American Creek Resources Adopts Shareholder Rights Plan

16 May 2013 - 11:00PM

Marketwired Canada

American Creek Resources Ltd. (TSX VENTURE:AMK) ("the Corporation") announces

that its board of directors (the "Board") has adopted a shareholder rights plan

(the "Rights Plan"), which the shareholders of the Corporation (the

"Shareholders") approved at the annual general and special meeting of

Shareholders held on January 25, 2013. The adoption of the Rights Plan is not in

response to a proposal to acquire control of the Corporation. At this time, the

Corporation is not aware of any such transaction that would trigger the

provisions of the Rights Plan.

The purpose of the Rights Plan is to give adequate time for Shareholders to

properly assess the merits of a bid without undue pressure and to allow

competing bids to emerge. The Rights Plan is designed to give the Board time to

consider alternatives to allow Shareholders to receive full and fair value for

their common shares in the capital of the Corporation (the "Common Shares"). The

adoption of the Rights Plan does not affect the duty of the Board to act

honestly and in good faith with a view to the best interests of the Corporation

and its shareholders.

The issuance of the rights under the Rights Plan will not alter the financial

condition of the Corporation. The issuance is not of itself dilutive, will not

affect reported earnings per Common Share and will not change the way in which

Shareholders would otherwise trade Common Shares. By permitting holders of

Rights other than an Acquiring Person (as defined in the Rights Plan) to acquire

Common Shares at a discount to market value, the Rights may cause substantial

dilution to a person or group that acquires 20% or more of the Common Shares of

the Corporation other than by way of a Permitted Bid (as defined in the Rights

Plan) or other than in circumstances where the Rights are redeemed or the Board

waives the application of the Rights Plan.

The Rights Plan should provide adequate time for Shareholders to assess a bid

and to permit competing bids to emerge. It also gives the Board sufficient time

to explore other options. A potential bidder can avoid the dilutive features of

the Rights Plan by making a bid that conforms to the requirements of a Permitted

Bid.

To qualify as a Permitted Bid, a take-over bid must be made for all Common

Shares and must be open for 60 days after the bid is made. If at least 50% of

the Common Shares held by persons independent of the bidder are deposited or

tendered pursuant to the bid and not withdrawn, the bidder may take up and pay

for such shares. The bid must then remain open for a further period of 10

business days on the same terms.

A copy of the Rights Plan is available on the Corporation's profile at

www.sedar.com.

American Creek Resources Ltd. is a Canadian junior mineral exploration company

focused on the acquisition, exploration and development of mineral deposits

within the Province of British Columbia, Canada.

Information relating to the Corporation is available on its website at

www.americancreek.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

American Creek Resources Ltd.

Darren Blaney

403 752-4040

info@americancreek.com

www.americancreek.com

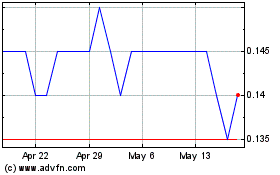

American Creek Resources (TSXV:AMK)

Historical Stock Chart

From Mar 2024 to Apr 2024

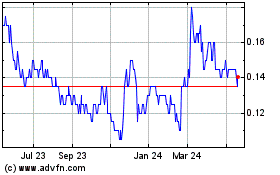

American Creek Resources (TSXV:AMK)

Historical Stock Chart

From Apr 2023 to Apr 2024