TomaGold Corporation Receives Approval for Option of Chibougamau Independent’s West Block and LOI on East Block

13 September 2023 - 10:59PM

Chibougamau Independent Mines Inc.

(“

Chibougamau”)

(CBG-TSX-V in

Canada, CLL1-Frankfurt, Stuttgart and Lang & Schwarz Stock

Exchanges in Germany, CMAUF-OTC in the US) is pleased to

announce that the

Option Agreement announced on

August 14, 2023 with TomaGold Corporation

(“

TomaGold”) (TSXV: LOT) (OTCQB: TOGOF) pursuant

to which Chibougamau granted TomaGold an option to acquire the West

Block, comprised of 99 claims in Barlow and McKenzie Townships,

Québec, has been approved by regulators.

In order to exercise its option and acquire a

100% interest in the West Block, TomaGold must make cash

payments to Chibougamau in an aggregate amount of $2,650,000 over a

period of five years, including an initial payment of $300,000 on

the effective date of the Option Agreement; issue 6 million

shares to Chibougamau within five business days of the effective

date of the Option Agreement; issue additional shares to

Chibougamau on an annual basis for five years thereafter in an

aggregate amount of $1,350,000, at an issue price per share equal

to the volume weighted average trading price of TomaGold’s shares

at the respective dates of issuance; and incur expenditures on the

West Block in an aggregate amount of $5,600,000 over a period of

five years, including $600,000 in the first year. Any

shares issued by TomaGold to Chibougamau under the Option Agreement

will be subject to a four-month “hold period” under applicable

securities regulations and the policies of the TSX Venture

Exchange.

Chibougamau will retain a 2% Gross

Metals Royalty (“GMR”) on the West Block, as will Globex Mining

Enterprises Inc. (GMX-TSX) (“Globex”). TomaGold has the right to

repurchase 0.5% of the 2% GMR held by each of Chibougamau and

Globex for a total purchase price of $1,500,000, to be divided

equally between Chibougamau and Globex.

Chibougamau is also pleased to announce

that TomaGold has received approval of the letter of intent (“LOI”)

for a potential sale of the East Block to TomaGold. The

East Block is comprised of 127 claims in McKenzie, Obalski, Roy and

Lemoine Townships, Québec.

Under the LOI exclusivity period, Chibougamau

undertakes not to seek to enter discussions or negotiations with

any party other than TomaGold regarding the sale of the East Block

in consideration for which TomaGold will pay $200,000 to

Chibougamau. During the exclusivity period, TomaGold will

be entitled to carry out a due diligence review of the East

Block.

An indicative term sheet forming part of the LOI

provides that if Chibougamau and TomaGold enter into a

definitive agreement for the purchase and sale of the East Block,

the purchase price will be $11 million in cash payments from

TomaGold to Chibougamau over a period of two years, including

$5 million upon signing of the definitive agreement,

and the issuance by TomaGold to Chibougamau on the closing date of

the sale of 10 million common shares at a deemed price of

$0.05 per share. The LOI provides that TomaGold will grant a

first-ranking hypothec to Chibougamau as security for payment of

the cash purchase price for the East Block.

The LOI also provides that TomaGold will grant a

2% GMR on the East Block to each of Chibougamau and Globex and that

TomaGold will have the right to repurchase 0.5% of the 2% GMR held

by CIM and Globex, respectively, for $750,000 for each 0.5%

purchased.

The LOI does not constitute a legally binding

contract, offer or promise of sale of the East Block and no

assurance can be given by Chibougamau that it will enter into a

definitive agreement with TomaGold with respect to the sale of the

East Block on the terms and conditions set out above or at all. Any

definitive agreement with respect to the sale of the East Block

will be subject to regulatory approval, including that of the TSX

Venture Exchange, and may be subject to shareholder approval.

TomaGold has received conditional approval from

the TSX Venture Exchange for these transactions. The common shares

to be issued in relation with the agreements are subject to a

resale restriction period of four months and one day.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of the release.

|

We Seek Safe Harbour. |

CUSIP Number 167101 203 LEI 529900GYUP9EBEF7U709 |

|

For further information, contact: |

|

Jack Stoch, P.Geo., Acc.Dir. President & CEO Chibougamau

Independent Mines Inc. 86, 14th Street Rouyn-Noranda, Quebec Canada

J9X 2J1 |

Tel.: 819.797.5242 Fax: 819.797.1470 info@chibougamaumines.com

www.chibougamaumines.com |

|

|

|

Forward Looking Statements

Except for historical information, this News Release may

contain certain “forward looking statements”, including statements

with respect to the option granted on the West Block property and

the letter of intent for a potential sale of the East Block

property. These statements may involve a number of known and

unknown risks and uncertainties and other factors that may cause

the actual results, level of activity and performance to be

materially different from the Company’s expectations and

projections. A more detailed discussion of the risks is available

under “disclaimer” on the Company’s website.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f084c760-887b-486c-96ba-bedfbbba76c5

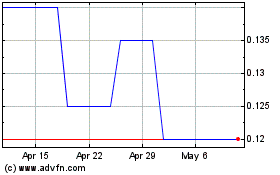

Chibougamau Independent ... (TSXV:CBG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Chibougamau Independent ... (TSXV:CBG)

Historical Stock Chart

From Dec 2023 to Dec 2024