Wilmington Announces 2012 First Quarter Results

11 May 2012 - 10:00AM

Marketwired

Wilmington Capital Management Inc. ("Wilmington" or the

"Corporation") (TSX:WCM.A)(TSX:WCM.B) today announced a net loss

for the three months ended March 31, 2012 of $398,000 or ($0.04)

per share compared to net income of $20.3 million or $2.56 per

share for the same period in 2011.

To view a full copy of the Corporation's unaudited condensed

financial results for the period ended March 31, 2012 including the

Corporation's unaudited condensed interim consolidated financial

statements and accompanying MD&A, please refer to the SEDAR

website www.sedar.com.

OPERATING HIGHLIGHTS

During the first quarter of 2012 the Corporation continued to

take steps in solidifying the foundation of its three newly

operating platforms - self storage facilities, private equity funds

and natural gas assets.

Real Storage Private Trust (46.15% owned) continued to show

operational improvements across its portfolio of 17 self-storage

facilities containing 648,978 square feet of rentable area and one

development site. The 5 properties located in western Canada, which

were acquired in February, 2011, are performing well and expected

to reach stabilized occupancy levels in 2012. The majority of the

western facilities are newly constructed and in the initial

lease-up stage. Overall occupancy for the three months ended March

31, 2012 averaged 75% across the portfolio as compared to 70% for

the same period in 2011. Operating margins for the three months

ended March 31, 2012 increased to 43%, up from 37% achieved for the

comparable period in 2011.

On the private equity front, Network Capital Management Inc.

(50% owned) successfully closed its $22.3 million 2012 fund.

Network's funds under management now total $50.4 million and

Network continues to see good opportunities to deploy available

capital in junior oil and gas companies. Wilmington committed $8

million of capital to the 2012 fund.

The natural gas assets owned through the Shackleton Partnership

(59% owned) are proving to be of high quality and present good

opportunities for growth and future development once we reach a

more favorable natural gas pricing environment. The weighted

average price realized during the quarter amounted to $2.09 per mcf

and operating netbacks averaged $0.63 per mcfl. Natural gas

production volumes averaged 5,924 mcf per day (987 boepd) for the

first quarter. Estimated proved plus probable reserves attributable

to the Shackleton assets as evaluated by GLJ Petroleum Consultants

Ltd. with an effective date of December 31, 2011 were 24,392

MMcf.

OUTLOOK

In 2011, the Corporation took significant steps to put in place

the foundation for achieving future growth by investing in three

operating platforms - the Real Storage Private Trust, Network

Capital Management Inc. and the Shackleton Partnership. In 2012 and

in the years ahead, the Corporation expects to add scale to these

operating platforms, improve valuations and earn attractive cash

flow and total returns for shareholders.

FINANCIAL HIGHLIGHTS

As reported under International Financial Reporting

Standards

CONSOLIDATED STATEMENTS OF INCOME

----------------------------------------------------------------------------

Unaudited Three months ended March 31

(Thousands of Canadian Dollars, except per

share amounts) 2012 2011

----------------------------------------------------------------------------

Income

Natural gas sales $ 1,130 $ ---

Royalties (191) ---

----------------------------------------------------------------------------

Natural gas revenue 939 ---

----------------------------------------------------------------------------

Income from investment property 292 292

Investment and other income 41 82

Foreign exchange gain 27 8

----------------------------------------------------------------------------

----------------------------------------------------------------------------

1,299 382

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Expenses

Petroleum operations 602 ---

Interest 372 293

General and administrative 319 66

Depletion, depreciation and amortization 439 ---

Stock compensation 41 ---

Foreign exchange loss --- ---

----------------------------------------------------------------------------

1,773 359

----------------------------------------------------------------------------

Income (loss) before gain on sale, share of

net loss from equity accounted investment and

income tax expense (benefit) (474) 23

Gain on sale of investment in Parkbridge

Lifestyle Communities Inc. --- 23,581

Share of net loss from Real Storage Private

Trust (30) (190)

Share of net loss from Network Capital

Management Inc. (24) ---

----------------------------------------------------------------------------

Income (loss) before income taxes (528) 23,414

Income tax expense (benefit) (130) 3,086

----------------------------------------------------------------------------

Net Income (loss) $ (398) $ 20,328

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income (loss) attributable to:

Owners of the Corporation $ (324) 20,328

Non-controlling interest $ (74) ---

----------------------------------------------------------------------------

(398) 20,328

Net income (loss) per share - basic $ (0.04) $ 2.56

Net income (loss) per share - diluted $ (0.04) $ 2.56

----------------------------------------------------------------------------

CONSOLIDATED BALANCE SHEET

----------------------------------------------------------------------------

Unaudited March 31, December 31,

(Thousands of Canadian Dollars) 2012 2011

----------------------------------------------------------------------------

Assets

Non-current assets

Investment property $ 18,491 $ 18,933

Investment in Real Storage Private Trust 7,067 7,096

Investment in Network Capital Management Inc. 1,731 1,755

Investment in Network 2012 Fund 2,640 ---

Natural gas properties and equipment 18,997 19,436

Deferred tax asset 218 135

----------------------------------------------------------------------------

49,144 47,355

----------------------------------------------------------------------------

Current assets

Loan to Network Capital Management Inc. 50 50

Receivables and other assets 720 923

Cash and cash equivalents 12,302 18,688

----------------------------------------------------------------------------

13,072 19,661

----------------------------------------------------------------------------

Total assets $ 62,216 $ 67,016

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Liabilities

Non-current liabilities

Secured debt $ 18,941 $ 19,403

Loan payable 1,595 1,615

Asset retirement obligations 719 708

Deferred tax liabilities --- ---

----------------------------------------------------------------------------

21,255 21,726

----------------------------------------------------------------------------

Current liabilities

Accounts payable and accrued liabilities 1,192 1,481

Revolving loan facility 7,500 7,830

Income taxes payable --- 3,336

----------------------------------------------------------------------------

8,692 12,647

----------------------------------------------------------------------------

Total liabilities 29,947 34,373

----------------------------------------------------------------------------

Equity

----------------------------------------------------------------------------

Shareholders' equity 28,145 28,445

Non-controlling interest 4,124 4,198

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total liabilities and equity $ 62,216 $ 67,016

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

----------------------------------------------------------------------------

Unaudited Three months ended March 31

(Thousands of Canadian Dollars) 2012 2011

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income (loss) $ (398) $ 20,328

----------------------------------------------------------------------------

Foreign currency translation (17) 1

Reversal of the fair value increment of

available for sale securities --- (23,414)

Future income taxes on above items --- 3,285

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Other comprehensive income (loss) (17) (20,128)

----------------------------------------------------------------------------

Comprehensive income (loss) $ (415) $ 200

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Comprehensive income (loss) attributable to:

Owners of the Corporation $ (341) $ 200

Non-controlling interest (74) ---

----------------------------------------------------------------------------

$ (415) $ 200

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Executive Officers of the Corporation will be available at

403-800-0869 to answer any questions on the Corporation's financial

results.

This news release contains forward-looking statements concerning

the Corporation's business and operations. The Corporation cautions

that, by their nature, forward-looking statements involve risk and

uncertainty and the Corporation's actual results could differ

materially from those expressed or implied in such statements.

Reference should be made to the most recent Annual Information Form

for a description of the major risk factors.

Boe Conversion: Certain natural gas volumes have been converted

to barrels of oil equivalent ("boe") whereby 6,000 cubic feet (mcf)

of natural gas is equal to .1 barrel (bbl) of oil. This conversion

ratio (6:1) is based on an energy equivalency conversion applicable

at the burner tip and does not represent a value equivalency at the

wellhead.

Contacts: Wilmington Capital Management Inc. (403) 800-0869

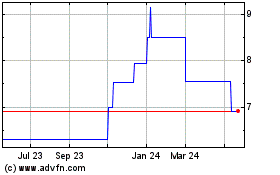

Wilmington Capital Manag... (TSX:WCM.B)

Historical Stock Chart

From Dec 2024 to Jan 2025

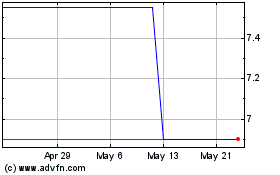

Wilmington Capital Manag... (TSX:WCM.B)

Historical Stock Chart

From Jan 2024 to Jan 2025