Supremex Inc. (“Supremex” or the “Company”) (TSX: SXP), a

leading North American manufacturer and marketer of envelopes and a

growing provider of paper-based packaging solutions, today

announced its results for the second quarter ended June 30, 2023.

The Company will hold a conference call to discuss these results,

today at 10:00 a.m. (Eastern Time).

Second Quarter Financial Highlights and

Recent Events

- Total revenue increased by 14.6% to $71.7 million, from $62.5

million in the second quarter of 2022.

- Envelope segment revenue up 7.3% to $49.3 million, from $45.9

million in the prior year.

- Packaging and specialty products segment revenue of $22.4

million, up 34.7% from $16.6 million last year.

- Net earnings were $2.1 million, compared to $7.4 million last

year.

- Earnings per share of $0.08, versus $0.28 a year ago.

- Adjusted EBITDA1 of $9.6 million, or 13.3% of revenue, versus

$13.9 million, or 22.3% of revenue, a year ago.

- Acquisition on May 8, 2023 of Graf-Pak Inc. (“Graf-Pak”), a

provider of folding carton packaging solutions located in the

province of Quebec.

- Appointment of François Bolduc as Chief Financial Officer of

the Company, effective July 4, 2023.

- On August 9, 2023, the Board of Directors declared a quarterly

dividend of $0.035 per common share, payable on September 22, 2023

to shareholders of record at the close of business on September 7,

2023.

Financial Highlights (in

thousands of dollars, except for per share amounts and margins)

|

|

Three-month periodsended

June 30 |

Six-month periodsended June

30 |

|

2023 |

2022 |

2023 |

2022 |

|

Statements of Earnings |

|

Revenue |

71,666 |

62,518 |

160,088 |

125,787 |

|

Operating earnings |

4,471 |

10,314 |

18,842 |

19,143 |

|

Adjusted EBITDA(1) |

9,562 |

13,914 |

28,403 |

25,997 |

|

Adjusted EBITDA margin(1) |

13.3% |

22.3% |

17.7% |

20.7% |

|

Net earnings |

2,113 |

7,364 |

11,609 |

13,666 |

|

Basic and diluted net earnings per share |

0.08 |

0.28 |

0.45 |

0.52 |

|

Adjusted net earnings(1) |

2,270 |

7,364 |

12,050 |

13,675 |

|

Adjusted net earnings per share(1) |

0.09 |

0.28 |

0.46 |

0.52 |

|

Cash Flow |

|

|

|

|

|

Net cash flows related to operating activities |

10,006 |

10,426 |

17,547 |

10,637 |

|

Free cash flow(1) |

9,808 |

10,235 |

13,211 |

10,131 |

(1) Non-IFRS financial measures or ratios.

Non-IFRS financial measures do not have standardized meanings

prescribed by IFRS and therefore may not be comparable to similar

measures presented by other entities. Refer to the non-IFRS

financial measures section for definitions and reconciliations.

“Our second quarter results reflect the

temporary effect of inventory adjustments by certain customers and

lower demand from sectors more affected by inflation and interest

rate levels,” said Stewart Emerson, President & CEO of

Supremex. “The first half of 2023 was a very busy period,

especially for our Packaging operations, as we consolidated a

significant portion of our folding carton activities under one roof

in Lachine while also integrating two acquisitions. Our Envelope

business continued to generate a solid free cash flow which allowed

us to fund our expansion and reduce debt by $3.1 million this past

quarter.”

“Although disappointed with the transitory

profitability reduction in Packaging, we are excited with the

significant potential of the Lachine facility. Its considerable

footprint will enable us to further expand folding carton

production to better meet additional demand from this growing

market. In this regard, the Graf-Pak operations have been

successfully merged into Lachine and we continue to assess

initiatives to further optimize efficiency and achieve synergies by

leveraging available capacity,” concluded Mr. Emerson.

Summary of three-month period ended June

30, 2023

Revenue

Total revenue for the three-month period ended

June 30, 2023, was $71.7 million, representing an increase of

$9.2 million, or 14.6%, from the equivalent quarter of 2022

essentially reflecting the acquisitions of Royal Envelope

Corporation (“Royal Envelope”), Impression Paragraph Inc.

(“Paragraph”) and Graf-Pak.

