Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF) (“Calibre” or the

“Company”) and Marathon Gold Corporation (TSX: MOZ) (“Marathon”)

are pleased to announce the successful completion of the previously

announced transaction pursuant to which, among other things,

Calibre acquired all of the issued and outstanding common shares of

Marathon (the “Marathon Shares”) pursuant to a court-approved plan

of arrangement (the “Arrangement”).

Pursuant to the Arrangement, former Marathon

shareholders received 0.6164 of a Calibre common share (each whole

share, a “Calibre Share”) in exchange for each Marathon Share held.

As a result of the Arrangement, Calibre issued an aggregate of

249,813,422 Calibre Shares. Upon closing of the Arrangement,

existing Calibre and former Marathon shareholders own approximately

65% and 35% of the issued and outstanding Calibre Shares,

respectively.

As a result of the Arrangement, Calibre acquired

a 100% interest in Marathon’s advanced-stage Valentine Gold Project

in Newfoundland & Labrador, one of the top mining jurisdictions

in the world.

Delisting of the Marathon

Shares

Calibre intends to cause Marathon to delist the

Marathon Shares from the Toronto Stock Exchange, to submit an

application to cease to be a reporting issuer and to otherwise

terminate its public company reporting requirements as soon as

possible thereafter. The Calibre Shares issued under the

Arrangement are expected to be listed and posted for trading on the

Toronto Stock Exchange.

Appointment of Matthew Manson to Calibre

Board of Directors

Calibre is pleased to announce the appointment

of Matthew Manson, the former President, CEO and director of

Marathon to the board of directors of Calibre, effective January

25, 2024.

Advisors and Counsel

Trinity Advisors Corporation and TD Securities

Inc. acted as financial advisors to Calibre. Scotiabank, Raymond

James Ltd. and Haywood Securities Inc. provided capital market

advisory services to Calibre, Cassels Brock & Blackwell LLP is

acting as Canadian legal advisor to Calibre and Dorsey &

Whitney LLP and GreenbergTraurig LLP are acting as U.S. legal

advisors to Calibre.

Maxit Capital LP acted as financial advisor to

Marathon and Canaccord Genuity Corp. was the financial advisor to

the Special Committee. National Bank provided capital market

advisory services to Marathon. Mason Law and Norton Rose Fulbright

Canada LLP acted as Canadian legal advisors to Marathon and Norton

Rose Fulbright US LLP as U.S. legal advisor to Marathon.

About Calibre Mining Corp.

Calibre (TSX:CXB) is a Canadian-listed, Americas

focused, growing mid-tier gold producer with a strong pipeline of

development and exploration opportunities across Newfoundland &

Labrador in Canada, Nevada and Washington in the USA, and

Nicaragua. Calibre is focused on delivering sustainable value for

shareholders, local communities and all stakeholders through

responsible operations and a disciplined approach to growth. With a

strong balance sheet, a proven management team, strong operating

cash flow, accretive development projects and district-scale

exploration opportunities Calibre will unlock significant

value.

For further information, please contact:

Ryan KingSVP Corporate Development & IRT:

604.628.1012E: calibre@calibremining.comW:

www.calibremining.com

Calibre’s head office is located at Suite 1560,

200 Burrard St., Vancouver, British Columbia, V6C 3L6.

https://twitter.com/CalibreMiningCo

https://www.facebook.com/CalibreMining

https://ca.linkedin.com/company/calibre-mining-corp-cxb-

https://www.youtube.com/@calibreminingcorp

The Toronto Stock Exchange has neither reviewed

nor accepts responsibility for the adequacy or accuracy of this

news release.

Cautionary Note Regarding Forward

Looking Information

This news release includes certain

“forward-looking information” and “forward-looking statements”

(collectively “forward-looking statements”) within the meaning of

applicable Canadian securities legislation, including statements

regarding the plans, intentions, beliefs and current expectations

of Calibre and Marathon with respect to future business activities

and operating performance. All statements in this news release that

address events or developments that Calibre and Marathon expect to

occur in the future are forward-looking statements. Forward-looking

statements are statements that are not historical facts and are

often identified by words such as "expect", "plan", "anticipate",

"project", "target", "potential", "schedule", "forecast", "budget",

"estimate", "intend" or "believe" and similar expressions or their

negative connotations, or that events or conditions "will",

"would", "may", "could", "should" or "might" occur, and include

information regarding: (i) expectations regarding the potential

benefits and synergies of the Arrangement and the ability of the

combined company to successfully achieve business objectives,

including integrating the companies or the effects of unexpected

costs, liabilities or delays, (ii) expectations regarding the

delisting of Marathon Shares from the Toronto Stock Exchange and

the listing of Calibre Shares issued under the Arrangement on the

Toronto Stock Exchange, (iii) expectations regarding future

exploration and development, growth potential for Calibre’s and

Marathon’s operations, and (iv) expectations for other economic,

business, and/or competitive factors.

Calibre’s and Marathon’s forward-looking

statements are based on the applicable assumptions and factors

management considers reasonable as of the date hereof, based on the

information available to management of Calibre and Marathon at such

time. Calibre and Marathon do not assume any obligation to update

forward-looking statements if circumstances or management’s

beliefs, expectations or opinions should change other than as

required by applicable securities laws. There can be no assurance

that forward-looking statements will prove to be accurate, and

actual results, performance or achievements could differ materially

from those expressed in, or implied by, these forward-looking

statements. Accordingly, undue reliance should not be placed on

forward-looking statements.

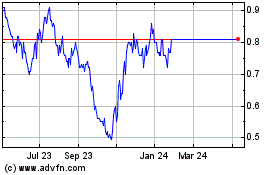

Marathon Gold (TSX:MOZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

Marathon Gold (TSX:MOZ)

Historical Stock Chart

From Nov 2023 to Nov 2024