Theratechnologies Inc. (“Theratechnologies” or the “Company”) (TSX:

TH) (NASDAQ: THTX), a biopharmaceutical company focused on the

development and commercialization of innovative therapies, today

reported business highlights and financial results for the second

quarter of fiscal year 2024 ended May 31, 2024 (Q2 2024). All

figures are in US dollars unless otherwise stated.

Revenue for Q2 2024 and First Half

Fiscal 2024 (in thousands of dollars)

|

|

Three monthsended May 31 |

% change |

Six months ended May 31 |

% change |

|

|

2024 |

2023 |

|

2024 |

2023 |

|

|

EGRIFTA SV® net sales |

16,200 |

10,853 |

49.3% |

25,786 |

23,564 |

9.4% |

|

Trogarzo® net sales |

5,817 |

6,696 |

(13.1%) |

12,478 |

13,893 |

(10.2%) |

|

Revenue |

22,017 |

17,549 |

25.5% |

38,264 |

37,457 |

2.2% |

“I am pleased to wrap up this very strong second

quarter with $22 million in revenue, $1 million in net income and

$5.5 million in Adjusted EBITDA,” said Paul Lévesque, President and

Chief Executive Officer at Theratechnologies. “At this halfway mark

of our fiscal year, we can reaffirm our full year 2024 guidance of

revenues between $87 and $90 million and an Adjusted EBITDA in the

range of $13 to $15 million. EGRIFTA SV® remains our priority

brand, with key performance metrics showing consistent growth and

continued strong gross margins. Moving forward we expect sales to

align with patient demand, now that inventory levels have returned

to normal. We continue to demonstrate strength on the bottom-line

with our fourth straight quarter of near-flat-to-positive Adjusted

EBITDA. In fact, for the first time in the Company’s recent

history, we recorded a positive net income marking the beginning of

a new and profitable journey for Theratechnologies.

“Regarding our pipeline, we are still addressing

questions from the FDA on the tesamorelin F8 sBLA following our

Type A meeting earlier this year. The FDA has confirmed a

four-month review. In oncology, we continue to be focused on

generating results from Part 3 of our Phase 1 clinical trial of

sudocetaxel zendusortide in advanced ovarian cancer. I am pleased

to confirm that we have fully recruited for the second cohort of

the study, with six patients already having completed the first

treatment cycle at the higher dose of 2.5 mg/kg and evaluable for

safety. In parallel, we have advanced three additional peptide-drug

conjugates (PDCs) using the same payloads as antibody-drug

conjugate (ADC) technology, such as exatecan. We continue to engage

with interested parties to further fund the development of our lead

PDC candidate and SORT1+ TechnologyTM platform.”

Recent Highlights:

Reorganization of Preclinical Oncology

Research Activities

On March 22, 2024, the Company announced that it

would phase down its preclinical oncology research activities while

continuing to conduct its ongoing Phase 1 clinical trial of

sudocetaxel zendusortide in patients with advanced ovarian cancer.

The phasing down of preclinical research activities is aligned with

the Company’s business strategy to focus on its commercial business

and generating positive Adjusted EBITDA and positive net income. As

a result, for the three and six-month periods ended May 31, 2024,

$336,000 was recorded in charges related to severance and other

expenses and a charge of approximately $200,000 is expected to be

recorded in the second half of 2024. In addition, the Company

recorded in the three and six-month periods ended May 31, 2024,

$766,000 in accelerated depreciation on equipment in research and

development expenses.

Sudocetaxel Zendusortide Presentation at

ASCO 2024 Demonstrates Signs of Long-Term Efficacy and Manageable

Safety Profile in Patients with Solid Tumors

At the 2024 American Society of Clinical

Oncology (ASCO) annual meeting, the Company presented Phase 1 data

from Parts 1 and 2 of the clinical trial with its lead

investigational PDC candidate sudocetaxel zendusortide

demonstrating signs of long-term efficacy and a manageable safety

profile in patients with solid tumors.