Envelope Segment

Revenue was $49.3 million, representing an

increase of $3.4 million, or 7.3%, from $45.9 million in the second

quarter of 2022. The increase reflects a $9.1 million contribution

from the Royal Envelope acquisition, an average selling price

increase of 33.6% from last year’s second quarter primarily

reflecting a more favourable customer and product mix in U.S.

operations and price increases implemented throughout 2022 to

mitigate input cost inflation, as well as a favourable currency

conversion effect. These factors were partially offset by a lower

volume of units sold following last year’s over-ordering in a time

of tight supply, and macro-economic effects of rising interest

rates and higher inflation. The Envelope segment represented 68.7%

of the Company’s revenue in the quarter, compared with 73.4% during

the equivalent period of last year.

Packaging & Specialty Products Segment

Revenue was $22.4 million, up 34.7% from $16.6

million for the corresponding quarter of 2022. The increase is

attributable to a $7.8 million contribution from the Paragraph

acquisition, while the activities of Graf-Pak have been integrated

into the pre-existing operations of the Company, and higher demand

for e-commerce packaging solutions. These factors were partially

offset by the wind down of the Durabox operations in 2022, lower

demand from certain sectors more closely correlated to economic

conditions and the residual effect on sales from the inefficiencies

from consolidating the folding carton operations in Lachine

concurrently with integrating acquisitions. Packaging &

Specialty Products represented 31.3% of the Company’s revenue in

the quarter, up from 26.6% during the equivalent period of last

year.

EBITDA2 and Adjusted

EBITDA2

EBITDA was $9.4 million, down from $13.9 million

in the second quarter of 2022. Adjusted EBITDA amounted to $9.6

million, compared to $13.9 million for the same period last year.

The decrease reflects higher operating and selling, general and

administrative expenses. The Adjusted EBITDA margin was 13.3% of

revenue, compared to 22.3% in the equivalent quarter of 2022.

Envelope Segment

Adjusted EBITDA was $9.7 million, compared to

$11.6 million in the second quarter of 2022. This decrease

mainly reflects a lower volume of units sold following last year’s

over-ordering in a time of tight supply which negatively impacted

the absorption of fixed costs. On a percentage of segmented

revenue, Adjusted EBITDA from the envelope segment was 19.6%,

compared with 25.3% in the equivalent period of 2022.

Packaging & Specialty Products Segment

Adjusted EBITDA was $1.7 million, versus $3.3

million in the second quarter of 2022. This decrease is mainly

explained by lower demand from certain sectors more closely

correlated to economic conditions, which negatively impacted the

absorption of fixed costs and by the residual effect on

profitability of inefficiencies from consolidating the folding

carton operations in Lachine concurrently with integrating business

acquisitions. On a percentage of segmented revenue, Adjusted EBITDA

from the packaging and specialty operations was 7.4%, compared to

19.6% in the equivalent period of 2022.

Corporate and unallocated costs

The Corporate and unallocated costs were $1.8

million in the second quarter of 2023, compared to $0.9 million in

the second quarter of 2022. The increase is essentially

attributable to a foreign exchange loss and, to a lesser extent, an

unfavourable adjustment related to the DSUs and PSUs during the

quarter.

Net Earnings, Adjusted Net Earnings, Net

Earnings per share and Adjusted Net Earnings per

share3

Net earnings were $2.1 million or $0.08 per

share for the three-month period ended June 30, 2023, compared to

$7.4 million or $0.28 per share for the equivalent period last

year.

Adjusted net earnings were $2.3 million or $0.09

per share for the three-month period ended June 30, 2023, compared

to $7.4 million or $0.28 per share for the equivalent period last

year.

Summary of six-month period ended June

30, 2023

Revenue

Total revenue for the six-month period ended

June 30, 2023, was $160.1 million, representing an increase of

$34.3 million, or 27.3%, from the equivalent period of 2022

essentially reflecting the acquisitions of Royal Envelope,

Paragraph and Graf-Pak.

Envelope Segment

Revenue was $113.7 million, representing an

increase of $23.2 million, or 25.6%, from $90.5 million in the

six-month period ended June 30, 2022. The increase is attributable

to a $21.1 million contribution from Royal Envelope, an average

selling price increase of 36.6% from last year primarily reflecting

a more favourable customer and product mix in U.S. operations and

price increases implemented throughout 2022 to mitigate input cost

inflation, as well as a favourable currency conversion effect.

