Storm Resources Ltd. ("Storm" or the "Company") is Pleased to Announce Its Financial and Operating Results For the Three and ...

18 August 2011 - 9:26AM

Marketwired Canada

Storm Resources Ltd. (TSX VENTURE:SRX)

Storm has also filed its unaudited condensed interim financial statements as at

June 30, 2011 and for the three and six months then ended along with the

Management's Discussion and Analysis ("MD&A") for the same period. This

information appears on SEDAR at www.sedar.com and on Storm's website at

www.stormresourcesltd.com.

Selected financial and operating information for the three and six months ended

June 30, 2011 appears below and should be read in conjunction with the related

financial statements and MD&A.

Consolidated Highlights

Three

Thousands of Cdn$, except volumetric and per Months to Six Months to

share amounts June 30, 2011 June 30, 2011

----------------------------------------------------------------------------

FINANCIAL

Gas sales 1,011 1,412

NGL sales 177 274

Oil sales 748 1,231

Royalty income - -

----------------------------------------------------------------------------

Production revenue 1,936 2,917

----------------------------------------------------------------------------

Funds from operations (1) 710 769

Per share - basic ($) 0.03 0.03

Per share - diluted ($) 0.03 0.03

Net income (loss) (562) (883)

Per share - basic ($) (0.02) (0.03)

Per share - diluted ($) (0.02) (0.03)

Capital expenditures, net of dispositions 2,012 11,714

Cash plus accounts receivable less accounts

payable 12,224 12,224

Weighted average common shares outstanding

(000s)

Basic 26,377 26,377

Diluted 26,377 26,377

Common shares outstanding (000s)

Basic 26,377 26,377

Fully diluted 28,391 28,391

----------------------------------------------------------------------------

----------------------------------------------------------------------------

OPERATIONS

Oil equivalent (6:1)

----------------------------------------------------------------------------

Barrels of oil equivalent (000s) 54 79

Barrels of oil equivalent per day 595 436

Average selling price (Cdn$ per Boe) 35.74 36.93

Royalties

Gas production

----------------------------------------------------------------------------

Thousand cubic feet (000s) 269 379

Thousand cubic feet per day 2,958 2,094

Average selling price (Cdn$ per Mcf) 3.76 3.72

NGL Production

----------------------------------------------------------------------------

Barrels (000s) 2 3

Barrels per day 22 18

Average selling price (Cdn$ per barrel) 86.53 85.50

Oil Production

----------------------------------------------------------------------------

Barrels (000s) 7 13

Barrels per day 80 69

Average selling price (Cdn$ per barrel) 103.20 97.85

Wells drilled

----------------------------------------------------------------------------

Gross - -

Net - -

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Funds from operations and funds from operations per share are non-GAAP

measurements. See discussion of Non-GAAP Measurements on page 5 of the

MD&A and the reconciliation of funds from operations to the most

directly comparable measurement under GAAP, "Cash Flows from Operating

Activities", on page 11 of the MD&A.

PRESIDENT'S MESSAGE

SECOND QUARTER 2011 HIGHLIGHTS

-- Production averaged 595 Boe per day for the quarter which represents

115% growth from first quarter production of 276 Boe per day. As Storm

Resources Ltd. ("Storm" or the "Company") commenced operations August

17, 2010, there is no prior year comparison.

-- Production performance of the first horizontal development wells in the

Montney at Umbach and in the Muskwa/Otter Park shales of the Horn River

Basin continue to meet expectations with declines moderating on both

horizontals throughout the quarter.

-- The first of four follow-up horizontals to be drilled at Umbach in the

second half of 2011 was cased in early July and completion with 10

fracture stimulations is under way. Drilling of the second horizontal

commenced in early August.

-- Operating netback was $25.98 per Boe and non-GAAP funds from operations

was $0.7 million in the second quarter.

-- Capital investment was $2.0 million with major expenditures being $0.7

million for land acquisition and $0.8 million for drilling.

-- At June 30, 2011, Storm's net funds available for investment (working

capital surplus excluding prepaids) were $12.2 million and the value of

Storm's investments in publicly listed companies totaled $9.6 million

(proceeds from the possible future sale of these securities may be used

to finance the Company's capital programs).

OPERATIONS REVIEW

Horn River Basin ("HRB"), North East British Columbia

Storm's undeveloped land position in the HRB totals 120 gross sections at a 40%

working interest (31,200 net acres) and is prospective for natural gas from the

Muskwa, Otter Park and Evie/Klua shales. This land position was acquired jointly

with Storm Gas Resource Corp. ("SGR") which owns the remaining 60% working

interest. Storm owns 2.5 million shares of SGR representing 22% equity

ownership, giving Storm exposure to 53% of the upside in the HRB when combined

with the 40% working interest in the undeveloped lands. In July 2011, SGR

announced a decision by its board of directors (the "Board") to enter into a

review of strategic alternatives in order to maximize shareholder value. The

process of reviewing strategic alternatives will be overseen by a special

committee comprised of the independent directors of the Board. SGR has not set a

definitive schedule to complete this review.

