Parika on

the Essequibo River. There are regular boat services between

Bartica and Parika.

The climate is equatorial and humid. The Project has operated

throughout the year without any interruptions related to the

weather.

Mineral Resource Estimate

Measured and Indicated Mineral Resources ("M&I") total 64.6

million tonnes ("Mt") at an average gold grade of 2.05 grams per

tonne ("g/t Au") for 4.27 million contained ounces of gold.

Contained gold in the M&I category represents 73% of the global

resource.

The MRE considers 397 diamond drill holes, 292 reverse

circulation holes, and 59 trenches completed by Reunion Gold

Corporation between December 2020 and

January 2024.

Table 4: Mineral Resource Estimate

|

Category

|

Tonnes

(kt)

|

Gold

Grade

(g/t)

|

Contained

Gold

(koz)

|

|

Pit Constrained

Resource

|

|

Indicated

|

64,115

|

2.06

|

4,237

|

|

Inferred

|

8,107

|

1.87

|

488

|

|

UG Constrained

Resource

|

|

Indicated

|

491

|

1.85

|

29

|

|

Inferred

|

11,510

|

3.01

|

1,116

|

|

Total OP and

UG

|

|

Indicated

|

64,606

|

2.05

|

4,266

|

|

Inferred

|

19,617

|

2.54

|

1,603

|

|

These Mineral Resources

are not Mineral Reserves as they have not demonstrated economic

viability. All figures are rounded to reflect the relative accuracy

of the estimates. The lower cut-offs used to report open pit

Mineral Resources are 0.30 g/t Au in saprolite and

alluvium/colluvium, 0.313 g/t Au in transition, and 0.37 g/t Au in

fresh rock. Underground Mineral Resources are reported inside

potentially mineable volume and include below cut-off material

(stope optimization cut-off grade of 1.38 g/t Au). A change in the

reporting method for the underground part of the deposit explains

the differences in tonnage and average grade between this PEA and

the MRE published in February 2024. Tonnage of potentially mineable

material stated below cut-off (i.e., must take material) is

declared for this constrained underground Mineral Resource

Estimate. Blocks have been reclassified inside each stope based on

deposit knowledge and continuity and reflect the existing

classification. No changes in total ounces is observed. The cut-off

grades are based on a gold price of US$1,950 per troy ounce and

show 96.0%, 95.0% and 92.5% processing recoveries for saprolite and

alluvium/colluvium, transition and fresh rock,

respectively.

|

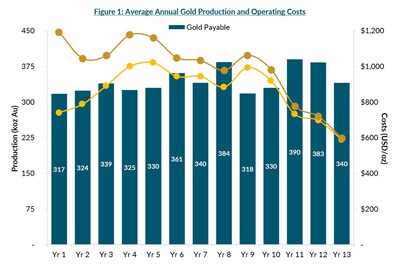

Production Profile

The PEA outlines an average annual gold production profile of

353 thousand ounces ("koz") over the 12.7-year mine life. Total

gold production is 4.5 million ounces with an average gold grade

milled of 2.00 g/t Au, and metallurgical recovery of 92.8%.

The processing feed will be supplied by the open pit during the

initial three years of commercial production. Starting in the

fourth year of production, underground mining will contribute a

significant tonnage of mineralized material.

Table 5: Gold Production by Mil Feed

Type

|

Open

Pit

|

Underground

|

Total OP +

UG

|

|

Material

|

Grade

|

Contained

|

Material

|

Grade

|

Contained

|

Contained

|

|

Gold

|

|

Milled

|

Milled

|

Gold

|

Milled

|

Milled

|

Gold

|

Gold

|

Recovery

|

Recovered

|

|

Year

|

(kt)

|

(g/t)

|

(koz)

|

(kt)

|

(g/t)

|

(koz)

|

(koz)

|

( %)

|

(koz)