Study results suggest a unique, multimodal

mechanism of action for sudocetaxel zendusortide that are distinct

from other cancer therapeutics, including induction of immune cell

infiltration even in “cold” tumor models, inhibition of

vasculogenic mimicry, targeting of chemotherapy-resistant cancer

stem cells, and activation of the cGAS/STING immune pathway.

Additionally, investigators observed an early efficacy signal

primarily in female cancers (ovarian cancer, endometrial cancer,

triple-negative breast cancer [TNBC]), with seven of 16

participants (44%) achieving a clinical benefit (complete response

+ partial response + stable disease), as confirmed via Response

Evaluation Criteria in Solid Tumors (RECIST) version 1.1.

Theratechnologies Reports on its Annual Meeting of

Shareholders

At its annual meeting of shareholders held on

May 9, 2024, shareholders proceeded to elect its candidates to the

Company’s Board of Directors for a one-year term and appointed KPMG

LLP as the Company’s auditors for the current fiscal year. All

candidates proposed for the position of director were elected,

including recently appointed Directors Elina Tea and Jordan Zwick.

Frank Holler will now act as Chairman of the Board of

Directors.

Fiscal 2024 Revenue and Adjusted EBITDA

Guidance

The Company’s anticipated Fiscal 2024 revenue

guidance range is confirmed between $87 million and $90 million, or

growth of the commercial portfolio in the range of 6.4% and 10.0%,

as compared to the 2023 fiscal year results. Theratechnologies

anticipates Adjusted EBITDA, a non-IFRS measure, to be between $13

and $15 million for Fiscal 2024.

Second Quarter Fiscal 2024 Financial

Results

The financial results presented in this press

release are taken from the Company’s Management's Discussion and

Analysis (“MD&A”) and interim consolidated financial statements

(“Interim Financial Statements”) for the three- and six month

periods ended May 31, 2024 (“Second Quarter Fiscal 2024”) which

have been prepared in accordance with International Accounting

Standard (“IAS”) 34, Interim Financial Reporting of International

Financial Reporting Standards (“IFRS”) as issued by the

International Accounting Standards Board (“IASB”). The MD&A and

the Interim Financial Statements can be found at www.sedarplus.ca,

on EDGAR at www.sec.gov and at www.theratech.com. Unless specified

otherwise, all capitalized terms have the meaning ascribed thereto

in our MD&A.

Second Quarter Fiscal 2024 Financial

Results

For the three- and

six-month periods ended May 31, 2024, consolidated revenue was

$22,017,000 and $38,264,000, compared to $17,549,000 and

$37,457,000 for the same periods ended May 31, 2023, representing

year-over-year increases of 25.5% for the second quarter and 2.2%

for the first half of the Fiscal 2024.

For the second quarter

of Fiscal 2024, net sales of EGRIFTA SV® were $16,200,000 compared

to $10,853,000 in the second quarter of fiscal 2023, representing

an increase of 49.3% year-over-year. Stronger sales of

EGRIFTA SV® in the second quarter were mostly the result of strong

demand for the product, combined with weaker than usual sales in Q2

of last year stemming from drawdowns in inventory early in the

second quarter of 2023. Net sales for the six-month period ended

May 31, 2024, which amounted to $25,786,000 compared to $23,564,000

in the same period in 2023, representing growth of 9.4%.

Trogarzo® net sales in

the second quarter of Fiscal 2024 amounted to $5,817,000 compared

to $6,696,000 for the same quarter of 2023, representing a decrease

of 13.1% year-over-year. Lower sales of Trogarzo® were mostly

due to competitive pressures in the multi-drug resistant segment of

the HIV-1 market, where Trogarzo remains an important part of the

treatment arsenal but has lost market share to market leaders in

the segment.

For the six-month

period ended May 31, 2024, Trogarzo® net sales were $12,478,000

compared to $13,893,000 in the same period in 2023.

Cost of Sales

For the three- and

six-months ended May 31, 2024, cost of sales was $4,547,000 and

$9,831,000 compared to $4,909,000 and $9,602,000 for the same

periods in fiscal 2023.

