Suncor to assume operatorship of Syncrude by end of 2021

24 November 2020 - 10:30AM

Suncor, as 58.74% owner of the Syncrude Joint Venture, announced

today that it, together with the other Syncrude joint venture

owners – Imperial Oil Resources Limited, CNOOC Oil Sands Canada and

Sinopec Oil Sands Partnership – have agreed in principle for Suncor

to become the operator of the Syncrude project by the end of 2021.

The agreement still requires formal approval from each of the

owners.

“This presents a significant strategic opportunity for Syncrude

and the joint venture owners,” said Mark Little, Suncor president

and chief executive officer. “We believe this transition will help

build on the progress made to date and unlock significant value. By

capitalizing on the collective strength of our regional operations,

synergies of $300 million annually are expected, making Syncrude

even more regionally and globally competitive as we work together

to achieve a Syncrude cash operating cost per barrel of C$30/bbl

(US$23/bbl) and achieve 90% utilization. Initiatives like the

Interconnect Pipelines have proven that by collaborating with a

shared vision to improve operating performance and efficiencies, we

can achieve more.” The bi-directional pipelines connecting Suncor’s

Base Plant and Syncrude’s operations, which are now complete and

being commissioned, will provide increased integration and

operational flexibility between the two assets.

Adding Syncrude operatorship to Suncor’s current

operations – Fort Hills Limited Partnership, Suncor’s Oil

Sands Base Plant and Suncor’s in situ assets – will mean a stronger

regional operations model to drive greater competitiveness across

all assets.

“As neighbours for almost fifty years, Syncrude and Suncor have

enjoyed a close relationship and a long, proud history in the

region,” added Little. “Many families have members who work at both

operations and both operations share a deep commitment to the

community working closely with the Regional Municipality of Wood

Buffalo and Indigenous communities and partners. We will be able to

build on our collective strengths to become stronger together.”

Suncor’s confidence in the Syncrude project and the opportunity

to improve its operational performance is evidenced by Suncor’s

strategy to increase its ownership in Syncrude. Since 2016, Suncor

has grown its ownership from 12% to 58.74% through

acquisitions.

The Syncrude joint venture owners are Suncor (58.74%), Imperial

Oil Resources Limited (25.0%), Sinopec Oil Sands Partnership

(9.03%) and CNOOC Oil Sands Canada (7.23%).

Legal Advisory – Forward-Looking Information

This news release contains certain forward-looking information and

forward-looking statements (collectively referred to herein as

“forward-looking statements”) within the meaning of applicable

Canadian and U.S. securities laws. Forward-looking statements in

this news release include: the expectation that Suncor will become

the operator of the Syncrude project by the end of 2021; Suncor’s

belief that this transition will help build on the progress made to

date and unlock significant value, synergies of $300 million

annually, and capitalize on the collective strength of its regional

operations which will make Syncrude even more regionally and

globally competitive; the expectation that Suncor will work to

achieve a Syncrude cash operating cost per barrel of C$30/bbl

(US$23/bbl) and achieve 90% utilization; the belief that the

bi-directional pipelines connecting Suncor’s Base Plant and

Syncrude’s operations will provide increased integration and

operational flexibility between the two assets; Suncor’s belief

that adding Syncrude operatorship to its current operations will

mean a stronger regional operations model to drive greater

competitiveness across all assets; and similar statements.

Forward-looking statements are based on Suncor’s current

expectations, estimates, projections and assumptions that were made

by the company in light of its information available at the time

the statement was made and consider Suncor’s experience and its

perception of historical trends, including expectations and

assumptions concerning: the accuracy of reserves estimates; the

current and potential adverse impacts of the COVID-19 pandemic,

including the status of the pandemic and future waves and any

associated policies around current business restrictions,

shelter-in-place orders or gatherings of individuals; commodity

prices and interest and foreign exchange rates; the performance of

assets and equipment; capital efficiencies and cost savings;

applicable laws and government policies; future production rates;

the sufficiency of budgeted capital expenditures in carrying out

planned activities; the availability and cost of labour, services

and infrastructure; the satisfaction by third parties of their

obligations to Suncor; the development and execution of projects;

and the receipt, in a timely manner, of regulatory and third-party

approvals. Some of the forward-looking statements may be identified

by words like “will”, “expected”, “estimated”, “anticipate”,

“believe” and similar expressions.Forward-looking statements are

not guarantees of future performance and involve a number of risks

and uncertainties, some that are similar to other oil and gas

companies and some that are unique to Suncor. Suncor’s actual

results may differ materially from those expressed or implied by

its forward-looking statements, so readers are cautioned not to

place undue reliance on them.

Suncor’s Annual Information Form and Annual Report to

Shareholders, each dated February 26, 2020, Form 40-F dated

February 27, 2020, Management’s Discussion and Analysis for the

third quarter of 2020 dated October 28, 2020 (the MD&A) and

other documents Suncor files from time to time with securities

regulatory authorities describe the risks, uncertainties, material

assumptions and other factors that could influence actual results

and such factors are incorporated herein by reference. Copies of

these documents are available without charge from Suncor at 150 6th

Avenue S.W., Calgary, Alberta T2P 3E3, by calling 1-800-558-9071,

or by email request to invest@suncor.com or by referring to the

company’s profile on SEDAR at sedar.com or EDGAR at sec.gov. Except

as required by applicable securities laws, Suncor disclaims any

intention or obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. NON-GAAP FINANCIAL

MEASURES

Syncrude cash operating costs is not prescribed by Canadian

generally accepted accounting principles (“GAAP”). This non-GAAP

financial measure is included because management uses the

information to analyze business performance, including on a per

barrel basis, as applicable, and it may be useful to investors on

the same basis. This non-GAAP financial measure does not have any

standardized meaning and, therefore, is unlikely to be comparable

to similar measures presented by other companies. This non-GAAP

financial measure should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

GAAP. This non-GAAP financial measure is defined and reconciled in

the Non-GAAP Financial Measures section of the MD&A.

Suncor Energy is Canada’s leading integrated energy company.

Suncor’s operations include oil sands development and upgrading,

offshore oil and gas production, petroleum refining, and product

marketing under the Petro-Canada brand. A member of Dow Jones

Sustainability indexes, FTSE4Good and CDP, Suncor is working to

responsibly develop petroleum resources while also growing a

renewable energy portfolio. Suncor is listed on the UN Global

Compact 100 stock index. Suncor's common shares (symbol: SU) are

listed on the Toronto and New York stock exchanges.

For more information about Suncor, visit our website at

suncor.com and follow us on Twitter @Suncor

Media inquiries: 1-833-296-4570 media@suncor.comInvestor

inquiries: 800-558-9071 invest@suncor.com

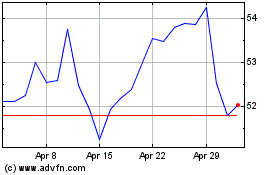

Suncor Energy (TSX:SU)

Historical Stock Chart

From Jan 2025 to Feb 2025

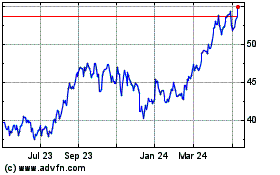

Suncor Energy (TSX:SU)

Historical Stock Chart

From Feb 2024 to Feb 2025