Cielo Waste Solutions Corp. (TSXV:CMC; OTC PINK:CWSFF)

(

“Cielo” or the

“Company”)

announces the sale of a portion of the Company’s currently inactive

assets, and the resulting assignment of a $2.6 million mortgage

loan (the “

Mortgage Loan”).

Background

As previously announced, the Company completed

an asset acquisition in November 2023 (the “2023

Acquisition”), pursuant to which the Company acquired,

among other items, an exclusive licence in Canada to use Expander

Energy Inc.’s patented EBTL™ and BGTL™ technologies and related

intellectual property for all feedstocks, as well as an exclusive

licence in the United States for creosote and treated wood waste

(the “Licensed Technologies”), which will be used

in facilities that will process biomass (waste) to renewable fuels.

It was the Company’s intention to continue to enhance Cielo’s

existing proprietary Thermal Catalytic Depolymerization (TCD)

technology (the “TCD Technology”), while

concurrently the Licensed Technologies would allow Cielo to

accelerate its timeline to revenue.

Strategic Focus

Since the closing of the 2023 Acquisition, Cielo

has focused on the Licensed Technologies and is currently in the

process of acquiring additional assets from Rocky Mountain Clean

Fuels Inc., as previously announced, which will operate in tandem

with the Licensed Technologies. Cielo has determined it to be in

the best interest of the Company to dispose of the TCD Technology

and the related assets (the “TCD Assets”), as well

as the land used for its development located in Aldersyde, Alberta

(the “Aldersyde Property”, together with the TCD

Assets, collectively the “Assets”), and by doing

so, also eliminate the Mortgage Loan secured against the Aldersyde

Property. Management and the Board of Directors of Cielo intends to

streamline operations with a strategic focus on the Licensed

Technologies that are market ready, without investing additional

research and development time and resources. Cielo has executed an

asset purchase agreement (the “Asset Purchase

Agreement”) dated November 28th, 2024 with a private,

arm’s length, Alberta corporation (the

“Purchaser”) setting out the terms upon which the

Company has agreed to sell the Assets in consideration for the

Purchase Price (as defined below) (the

“Transaction”). The Asset Purchase Agreement and

the closing of the Transaction are subject to the removal of

customary commercial conditions, including obtaining lender

approval. The Transaction will close subject to and upon removal of

conditions and will be effective on November 29, 2024. Cielo has

opted to focus on the Licensed Technologies as a means to advance

its BioSynfuels® business given the more advanced technological

readiness of the Licensed Technologies as compared to the TCD

Technology.

Ryan Jackson, CEO of Cielo stated, “This allows

Cielo to focus on becoming a renewable fuels producer and

transition away from developing technologies within the sector. We

are focused on moving forward with the completion of the Rocky

Transaction and the resulting expansion of the Carseland Facility

using the Licensed Technologies.”

Transaction Overview

Under the terms of the Asset Purchase Agreement,

Cielo agreed to sell to the Purchaser, on and subject to the terms

and conditions set out in the Asset Purchase Agreement, the

Property together with the equipment located on the Property (the

“Equipment”) and the entire right, title and

interest in the invention and improvements of the Company in its

Canadian and U.S. patents for “Enhanced Distillate Oil Recovery

From Thermal Processing And Catalytic Cracking Of Biomass Slurry”

(the “IP”, together with the Property and

Equipment, collectively the “Assets”).

Under the terms of the Asset Purchase Agreement,

the Company sold the Assets to the Purchaser for an aggregate

purchase price of $3.9 million (the “Purchase

Price”), subject to a $15,000 reduction for outstanding

fees owed by Cielo associated with the Aldersyde Property, and

adjustments, paid/to be paid as follows:

- $300,000 paid

on or prior to closing;

- The

assumption, by the Purchaser, of the Mortgage Loan (eliminating the

Company’s obligation to pay the Mortgage Loan); and

- A promissory

note in favour of the Company on the following terms:

- A principal

amount of $1 million (the “Loan”);

- Secured

against the Aldersyde Property (second place behind the existing

mortgagor);

- Bearing an

interest rate of 7.5% per annum, payable monthly;

- To be paid as

to $200,000 on each of February 15, 2025 and May 15, 2025, and as

to $150,000 on each of August 15, 2025, November 15, 2025, February

15, 2026, and May 15, 2026, provided that in the event that the

Purchaser pays $700,000 of the Loan on or before May 15, 2025, the

balance of the Loan will be forgiven.