During the second quarter, production from this area averaged 350 Boe per day

net to Storm at an operating netback of $14.81 per Boe. The first horizontal

well (0.4 net) was completed with 12 fracture treatments, commenced production

March 7, 2011 at a rate of 6.5 Mmcf per day gross raw gas and averaged 5.8 Mmcf

per day gross raw gas in the second quarter. Current production is approximately

5.0 Mmcf per day gross raw gas, or 290 Boe per day sales net to Storm, after

accounting for 12% shrinkage. The rate is restricted by 2 3/8" tubing and high

gathering system pressures (tubing pressure 800 psig, casing pressure 1,280

psig) which has resulted in production declining at a relatively moderate

annualized rate of 35% since early May. A second horizontal well (40% working

interest) drilled in late 2010 may be completed in the fourth quarter of 2011

depending on natural gas prices and potential reserve additions from additional

undrilled horizontal locations that would be recognized with a successful

completion. At current natural gas prices, Storm expects that no royalties will

be paid on production from the first two horizontals in the next two years due

to their qualification under British Columbia's Deep Royalty Credit and

Infrastructure Royalty Credit Programs.

Storm's initial efforts in the HRB have been focused on the Muskwa and Otter

Park shales within a central project area consisting of 21 gross sections (8.4

net to Storm). Within this area, Storm management estimates that gross

Discovered Petroleum Initially in Place ("DPIIP")(1) is 2.0 to 2.2 TCF in the

Muskwa and Otter Park shales based on average net pay of 95 metres, porosity of

3.7% to 5.0%, gas saturation of 77% and an adsorbed gas content of 61 Scf/ton.

The parameters used in estimating DPIIP came from analysis of 3-D seismic data

and from vertical wells within the central project area including two wells

drilled, completed and tested by SGR/Storm plus log data from four additional

wells.

(1) Discovered Petroleum Initially in Place ("DPIIP") - is defined in the

Canadian Oil and Gas Evaluation Handbook ("COGEH") as the quantity of

hydrocarbons that are estimated to be in place within a known

accumulation. Original Gas in Place ("OGIP") is a more commonly used

industry term when referring to gas accumulations. DPIIP is divided into

recoverable and unrecoverable portions, with the estimated future

recoverable portion classified as reserves and contingent resources.

There is no certainty that it will be economically viable or technically

feasible to produce any portion of this DPIIP except for those portions

identified as proved or probable reserves.

Umbach, North East British Columbia

At Umbach Storm has 55,400 net undeveloped acres which are primarily prospective

in the Montney formation (101 gross sections, 72 net sections). Production

averaged 168 Boe per day in the second quarter and was reduced by a scheduled

maintenance turnaround at the McMahon Gas Plant which caused production to be

shut in for the final two weeks of the second quarter and the first two weeks of

the third quarter.

Storm's first horizontal well (0.6 net) was completed with seven 100-ton

fracture treatments, came on production March 6, 2011 at 5.0 Mmcf per day gross

raw gas, and second quarter production averaged 1.6 Mmcf per day gross raw gas

(shut in for last 2 weeks of the quarter). The second quarter operating netback

was $19.90 per Boe. Current production is approximately 1.6 Mmcf per day gross

raw gas or 170 Boe per day net sales to Storm after including shrinkage of

approximately 11% and natural gas liquids recovery of approximately 30 barrels

per Mmcf of sales. This horizontal qualified for a royalty initiative capping

the royalty rate at 2% for the first 12 months of production; however,

subsequent horizontals will not benefit from this initiative as it expired at

the end of 2010.

In the second half of 2011, Storm plans to drill four follow-up horizontal wells

(2.4 net) and another one to two vertical delineation wells (0.6 to 1.6 net).

The first of these horizontals was cased in early July and is currently being

completed with 10 fracture stimulations. Drilling operations commenced on the

next horizontal in early August. To try to improve productivity, horizontal

length is being increased and 10 to 12 fracture treatments are planned on all

future horizontals. The cost to drill, complete and tie in horizontals with 10

fracture treatments is forecast to be $4.5 million using a mechanical packer

system instead of the perf and plug system used on the first horizontal.

Initially, infrastructure costs are not expected to be significant given that

Storm can access existing facilities and pipelines which are connected to

Spectra's McMahon Gas Plant.

