Marimaca Announces Results From Annual General and Special Meeting

26 May 2022 - 9:00PM

Marimaca Copper Corp. (“Marimaca Copper” or the

“Company”) (TSX: MARI) is pleased to report that all

of its incumbent directors were re-elected at its annual general

meeting of shareholders, held virtually via webcast on Wednesday

25, 2022 (the “

Meeting”). Below are the detailed

results of the votes cast by ballot (including votes cast by proxy)

at the Meeting on the election of the Company’s directors:

|

|

VOTES FOR |

|

VOTES WITHHELD |

|

PERCENTAGE OF VOTES FOR |

|

|

Hayden Locke |

55,620,550 |

|

25,116 |

|

99.94 |

% |

|

Alan J. Stephens |

55,618,971 |

|

25,116 |

|

99.94 |

% |

|

Colin Kinley |

55,618,625 |

|

324,802 |

|

99.94 |

% |

|

Michael Haworth |

55,566,084 |

|

25,212 |

|

99.85 |

% |

|

Clive Newall |

55,641,498 |

|

2,167 |

|

99.98 |

% |

|

Tim Petterson |

55,642,585 |

|

2,167 |

|

99.98 |

% |

At the Meeting, shareholders also (i) authorized

the Company to appoint PricewaterhouseCoopers LLP, Chartered

Professional Accountants, as auditors of the Company for the

ensuing year and authorize the board of directors of the Company

(the “Board”) to determine the remuneration to be

paid to the auditors and (ii) authorized the Company to implement a

warrant early exercise incentive program (the “Warrant

Early Exercise Incentive Program”), as more particularly

described in the Company’s management information circular dated

April 28, 2022 and filed under the Company’s SEDAR profile at

www.sedar.com (the “Circular”). In accordance with

the requirements of the Toronto Stock Exchange (the

“TSX”), the Warrant Early Exercise Incentive

Program was approved by a majority of “disinterested shareholders”,

being shareholders of the Company who do not also hold Warrants (as

defined below).

Please see the Company’s report of voting

results filed under the Company’s SEDAR profile at www.sedar.com

for the detailed results of all votes received on the matters

presented to shareholders at the Meeting.

Warrant Early Exercise Incentive Program

The Company sought approval for the Warrant

Early Exercise Program in order to provide the Company with a

mechanism to provide an incentive for the early exercise of its

common share purchase warrants (the “Warrants”). The Company

currently has 11,069,054 Warrants issued and outstanding, each of

which entitles the holder (a “Warrantholder”) to acquire one common

share of the Company (a “Common Share”) for an exercise price of

$4.10 per share at any time up to and including December 3,

2022.

As set forth in more detail in the Circular, the

Company is only authorized to proceed with the Warrant Early

Exercise Incentive Program in certain circumstances and on certain

terms (the “Approved Terms”). In particular:

- any adoption of the Warrant Early Exercise Incentive Program

will be subject to receipt of all required regulatory approvals,

including without limitation the approval of the TSX;

- the Company will not adopt the Warrant Early Exercise Incentive

Program unless the “market price” of the Common Shares (as

determined in accordance with Part I of the TSX Company Manual) on

the date the Board approves the Warrant Early Exercise Incentive

Program is equal to or greater than $4.75 (the “Minimum Market

Price”);

- if adopted, the Warrant Early Exercise Incentive Program will

be open for a period not to exceed 30 days following the Company’s

first public announcement of the program (the “Incentive Period”)

and, subject to compliance with applicable securities laws, will

entitle each Warrantholder who exercises a Warrant in accordance

with its terms during the Incentive Period to receive, in addition

to one Common Share, up to one additional warrant (an “Incentive

Warrant”) entitling the holder thereof to acquire one Common

Share;

- the Incentive Period will commence no later than September 3,

2022;

- the exercise price of the Incentive Warrants will be fixed at a

price that represents a premium of at least 25% to the market price

of the Common Shares on the date the Board approves the Warrant

Early Exercise Incentive Program;

- each Incentive Warrant will expire no later than three years

following the date on which the Warrant Early Exercise Incentive

Program is launched;

- the Incentive Warrants will have standard anti-dilution

provisions consistent with the anti-dilution provisions included in

the existing Warrants; and

- in order to receive Incentive Warrants on exercise of their

Warrants, Warrantholders subject to U.S. securities will be

required to qualify for an applicable exemption from registration

under the U.S. Securities Act of 1933, as amended.

