California Nanotechnologies Reports Record Fourth Quarter and Year End Financial Results

02 July 2014 - 10:30PM

Marketwired

California Nanotechnologies Reports Record Fourth Quarter and Year

End Financial Results

CERRITOS,

CA--(Marketwired - July 02, 2014) - California

Nanotechnologies Corp. ("Cal Nano" or the "Company") is pleased to

report record financial results for the 4th quarter and year ended

February 28, 2014. For fiscal 2014, revenues increased 43% to

$373,481US ($415,804CAD) compared to $261,302US ($268,025CAD) in

2013. Gross margin for the year was 87% which was unchanged from

fiscal 2013. This improvement in revenues was due primarily to

increases in the oil and gas and sports and recreational divisions.

In the fourth quarter, Cal Nano achieved record quarterly results

with revenues of $175,172US ($195,023CAD), an increase of 338% over

the same quarter last year. The main sources of revenue during

fiscal 2014 were from cryogenic milling, research projects,

engineering services and the sale of commercial parts made from

advanced nano-engineered materials.

The Company's cash flow provided by (used for)

operations (1) for the year was ($198,383US) compared with

($327,631US) during the prior year. Cash flow from operations (1)

in the fourth quarter of fiscal 2014 neared break-even at

($6,310US).

Cal Nano's net loss for the year was $302,365US

($336,629CAD) or $0.01 per share, compared to a loss of $531,811US

($545,494CAD) or $0.02 per share in the prior year. Amortization

and depreciation expense and salaries, wages and benefits,

research, and supplies were the greatest expense items. Overall

operating expenses of $619,161US were lower by 12% when compared to

the prior year.

| |

|

| |

|

| SUMMARY OF FINANCIAL HIGHLIGHTS (US $) |

|

| All figures in US dollars unless noted. |

|

| |

|

| Basic

Weighted Average Shares |

|

For the year |

|

|

For the year |

|

|

% |

|

| Issued And

Outstanding : |

|

ended |

|

|

ended |

|

|

Increase |

|

|

25,820,000 |

|

February 28, |

|

|

February 28, |

|

|

(Decrease) |

|

|

|

|

2014 |

|

|

2013 |

|

|

|

|

|

Revenue |

|

$ |

373,481 |

|

|

$ |

261,302 |

|

|

43 |

% |

| Cash flow

provided by (used for) |

|

|

|

|

|

|

|

|

|

|

|

| operations

(1) |

|

|

(198,383 |

) |

|

|

(327,631 |

) |

|

n/a |

|

| Net

Loss |

|

|

(302,365 |

) |

|

|

(531,811 |

) |

|

n/a |

|

| EPS

(US) |

|

|

(0.01 |

) |

|

|

(0.02 |

) |

|

n/a |

|

| EPS

(CAD) |

|

|

(0.01 |

) |

|

|

(0.02 |

) |

|

n/a |

|

(Note: at 02/28/14, $1US = $1.1133 CAD; 02/28/13,

$1US = $1.0257 CAD)

- Cash flow used for operations is a non-GAAP term requested by

the oil and gas investment community that represents net earnings

adjusted for non-cash items including depreciation, depletion and

amortization, deferred taxes, asset write-downs and gains (losses)

on sale of assets, if any.

The Company's immediate short-term objectives will

be to install larger scale production systems to meet the growing

demand for the nano-engineered materials currently produced by Cal

Nano. The Company has recently purchased a larger high-energy

attritor to be adapted and modified for advanced cryogenic

processing, increasing the Company's cryomilling capacity by a

factor of six. The company is continuing to develop new technology

and is sourcing new opportunities through collaborations and

partnerships with select universities and tier one production

suppliers.

Subsequent to year end, Cal Nano completed a

private placement raising gross proceeds of $714,190 CAD. As a

result of this transaction, Cal Nano currently has 31,230,296

shares issued and outstanding.

"Management is very pleased with financial results

achieved in fiscal 2014 and those obtained in Q1/15. Revenues in Q1

were approximately $159,575US ($172,959CAD) and the movement toward

cash flow break-even strengthens the company's financial position

while allowing management to focus on moving Cal Nano's products

toward commercialization. With increasing revenues, high margins,

and several research and development projects scheduled for

completion in the near future, management remains optimistic as the

Company transitions into the commercial marketplace," stated

Christopher Melnyk, CEO.

Reader Advisory Except for statements of

historical fact, this news release contains certain

"forward-looking information" within the meaning of applicable

securities law. Forward-looking information is frequently

characterized by words such as "plan", "expect", "project",

"intend", "believe", "anticipate", "estimate", "budget",

"scheduled", "estimates", "forecast" and other similar words or

variations thereof, or statements that certain events or conditions

"may", "could", "would", "might" or "will" occur. In particular,

forward-looking information in this press release includes, but is

not limited to, statements with respect to the expected use of

proceeds. Although we believe that the expectations reflected in

the forward-looking information are reasonable, there can be no

assurance that such expectations will prove to be correct. We

cannot guarantee future results, performance or achievements.

Consequently, there is no representation that the actual results

achieved will be the same, in whole or in part, as those set out in

the forward-looking information.

Forward-looking information is based on the

opinions and estimates of management at the date the statements are

made, and are subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those anticipated in the forward-looking

information. Some of the risks and other factors that could cause

the results to differ materially from those expressed in the

forward-looking information include, but are not limited to:

additional funding required by the Company on an ongoing basis;

market competition against third parties with greater financial and

human resources; the protection of the Company's intellectual

property rights; costs of production; capital expenditures;

requirements for additional capital; failure of equipment or

processes to operate as anticipated; delays in obtaining regulatory

approvals, claims limitations on insurance coverage; risks

associated with international operations; risks related to material

customer agreements; fluctuations in the currency markets; and

changes in national and local government legislation, controls,

regulations and political or economic developments in Canada, the

United States or other countries in which the Company may carry on

business in the future. Readers are cautioned that this list of

risk factors should not be construed as exhaustive.

The forward-looking information contained in

this news release is expressly qualified by this cautionary

statement. We undertake no duty to update any of the

forward-looking information to conform such information to actual

results or to changes in our expectations except as otherwise

required by applicable securities legislation. Readers are

cautioned not to place undue reliance on forward-looking

information.

NEITHER TSX-VENTURE EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE

TSX-VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

For further information, please contact:Andrew BengisChief

Financial OfficerT: (562) 991-5211F: (562) 926-6913E: Email

contactW: Email contact

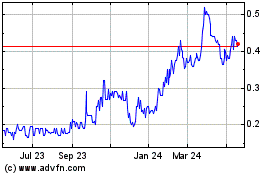

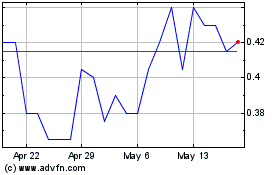

California Nanotechnolog... (TSXV:CNO)

Historical Stock Chart

From Nov 2024 to Dec 2024

California Nanotechnolog... (TSXV:CNO)

Historical Stock Chart

From Dec 2023 to Dec 2024