|

|

Year 1

|

6,368

|

1.63

|

334

|

40

|

1.97

|

3

|

336

|

94 %

|

317

|

|

Year 2

|

6,933

|

1.54

|

343

|

67

|

2.09

|

4

|

348

|

93 %

|

324

|

|

Year 3

|

6,714

|

1.58

|

340

|

286

|

2.63

|

24

|

365

|

93 %

|

339

|

|

Year 4

|

6,054

|

1.41

|

275

|

946

|

2.39

|

73

|

347

|

94 %

|

325

|

|

Year 5

|

4,655

|

1.46

|

219

|

1,345

|

3.18

|

138

|

357

|

93 %

|

330

|

|

Year 6

|

4,405

|

1.51

|

213

|

1,595

|

3.43

|

176

|

389

|

93 %

|

361

|

|

Year 7

|

4,432

|

1.46

|

208

|

1,568

|

3.16

|

159

|

368

|

93 %

|

340

|

|

Year 8

|

4,260

|

1.86

|

255

|

1,562

|

3.19

|

160

|

416

|

93 %

|

385

|

|

Year 9

|

3,455

|

1.72

|

192

|

1,545

|

3.08

|

153

|

344

|

93 %

|

319

|

|

Year 10

|

3,489

|

1.90

|

213

|

1,511

|

2.96

|

144

|

357

|

93 %

|

331

|

|

Year 11

|

3,518

|

2.31

|

261

|

1,482

|

3.37

|

161

|

422

|

93 %

|

390

|

|

Year 12

|

3,572

|

2.23

|

256

|

1,428

|

3.45

|

158

|

415

|

93 %

|

384

|

|

Year 13

|

2,406

|

3.04

|

235

|

1,125

|

3.66

|

132

|

367

|

93 %

|

340

|

|

Total

|

60,261

|

1.72

|

3,345

|

14,501

|

3.19

|

1,485

|

4,831

|

93 %

|

4,484

|

Mining

The Project is planned as a mining operation that integrates

both conventional open pit mining and mechanized long hole open

stoping for the underground mine.

The main OP is centered on Block 4 with two smaller sub-pits

positioned on the northern and southern extensions to the main pit.

A total of 60.7 Mt of mineralized material will be mined from the

OP at an average diluted gold grade of 1.72 g/t Au. 0.4 Mt of this

material will be milled during the pre-production period. A total

of 364.6 Mt of combined waste and overburden will be extracted,

resulting in a strip ratio of 6.0x. The OP operation will be

executed in 4 phases over 15 years, including 2 years of

pre-production, with an owner-operated mining fleet.

The UG operation will take place in three zones: the main zone

and two satellite zones, all accessible from a surface mine portal

through the same main decline ramp. Long hole open stoping mining

method will be used, including transverse stoping and longitudinal

stoping variations. The average UG production rate is expected to

be 4,250 tonnes per day ("tpd") of mineralized material,

with 4,000 tpd and 250 tpd from stope production and lateral

development, respectively. A total of 14.5 Mt of mineralized

material is expected to be mined at an average diluted gold grade

of 3.19 g/t Au. The UG mine is expected to be in production for 13

years, including a two-year development period. The initial 2 years

of construction and development will use contract mining and

transition to owner-operated mining thereafter.

Processing and Recovery

The proposed process plant design for Oko is based on a standard

metallurgical flowsheet to treat gold bearing material and produce

doré. The process plant is designed to nominally treat 6.0 Mtpy of

fresh rock and will consist of comminution, gravity concentration,

cyanide leach and adsorption via carbon-in-leach ("CIL"),

carbon elution and gold recovery circuits. CIL tailings will be

treated in a cyanide destruction circuit and pumped to a tailings

storage facility.

The milling rate is initially set at 6.0 million tonnes per

annum ("Mtpa") for hard rock but will be increased to

7.0 Mtpa when saprolite and transition materials are added. During

the open pit operational period, the ramp-up period is 5 months.

The mill will operate for 13 years.

Select key design criteria include crushing plant availability

of 70%; grinding, gravity, CIL, gold recovery and tailings handling

circuit availability of 92% through the use of standby equipment in

critical areas, inline crushed material stockpile and reliable

power supply; comminution circuit to produce a primary grind size

of (P80) 80% passing 75 µm; and CIL residence time of 48 hours to

achieve optimal gold extraction.

Table 6: Metallurgical Recoveries

|

Feed

|

Total

|

Mill

|

|

Feed

Material

|

Grade

|

Recovery

|

Feed

|

|

Saprolite

|

1.40

|

96 %

|

10 %

|

|

Transition

|

1.47

|

95 %

|

5 %

|

|

Fresh Rock

|

2.11

|

93 %

|

85 %

|

|

Total

LOM

|

2.00

|

93 %

|

100 %

|

Power

Plant site activities, including the process plant, UG mining,

OP mine, and balance of plant infrastructure, will require an

average of 37 megawatts ("MW") at full operation. The

plant's full power consumption was benchmarked against similar

projects, with OP mining and UG mining adjusted for processing

throughputs.

The Project's base case scenario considers installing a

dedicated Heavy Fuel Oil ("HFO") fired power plant. The

power plant is anticipated to comprise six 9.4 MW engine generating

sets ("genset"), totaling 56.4 MW installed capacity and

42.3 MW running capacity. This assumes that one of the generators

would be on standby. One additional genset is planned in sustaining

capital to allow for maintenance activities.