These factors were partially offset by the volume reduction in the

second quarter. Envelope represented 71.0% of the Company’s revenue

in the period, versus 72.0% during the equivalent period of last

year.

Packaging & Specialty Products Segment

Revenue was $46.4 million, up 31.5%, from $35.3

million in the corresponding period of 2022. The increase reflects

a $15.6 million contribution from the Paragraph acquisition and

higher demand for e-commerce packaging solutions. These factors

were partially offset by the wind down of the Durabox operations in

2022, lower demand from certain sectors more closely correlated to

economic conditions and the residual effect on sales from the

inefficiencies from consolidating the folding carton operations in

Lachine concurrently with integrating acquisitions. Packaging &

Specialty Products represented 29.0% of the Company’s revenue in

the first half of 2023, compared with 28.0% during the equivalent

period of last year.

EBITDA4

and Adjusted EBITDA4

EBITDA was $27.8 million, up from $26.0 million

in the first six months of 2022. Adjusted EBITDA was

$28.4 million, up from $26.0 million for the same period a

year ago. This increase reflects higher total revenue, partially

offset by the higher material and labour costs as well as higher

selling, general and administrative expenses. The Adjusted EBITDA

margin reached 17.7% in the first half of 2023, versus 20.7% in the

first half of 2022.

Envelope Segment

Adjusted EBITDA was $26.9 million, up from $21.6

million in the first half of 2022. This increase was primarily due

to higher revenue, driven by an increase in the average selling

price and a more favorable product mix in U.S. operations,

partially offset by the effect of lower volume on the absorption of

fixed costs. On a percentage of segmented revenue, Adjusted EBITDA

from the envelope segment was 23.7%, compared to 23.8% in the

equivalent period of 2022.

Packaging & Specialty Products Segment

Adjusted EBITDA was $5.5 million, compared to

$7.4 million in the first half of 2022. This decrease mostly

reflects lower demand from certain sectors more closely correlated

to economic conditions which impacted the absorption of fixed costs

and the residual effect on profitability of inefficiencies from

consolidating the folding carton operations in Lachine concurrently

with integrating acquisitions. On a percentage of segmented

revenue, Adjusted EBITDA from the packaging and specialty

operations was 11.9%, compared to 21.1% in the equivalent period of

2022.

Corporate and unallocated costs

The Corporate and unallocated costs were $4.0

million compared to $3.0 million in the first half of 2022. The

increase resulted mainly from a foreign exchange loss and

severances.

Net Earnings, Adjusted Net Earnings, Net

Earnings per share and Adjusted Net Earnings per

share4

Net earnings were $11.6 million or $0.45 per

share for the six-month period ended June 30, 2023, compared to

$13.7 million or $0.52 per share for the equivalent period last

year.

Adjusted net earnings amounted to $12.1 million

or $0.46 per share for the six-month period ended June 30, 2023,

compared to $13.7 million or $0.52 per share for the equivalent

period in 2022.

Liquidity and Capital

Resources

Cash Flow

Net cash flows from operating activities were

$10.0 million for the three-month period ended June 30, 2023,

compared to $10.4 million for the same period in 2022. The slight

decrease is attributable to lower profitability mostly offset by

lower working capital requirements this quarter compared to the

equivalent period of 2022.

For the six-month period ended June 30, 2023,

net cash flows from operating activities reached $17.5 million,

compared to $10.6 million in the equivalent period of 2022. The

increase is mainly attributable to lower working capital

requirement partially offset by lower profitability.

Free cash flow4 amounted to $9.8 million in the

second quarter of 2023 compared to $10.2 million for the same

period last year. The slight decrease mirrors a similar reduction

in cash flow from operations.

Free cash flow4 amounted to $13.2 million in the

six-month period ended June 30, 2023 compared to $10.1 million in

the corresponding period of 2022. The increase is mainly

attributable to higher cash flow from operations, partially offset

by higher acquisitions of property, plant and equipment.

Normal Course Issuer Bid

(“NCIB”)

During the three and six-month periods ended

June 30, 2023, the Company repurchased 56,700 common shares for

cancellation under its NCIB program for a total consideration of

$0.3 million.

Subject to the approval of the TSX, the Company

intends to renew its NCIB which expires on August 30, 2023.