Storm is also pursuing a second lead in the Montney formation on additional

lands acquired to the south of the first horizontal well. In the first quarter,

two vertical wells (100% working interest) on these lands were completed in the

Montney formation with 100-ton fracture treatments. Final test rates on each

well were approximately 150 to 200 Mcf per day. These verticals are 5 miles

apart and confirm that the Montney is productive over a large area, however, the

test rates are indicative of lower reservoir quality. Areas likely to have

better reservoir quality have been identified from recently acquired 3-D seismic

and a vertical delineation well is being planned for the fourth quarter of 2011.

Storm management estimates that DPIIP in the Montney formation is approximately

15 to 30 Bcf of raw gas per section which is based on log analysis from a

limited number of vertical wells on Storm's lands plus core data from two

vertical wells in the area. Estimated DPIIP is based on net pay of 15 to 30

metres (using a 3% sandstone scale cut-off), average porosity of 7%, average gas

saturation of 83% and reservoir pressure of 15,300 kPa. Given that there is only

limited production history from the Montney formation in the immediate area,

well performance and recovery factors cannot be estimated at this time.

Red Earth, North Central Alberta

Production at Red Earth averaged 80 barrels of oil per day in the second quarter

from two Slave Point horizontal wells (0.4 net) which commenced production in

early February. The operating netback was $87.00 per barrel in the quarter with

both horizontals benefiting from a 5% royalty rate under Alberta's New Well

Royalty Rate program.

INVESTMENTS

Storm has share ownership positions in one private company and two publicly

traded companies. These shareholdings were transferred to Storm under the Plan

of Arrangement with ARC Energy Trust. The value of the share positions in the

two public companies totaled $9.6 million at the end of the second quarter and

these securities could possibly be sold in the future with the proceeds being

used to finance the Company's capital programs.

Storm Gas Resource Corp. SGR is a private company formed in June 2007 to pursue

unconventional gas opportunities in the HRB and elsewhere. Storm's share

ownership position totals 2.5 million shares, representing 22% ownership of SGR.

Currently, SGR's land position totals 81,400 net acres with 61,000 net acres in

the HRB. SGR's working capital available for investment was $8.5 million at the

end of the first quarter 2011. In July 2011, SGR commenced a review of strategic

alternatives.

Chinook Energy Inc. ("Chinook") Storm holds 4.5 million shares of Chinook which

is a TSX-listed oil and gas exploration and production company (symbol 'CKE')

based in Calgary with operations focused in Tunisia and Western Canada. Storm

Exploration Inc. had previously owned 4.5 million shares of Storm Ventures

International Inc. ("SVI"), a private company, which were converted into shares

of Chinook when SVI and Iteration Energy Ltd. completed a business combination

June 29, 2010.

Bridge Energy ASA ("Bridge") Storm holds 1.05 million common shares of Bridge

(symbol 'Bridge' on the Oslo Stock Exchange), a Norwegian-based exploration and

production company with production of approximately 1,500 Boe per day, several

development opportunities in the UK sector of the North Sea, and a number of

exploratory leads in the Norwegian sector of the North Sea. Bridge is the result

of a business combination completed in March 2010 whereby SVI's United Kingdom

North Sea assets were combined with a private Norwegian based company which

resulted in SVI receiving 28,776,000 common shares of Bridge that were

distributed to SVI shareholders.

OUTLOOK

Storm's 2011 guidance remains unchanged. A total of $24.0 million will be

invested with the majority being allocated towards drilling four horizontals

(2.4 net) and one to two vertical wells (0.6 to 1.6 net) at Umbach. Production

in the fourth quarter of 2011 is expected to average approximately 1,000 to

1,200 Boe per day (15% oil and NGLs). Operating costs are forecast to average

$7.25 per Boe with cash general and administrative costs totaling $2.7 million.

The corporate average royalty rate is estimated to be 10% which includes the

effect of royalty incentive programs in Alberta and British Columbia. The

current cash balance and cash flow is expected to be sufficient to fund planned

2011 capital expenditures.

Current production is approximately 525 Boe per day and third quarter production

is expected to average 500 to 550 Boe per day. Rain, resulting in very wet

ground conditions, delayed drilling and completion operations at Umbach which

will result in new well tie-ins occurring late in the third quarter.