Alternative power supplies will be studied as part of the

Feasibility Study, including using liquefied natural gas ("LNG")

power plant.

Environmental and Permitting

Between 2022 and 2024, comprehensive physical, biological, and

social baseline studies were conducted to support Project planning,

including environmental assessments during both dry and wet

seasons. These studies aim to identify potential concerns and

recommend actions for effective Project design and regulatory

compliance. The Project area is not a priority conservation site

and does not overlap with any protected or Indigenous lands.

Ongoing data collection will help refine Project design, identify

potential environmental and social impacts, and contribute to the

submission of an Environmental Impact Assessment ("EIA").

Future studies will also address additional project components such

as power supply and road access.

The permitting process for the Oko involves obtaining

environmental authorization from Guyana's Environmental Protection Agency

("EPA") following the submission and approval of an EIA,

which GMIN expects to file by year end 2024. Exploration activities

are conducted under a previously received no-objection letter from

the EPA.

The necessary permits covering the construction of the mine,

processing plant, transmission line, port, HFO power generation,

and access road, will be issued after the EPA's review, which GMIN

anticipates may take approximately six months after submission of

the EIA. GMIN's permitting activities will be guided by ongoing

stakeholder engagement and government consultations, ensuring

compliance with environmental and social

international standards.

Operating Costs

LOM operating costs are estimated at $728 per ounce of gold produced, excluding

royalty costs, as summarized below. The LOM AISC is estimated to be

$986 per ounce of gold produced based

on average annual gold production of 353,000 ounces over the 12.7

years of mine life. The cost structure places the Project in the

bottom quartile of the global gold cost curve.

Table 7: Operating Cost and AISC

Summary

|

Costs

|

Unit

Cost

|

Unit

Cost

|

|

(USD/t

milled)

|

(USD/oz)

|

|

Mining Costs -

OP

|

$13.13

|

$219

|

|

Mining Costs -

UG

|

$10.76

|

$179

|

|

Rehandle

Costs

|

$0.15

|

$2

|

|

Processing

Costs

|

$9.04

|

$151

|

|

Power Costs

|

$5.93

|

$99

|

|

G&A

Costs

|

$4.14

|

$69

|

|

Transport &

Refining

|

$0.48

|

$8

|

|

Total Site

Cost

|

$43.62

|

$728

|

|

Royalty

Costs

|

$7.53

|

$126

|

|

Total Operating

Costs

|

$51.15

|

$853

|

|

Sustaining

Capex

|

$7.19

|

$120

|

|

Closure

Costs

|

$0.49

|

$8

|

|

Land

Payments

|

$0.30

|

$5

|

|

All-in Sustaining

Costs ("AISC")

|

$59.13

|

$986

|

|

Note: Total Cash Costs

and AISC are non-GAAP measures and include royalties

payable.

|

|

Project Royalties

The PEA considers two federal government royalties:

- Underground Royalty: 3.0% of net smelter return of the mineral

product.

- Open Pit Royalty: 8.0% of net

smelter return of the mineral product.

The production profile results in a blended royalty rate of

6.5%.

Capital Cost Estimates

The initial capital cost ("capex") is estimated to be

$936 million after accounting for

$29 million in pre-production

credits. A 12% contingency totaling $100

million is included in the estimate. Underground-related

capex is captured in sustaining capex, with ramp development to

initiate in Year 1 of operations.

The total construction period, including the early works

program, is forecast to be 28 months.

Table 8: Capital Cost Summary

|

Initial

CAPEX

|

USD M

|

|

100 -

Infrastructure

|

$71

|

|

200 - Power &

Electrical

|

$118

|

|

300 - Water

Management

|

$16

|

|

400 - Surface

Operations

|

$46

|

|

500 - Mining

|

$129

|

|

600 - Process

Plant

|

$190

|

|

700 - Construction

Indirects

|

$107

|

|

800 - General Services

/ Owner's Costs

|

$111

|

|

900 - Pre-Production,

Start-up & Commissioning

|

$76

|

|

990 – Contingency

(12%)

|

$100

|

|

Capital

Costs

|

$965

|

|

Less: Pre-Prod. Credit

net of TC/RC & Royalties

|

($29)

|

|

Total Capital

Costs

|

$936

|

The sustaining capex is estimated to be $574 million, including $37 million of closure and rehabilitation costs,

split between open pit and underground operations. Open pit

sustaining capex is earmarked for additional equipment, replacement

units, and major repairs. Other sustaining capex captures tailings

storage facility raises, process plant, power plant expansion, and

G&A.