Debt and Leverage

The Company’s total debt increased to $78.2

million as at June 30, 2023, compared to $54.7 million as at

December 31, 2022. The increase is essentially attributable to the

acquisitions of Paragraph and Graf-Pak for considerations of $25.7

million and $6.0 million, respectively, net of cash acquired,

partially offset by debt repayment resulting from a solid free cash

flow generation.

Dividend Declaration

On August 9, 2023, the Board of Directors

declared a quarterly dividend of $0.035 per common share, payable

on September 22, 2023, to the shareholders of record at the close

of business on September 7, 2023. This dividend is designated as an

“eligible” dividend for the purpose of the Income Tax Act (Canada)

and any similar provincial legislation.

Outlook

Since the beginning of 2023, new order intake

has slowed appreciably as customers work through excess inventory

built via over-ordering in a time of tight supply in 2022 and

macro-economic conditions including rising interest rates and high

inflation, which has adversely affected discretionary spending. The

Company expects these conditions to affect its operations in the

third quarter and potentially into the fourth quarter. Supremex

will rely on its solid reputation and geographic reach to assist in

mitigating a slowdown while continuing to tightly control

expenses.

The Company will continue to focus on

integrating the Royal Envelope Corporation, Impression Paragraph

Inc. and Graf-Pak business acquisitions, while actively seeking to

capture all sales and cost synergies. As planned, Graf-Pak’s

operations have been merged into the Lachine facility and the

Company continues to assess optimization initiatives to leverage

Lachine’s larger capacity.

With respect to capital deployment for 2023, the

Company will continue to look for strategic acquisitions, mainly in

the Packaging and specialty products segment, while sustaining

capital returns to shareholders.

August 10, 2023 - Second Quarter Results

Conference Call:

A conference call to discuss the Company’s

results for the second quarter ended June 30, 2023 will be held

Thursday, August 10, 2023 at 10:00 a.m. (Eastern Time).

A live broadcast of the Conference Call will be

available on the Company’s website, in the Investors section under

Webcast.

To participate (professional investment

community only) or to listen to the live conference call, please

dial the following numbers. We suggest that participants call-in at

least 5 minutes prior to the scheduled start time:

|

⋅ Confirmation Number: |

10022126 |

| ⋅

Local (Vancouver) and international participants, dial: |

604-638-5340 |

| ⋅

North-American participants, dial toll-free: |

1-800-319-4610 |

|

|

|

A replay of the conference call will be

available on the Company’s website in the Investors section under

Webcast. To listen to a recording of the conference call, please

call toll-free 1-855-669-9658 or 604-674-8052 and enter

the code 0277. The recording will be available until Thursday,

August 17, 2023.

Non-IFRS Financial Measures

Non-IFRS financial measures do not have any

standardized meaning prescribed by IFRS and therefore may not be

comparable to similar measures presented by other companies and

should not be viewed as alternatives to measures of financial

performance prepared in accordance with IFRS. Management considers

these metrics to be information which may assist investors in

evaluating the Company’s profitability and enable better

comparability of the results from one period to another.

These Non-IFRS Financial Measures are defined as

follows:

|

Non-IFRS Measure |

Definition |

|

EBITDA |

EBITDA represents earnings before net financing charges, income tax

expense, depreciation of property, plant and equipment and

right-of-use assets and amortization of intangible assets. The

Company uses EBITDA to assess its performance. Management believes

this non-IFRS measure, provides users with an enhanced

understanding of its operating earnings. |

|

Adjusted EBITDA |

Adjusted EBITDA represents EBITDA adjusted to remove items of

significance that are not in the normal course of operations. These

items of significance include, when applicable, but are not limited

to, charges for impairment of assets, restructuring expenses, value

adjustment on inventory acquired and business acquisition costs.

The Company uses Adjusted EBITDA to assess its operating

performance, excluding items that are not in the normal course of

operations. Management believes this non-IFRS measure, provides

users with enhanced understanding of the Company’s operating

earnings and increase the transparency and clarity of the Company’s

core results. It also allows users to better evaluate the Company’s

operating profitability when compared to previous years. |

|

Adjusted EBITDA margin |

Adjusted EBITDA margin is a percentage corresponding to the ratio

of Adjusted EBITDA divided by revenue. The Company uses Adjusted

EBITDA margin for purpose of evaluating business performance,

excluding items that are not in the normal course of operations.

