McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is

pleased to report full year and fourth quarter 2023 production

results that represent a significant improvement year-over-year and

compared to prior quarters. Consolidated production in Q4 2023 was

49,850 gold equivalent ounces (“GEOs”)(1),

and full year production for 2023 was

154,600

GEOs. These results were consistent with our latest

forecast (Q3 results press release dated Nov 8, 2023) and within

our guidance range for the year (press release dated Mar 14, 2023).

Gold Bar production accelerated during Q4 and

the month of December, making new records for the quarter and the

month, through the addition of mining crews and the completion of

the heap leach pad expansion. At Fox, production continued steady

above 10,000 GEOs. San José production continued to strengthen

throughout the year, past the operational challenges of the first

quarter.

Chart 1: 2023 Quarterly Production - Gold

Bar, Fox, San José and Consolidated (GEOs)

In 2023, Gold Bar produced

43,700 gold ounces, within guidance range, Fox

produced 44,450 gold ounces, also within guidance

range, and San José produced 65,650 GEOs, slightly

below guidance range (see Table 1).

| Table 1:

Consolidated Production Summary |

| |

|

|

Q42022 |

Q42023(3) |

Full Year2023(3) |

2023Guidance |

|

Consolidated Production |

|

|

|

| Gold (oz) |

28,970 |

42,400 |

128,650 |

123,000-139,000 |

| Silver (oz) |

702,000 |

635,650 |

2,166,850 |

2.3M-2.6M |

|

GEOs(1) |

37,280 |

49,850 |

154,600 |

150,000-170,000 |

|

Gold Bar Mine, Nevada |

|

|

|

|

GEOs |

7,940 |

19,800 |

43,700 |

42,000-48,000 |

|

Fox Complex, Canada |

|

|

|

|

GEOs |

9,870 |

10,200 |

44,450 |

42,000-48,000 |

|

San José Mine, Argentina (49%)(2) |

|

|

|

| Gold Production (oz) |

11,170 |

11,700 |

39,700 |

39,000-43,000 |

| Silver Production (oz) |

700,850 |

635,650 |

2,166,850 |

2.3M-2.6M |

|

GEOs |

19,420 |

19,150 |

65,650 |

66,000-74,000 |

| |

|

|

|

|

Our consolidated production is recovering after

experiencing a challenging period from 2020. Looking ahead, while

we forecast lower production in 2024, the historic production trend

remains positive.

Chart 2: Historic Consolidated Annual

Production (Thousand GEOs)

2024 Production and Cost Guidance

For 2024, we expect to produce in the range of

130,000 to 145,000 GEOs attributable to MUX from

all operations (see Table 2). The reduction compared to 2024 is

primarily driven by lower output from our Fox operation and from

San José, which is operated by our partner Hochschild Mining. We

are currently evaluating potential areas for enhancing production

and profitability, and we will update our guidance accordingly once

any further improvements are implemented.

| Table 3:

2024 Production & Costs per GEO Guidance |

| |

|

|

|

2024 Guidance |

|

100% Owned Mines (Gold Bar and Fox) |

|

|

GEOs |

80,000-85,000 |

| Cash

Costs/GEO |

$1,350-1,450 |

|

AISC/GEO |

$1,550-1,650 |

|

Gold Bar Mine, Nevada |

|

|

GEOs |

40,000-43,000 |

| Cash

Costs/GEO |

$1,450-1,550 |

|

AISC/GEO |

$1,650-1,750 |

|

Fox Complex, Canada |

|

|

GEOs |

40,000-42,000 |

| Cash

Costs/GEO |

$1,225-1,325 |

|

AISC/GEO |

$1,450-1,550 |

|

49% Owned San José Mine |

|

|

GEOs |

50,000-60,000 |

| Cash

Costs/GEO |

$1,300-1,500 |

|

AISC/GEO |

$1,500-1,700 |

| |

|

At Fox in 2024, we will be starting the

development of underground ramp access to the Stock orebodies,

particularly Stock West, which will become the primary source of

feed following the completion of mining the Froome deposit in 2026.

This capital investment is partially funded by the US$16.1 million

flow-through financing completed in December 2023.

At Gold Bar in 2024, the first half of the year

is expected to deliver higher production relative to the second

half, due to a scheduled waste stripping phase in the Pick pit, in

preparation for the 2025 mining program. The mining sequence

continues to be optimized.

McEwen Copper

Twenty drill rigs are currently on site at Los

Azules and over 36,000 meters (118,000 ft) of drilling have been

completed so far this season, to advance all areas that contribute

to the upcoming Feasibility Study (FS), which is expected to be

published in Q1 2025.

At the Los Azules Project, we've made

significant progress. Our drilling program is over halfway

complete, with 36,000 meters drilled out of the 55,000 planned for

our comprehensive feasibility study. The work necessary for the

completion of the feasibility study includes mineral resource

estimation, metallurgical testing, equipment selection, final

completion and cost estimation of design for the mine and our

facilities. Additionally, we will work to advance our power and

road infrastructure plans and establish preliminary site-wide water

balance including pit dewatering.

On the ground, we've made tangible progress with

the drilling program, construction of our winter camp and

improvements to the exploration road facilitating year-round

operations. We're also on track with environmental permitting,

reflecting our commitment to responsible development.

Financially, we've been diligent in protecting

our treasury. The majority of our funds have been invested in

depository receipts of foreign and major Argentinean corporations,

to shield us from devaluation. This strategic move ensures that the

Los Azules project's financial backbone stays robust in supporting

our project development.

“We are adapting to a changing

environment in Argentina, recognizing the importance of current

political and economic reforms for the future stability and growth

of the nation. Mining is a vital component of Argentina’s economy

and, under the right conditions, one that is poised to grow

significantly and support the country’s economic

recovery,” said Michael Meding, VP of McEwen Copper and

General Manager of the Los Azules Project.