Table 9: Sustaining Cost Summary

|

Sustaining

Capex

|

USD M

|

USD/oz

|

|

Open Pit

|

$216

|

$48

|

|

Underground (Initial

capex)

|

$124

|

$28

|

|

Underground

|

$133

|

$30

|

|

Other

|

$64

|

$14

|

|

Sustaining

Capex

|

$537

|

$120

|

|

Closure &

Rehabilitation

|

$37

|

$8

|

|

Total Sustaining

Capex

|

$574

|

$128

|

UG sustaining capex totals $257

million and includes lateral and vertical development of the

mine, mobile equipment, fixed equipment, construction, and

pre-production. The initial 2 years of construction and development

total $124 million (48% of total UG

sustaining capex). The table below sets out more details on the

underground portion of the sustaining capex.

Table 10: Underground Sustaining Cost

Summary

|

Underground

Sustaining Capex

|

USD M

|

|

Lateral

Development

|

$97

|

|

Mobile Equipment

UG

|

$63

|

|

Construction

UG

|

$29

|

|

Pre-Production

UG

|

$26

|

|

Vertical

Development

|

$13

|

|

Fixed Equipment

UG

|

$12

|

|

Mobile Equipment UG

Rebuild

|

$11

|

|

Other Equipment

UG

|

$5

|

|

Total Underground

Sustaining Capex

|

$257

|

Project Timetable and Next Steps

Corporate Timetable and Next Steps

Upcoming key milestones include:

- Q4-2024: Oko Exploration results

- Q4-2024: Tocantinzinho Gold Mine ("TZ") exploration

results

- Q1-2025: TZ nameplate capacity

- Q1-2025: Oko Feasibility Study

- H1-2025: Oko Early Works and

Construction Decision

- H2-2027: Oko Commissioning

- H1-2028: Oko Commercial Production

Preliminary Economic Assessment Study 3D VRIFY

Presentation

To view a 3D VRIFY presentation of the Study please click on the

following link: https://vrify.com/decks/16400 or visit the

Corporation's website at www.gmin.gold.

Updated corporate presentation is available at:

https://vrify.com/decks/14338.

Technical Report Preparation and Qualified Persons

The Study has an effective date of September 4, 2024 and was issued on September 9, 2024. It was authored by independent

Qualified Persons and is in accordance with National Instrument

43-101 – Standards of Disclosure for Mineral Projects.

GMS was responsible for the overall report and PEA coordination,

property description and location, accessibility, history, mineral

processing and metallurgical testing, mineral resource estimation,

mining methods, recovery methods, project infrastructures,

operating costs, capex, economic analysis and project execution

plan. For readers to fully understand the information in this news

release, they should read the technical report in its entirety,

including all qualifications, assumptions, exclusions and risks.

The technical report is intended to be read as a whole and sections

should not be read or relied upon out of context.

The Qualified Persons ("QPs") are Paul Murphy, P. Eng. having overall

responsibility for the Report including capital and operating

costs. Neil Lincoln, P. Eng. having

responsibility for metallurgy, recovery methods and process plant

operating costs. Christian Beaulieu,

MSc, PGeo, of Minéralis Consulting Services is responsible for

property description, geology, drilling, sampling and the mineral

resource estimate. Alexandre

Burelle, P. Eng. is responsible for the mining method and

capital and operating costs related to the mine and the economic

analysis. Derek Chubb, P. Eng., of

ERM Consultants Canada Ltd., is responsible for the environment and

permitting aspects.

The technical content of this press release has been reviewed

and approved by the QPs who were involved with preparation of the

Study. In addition, Louis-Pierre

Gignac, President & Chief Executive Officer of GMIN, a

QP as defined in NI 43-101, has reviewed the Study on behalf of the

Corporation and has approved the technical disclosure contained in

this news release. The PEA is summarized into a technical report

that is filed on the Corporation's website at www.gmin.gold and on

SEDAR+ at www.sedar.com in accordance with NI 43-101.

About G Mining Ventures Corp.

G Mining Ventures Corp. (TSX: GMIN) (OTCQX: GMINF) is a mining

company engaged in the acquisition, exploration and development of

precious metal projects to capitalize on the value uplift from

successful mine development. GMIN is well-positioned to grow into

the next mid-tier precious metals producer by leveraging strong

access to capital and proven development expertise. GMIN is

currently anchored by the Tocantinzinho Gold Mine in Brazil and Oko West Project in Guyana, both mining friendly and prospective

jurisdictions.