Cost of Sales

|

|

Three monthsended May 31 |

Six months ended May 31 |

|

|

2024 |

2023 |

2024 |

2023 |

|

|

($000s) |

% of Revenue |

($000s) |

% of Revenue |

($000s) |

% of Revenue |

($000s) |

% of Revenue |

|

EGRIFTA SV® |

1,549 |

9.6% |

1,187 |

10.9% |

3,436 |

13.3% |

2,226 |

9.4% |

|

Trogarzo® |

2,998 |

51.5% |

3,722 |

55.6% |

6,395 |

51.2% |

7,376 |

53.0% |

|

Total |

4,547 |

20.7% |

4,909 |

28.0% |

9,831 |

25.7% |

9,602 |

25.6% |

For the three- and

six-month periods ended May 31, 2024, EGRIFTA SV® cost of sales was

affected by a $251,000 and $1,088,000 provision related to the

manufacturing of a batch of F8 formulation of tesamorelin, as the

F8 formulation has not yet been approved by the FDA for

commercialization. Trogarzo® cost of sales is contractually

established at 52% of net sales, subject to periodic adjustment for

returns or other factors.

R&D Expenses

R&D expenses in

the three- and six-month periods ended May 31, 2024, amounted to

$4,725,000 and $8,477,000 compared to $10,389,000 and $19,745,000

in the comparable periods of fiscal 2023. R&D expenses in

the three-month period ended May 31, 2024, include the accelerated

depreciation ($766,000) of equipment used as part of the

preclinical oncology research activities, following the decision to

cease early-stage R&D activities.

R&D expenses

(in thousands of

dollars)

|

|

Three monthsended May 31 |

Six monthsended May 31 |

|

|

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|

Oncology |

|

|

|

|

|

|

|

Laboratory research and personnel |

1,033* |

475 |

117% |

1,366* |

988 |

38% |

|

Pharmaceutical product development |

44 |

3,394 |

-99% |

157 |

4,343 |

-96% |

|

Phase 1 clinical trial |

588 |

482 |

22% |

977 |

1,602 |

-39% |

|

Medical projects and education |

278 |

1,081 |

-74% |

504 |

2,382 |

-79% |

|

Salaries, benefits and expenses |

1,271 |

2,491 |

-49% |

2,614 |

5,121 |

-49% |

|

Regulatory activities |

376 |

415 |

-9% |

807 |

798 |

1% |

|

Trogarzo® IM formulation |

6 |

320 |

-98% |

26 |

850 |

-97% |

|

Tesamorelin formulation development |

448 |

379 |

18% |

1,052 |

1,108 |

-5% |

|

F8 human factor studies |

5 |

454 |

-99 |

7 |

613 |

-99% |

|

Pen injector |

- |

44 |

- |

- |

339 |

- |

|

European activities |

50 |

113 |

-56% |

52 |

339 |

-85% |

|

Travel, consultants, patents, options, others |

308 |

741 |

-58% |

579 |

1,262 |

-54% |

|

Restructuring costs |

318 |

- |

- |

336 |

- |

- |

|

Total |

4,725 |

10,389 |

-55% |

8,477 |

19,745 |

-57% |

*Including accelerated

depreciation ($766,000) of equipment used in the oncology program,

following the decision to cease R&D activities related to the

oncology program.

R&D expenses in

the second quarter of 2023 were negatively impacted by a provision

of $3,042,000 related to sudocetaxel zendusortide material which

could expire before the Company is able to use it in its clinical

program. Theratechnologies recorded no such provision in the second

quarter of 2024.

Selling Expenses

Selling expenses

decreased to $6,367,000 and $12,068,000 for the three- and

six-month periods ended May 31, 2024, compared to $6,479,000 and

$13,293,000 for the same periods last year. The decrease in

selling expenses in the six-month period ended May 31, 2024, is due

in large part to tighter expense control in commercialization

activities. Spending in the second quarter of Fiscal 2024 has

stabilized following the completion of cost-cutting measures

implemented in Fiscal 2023.