Notes:(1) 'Gold Equivalent

Ounces' are calculated based on a gold-to-silver price ratio of

84:1 for Q1 2023, 83:1 for Q2, 2023, 82:1 for Q3 2023, 85:1 for Q4

2023. 2023 production guidance is calculated based on an 85:1

gold-to-silver price ratio.(2) The San José Mine

is 49% owned by McEwen Mining Inc. and 51% owned and operated by

Hochschild Mining plc. Production is shown on a 49%

basis.(3) El Gallo Mine (on care and maintenance)

produced 704 GEO and 797 GEO in Q4 and FY2023, respectively, from

plant and pond cleanout.

Technical InformationThe

technical content of this news release related to financial

results, mining and development projects has been reviewed and

approved by William (Bill) Shaver, P.Eng., COO of McEwen Mining and

a Qualified Person as defined by SEC S-K 1300 and the Canadian

Securities Administrators National Instrument 43-101 "Standards of

Disclosure for Mineral Projects."

Reliability of

Information Regarding San JoséMinera Santa Cruz S.A., the

owner of the San José Mine, is responsible for and has supplied the

Company with all reported results from the San José Mine. McEwen

Mining’s joint venture partner, a subsidiary of Hochschild Mining

plc, and its affiliates other than MSC do not accept responsibility

for the use of project data or the adequacy or accuracy of this

release.

CAUTION

CONCERNING FORWARD-LOOKING STATEMENTSThis news release

contains certain forward-looking statements and information,

including "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. The

forward-looking statements and information expressed, as at the

date of this news release, McEwen Mining Inc.'s (the "Company")

estimates, forecasts, projections, expectations or beliefs as to

future events and results. Forward-looking statements and

information are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by management, are

inherently subject to significant business, economic and

competitive uncertainties, risks and contingencies, and there can

be no assurance that such statements and information will prove to

be accurate. Therefore, actual results and future events could

differ materially from those anticipated in such statements and

information. Risks and uncertainties that could cause results or

future events to differ materially from current expectations

expressed or implied by the forward-looking statements and

information include, but are not limited to, fluctuations in the

market price of precious metals, mining industry risks, political,

economic, social and security risks associated with foreign

operations, the ability of the corporation to receive or receive in

a timely manner permits or other approvals required in connection

with operations, risks associated with the construction of mining

operations and commencement of production and the projected costs

thereof, risks related to litigation, the state of the capital

markets, environmental risks and hazards, uncertainty as to

calculation of mineral resources and reserves, and other risks.

Readers should not place undue reliance on forward-looking

statements or information included herein, which speak only as of

the date hereof. The Company undertakes no obligation to reissue or

update forward-looking statements or information as a result of new

information or events after the date hereof except as may be

required by law. See McEwen Mining's Annual Report on Form 10-K for

the fiscal year ended December 31, 2022, and other filings with the

Securities and Exchange Commission, under the caption "Risk

Factors", for additional information on risks, uncertainties and

other factors relating to the forward-looking statements and

information regarding the Company. All forward-looking statements

and information made in this news release are qualified by this

cautionary statement.

The NYSE and TSX have

not reviewed and do not accept responsibility for the adequacy or

accuracy of the contents of this news release, which has been

prepared by management of McEwen Mining Inc.

ABOUT MCEWEN

MINING

McEwen Mining is a

gold and silver producer with operations in Nevada, Canada, Mexico

and Argentina. In addition, it owns 47.7% of McEwen Copper which

owns the large, advanced stage Los Azules copper project in

Argentina. The Company’s goal is to improve the productivity and

life of its assets with the objective of increasing its share price

and providing a yield. Rob McEwen, Chairman and Chief Owner, has

personally provided the company with $220 million and takes an

annual salary of $1.

|

WEB SITEwww.mcewenmining.com |

SOCIAL MEDIA |

|

| |

|

McEwen Mining |

| CONTACT

INFORMATION150 King Street West Suite 2800, PO Box

24 Toronto, ON, Canada M5H 1J9 |

Facebook:LinkedIn:Twitter:Instagram: |

facebook.com/mcewenmininglinkedin.com/company/mcewen-mining-inc- twitter.com/mcewenmininginstagram.com/mcewenmining |

| |

|

|

| |

|

McEwen Copper |

| Relationship with

Investors: (866)-441-0690 Toll

free (647)-258-0395 |

Facebook:LinkedIn:Twitter:Instagram: |

facebook.com/

mcewencopperlinkedin.com/company/mcewencoppertwitter.com/mcewencopperinstagram.com/mcewencopper |

| |

|

|

| |

|

Rob

McEwen |

| Mihaela

Iancu ext. 320 info@mcewenmining.com |

Facebook:LinkedIn:Twitter: |

facebook.com/mcewenrob linkedin.com/in/robert-mcewen-646ab24twitter.com/robmcewenmux |

Charts accompanying this announcement are available

at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ee4cd6c3-acdc-4060-b496-7c7fbfaae533

https://www.globenewswire.com/NewsRoom/AttachmentNg/96105457-4e6c-4637-9762-357fde45774b

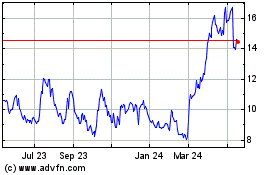

McEwen Mining (TSX:MUX)

Historical Stock Chart

From Nov 2024 to Dec 2024

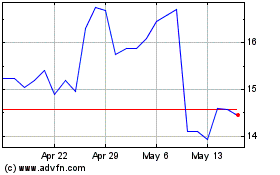

McEwen Mining (TSX:MUX)

Historical Stock Chart

From Dec 2023 to Dec 2024