Additional Information

For further information on GMIN, please visit the website at

www.gmin.gold.

Cautionary Statement on Forward-Looking Information

All statements, other than statements of historical fact,

contained in this press release constitute "forward-looking

information" and "forward-looking statements" within the meaning of

certain securities laws and are based on expectations and

projections as of the date of this press release. Forward-looking

statements contained in this press release include, without

limitation, those related to the PEA results (as such

results are set out in the various charts, figures, graphs,

schedules and tables featured hereinabove, and are commented in the

text of this press release), such as the Project's production

profile, LOM, construction and payback periods, NPV, IRR

(direct/indirect, before/after tax), startup capital costs,

contingency, operating costs, AISC, sustaining capital costs, free

cash flows, M&I resources, OP and UG mining phases, mill feed,

milling process, recovery and output (for hard rock as well as

saprolite), power supply arrangements and power consumption (and

potentially available alternatives), and closure

costs. Forward-looking statements also include, without

limitation, those related to (i) the job creation, (ii) the

targeted ESIA submission (iii) the EPA authorization and permitting

process in general, (iv) the quoted comments of GMIN's President

& CEO and, more generally, the contents of the above sections

entitled "Project Timetable and Next Steps", "Corporate Timetable

and Next Steps" and "About G Mining Ventures Corp.".

Forward-looking statements are based on expectations,

estimates and projections as of the time of this press release.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions that, while considered reasonable by the

Corporation as of the time of such statements, are inherently

subject to significant business, economic and competitive

uncertainties and contingencies. These estimates and assumptions

may prove to be incorrect. Such assumptions include, without

limitation, those underlying the items listed in the above section

entitled "About G Mining Ventures Corp." and:

- long-term consensus gold price at $1,950 per ounce;

- the USD:CAD foreign exchange rate;

- low inflation environment and Guyana's developing economy;

- the various tax assumptions;

- the capital cost estimates being supported by budgetary

quotes; and

- the Project's permitting expectations, notably obtaining the

EPA authorization.

Many of these uncertainties and contingencies can directly or

indirectly affect, and could cause, actual results to differ

materially from those expressed or implied in any forward-looking

statements. There can be no assurance that, notably but without

limitation:

- all permits necessary to build and bring Oko into commercial

production will be obtained or, as applicable, reinstated;

- the price of gold environment and the inflationary context

will remain conducive to bringing Oko into commercial

production;

- the business conditions in Guyana will remain favorable for developing

mining projects such as Oko; and

- the Corporation will bring Oko into commercial production

and that it will acquire any other significant gold

assets.

In addition, there can be no assurance that, notably but

without limitation, (i) the Corporation will use TZ as the flagship

asset to grow GMIN into the next mid-tier precious metals producer

and (ii) Brazil and Guyana will remain mining friendly and

prospective jurisdictions, as future events could differ materially

from what is currently anticipated by the Corporation.

By their very nature, forward-looking statements involve

inherent risks and uncertainties, both general and specific, and

risks exist that estimates, forecasts, projections and other

forward-looking statements will not be achieved or that assumptions

do not reflect future experience. Forward-looking statements are

provided for the purpose of providing information about

management's expectations and plans relating to the future. Readers

are cautioned not to place undue reliance on these forward-looking

statements as a number of important risk factors and future events

could cause the actual outcomes to differ materially from the

beliefs, plans, objectives, expectations, anticipations, estimates,

assumptions and intentions expressed in such forward-looking

statements. All of the forward-looking statements made in this

press release are qualified by these cautionary statements and

those made in the Corporation's other filings with the securities

regulators of Canada including,

but not limited to, the cautionary statements made in the relevant

sections of the Corporation's (i) Annual Information Form dated

March 27, 2024, for the financial

year ended December 31, 2023, and

(ii) Management Discussion & Analysis. The Corporation cautions

that the foregoing list of factors that may affect future results

is not exhaustive, and new, unforeseeable risks may arise from time

to time. The Corporation disclaims any intention or obligation to

update or revise any forward-looking statements or to explain any

material difference between subsequent actual events and such

forward-looking statements, except to the extent required by

applicable law.

View original content to download

multimedia:https://www.prnewswire.com/news-releases/g-mining-ventures-delivers-pea-for-high-grade-oko-west-gold-project-in-guyana-302241627.html

View original content to download

multimedia:https://www.prnewswire.com/news-releases/g-mining-ventures-delivers-pea-for-high-grade-oko-west-gold-project-in-guyana-302241627.html

SOURCE G Mining Ventures Corp