Management believes this non-IFRS measure, provides users with

enhanced understanding of its results and related trends. |

|

Adjusted net earnings |

Adjusted net earnings represents net earnings excluding items of

significance listed above under Adjusted EBITDA, net of income

taxes. The Company uses Adjusted net earnings to assess its

business performance and profitability without the effect of items

that are not in the normal course of operations, net of income

taxes. Management believes this non-IFRS measure, provides users

with an alternative assessment of the Company’s earnings without

the effect of items that are not it the normal course of operations

making it valuable to assess ongoing operations and trends in the

business performance. Management also believes this non-IFRS

measure provides users with enhanced understanding of the Company’s

results and provides better comparability between periods. |

|

Adjusted net earnings per share |

Adjusted net earnings per share represents Adjusted net earnings

divided by the weighted average number of common shares outstanding

for the relevant period. The Company uses Adjusted net earnings per

share for purposes of evaluating performance and profitability,

excluding items that are not in the normal course of operations of

the Company, net of income taxes, on a per share basis. |

|

Free cash flow |

This measure corresponds to net cash flows related to operating

activities according to the consolidated statements of cash flows

less additions (net of disposals) to property, plant and equipment

and intangible assets. Management considers Free cash flow to be a

good indicator of the Company’s financial strength and operating

performance because it shows the amount of funds available to

manage growth, repay debt and reinvest in the Company. Management

considers this measure useful to provide investors with a

perspective on its ability to generate liquidity, after making

capital investments required to support business operations and

long-term value creation. |

The following tables provide the reconciliation of

Non-IFRS Financial Measures:

Reconciliation of Net earnings to Adjusted

EBITDA (in thousands of dollars, except for margins)

|

|

Three-month periodsended

June 30 |

Six-month periodsended June

30 |

|

2023 |

2022 |

2023 |

2022 |

|

Net earnings |

2,113 |

7,364 |

11,609 |

13,666 |

|

Income tax expense |

850 |

2,458 |

4,255 |

4,542 |

|

Net financing charges |

1,508 |

492 |

2,978 |

935 |

|

Depreciation of property, plant and equipment |

1,722 |

1,640 |

3,269 |

2,890 |

|

Depreciation of right-of-use assets |

1,380 |

1,091 |

2,726 |

2,175 |

|

Amortization of intangible assets |

1,777 |

869 |

2,970 |

1,777 |

|

EBITDA |

9,350 |

13,914 |

27,807 |

25,985 |

|

Acquisition costs related to business combinations |

72 |

— |

263 |

12 |

|

Restructuring expenses |

129 |

— |

255 |

— |

|

Value adjustment on acquired inventory through a business

combination |

11 |

— |

78 |

— |

|

Adjusted EBITDA |

9,562 |

13,914 |

28,403 |

25,997 |

|

Adjusted EBITDA margin (%) |

13.3% |

22.3% |

17.7% |

20.7% |

| |

|

|

|

|

Reconciliation of Net earnings to Adjusted

net earnings and of Net earnings per share to Adjusted net earnings

per share (in thousands of dollars, except for per share

amounts)

|

|

Three-month periodsended

June 30 |

Six-month periodsended June

30 |

|

2023 |

2022 |

2023 |

2022 |

|

Net earnings |

2,113 |

7,364 |

11,609 |

13,666 |

|

Adjustments, net of income taxes |

|

|

|

|

|

Acquisition costs related to business combinations |

53 |

— |

194 |

9 |

|

Restructuring expenses |

95 |

— |

188 |

— |

|

Value adjustment on acquired inventory through a business

combination |

9 |

— |

59 |

— |

|

Adjusted net earnings |

2,270 |

7,364 |

12,050 |

13,675 |

|

|

|

Net earnings per share |

0.08 |

0.28 |

0.45 |

0.52 |

|

Adjustments, net of income taxes, per share |

0.01 |

— |

0.01 |

— |

|

Adjusted net earnings per share |

0.09 |

0.28 |

0.46 |

0.52 |

|

|

Reconciliation of Cash flows related to

operating activities to Free cash flow (in thousands of

dollars)

|

|

Three-month periods ended

June 30 |

Six-month periods ended June

30 |

|

2023 |

2022 |

2023 |

2022 |

|

Cash flows related to operating activities |

10,006 |

10,426 |

17,547 |

10,637 |

|

Acquisitions (net of disposals) of property, plant and

equipment |

(164) |

(175) |

(4,297) |

(381) |

|

Acquisitions of intangible assets |

(34) |

(16) |

(39) |

(125) |

|

Free cash flow |

9,808 |

10,235 |

13,211 |

10,131 |

| |

|

|

|

|

Forward-Looking Information

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

laws, including (but not limited to) statements about the EBITDA,

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net earnings,

Adjusted net earnings per share, free cash flow5, capital

expenditures, dividend payments and future performance of Supremex

and similar statements or information concerning anticipated future

results, circumstances, performance or expectations.