The amortization of

the intangible asset value for the EGRIFTA SV® and Trogarzo®

commercialization rights is also included in selling expenses. As

such, the Company recorded amortization expense of $360,000 and

$720,000 for the three- and six-month periods ended May 31, 2024,

compared to $739,000 and $1,478,000 in the same periods of Fiscal

2023.

General and Administrative

Expenses

General and

administrative expenses in the three- and six-month periods ended

May 31, 2024, amounted to $3,090,000 and $6,846,000 compared to

$3,716,000 and $8,168,000 reported in the comparable periods of

fiscal 2023. The decrease in General and Administrative expenses is

largely due to the implementation of cost-cutting measures

announced in Fiscal 2023.

Adjusted EBITDA

Adjusted EBITDA was $5,459,000 for the second

quarter of fiscal 2024 and $5,212,000 for the six-month period

ended May 31, 2024, compared to $(6,140,000) and $(10,032,000) for

the same periods of Fiscal 2023. See “Non-IFRS and Non-US-GAAP

Measure” above and see “Reconciliation of Adjusted EBITDA” below

for a reconciliation to Net Loss for the relevant periods.

Net Finance Costs

Net finance costs for

the three- and six-month periods ended May 31, 2024, were

$2,183,000 and $4,308,000 compared to $1,943,000 and $6,883,000 for

the comparable periods of Fiscal 2023. Net finance costs in the

second quarter of Fiscal 2024 included interest of $2,313,000,

versus $1,874,000 in the second quarter of Fiscal 2023. Net finance

costs in the six-month period ended May 31, 2024, included interest

of $4,587,000 versus $3,658,000 in the six-month period of Fiscal

2023. During the six-month period ended on May 31, 2023, net

finance costs were also impacted by the loss on debt modification

of $2,650,000 related to the issuance of common share purchase

warrants (the “Marathon Warrants”) issued in connection with the

amendments to the credit agreement entered into with affiliates of

Marathon Asset Management (the “Credit Agreement”).

Net finance costs for

the three- and six-month periods ended May 31, 2024, also included

accretion expense of $382,000 and $756,000, compared to $609,000

and $1,142,000 for the comparable periods in 2023.

Net Income (Loss)

As a result of

stronger revenues and the tight management of expenses over the

past year, net income for the second quarter ended May 31, 2024,

amounted to $987,000 compared to a net loss of $10,013,000. For the

six-month periods ended May 31, 2024 and 2023, the Company recorded

net losses of $3,494,000 and $20,456,000, respectively.

Financial

Position, Liquidity and Capital Resources

Liquidity and Going Concern

As part of the preparation of the Interim

Financial Statements, management is responsible for identifying any

event or situation that may cast doubt on the Company’s ability to

continue as a going concern.

As of the issuance date of the Interim Financial

Statements, the Company expects that its existing cash and cash

equivalents as of May 31, 2024, together with cash generated from

its existing operations will be sufficient to fund its operating

expenses and debt obligations requirements for at least the next 12

months from the issuance date of the Interim Financial Statements.

Considering the recent actions of the Company, material uncertainty

that raised substantial doubt about the Company’s ability to

continue as a going concern was alleviated effective from these

second quarter interim financial statements.

In an effort to reach sustainable profitability,

the Company has undertaken a number of measures to rationalize its

operations, including a decrease in research and development

expenses and has established a new operating structure focused on

its commercial business (including, for example as described in

note 6 (a) of the Interim Financial Statements). For the

three-month ended May 31, 2024, the Company generated a net profit

of $987,000 (2023-net loss of $10,013,000) and had negative cash

flows from operating activities of $290,000 (2023- negative

$3,562,000). As at May 31, 2024, cash, bonds and money market funds

amounted to $36,028,000.

