ARIZONA SILVER ANNOUNCES METALLIC SCREEN ASSAYS SIGNIFICANTLY INCREASE GOLD GRADES OF HIGH-GRADE DRILL INTERCEPTS AT PHILADELPHIA PROJECT, ARIZONA HIGHEST GRADE SAMPLE INCREASES FROM 51 TO 72.5 GPT GOLD

11 July 2023 - 11:00PM

Arizona Silver Exploration

Inc. (TSXV:

AZS)

(

OTCQB:AZASF) is pleased to announce very positive

results from re-assays by the metallic screen procedure on selected

drill hole intervals on the Philadelphia epithermal gold project.

The highest-grade interval to be re-assayed showed the largest

grade increase, 42.2% (51 gpt to 72.5 gpt) gold. A total of 24

samples of both high and low-grade material were re-assayed if they

contained visible gold. The samples were all from the spring 2023

reverse circulation (“RC”) drilling campaign.

Mr. Greg Hahn, VP Exploration commented,

“Re-assaying of samples with coarse gold is a normal industry

practice to gauge if grades are being underestimated simply because

a standard 30-gram sample for fire assay can miss coarse gold that

might not be represented in a 30-gram split.. Re-assaying on 24

samples is considered statistically meaningful as we assayed both

higher and lower grade material. For all 24 samples the average

grade increased by 25.9%.”

“Going forward we will routinely re-assay

high-grade intervals and use the metallic screen technique also on

duplicate samples to resolve potential assay discrepancies when our

geologist identifies coarse gold in his logging. In due course when

Philadelphia advances into the evaluation phase much more

re-assaying will be done. In the meantime, I am delighted that our

project continues to have positive outcomes as we continue drilling

off this deposit” added Greg Hahn.

