Aura Minerals Inc. (TSX: ORA, B3: AURA33 and OTCQX: ORAAF)

(“Aura” or the “Company”) is pleased to announce the Q3

2023 preliminary production results from the Company’s four

operating mines: Aranzazu Mine, Ernesto/Pau-a-Pique Mine (“EPP”),

San Andres Mine, and Almas Mine. Total production during Q3 2023

reached 64,875 gold equivalent ounces (“GEO”)1. Production

increased in all operating mines vs. the previous quarter.

Highlights

-

Total production in GEO increased by 34% in Q3 2023 compared to Q2

2023, due to the commencement of commercial production in Almas

mine, higher production at the Aranzazu, San Andres and EPP mines.

Compared to Q3 2022, production increased 12%.

-

At Aranzazu, production was 27,933 GEO in line with the Company’s

expectations. Production was 11% higher compared to Q2 2023, due

higher tonnage and higher head grades. Compared to Q3 2022,

production also increased by 7%.

-

At EPP, production was 11,185 GEO, 62% higher in Q3 2023 than in Q2

2023. As expected, the production increase in EPP was attributable

to the high-grade zone in Ernesto and a reduction in the use of

existing stockpiles. The Company will continue mining in the

higher-grade zone in Ernesto during the last quarter of the year

and expects a robust fourth quarter production, in a trend similar

to the one observed in 2022. Compared to Q3 2022, production

decreased 38%.

-

At San Andres, production was 17,543 GEO for the quarter,

representing a 7% increase compared to the previous quarter. This

represents a third quarterly increase in production in a row. The

quarter's production was enhanced by operational efficiency with

the upgrade in the stacking system with the installation of new

grasshoppers, boosting productivity. Compared to Q3 2022,

production at San Andres increased by 25%.

-

At Almas, production was 8,214 GEO considering only two months of

production. Almas commenced commercial production this quarter, and

the results have exceeded market benchmarks. Furthermore, upgrades

in infrastructure are underway to increase the plant processing

capacity for the upcoming quarters.

Rodrigo Barbosa, Aura’s President and CEO

commented, “In this quarter, we experienced a significant rise in

production volumes in all our operations. Also, a standout

accomplishment this quarter was Almas's ramp-up, which exceeded

industry benchmarks. As our operations thrived, we finalized and

released a highly accretive Feasibility Study, secured funding and

commenced construction at Borborema. We, at Aura team, are focused

and building a solid track record in order to achieve our 450,000

Oz annualized by the end of 2025.”

Production Results

Preliminary GEO23 production volume for the

three months ended September 30, 2023, when compared to the

previous quarter and the same period of the previous year is

presented below:

Production for the last twelve months as of

September 30, 2023 (“LTM”) was 234,325 GEO, 3% increase compared to

the previous quarter.

The chart below shows the quarterly consolidated

GEO production measured in current and constant prices since Q3

2021, as well as the LTM at the end of each reporting period:

Consolidated GEO Production per Quarter

and LTM

(000’s GEO, current and constant prices as

reported)

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/29036400-3eff-487a-a0fe-c993c51aa042

The table below shows production by each type of

metal at Aranzazu. Production increased for all types of metals,

both vs. Q2 2023 and Q3 2022:

Qualified Person

The scientific and technical information

contained within this news release has been reviewed and approved

by Farshid Ghazanfari, P.Geo. Mineral resources and Geology

Director for Aura Minerals Inc. and serve as the Qualified Person

as defined in National Instrument 43-101 – Standards of Disclosure

for Mineral Projects.

About Aura 360° Mining

Aura is focused on mining in complete terms –

thinking holistically about how its business impacts and benefits

every one of our stakeholders: our company, our shareholders, our

employees, and the countries and communities we serve. We call this

360° Mining.

Aura is a mid-tier gold and copper production

company focused on operating and developing gold and base metal

projects in the Americas. The Company has 4 operating mines

including the Aranzazu copper-gold-silver mine in Mexico, the EPP

and Almas gold mines in Brazil, and the San Andres gold mine in

Honduras. The Company’s development projects include Borborema and

Matupá both in Brazil. Aura has unmatched exploration potential

owning over 630,000 hectares of mineral rights and is currently

advancing multiple near-mine and regional targets along with the

Serra da Estrela copper project in the prolific Carajás region of

Brazil.

Forward-Looking Information

This press release contains “forward-looking

information” and “forward-looking statements”, as defined in

applicable securities laws (collectively, “forward-looking

statements”) which may include, but is not limited to, statements

with respect to the activities, events or developments that the

Company expects or anticipates will or may occur in the future.

Often, but not always, forward-looking statements can be identified

by the use of words and phrases such as “plans,” “expects,” “is

expected,” “budget,” “scheduled,” “estimates,” “forecasts,”

“intends,” “anticipates,” or “believes” or variations (including

negative variations) of such words and phrases, or state that

certain actions, events or results “may,” “could,” “would,” “might”

or “will” be taken, occur or be achieved.

Known and unknown risks, uncertainties and other

factors, many of which are beyond the Company’s ability to predict

or control, could cause actual results to differ materially from

those contained in the forward-looking statements. Specific

reference is made to the most recent Annual Information Form on

file with certain Canadian provincial securities regulatory

authorities for a discussion of some of the factors underlying

forward-looking statements, which include, without limitation,

volatility in the prices of gold, copper and certain other

commodities, changes in debt and equity markets, the uncertainties

involved in interpreting geological data, increases in costs,

environmental compliance and changes in environmental legislation

and regulation, interest rate and exchange rate fluctuations,

general economic conditions and other risks involved in the mineral

exploration and development industry. Readers are cautioned that

the foregoing list of factors is not exhaustive of the factors that

may affect the forward-looking statements.

All forward-looking statements herein are

qualified by this cautionary statement. Accordingly, readers should

not place undue reliance on forward-looking statements. The Company

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements whether as a result of new information

or future events or otherwise, except as may be required by law. If

the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements.

1 Gold equivalent ounces, or GEO, is calculated

by converting the production of silver, copper and gold into gold

using a ratio of the prices of these metals to that of gold. The

prices used to determine the gold equivalent ounces are based on

the weighted average price of gold, silver and copper realized from

sales at the Aranzazu Complex during the relevant period.2 The

total may not add due to rounding.3 Applies the metal sale prices

in Aranzazu realized during Q2 2023 to the previous quarters in all

operations, being: Copper price = US$3.77/lb; Gold Price =

US$1,928.94/oz; Silver Price = US$23.57/oz.

For more information, please contact:

Investor Relations

ir@auraminerals.com

www.auraminerals.com

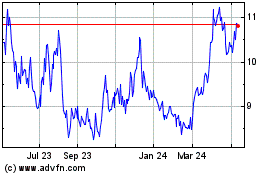

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Dec 2024 to Jan 2025

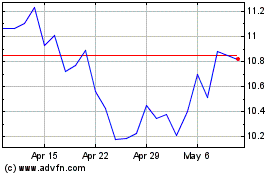

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Jan 2024 to Jan 2025