The Company’s Loan Facility contains various

covenants, including minimum liquidity covenants whereby the

Company needs to maintain significant cash, cash equivalent and

eligible short-term investments balances in specified accounts,

which restricts the management of the Company’s liquidity (refer to

Note 7 of the Interim Financial Statements). As at May 31, 2024,

the material covenants of the Marathon Credit Agreement, as

amended, include: (i) minimum liquidity requirements to be between

$15,000,000 and $20,000,000, based on the Marathon adjusted EBITDA

(as defined in the Marathon Credit Agreement, the “Marathon

Adjusted EBITDA”) targets over the most recently ended four fiscal

quarters; and, (ii) minimum Marathon Adjusted EBITDA targets over

the most recently ended four fiscal quarters. The breach of a

covenant provides the lender with the ability to demand immediate

repayment of the Loan Facility and makes available to the lender

the collateralized assets, which includes substantially all cash,

cash equivalents and money market funds which are subject to

control agreements. The Company does not currently have other

committed sources of financing available to it.

The Company’s ability to continue as a going

concern for a period of at least, but not limited to, 12 months

from May 31, 2024, involves significant judgement and is dependent

on the adherence to the conditions of the Marathon Credit Agreement

or to obtain the support of the lender (including possible waivers

and amendments, if necessary), on increasing its EGRIFTA SV®

revenues and the continuing management of its expenses in order to

meet or exceed the Marathon Adjusted EBITDA target and generate

sufficient positive operating cash flows.

The Interim Financial Statements have been

prepared assuming the Company will continue as a going concern,

which assumes the Company will continue its operations in the

foreseeable future and will be able to realize its assets and

discharge its liabilities and commitments in the normal course of

business.

Analysis of cash flows

The Company ended the second quarter of Fiscal

2024 with $36,028,000 in cash, bonds and money market funds.

Available cash is invested in highly liquid fixed income

instruments including governmental and municipal bonds, and money

market funds.

For the three-month period ended May 31, 2024,

cash generated by operating activities before changes in operating

assets and liabilities improved to $2,616,000, compared to a cash

usage of $8,205,000 in the comparable period of Fiscal 2023, or an

improvement of $10,821,000.

In the second quarter of Fiscal 2024, changes in

operating assets and liabilities had a negative impact on cash flow

of $2,906,000 (2023-positive impact of $4,643,000). These changes

included positive impacts from a decrease in inventories

($769,000), lower prepaid expenses and deposits ($473,000) and

higher provisions ($524,000), and also include a negative impact

from higher accounts receivable ($2,858,000) and lower accounts

payable ($1,781,000).

During the second quarter of Fiscal 2024, cash

used by investing activities amounted to $639,000, and financing

activities used $137,000 in cash, mostly related to payment of the

second milestone to TaiMed Biologics related to the approval of the

IV push method of administration of Trogarzo® ($1,500,000), which

was offset by the sale of bonds ($1,363,000).

Non-IFRS and Non-U.S. GAAP Measure

The information presented in this press release

includes a measure that is not determined in accordance with

International Financial Reporting Standards (“IFRS”) or U.S.

generally accepted accounting principles (“U.S. GAAP”), being the

term “Adjusted EBITDA”. “Adjusted EBITDA” is used by the

Corporation as an indicator of financial performance and is

obtained by adding to net profit or loss, finance income and costs,

depreciation and amortization, income taxes, share-based

compensation from stock options, and certain write-downs (or

related reversals) of inventories. “Adjusted EBITDA” excludes the

effects of items that primarily reflect the impact of long-term

investment and financing decisions rather than the results of

day-to-day operations. The Corporation believes that this measure

can be a useful indicator of its operational performance from one

period to another. The Corporation uses this non-IFRS measure to

make financial, strategic and operating decisions. Adjusted EBITDA

is not a standardized financial measure under the financial

reporting framework used to prepare the financial statements of the

Corporation to which the measure relates and might not be

comparable to similar financial measures disclosed by other

issuers. The Corporation has reinstated its use of Adjusted EBITDA

starting this quarter and has included Adjusted EBITDA for the

comparative period. A quantitative reconciliation of the Adjusted

EBITDA is presented in the table below:

Reconciliation of Adjusted EBITDA

(In thousands of dollars)

| |

Three-month periods ended May 31 |

Six-month periods ended May 31 |

|

|

2024 |

2023 |

2024 |

2023 |

|

Net income (loss) |

987 |

(10,013) |

(3,494) |

(20,456) |

|

|

|

|

|

|

|

Add : |

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization2 |

1,262 |

932 |

1,779 |

1,871 |

|

|

|

|

|

|

|

Net Finance costs3 |

2,183 |

1,943 |

4,308 |

6,883 |

|

|

|

|

|

|

|

Income taxes |

118 |

126 |

228 |

222 |

|

|

|

|

|

|

|

Share-based compensation |

340 |

702 |

967 |

1,278 |

|

|

|

|

|

|

|

Inventory provision4 |

251 |

170 |

1,088 |

170 |

|

|

|

|

|

|

|

Restructuring costs |

318 |

- |

336 |

- |

|

|

|

|

|

|

|

Adjusted EBITDA |

5,459 |

(6,140) |

5,212 |

(10,032) |

Conference Call Details

The call will be held

on Wednesday, July 10 at 8:30 a.m. ET and will be hosted by Paul

Lévesque, President and Chief Executive Officer. He will be joined

by other members of the management team, including Philippe Dubuc,

Senior Vice President and Chief Financial Officer, Christian

Marsolais, Ph.D., Senior Vice President and Chief Medical Officer

and John Leasure, Global Commercial Officer who will be available

to answer questions from participants following prepared

remarks.

Participants are

encouraged to join the call at least ten minutes in advance to

secure access. Conference call dial-in and replay information can

be found below.

|

CONFERENCE CALL INFORMATION |

|

Conference Call Date |

July 10, 2024 |

|

Conference Call Time |

8:30 a.m. ET |

|

Webcast link |

https://edge.media-server.com/mmc/p/4mkgkywo |

|

Dial in |

1-888-513-4119 (toll free) or 1-412-902-6615 (international) |

|

Access Code |

0474907 |

|

CONFERENCE CALL REPLAY |

|

Toll Free |

1-877-344-7529 (US) / 1-855-669-9658 (Canada) |

|

International Toll |

1-412-317-0088 |

|

Replay Access Code |

4477930 |

|

Replay End Date |

July 17, 2024 |

|

To access the replay using an international dial-in number, please

select this

link:https://services.choruscall.com/ccforms/replay.html |

An archived webcast

will also be available on the Company’s Investor Relations website

under ‘Past Events’.

About Theratechnologies

Theratechnologies

(TSX: TH) (NASDAQ: THTX) is a biopharmaceutical company focused on

the development and commercialization of innovative therapies

addressing unmet medical needs. Further information about

Theratechnologies is available on the Company's website

at www.theratech.com, on SEDAR+

at www.sedarplus.ca and on EDGAR at www.sec.gov.

Follow Theratechnologies on Linkedin and Twitter.

Forward-Looking Information

This press release contains forward-looking

statements and forward-looking information (collectively,

“Forward-Looking Statements”), within the meaning of applicable

securities laws, that are based on our management’s beliefs and

assumptions and on information currently available to our

management. You can identify Forward-Looking Statements by terms

such as "may", "will", "should", "could", “would”, "outlook",

"believe", "plan", "envisage", "anticipate", "expect" and

"estimate", or the negatives of these terms, or variations of them.