Management of the Company has reviewed the

Company’s capital structure and capital requirements, and has

determined that implementing a Warrant Early Exercise Incentive

Program in accordance with the Approved Terms would be an effective

tool for financing its short to near-term capital requirements. See

“Warrant Early Exercise Incentive Program – Rationale for Adopting

Warrant Early Exercise Incentive Program” in the Circular for

additional information.

If the Company chooses to implement a Warrant

Early Exercise Incentive Program in accordance with the Approved

Terms, it will issue and file a press release describing the

specific terms and conditions of the Warrant Early Exercise

Incentive Program and provide written notice to Warrantholders in

accordance with the notice provisions set forth in their respective

Warrants. In particular, the press release and written notice will

provide details as to (i) the number of Incentive Warrants that

will be issued to Warrantholders who exercise their Warrants during

the Incentive Period, (ii) the expiry date of the Incentive

Warrants and (iii) the exercise price of the Incentive Warrants.

Under the Approved Terms, the maximum term of the Incentive

Warrants will not exceed three years and the exercise price of the

Incentive Warrants will not be less than $5.94.

Contact Information

Tavistock +44 (0) 207 920 3150Jos

Simson/Oliver Lamb / Nick Elwesmarimaca@tavistock.co.uk

Forward Looking Statements

This news release includes certain “forward-looking

statements” under applicable Canadian securities legislation,

including with respect to the effectiveness of the Warrant Early

Exercise Incentive Program as a tool to finance the Company’s short

to near-term capital requirements. There can be no assurance that

such statements will prove to be accurate, and actual results and

future events could differ materially from those anticipated in

such statements. Forward-looking statements reflect the beliefs,

opinions and projections on the date the statements are made and

are based upon a number of assumptions and estimates that, while

considered reasonable by Marimaca Copper, are inherently subject to

significant business, economic, competitive, political and social

uncertainties and contingencies. Many factors, both known and

unknown, could cause actual results, performance or achievements to

be materially different from the results, performance or

achievements that are or may be expressed or implied by such

forward-looking statements and the parties have made assumptions

and estimates based on or related to many of these factors. Such

factors include, without limitation, risks related to share price

and market conditions, the inherent risks involved in the mining,

exploration and development of mineral properties, uncertainties

related to the necessity of financing, the availability of and

costs of financing needed in the future as well as those factors

disclosed in the annual information form of the Company dated March

25, 2022 and other filings made by the Company with the Canadian

securities regulatory authorities (which may be viewed

at www.sedar.com). Accordingly, readers should not place undue

reliance on forward-looking statements. Marimaca Copper undertakes

no obligation to update publicly or otherwise revise any

forward-looking statements contained herein whether as a result of

new information or future events or otherwise, except as may be

required by law.

Neither the Toronto Stock Exchange nor the

Investment Industry Regulatory Organization of Canada accepts

responsibility for the adequacy or accuracy of this

release.

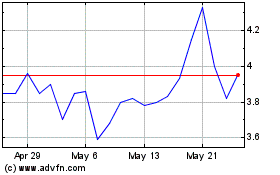

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Oct 2024 to Nov 2024

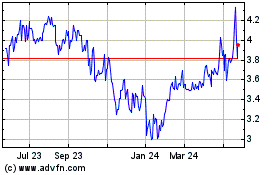

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Nov 2023 to Nov 2024