| |

|

|

|

Reassay 1 |

Reassay 2 |

|

|

|

| Method |

Au-SCR21 |

Au-SCR21 |

Au-SCR21 |

Au-AA25 |

Au-AA25D |

Original |

|

|

| Analyte |

Au Total (+)(-) Combined |

Au (+) Fraction |

Au (-) Fraction |

Au |

Au |

Au |

|

|

| |

ppm |

ppm |

ppm |

ppm |

ppm |

ppm |

Delta |

Delta |

| Description |

0.05 |

0.05 |

0.05 |

0.01 |

0.01 |

0.01 |

% |

ppm |

|

PRC23-97 180-185 |

72.50 |

123.00 |

70.20 |

74.80 |

65.50 |

51.00 |

42.2 |

% |

21.50 |

|

PRC23-101 345-350 |

13.90 |

37.20 |

12.85 |

12.65 |

13.05 |

8.84 |

57.2 |

% |

5.06 |

|

PRC23-99 70-75 |

3.57 |

1.43 |

3.67 |

3.83 |

3.50 |

1.83 |

95.1 |

% |

1.74 |

|

PRC23-107 195-200 |

7.42 |

12.85 |

7.13 |

6.56 |

7.70 |

5.72 |

29.7 |

% |

1.70 |

|

PRC23-101 350-355 |

4.02 |

11.40 |

3.65 |

2.89 |

4.41 |

2.54 |

58.3 |

% |

1.48 |

|

PRC23-104 235-240 |

4.74 |

12.50 |

4.44 |

4.66 |

4.22 |

3.81 |

24.4 |

% |

0.93 |

|

PRC23-99 65-70 |

1.91 |

0.82 |

1.96 |

2.50 |

1.42 |

1.31 |

46.4 |

% |

0.61 |

|

PRC23-98 30-35 |

2.30 |

1.16 |

2.35 |

2.61 |

2.09 |

1.95 |

17.9 |

% |

0.35 |

|

PRC23-99 75-80 |

2.12 |

1.90 |

2.14 |

2.29 |

1.98 |

2.01 |

5.5 |

% |

0.11 |

|

PRC23-109 215-220 |

2.96 |

2.46 |

2.99 |

2.85 |

3.12 |

2.86 |

3.5 |

% |

0.10 |

|

PRC23-106 455-460 |

3.19 |

2.98 |

3.20 |

3.32 |

3.08 |

3.16 |

0.9 |

% |

0.03 |

|

PRC23-108 255-260 |

4.58 |

4.41 |

4.59 |

4.53 |

4.65 |

4.56 |

0.4 |

% |

0.02 |

|

PRC23-107 195-200B |

3.78 |

2.85 |

3.83 |

3.85 |

3.80 |

3.76 |

0.5 |

% |

0.02 |

|

PRC23-105 300-305 |

5.67 |

7.12 |

5.61 |

5.54 |

5.68 |

5.65 |

0.4 |

% |

0.02 |

|

PRC23-104 225-230 |

1.25 |

0.91 |

1.27 |

1.36 |

1.17 |

1.28 |

-2.0 |

% |

-0.02 |

|

PRC23-97 50-55 |

2.49 |

1.96 |

2.52 |

2.71 |

2.33 |

2.54 |

-2.0 |

% |

-0.05 |

|

PRC23-105 305-310 |

1.88 |

1.63 |

1.89 |

1.85 |

1.93 |

1.94 |

-2.8 |

% |

-0.06 |

|

PRC23-99 80-85 |

0.86 |

0.53 |

0.88 |

0.87 |

0.88 |

0.92 |

-6.8 |

% |

-0.06 |

|

PRC23-104 245-250 |

1.20 |

1.46 |

1.19 |

1.45 |

0.92 |

1.30 |

-7.7 |

% |

-0.10 |

|

PRC23-107 200-205 |

0.82 |

0.55 |

0.84 |

0.89 |

0.78 |

1.13 |

-27.4 |

% |

-0.31 |

|

PRC23-104 240-245 |

3.53 |

3.31 |

3.54 |

3.51 |

3.57 |

3.84 |

-8.1 |

% |

-0.31 |

|

PRC23-104 230-235 |

1.91 |

0.89 |

1.97 |

1.99 |

1.94 |

2.26 |

-15.5 |

% |

-0.35 |

|

PRC23-108 260-265 |

0.99 |

1.14 |

0.99 |

0.97 |

1.00 |

1.42 |

-30.0 |

% |

-0.43 |

|

PRC23-107 190-195 |

4.91 |

7.05 |

4.82 |

4.41 |

5.23 |

5.49 |

-10.6 |

% |

-0.58 |

|

|

|

|

|

|

|

|

|

|

| AVERAGES |

6.35 |

|

|

6.37 |

6.00 |

5.05 |

25.9 |

% |

1.31 |

ppm (parts per million) is equal to gpt (grams

per tonne).

Metallic Screen and Duplicate

Re-Assays

Metallic screen assays and duplicate re-assays

were run on selected intervals from the spring 2023 RC drilling

campaign, where visible gold was identified, in order to assess the

potential for coarse gold that is not adequately represented in

standard 30-gram fire assay analyses. The results are tabulated

herein and show the high-grade intervals clearly have “coarse” gold

present in the plus 100-mesh size fraction used in the analyses.

This coarse gold fraction tends to be under-represented in a

standard 30-gram sample preparation for fire assay. The highest

grade samples show the largest amount of “coarse’ gold relative to

the lower grade samples, for which the presence of particulate gold

does not appear to be an issue. Generally, the results show a

dramatic grade increase for samples with initial grades of +4-5

grammes per tonne (“gpt”) gold, although that is not always the

case.

The highest grade sample in drill hole PRC23-97,

which originally contained a grade of 51 gpt gold, returned a grade

of 72.5 gpt gold in metallic screen analyses, a 42% increase in

grade. For that sample grades of 65 and 74.8 gpt gold were also

returned upon re-assaying the original sample using a larger

(50-gram) pulp size. The results of metallic screen analyses and

re-assaying using a larger pulp compare very favorably with one

another. This suggests re-assaying by the metallic screen procedure

of +4 gpt gold internals is recommended. Metallic screen analyses

are recommended also when discrepancies exist in standard assay and

re-assay sampling.