Production performance of the first horizontal development wells in Storm's

resource plays at Umbach and the HRB has been very encouraging. The presentation

on Storm's website (www.stormresourcesltd.com) includes updated production

graphs for both horizontal wells. In the second half of 2011, we are planning to

follow up on our success in both areas and will also try to improve productivity

and associated reserves by increasing the number of fracture stimulations on

future horizontals. In the HRB, a second horizontal drilled late in 2010 may be

completed with 14 fracture treatments in the fourth quarter depending on natural

gas prices and potential reserve additions (the first horizontal was completed

with 12 fracture stimulations). At Umbach, we benefit from the recovery of

approximately 30 barrels of natural gas liquids per Mmcf sales and four

horizontals are planned for the second half of 2011. Productivity and the

associated rate of return should be improved by pumping 10 to 12 fracture

treatments on these horizontals as compared to seven fracture treatments on the

first horizontal.

Longer term, we remain optimistic that natural gas prices will eventually

improve. Cost inflation and poor rates of return at current natural gas prices

are expected to gradually reduce natural gas supply as capital is redirected

towards liquids rich opportunities where production rates tend to be lower and

initial declines steeper. In the near term, we will focus on resource

delineation as this is expected to provide a greater return on invested capital

than growing production and/or cash flow.

Storm has now been in business in its current form for 12 months. We have made

steady progress advancing both of our core resource plays, each with multi-year

development potential which provides a solid base for future growth. Generating

accretive, per-share growth remains a commitment for us and we appreciate the

support and patience of our shareholders.

Respectfully,

Brian Lavergne, President and Chief Executive Officer

August 17, 2011

Boe Presentation - For the purpose of calculating unit revenues and costs,

natural gas is converted to a barrel of oil equivalent ("Boe") using six

thousand cubic feet ("Mcf") of natural gas equal to one barrel of oil unless

otherwise stated. Boe may be misleading, particularly if used in isolation. A

Boe conversion ratio of six Mcf to one barrel ("Bbl") is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. All Boe measurements and

conversions in this report are derived by converting natural gas to oil in the

ratio of six thousand cubic feet of gas to one barrel of oil. Mboe means 1,000

Boe.

Forward-Looking Information - This press release contains forward-looking

statements and forward-looking information within the meaning of applicable

securities laws. The use of any of the words "will", "expects", "believe",

"plans", "potential" and similar expressions are intended to identify

forward-looking statements or information. More particularly, and without

limitation, this press release contains forward-looking statements and

information concerning: production; drilling plans; reserve volumes; capital

expenditures; royalties; and production and general and administrative costs.

The forward-looking statements and information in this press release are based

on certain key expectations and assumptions made by Storm, including: prevailing

commodity prices and exchange rates; applicable royalty rates and tax laws;

future well production rates; reserve and resource volumes; the performance of

existing wells; success to be expected in drilling new wells; the adequacy of

budgeted capital expenditures to carrying out planned activities; the

availability and cost of services; and the receipt, in a timely manner, of

regulatory and other required approvals. Although the Company believes that the

expectations and assumptions on which such forward-looking statements and

information are based are reasonable, undue reliance should not be placed on

these forward-looking statements and information because of their inherent

uncertainty. In particular, there is no assurance that exploitation of the

Company's undeveloped lands and prospects will result in the emergence of

profitable operations.

Since forward-looking statements and information address future events and

conditions, by their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently anticipated due to a

number of factors and risks. These include, but are not limited to the risks

associated with the oil and gas industry in general such as: operational risks

in development, exploration and production; delays or changes in plans with

respect to exploration or development projects or capital expenditures; the

uncertainty of reserve estimates; the uncertainty of estimates and projections

relating to reserves, production, costs and expenses; health, safety and

environmental risks; commodity price and exchange rate fluctuations; marketing

and transportation of petroleum and natural gas and loss of markets;

environmental risks; competition; ability to access sufficient capital from

internal and external sources; stock market volatility; and changes in

legislation, including but not limited to tax laws, royalty rates and

environmental regulations.

Readers are cautioned that the foregoing list of factors is not exhaustive.

Additional information on these and other factors that could affect the

operations or financial results of the Company are included or are incorporated

by reference in the company's MD&A for the three and six months ended June 30,

2011.

The forward-looking statements and information contained in this press release

are made as of the date hereof and the Company undertakes no obligation to

update publicly or revise any forward-looking statements or information, whether

as a result of new information, future events or otherwise, unless so required

by applicable securities laws.

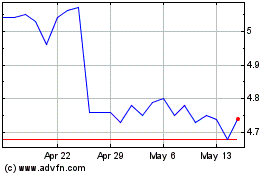

StorageVault Canada (TSX:SVI)

Historical Stock Chart

From Oct 2024 to Nov 2024

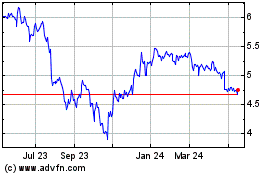

StorageVault Canada (TSX:SVI)

Historical Stock Chart

From Nov 2023 to Nov 2024