Forward-looking information may include words such as anticipate,

assumption, believe, could, expect, goal, guidance, intend, may,

objective, outlook, plan, seek, should, strive, target and will.

Such information relates to future events or future performance and

reflects current assumptions, expectations and estimates of

management regarding growth, results of operations, performance,

business prospects and opportunities, Canadian economic environment

and ability to attract and retain customers. Such forward-looking

information reflects current assumptions, expectations and

estimates of management and is based on information currently

available to Supremex as at the date of this press release. Such

assumptions, expectations and estimates are discussed throughout

the MD&A for the year ended December 31, 2022. Supremex

cautions that such assumptions may not materialize and that

economic conditions such as heightened inflation and central banks’

large interest rate hikes, economic downturns or recessions, may

render such assumptions, although believed reasonable at the time

they were made, subject to greater uncertainty.

Forward-looking information is subject to

certain risks and uncertainties and should not be read as a

guarantee of future performance or results and actual results may

differ materially from the conclusion, forecast or projection

stated in such forward-looking information. These risks and

uncertainties include but are not limited to the following: decline

in envelope consumption, growth and diversification strategy, key

personnel, labour shortage, contributions to employee benefits

plans, cyber security and data protection, raw material price

increases, operational disruption, dependence on and loss of

customer relationships, increase of competition, economic cycles,

exchange rate fluctuation, interest rate fluctuation, credit risks

with respect to trade receivables, availability of capital,

concerns about protection of the environment, potential risk of

litigation, no guarantee to pay dividends and other external risks

such as global health crisis and pandemic and inflation. Such risks

and uncertainties are discussed throughout the MD&A for the

year ended December 31, 2022, and in particular, in ‘’Risk

Factors’’. Consequently, the Company cannot guarantee that any

forward-looking information will materialize. Readers should not

place any undue reliance on such forward-looking information unless

otherwise required by applicable securities legislation. The

Company expressly disclaims any intention and assumes no obligation

to update or revise any forward-looking information, whether as a

result of new information, future events or otherwise.

The Management Discussion and Analysis and

Financial Statements can be found on www.sedar.com and on Supremex’

website.

About Supremex

Supremex is a leading North American

manufacturer and marketer of envelopes and a growing provider of

paper-based packaging solutions. Supremex operates eleven

manufacturing facilities across four provinces in Canada and six

manufacturing facilities in four states in the United States

employing over 1,000 people. Supremex’ growing footprint allows it

to efficiently manufacture and distribute envelope and packaging

solutions designed to the specifications of major national and

multinational corporations, direct mailers, resellers, government

entities, SMEs and solutions providers.

For more information, please visit

www.supremex.com.

| Contact: |

|

| Stewart Emerson |

Martin Goulet, M.Sc., CFA |

| President & CEO |

MBC Capital Markets Advisors |

| investors@supremex.com |

mgoulet@maisonbrison.com |

| 514 595-0555, extension 2316 |

514 731-0000, extension 229 |

| |

|

1 Non-IFRS financial measures or ratios. Refer to the

non-IFRS financial measures section for definitions and

reconciliations.2 Non-IFRS financial measures or ratios. Refer

to the non-IFRS financial measures section for definitions and

reconciliations.3 Non-IFRS financial measures or ratios. Refer

to the non-IFRS financial measures section for definitions and

reconciliations.4 Non-IFRS financial measures or ratios. Refer

to the non-IFRS financial measures section for definitions and

reconciliations.5 Non-IFRS financial measures or ratios. Refer to

the non-IFRS financial measures section for definitions and

reconciliations.

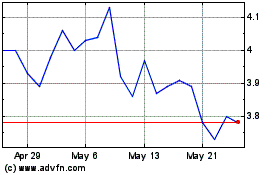

Supremex (TSX:SXP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Supremex (TSX:SXP)

Historical Stock Chart

From Dec 2023 to Dec 2024