Overall the metallic screen analysis and

re-assaying exercise of the sample selected resulted in a 25.9%

increase in average grade of the sample suite. Metallic screen

analyses and re-assaying of low-grade samples returns grade

discrepancies of generally less than 0.5 gpt gold, and mostly less

than 0.1 gpt gold, suggesting coarse gold is not an issue in the

lower grade samples submitted for metallic screen analyses.

QA/QC Program

All assaying was conducted by ALS Global, an

independent analytical laboratory. Pulverized splits are sent to

the ALS analytical facility in Vancouver, British Columbia for

analyses. All material handling is done under a strict chain of

custody protocol. Gold is determined by fire assay with an AA

finish and silver is determined by ICP-MS methods within a

31-element suite.

The Company maintains its own program of

inserting Standard Reference material in the form of standards and

blanks to the sampling stream, prior to being shipped to ALS's

preparation facility in Tucson, Arizona, in addition to the

independent QA/QC protocols of ALS Global.

Qualified Person

Gregory Hahn, VP-Exploration and a Certified

Professional Geologist (#7122) is a Qualified Person under National

Instrument 43-101 ("NI 43-101") and has reviewed and approved the

technical information contained in this news release.

About Arizona Silver

Exploration Inc.

Arizona Silver is a young exploration company

focused on exploring gold-silver properties in western Arizona

and Nevada. The flagship asset is the Philadelphia gold-silver

property where the Company is drilling off an epithermal

gold-silver system.

On behalf of the Board of Directors:

ARIZONA SILVER EXPLORATION

INC.

Mike Stark, President

and CEO, DirectorPhone: (604)

833-4278

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This news release includes certain

forward-looking statements or information. All statements other

than statements of historical fact included in this release are

forward-looking statements that involve various risks and

uncertainties. Forward-looking statements in this news release

include statements in relation to the timing, cost and other

aspects of the 2023 exploration program; the potential for

development of the mineral resources; the potential mineralization

and geological merits of the exploration properties; and other

future plans, objectives or expectations of the Company. There can

be no assurance that such statements will prove to be accurate and

actual results and future events could differ materially from those

anticipated in such statements. Important factors that could cause

actual results to differ materially from the Company's plans or

expectations include the risk that actual results of current and

planned exploration activities, including the results of the

Company's 2023 drilling program(s) on its properties, will not be

consistent with the Company's expectations; the geology, grade and

continuity of any mineral deposits and the risk of unexpected

variations in mineral resources, grade and/or recovery rates;

fluctuating metals prices; possibility of accidents, equipment

breakdowns and delays during exploration; exploration cost overruns

or unanticipated costs and expenses; uncertainties involved in the

interpretation of drilling results and geological tests;

availability of capital and financing required to continue the

Company's future exploration programs and preparation of geological

reports and studies; delays in the preparation of geological

reports and studies; the metallurgical characteristics of

mineralization contained within the exploration properties are yet

to be fully determined; general economic, market or business

conditions; competition and loss of key employees; regulatory

changes and restrictions including in relation to required permits

for exploration activities (including drilling permits) and

environmental liability; timeliness of government or regulatory

approvals; and other risks detailed herein and from time to time in

the filings made by the Company with securities regulators. In

connection with the forward-looking information contained in this

news release, the Company has made numerous assumptions, including

that the Company's 2023 programs would proceed as planned and

within budget. The Company expressly disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise,

except as otherwise required by applicable securities

legislation.

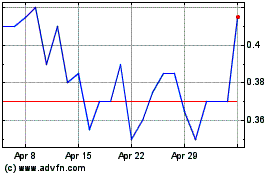

Arizona Gold and Silver (TSXV:AZS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Arizona Gold and Silver (TSXV:AZS)

Historical Stock Chart

From Dec 2023 to Dec 2024