The Forward-Looking Statements contained in this press release

include, but are not limited to, statements regarding our 2024

fiscal year revenue and Adjusted EBITDA guidance, the resubmission

with the FDA of the sBLA for tesamorelin F8 for approval of this

new product formulation and the timeline to receive a decision from

the FDA, the generation of results from Part 3 of our Phase 1

clinical trial studying sudocetaxel zendusortide in advanced

ovarian cancer, and the Company’s business strategy to focus on its

commercial business and generating positive Adjusted EBITDA and

positive net income. Although the Forward-Looking Statements

contained in this press release are based upon what the Company

believes are reasonable assumptions in light of the information

currently available, investors are cautioned against placing undue

reliance on these statements since actual results may vary from the

Forward-Looking Statements. Certain assumptions made in preparing

the Forward-Looking Statements include that (i) sales of our

products will continue to grow in 2024 and beyond; (ii) we will

control expenses as planned and no unforeseen events will occur

which would have the effect of increasing our expenses in 2024 and

beyond; (iii) we will file a resubmission with the FDA of the sBLA

for tesamorelin F8 for approval of this new product formulation and

the FDA will approve such new formulation allowing us to start its

commercialization; (iv) we will be in compliance with the terms and

conditions of the Loan Facility; (v) we will be able to generate

positive results from Part 3 of our Phase 1 clinical trial studying

sudocetaxel zendusortide in advanced ovarian cancer; and (vi) no

event will occur that would prevent us from executing the

objectives set forth in this press release. Forward-Looking

Statements assumptions are subject to a number of risks and

uncertainties, many of which are beyond Theratechnologies’ control

that could cause actual results to differ materially from those

that are disclosed in or implied by such Forward-Looking

Statements. These risks and uncertainties include, but are not

limited to, a decrease or stagnation in sales of our products in

2024 and beyond, product recalls or change in the regulation that

would adversely impact the sale of our products, the occurrence of

events which would lead us to spend more cash than anticipated, the

effect of which could result in a negative Adjusted EBITDA position

by the fiscal year-end and beyond, defaults under the Loan Facility

triggering an increase of 300 basis points on the loaned amount and

a decision by the lenders to declare all amounts owed under the

Loan Facility as immediately due and payable, the inability to

complete the resubmission with the FDA of the sBLA for tesamorelin

F8 and/or to get approval from the FDA of this new product

formulation, financial difficulties in meeting our contractual

obligations or default under contractual covenants, and changes in

our business plan. We refer current and potential investors to the

“Risk Factors” section of our Annual Information Form in the form

of a Form 20-F Annual Report dated February 21, 2024,

available on SEDAR+ at www.sedarplus.ca and on EDGAR at

www.sec.gov, under Theratechnologies’ public filings for additional

risks related to the Company. The reader is cautioned to consider

these and other risks and uncertainties carefully and not to put

undue reliance on Forward-Looking Statements. Forward-Looking

Statements reflect current expectations regarding future events and

speak only as of the date of this press release and represent our

expectations as of that date. We undertake no obligation to update

or revise the information contained in this press release, whether

as a result of new information, future events or circumstances or

otherwise, except as may be required by applicable law.

Contacts:

Investor inquiries:Philippe DubucSenior Vice President and Chief

Financial Officerpdubuc@theratech.com1-438-315-6608

Media inquiries:Julie SchneidermanSenior Director,

Communications & Corporate

Affairscommunications@theratech.com1-514-336-7800

1 This is a non-IFRS

measure that is forward looking. The amount indicated diverges

significantly from amounts achieved historically. See “Non-IFRS and

Non-US GAAP Measure” below for such historical amounts and a

reconciliation thereof to the most directly comparable IFRS

measure.2 Includes depreciation of property and equipment,

amortization of intangible, other assets and right-of-use assets.3

Includes all finance income and finance costs consisting of:

Foreign exchange, interest income, accretion expense and

amortization of deferred financing costs, interest expense, bank

charges, gain or loss on financial instruments carried at fair

value and loss on debt modification and gain on lease termination.

4 Inventory provision pending marketing approval of the F8

formulation.

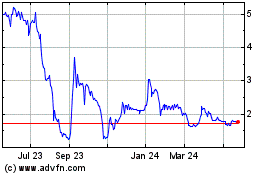

Theratechnologies (TSX:TH)

Historical Stock Chart

From Jan 2025 to Feb 2025

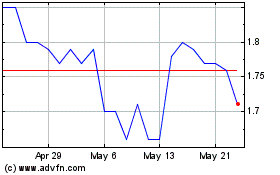

Theratechnologies (TSX:TH)

Historical Stock Chart

From Feb 2024 to Feb 2025