Other than customary fees, no third-party finder

fees have been or will be paid with respect to the Transaction.

The Transaction constitutes an “exempt

transaction” under TSX Venture Exchange Policy 5.3 (the

“Policy”) as it satisfies all of the requirements

set out in Section 3.1 of the Policy.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

ABOUT CIELO

Cielo is fueling renewable change with a mission

to be a leader in the wood by-product-to-fuels industry by using

environmentally friendly, economically sustainable and market-ready

technologies. We are proud to advance our non-food derived model

based on our exclusive licence in Canada for patented Enhanced

Biomass to Liquids (EBTL™) and Biomass Gas to Liquids (BGTL™)

technologies and related intellectual property, along with an

exclusive licence in the US for creosote and treated wood waste,

including abundant railway tie feedstock. We have assembled a

diverse portfolio of projects across geographic regions and secured

the ability to leverage the expertise of proven industry leaders.

Cielo is committed to helping society ‘change the fuel, not the

vehicle’, which we believe will contribute to generating positive

returns for shareholders. Cielo shares are listed on the TSX

Venture Exchange under the symbol “CMC,” as well as on the OTC Pink

Market under the symbol “CWSFF.”

For further information please contact:

Cielo Investor Relations

Ryan Jackson, CEO Phone: (403)

348-2972 Email: investors@cielows.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This news release contains certain

forward-looking statements and forward-looking information

(collectively referred to herein as “forward-looking statements”)

within the meaning of applicable Canadian securities laws. All

statements other than statements of present or historical fact are

forward-looking statements. Forward-looking statements are often,

but not always, identified by the use of words such as

“anticipate”, “achieve”, “could”, “believe”, “plan”, “intend”,

“objective”, “continuous”, “ongoing”, “estimate”, “outlook”,

“expect”, “may”, “will”, “project”, “should” or similar words,

including negatives thereof, suggesting future outcomes.

Forward-looking statements are subject to both

known and unknown risks, uncertainties, and other factors, many of

which are beyond the control of the Company, that may cause the

actual results, level of activity, performance, or achievements of

the Company to be materially different from those expressed or

implied by such forward looking statements. Forward-looking

statements and information are based on plans, expectations and

estimates of management at the date the information is provided and

are subject to certain factors and assumptions. Cielo is making

forward-looking statements, including but not limited to with

respect to: the Transaction and the terms and closing conditions

and date thereof; the payment terms of the Loan; and the Licensed

Technologies and the intended use(s) thereof, including the focus

of the Company and the fuels to be produced.

Investors should continue to review and consider

information disseminated through news releases and filed by the

Company on SEDAR+. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended.

Forward-looking statements are not a guarantee

of future performance and involve a number of risks and

uncertainties, some of which are described herein. Such

forward-looking statements necessarily involve known and unknown

risks and uncertainties, which may cause the Company’s actual

performance and results to differ materially from any projections

of future performance or results expressed or implied by such

forward-looking statements. Any forward-looking statements are made

as of the date hereof and, except as required by law, the Company

assumes no obligation to publicly update or revise such statements

to reflect new information, subsequent or otherwise.

Cielo Waste Solutions (TSXV:CMC)

Historical Stock Chart

From Nov 2024 to Dec 2024

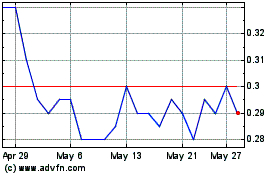

Cielo Waste Solutions (TSXV:CMC)

Historical Stock Chart

From Dec 2023 to Dec 2024